Emulators on iPhone: Everything you need to know

If you’re not sure what an emulator is, how one works, or what the terms mean, you’ve come to the right place.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

By Daryl Baxter published

Delta has been found to work on Apple Vision Pro, as well as a Mac, but you’ll have a hard time using it without a controller.

By Stephen Warwick published

Apple's iPhone 16 is fast approaching, but what about Apple's future plans for iPhone next year?

By James Bentley published

PPSSPP, a PSP emulator for iPhone, is currently in the works but Apple’s unclearness around its own rules leaves the developer unsure of if it will launch.

By Daryl Baxter published

Delta has been found to work on Apple Vision Pro, as well as a Mac, but you’ll have a hard time using it without a controller.

By Stephen Warwick published

Apple's iPhone 16 is fast approaching, but what about Apple's future plans for iPhone next year?

By John-Anthony Disotto published

Quick Tips Your iPhone has a hidden sound library with calming noises like white noise and rain.

By Connor Jewiss published

According to a new report, the iPhone 17 may offer a new display size that sits between the regular and Pro models.

By Stephen Warwick last updated

Each iPad lineup offers different storage configurations, so let's run through all of them for you.

By Stephen Warwick published

Apple's OLED iPad Pro is close at hand, but several well-established Android rivals already have devices on the market.

By Stephen Warwick published

A new report says Apple's OLED iPad could drive a 600% increase in OLED tablet sales in 2024.

By Tammy Rogers published

The iPad Air 5 is currently at its lowest price ever, although we don't think you should buy one right now — wait until the new ones come out instead.

By Stephen Warwick published

Qualcomm says its Snapdragon X Elite bests Apple's M3 Mac in some benchmark tests, but other results are missing...

By John-Anthony Disotto last updated

Transfer photos, music, and watch movies with our pick of the best CD and DVD drives for Mac.

By Gerald Lynch published

The Satechi Thunderbolt 4 Slim Pro Hub is excellent — if all you need is more Thunderbolt ports for your Mac and practically nothing else.

By Daryl Baxter published

Opinion It’s mainly agreed that Apple’s solution to replace the function row was a failure — what if it came back as an app?

By John-Anthony Disotto published

Quick Tips There's a temporary fix for ghost touch on Apple Watch but you'll need to wait for a more permanent one.

By James Bentley published

What are the best accessories for Apple Watch? From high-tech chargers to cool carry bags, we have a few ideas!

By John-Anthony Disotto published

Quick Tips This Apple Watch trick will make charging your smartwatch that much easier and it's been under our noses the whole time.

By Matt Evans published

Connecting your Apple Watch to treadmills, exercise bikes and other fitness equipment brings outdoor accuracy inside.

By John-Anthony Disotto published

Quick Tips Your iPhone has a hidden sound library with calming noises like white noise and rain.

By John-Anthony Disotto last updated

How-to How to transfer data from iPhone to iPhone, so your shiny new device works straight out of the box.

By James Bentley last updated

Fortnite isn't on The App Store, but you can still play it on iPhone or iPad for free. Here's how to play Fortnite on iPhone or iPad in just a few simple steps.

By James Bentley published

PPSSPP, a PSP emulator for iPhone, is currently in the works but Apple’s unclearness around its own rules leaves the developer unsure of if it will launch.

By James Bentley last updated

Fortnite isn't on The App Store, but you can still play it on iPhone or iPad for free. Here's how to play Fortnite on iPhone or iPad in just a few simple steps.

By James Bentley published

A Virtual Boy Emulator is coming to Apple Vision Pro, letting users play a piece of VR history

By Gerald Lynch published

The Satechi Thunderbolt 4 Slim Pro Hub is excellent — if all you need is more Thunderbolt ports for your Mac and practically nothing else.

By John-Anthony Disotto published

The BenQ beCreatus DP1310 is the perfect dock for Mac users who play games on console. With just one click you can jump between USB-C and HDMI 2.1.

By Alex Blake published

Stage View adds previews to apps and windows in the Stage Manager sidebar. Is it worth your cash?

By Tammy Rogers published

The Geekom A7 is a powerful, tiny, and very well-priced mini PC — but should you choose one over the Mac mini?

By Alex Blake published

The Logitech Signature Slim K950 is a more affordable version of the MX Keys S, with a similar typing feel but without a few nice-to-haves.

By Oliver Haslam published

Roadtrip is a new app to the UK where it now promises to offer customized data on which routes and fuel stops to use to save money on journeys.

By Becca Caddy published

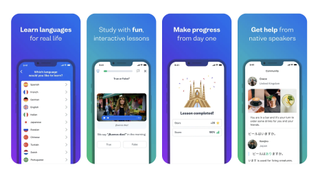

App of the day If you're looking for an alternative to Duolingo, Busuu might not be as fun and colorful, but it's simple and effective.

By Oliver Haslam published

WhatsApp has announced a new update to the way it lists chat threads with a new filter option.

By Oliver Haslam published

Adobe has previewed new generative AI features coming to Premiere Pro designed to make creating video and audio easier.