iOS 17.5 and iPadOS 17.5 beta 3 lands as public release gets closer

Apple has released iOS 17.5 and iPadOS 17.5 beta 3 to developers enrolled in the program as the public release gets closer to arriving.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

By Gerald Lynch last updated

We're well overdue an update to Apple's stylus devices, but what could be in store for artists with an Apple Pencil 3?

By Oliver Haslam last updated

The iPad Pro M3 is expected to launch in early May, 2024.

By James Bentley published

Apple Watch Ultra 2 is now available refurbished at the Apple store, which means you can get a restored Apple Watch with official parts for cheaper.

By Karen S Freeman last updated

A screen protector will keep your iPhone from getting scratched, and maybe even ward off a costly repair in case of drops. Protect your iPhone 15 from the first day you get it with one of these.

By Karen S Freeman last updated

The iPhone 15 Pro sports Apple's best screen yet. Keep it looking amazing from the moment you take it out of the box.

By Karen S Freeman last updated

It's big, it's beautiful — protect it.

By Daryl Baxter published

We’ve got 10 games that you can play on your iPhone with the Delta emulator without worrying about Nintendo’s lawyers knocking on your door.

By Gerald Lynch last updated

We're well overdue an update to Apple's stylus devices, but what could be in store for artists with an Apple Pencil 3?

By Oliver Haslam last updated

The iPad Pro M3 is expected to launch in early May, 2024.

By James Bentley published

The iPad Air 6 and OLED iPad Pro have seemingly been confirmed by a popular Apple case manufacturer.

By James Bentley published

The iPad Air 6 is tipped to receive new upgrade, giving it a much nicer screen.

By Oliver Haslam published

Apple isn't expected to update its Mac mini or Mac Pro lineups with M3 chips, leaving buyers to wait for M4 versions instead.

By Connor Jewiss published

According to a new report, the upcoming macOS 15 update is set to include a revamped and smarter Calculator app that looks like the one on iOS.

By Stephen Warwick last updated

With the advent of Apple silicon, gaming on Mac is better than ever. But what's the best gaming MacBook you can buy right now?

By Stephen Warwick published

2024 could herald the first wave of M4 Macs, what do we know about the next generation of Apple silicon?

By Karen S Freeman last updated

Ultimate bands for the ultimate watch.

By James Bentley published

Apple Watch Ultra 2 is now available refurbished at the Apple store, which means you can get a restored Apple Watch with official parts for cheaper.

By Stephen Warwick last updated

If you've lost your iPhone, it's super easy to find it using your Apple Watch.

By Daryl Baxter published

Quick Tips YouTube has rolled out a new update for its Apple TV app, which replaces the pause screen with a moving landscape. Here’s how you can reverse this frustrating change.

By Stephen Warwick last updated

If you've lost your iPhone, it's super easy to find it using your Apple Watch.

By John-Anthony Disotto last updated

You can play retro games with Delta Game Emulator for iPhone. Here's everything you need to know to add games, play games, and use the app everyone's talking about.

By John-Anthony Disotto published

Quick Tips Did you know you can see your friends and family's locations directly in the Maps app on iPhone? Here's how.

By John-Anthony Disotto last updated

You can play retro games with Delta Game Emulator for iPhone. Here's everything you need to know to add games, play games, and use the app everyone's talking about.

By James Bentley published

With Apple allowing game emulation on its app store, users have had a great week of video games, despite developers worrying about Apple’s guidelines.

By James Bentley published

PPSSPP, a PSP emulator for iPhone, is currently in the works but Apple’s unclearness around its own rules leaves the developer unsure of if it will launch.

By James Bentley published

The Lofree Dot Foundation is a gorgeous mechanical keyboard that takes its looks from makeup. Our review:

By Gerald Lynch published

The Satechi Thunderbolt 4 Slim Pro Hub is excellent — if all you need is more Thunderbolt ports for your Mac and practically nothing else.

By John-Anthony Disotto published

The BenQ beCreatus DP1310 is the perfect dock for Mac users who play games on console. With just one click you can jump between USB-C and HDMI 2.1.

By Alex Blake published

Stage View adds previews to apps and windows in the Stage Manager sidebar. Is it worth your cash?

By Tammy Rogers published

The Geekom A7 is a powerful, tiny, and very well-priced mini PC — but should you choose one over the Mac mini?

By Alex Blake published

The Logitech Signature Slim K950 is a more affordable version of the MX Keys S, with a similar typing feel but without a few nice-to-haves.

By Michael Sawh published

There are plenty of apps out there to make your Apple Watch more useful — here are ten of the best for runners

By Becca Caddy published

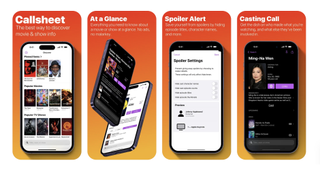

App of the day If you love finding out more about your favorite movies and TV shows, you need this app.

By Becca Caddy published

App of the day Yuka gives you more info about your groceries and flags healthy choices, ideal if you can't decide what to buy.

By Stephen Warwick published

Apple says it has removed WhatsApp and Meta's Threads from the App Store in China at the behest of the government.

By Oliver Haslam published

Roadtrip is a new app to the UK where it now promises to offer customized data on which routes and fuel stops to use to save money on journeys.