Apple Pay — or Pay — launched in October of 2014 as part of iOS 8.1. It enabled the NFC-based tap-to-pay system in the iPhone 6 and iPhone 6 Plus, and the online payment system in both iPhones 6 and the iPad mini 3 and iPad Air 2. While it hasn't yet rolled out internationally, Apple Pay has expanded to more banks, retailers, and apps in the U.S. We went in-store with it at launch, but how's Apple Pay doing now, some three months later?

Apple Pay and banks

Peter: My bank was there on day one, and I had absolutely no problem signing up my debit card in Apple Pay. I know a lot of other people haven't been as lucky. One of the few times I've been happy to be with my giant, monolithic, massively unfriendly and expensive bank.

Ally: I have lots of different cards in Apple Pay and for the most part I've had zero problem. Everything works as I'd expect it to. However, a month or so ago I restored my iPhone 6 Plus and since then I haven't been able to get one of my cards added back. The recent iOS update that was supposed to address that particular Apple Pay issue unfortunately hasn't worked for me either. Calls to my issuer haven't helped either.

Ren: I'm with Peter — I was lucky in that my major debit and credit cards all supported Apple Pay at launch, and I've had no real problems with them. (Though the initial add process did require a couple of random steps, including sending confirmation codes to a phone number I haven't had on file in four years.)

Apple Pay at retail

Peter: I've used Apple Pay a precious few times and it's worked out quite well, but I have to be frank: I don't shop at most of the places it's taken. The places I do shop most frequently, including my grocery store and my pharmacy, aren't yet signed up. So Apple Pay has, for me anyway, been an interesting curiosity. But it really hasn't moved into a daily use for me yet.

Ally: When actually using Apple Pay, the process is painless. Just tap and done. The only time I've found the process slightly odd is when using self checkouts. The ones are our local grocery stores are a little finicky and don't always seem to activate tap payments. Other than that, the experience has been pleasant.

Ren: I used Apple Pay a lot when it first launched, in part for novelty, but I've really grown to love using it. My pharmacy and three grocery stores in my area take it, and I keep on running into other places that take it. (For awhile, I'd tap my iPhone at any register that looked like it might take contactless payments… just in case.)

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Apple Pay in-apps

Peter: I actually haven't used Apple Pay in apps once. I admit I'm on a limited budget to begin with, so I don't do a lot of in-app shopping anyway, but it really hasn't come up for me even as a possibility.

Ally: I've only used Apple Pay with the Apple Store app when purchasing a case for my iPhone 6 Plus. It was a heck of a lot easier than entering all my details or having to change them from what is in my iTunes account. I'm sure I'll end up using it more and more as different merchants start supporting the functionality.

Ren: I've actually started using Panera's in-app Apple Pay to place advance orders rather than wait in line — it's much faster, and there's no hassle about finding a payment option to input into my iPhone, since my credit card info is already stored. (It's also an easy way for my purchases to count toward Panera's loyalty program, as in-store Apple Pay doesn't register that you're a member without flashing your MyPanera card.)

I've used the Apple Store's app to buy things while in the store, as well, but it feels a lot weirder to use than Panera's or Target's; I'm guessing that's because I'm actually in the store, but not dealing with people.

Apple Pay evolution

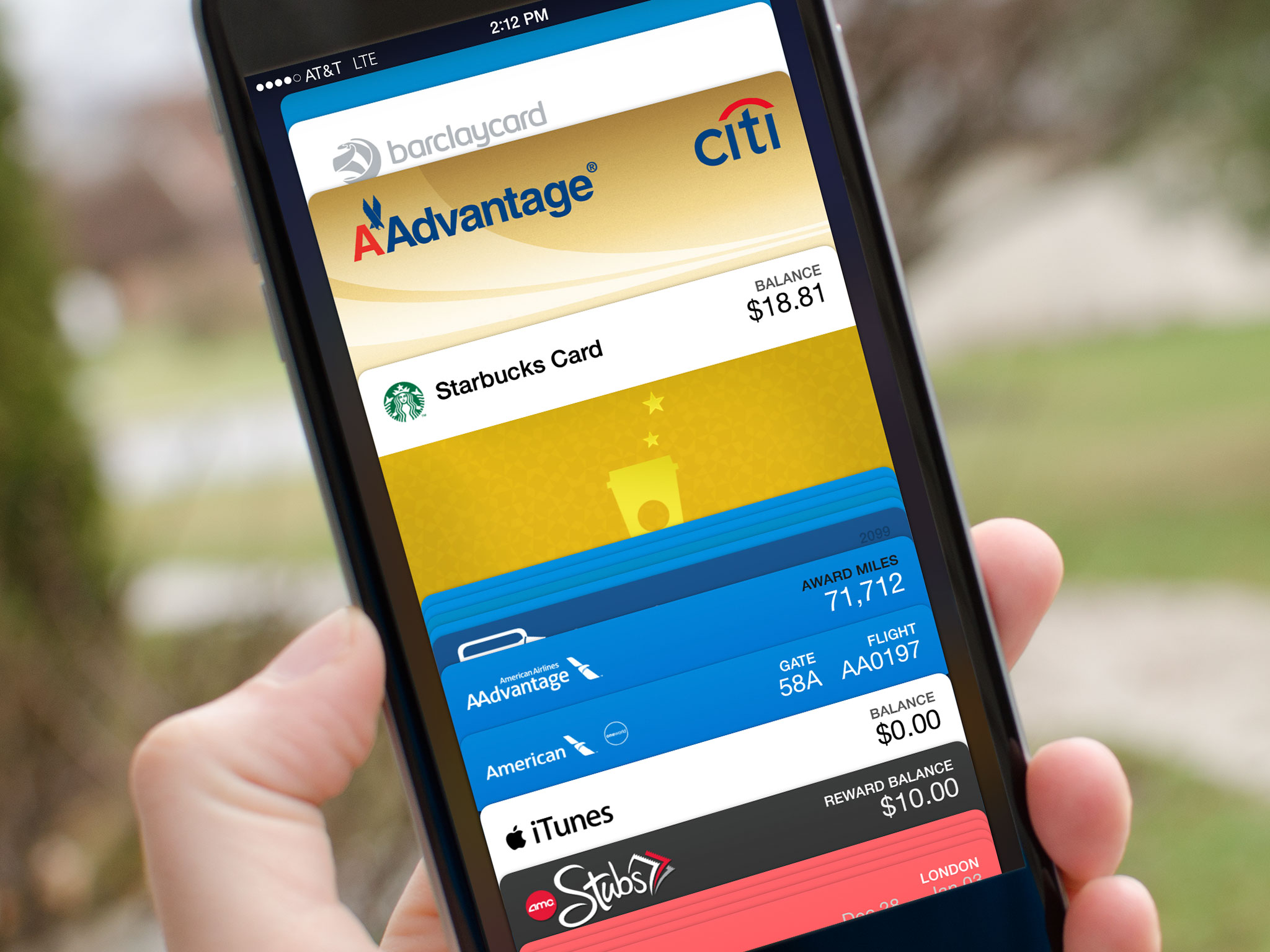

Rene: Canada! (You expected nothing less, and I would not disappoint!). Seriously, though. International rollout feels inevitable. So does support for loyalty programs. I don't know if there would ever be Apple Point, redeemable for iTunes credit, but I'd love to my Lego VIP card in there. Also, there's the whole world of consumer-to-consumer transactions to get into. People have been begging for a PayPal alternative for years. Maybe Apple Pay could be just that?

Ren: Though I haven't spent much time abroad in the last three months, I would love for Apple Pay to take hold in Canada and the UK; I'm planning trips to both in the near future, and it would be swell to not have to worry about my wallet while traveling.

And though I don't think the company's "Year of Apple Pay" will be doomed without loyalty cards or frequent customer attachments, I'd really like to be able to connect things like my Panera card to my purchases there — right now, it's easier to order in advance through the app than pay in-store with Apple Pay and then pull out my Panera card.

Finally, more merchants supporting it. I wish CurrentC would die in a fiery pit, but at the least, some of its supporters are aging out of their original exclusivity contracts — hopefully that means we'll see retailers like Target (who already support Apple Pay in-app) using the in-store kiosks, as well.

Peter: MOAR VENDORS. Apple Pay has already succeeded where other digital payment systems have failed, but it's nothing approaching critical mass. Major retailers still don't have support for Apple Pay, and many banks don't either. It's also a complete non-entity outside the United States.

Bottom line

Peter: Apple Pay is everything I wanted in a mobile payment system: Elegant, fast, secure. If Apple can get the entire world using it, more the better. In the interim, Apple Pay is still squarely a novelty for me. I use it whenever I can, but for what I've been spending money on since it was introduced, that's not that much.

Rene: I share Tim Cook's bullishness on the future of Apple Pay. It does so many things right that, given enough time, adoption, and propagation, I think it could fundamentally transform how I pay for things on a daily basis. It could end up being a bigger deal than even the current crop of devices because it's not just another device — it's another service for all devices.

Ren: Using Apple Pay is awesome and keeps me from pulling out my credit card all the time, but it's not so widespread that I can just leave my wallet at home. I'm hoping 2015 is the year enough of my merchants begin accepting Apple Pay that I can consider actually going phone-only and saving some of that pocket space for, say, an extra battery for my iPhone. I also wouldn't mind some sort of loyalty program integration. (Fingers crossed!)

Ally: I love the idea of Apple Pay and what it offers. The only barrier is merchants adopting it within the United States. It's kind of ironic since it's only available in the the US yet our country is pathetically behind when it comes to NFC and payment technology in general. Let's hope the next year or so changes that.

Serenity was formerly the Managing Editor at iMore, and now works for Apple. She's been talking, writing about, and tinkering with Apple products since she was old enough to double-click. In her spare time, she sketches, sings, and in her secret superhero life, plays roller derby. Follow her on Twitter @settern.