Can you trust Libra, Facebook's crypto plan for world financial domination?

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

Facebook CEO Mark Zuckerberg has just announced Libra, his company's and their allies attempt to revolutionize not just payments, but money itself, on a global scale, and Calibra, Facebook's wallet app for Libra.

From his Facebook post:

Today, Facebook is coming together with 27 organizations around the world to start the non-profit Libra Association and create a new currency called Libra.Libra's mission is to create a simple global financial infrastructure that empowers billions of people around the world. It's powered by blockchain technology and the plan is to launch it in 2020. You can read more about the association here: https://libra.org/

But what is Libra more exactly and why, after the terrible, scandalous, privacy-violating, trust rending, not good very bad year if not decade Facebook's had, why would anyone in their right mind, or Mark Zuckerberg, think for a smoking hot minute we'd trust them with our money?

Tantalizingly — or appallingly, you be the judge — Zuckerberg thinks he has an answer.

Rather watch than read? Hit play on the video above!

Who is Libra?

Facebook is the face of Libra, no doubt about it, but for reasons I'll get to in a bit, it's deliberately not making itself all of Libra. Instead, Facebook has put together the Libra Association, a cadre of payment, services, blockchain, and venture capital companies, to make things what Facebook calls "fairer" but probably also to mitigate against any negative sentiment Facebook has engendered from end-users and others in the industry over the last year.

According to their website, Libra.org, here are the companies currently listed as Founding Members:

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

- Payments: Mastercard, PayPal, PayU (Naspers' fintech arm), Stripe, Visa

- Technology and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, Mercado Pago, Spotify AB, Uber Technologies, Inc.

- Telecommunications: Iliad, Vodafone Group

- Blockchain: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited

- Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures

- Nonprofit and multilateral organizations, and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women's World Banking

Buy-in isn't high, at least not at mega-corp scale. $10M gets you a vote at the table. And all any single member can ever get is one vote or 1% of votes, including Facebook, or more specifically, Facebook's new Calibra subsidiary will ever get.

Calibra is meant to, again, assuage fears that Facebook will have too much control over Libra and/or use it as just another way to hoover up user data. Facebook claims Calibra and only Calibra will ever handle any and all dealings with Libra, and that Facebook won't be able to Calbra data for ad targeting unless users opt-in. And Zuckerberg says:

This is an important part of our vision for a privacy-focused social platform -- where you can interact in all the ways you'd want privately, from messaging to secure payments.

But Facebook has a history of altering the bargain, Vader style, when it comes to this stuff, just ask the departed founders of WhatsApp and Instagram. It's also easy to imagine any number of incentives, good or bad, offered to get that opt-in box checked.

Also, Facebook, like Google, is heavily invested in gaslighting people when it comes to privacy right now. Specifically in Facebook's case, their not using the word to mean actual privacy but to mean encryption, or private from people other than Facebook. Meanwhile, Facebook still pillages all the metadata and pads all the profiles, real and shadow, they possibly can.

Also, the intentions of the other association members have been questioned as well.

Here's Alphaville's take from the Financial Times:

Don't focus on who is in the association, focus on who is out: notably Apple, Amazon, Google, and all of the banks. Don't presume the presence of the more successful payment incumbents necessarily means their interests are aligned with those of Facebook. $10m isn't too hefty a price tag for insider information about what Facebook is planning and/or a vote at the table when the time comes to sabotage the system. Everyone else of any note is either a loss-leading company yet to make a profit, a VC, a blockchain company, or an actual non-profit.

What is Libra?

Well, Libra is Facebook and the Libra Associations just-announced cryptocurrency. Basically digital money. It uses a triple wave symbol, like a melty hamburger, instead of a dollar or pound or euro sign.

Bitcoin is the first, best-known example. Instead of a country minting or printing and backing and controlling it, it's typically decentralized, and uses a blockchain — literally a linked chain of time-stamped transaction blocks — encryption, and peer-to-peer networking to protect the security, integrity, and state of the currency.

Or, in Alphaville's words:

it's a glorified exchange traded fund which uses blockchain buzzwords to neutralise the regulatory impact of coming to market without a licence as well as to veil the disproportionate influence of Facebook in what it hopes will eventually become a global digital reserve system.

Now, Libra isn't truly decentralized. Facebook said it couldn't figure out a way to make a system that needs to scale the way Libra does fully decentralized in a way that performed reliably. In other words, the bigger it got, the slower it got. So, they're using a quote-unquote "permissioned" model. At least for now.

That does make the system more vulnerable to distrust and to attack, but Libra says they'll halt transactions if they catch fire, and will work towards a kinda-sorta permissionless system in the future.

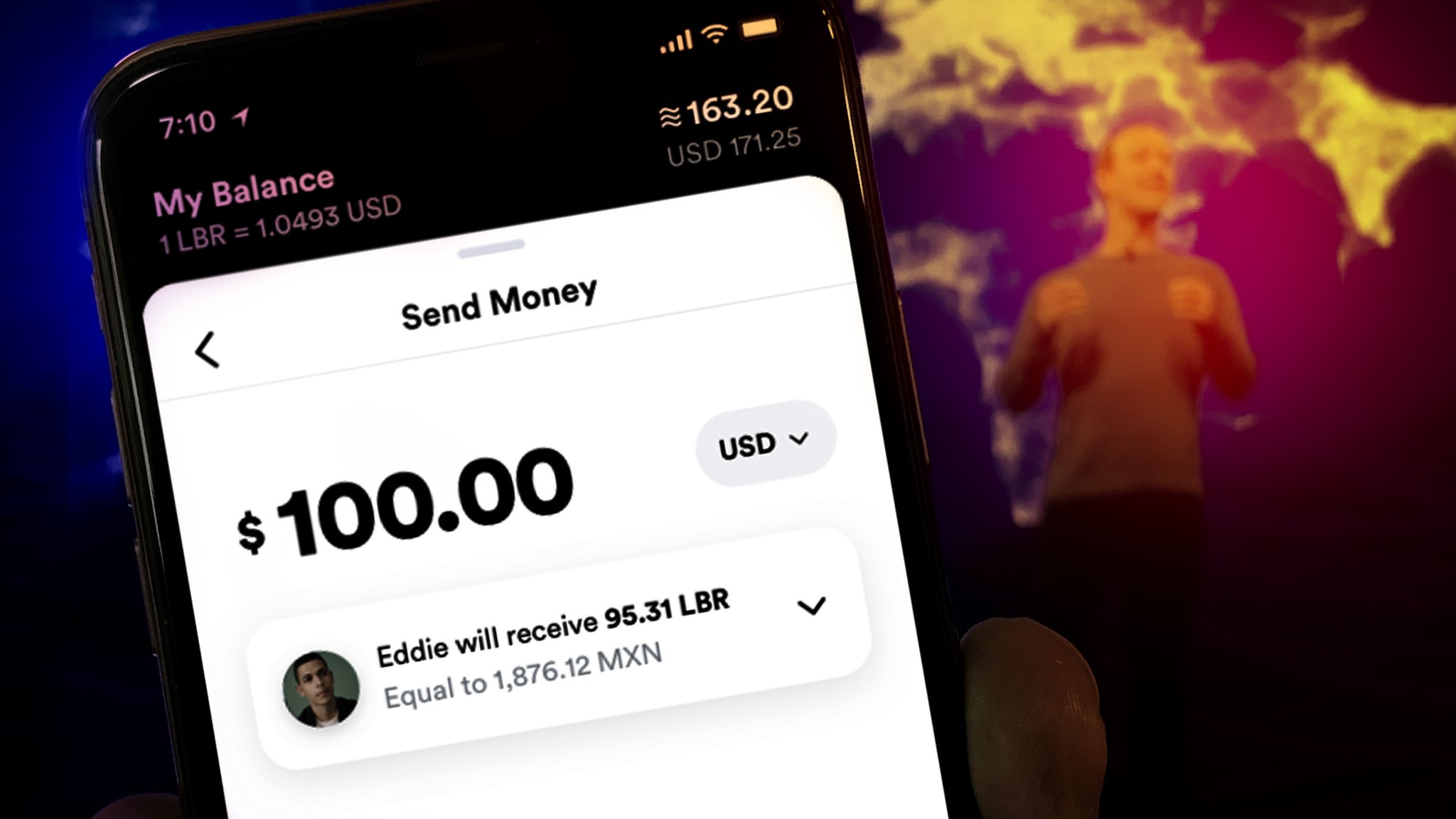

Calibra, in addition to being Facebook's supposedly air-gapped Libra subsidiary, is also the name of their Libra wallet app. It'll be baked into the big blue Facebook app proper as well as Facebook Messenger and WhatsApp, and, while I don't think they've mentioned it yet, who knows, Instagram as well?

You'll be able to use Calibra to exchange local currency for Libra, pay and receive payments in Libra, and cash out your Libra back to local currency.

Libra's blockchain is open source under the Apache 2 license. There's also a developer platform and programming language, called Move, designed to make it easier and safer for others to build transactional apps and services based on Libra, and integrate it into existing apps and services.

That way, if you don't want to use Facebook's implementation, you'll hopefully have others to choose from.

Why is Libra?

Facebook is saying:

Being able to use mobile money can have an important positive impact on people's lives because you don't have to always carry cash, which can be insecure, or pay extra fees for transfers. This is especially important for people who don't have access to traditional banks or financial services. Right now, there are around a billion people who don't have a bank account but do have a mobile phone.

Wow, altruism is tight!

But, let's get real. Facebook has shown a canny ability over the last decade to acquire or duplicate any company that threatens their ability to harvest data or keep attention. They bought Instagram when it was getting all our photos. They bought WhatsApp when it was taking all our texts. And, when Snapchat wouldn't sell, they copied all of Snapchat's most compelling features into Instagram, destroying most of Snap's growth potential, if not their outright business.

The threat here is more subtle but perhaps no less existential.

WeChat in China has already shown that when communications and payments combine, they can become the default platform for one of the biggest countries and economies on earth, abstracting away even the likes of Android and Apple.

Facebook is also heavily invested in identity and, outside of medicine, there's nothing like financial services when it comes to extracting and owning identity not just online but anywhere.

Messaging, and the associated payment and identity potential therein, remains incredibly fragmented around the world and it might just stay that way. But, if anyone is going to have a lock on it outside China the way WeChat does inside, Facebook desperately wants it to be them.

How is Libra?

The way Libra works is fairly straightforward. You get something like Facebook's Calibra, exchange your local currency for Libra, send and receive payments with Libra, and convert Libra back into your local currency when and if you want to.

Meanwhile, as long as you're using Libra, Facebook and the rest of the Libra will earn interest from deposits and investments of that local currency you converted.

Again, Alphaville:

This is hardly a novel strategy. PayPal came to market doing the same thing until it transpired a money transmission license wasn't enough to allow such operations. Under a money transmission license, entities are limited to keeping deposits in regulated banking institutions. From a regulatory standpoint, the fact Libra intends to use the deposits to purchase interest-yielding securities but only has a money transmission license would usually be considered a big no no.

So, there's that. But there's also quite a bit else that's worth breaking down.

First, to make this work, Libra isn't going to be a cryptocurrency like Bitcoin that can shoot up or down wildly based on trading and speculation. It's going to be handled much more like a real-world currency, and that means the goal is stability.

It's going to start somewhere around the value of the U.S. dollar or European Euro, so most people will be familiar with its value, and then the Libra association will manage its assets to keep it around there.

That way, no one has to worry, not customers, not merchants, that the value will drop between transactions. Because then they'd want no part of it.

Where is Libra?

In addition to on-device through Calibra and similar apps and services, Libra really wants to be everywhere.

For IRL usage in real-world stores, there'll be a regressively pragmatic QR code system, straight out of Current-C, where you scan theirs or they scan yours.

There's also apparently a plan to integrate with point-of-sale services like Square. But, again, a lot of this boils down to Facebook never shipping its own mobile payment system like Apple Pay or Android Pay or Samsung Pay, much like they never shipped their own maps or OS or any of the other infrastructure Apple, Google, and others have been laying for years.

And, if Libra wants to make the massive interest-based revenue it's slathering over, it's going to need a lot of people converting currency over, and that means giving them a lot of compelling reasons to do so.

So, Libra is doing a few things to incentive adoption.

First, Libra transactions aren't completely free. For normal use, the cost is really low. But there's still a cost so that, in theory, it'll prevent bad actors from trying to run through high volumes of fake transactions to scam or DDoS the system.

But also so that Libra can give a percentage of the fee back to merchants to both encourage them to use it and so that merchant's can also pass a percentage of that percentage back to customers in the form of discounts or rewards, encouraging, you guessed it, them to use it.

Second, Libra plans to issue incentives to pretty much every participant along the chain, from validators to sign-ups to vendors to users.

Third, there'll be a network for resellers so everyone from your local gas station to who knows who will be able to do conversions. Which, may be great or may be problematic. It depends if they end up an enabling force helping grow the currency or just a privileged middle layer sucking profit out of the system.

Ultimately, Facebook and Libra sound like they'll do anything and everything, within financial reason, to get people to get their Libra on.

When is Libra?

Libra has gone into a prototype stage, with its TestNet developer beta as of today, and is supposed to launch officially sometime in the first half of 2020.

So, here's my bottom line: Facebook has shown us over the years that they simply can't be trusted, from the derogatory, offensive curse words Mark Zuckerberg called those of us willing to give him our data, to Cambridge Analytica and all the other scandals over the last year that made us wake up and realize the massive privacy abuses and security malpractices the company had been perpetrating… since becoming a company,

When a company and the people who run it tell you so repeatedly who they are, how can we not believe them?

Facebook is doing this because they're terrified Google or Amazon or Apple is going to do it and lock them out or marginalize them in the next great information, identity, and commerce grab.

Good for them. Good for us will be having all those options from all those tech companies, and hopefully some truly open alternatives, so all of them will have to compete based on AI if they're Google, ease of transaction if they're Amazon, privacy if they're Apple… and god knows what's left if they're Facebook.

So I'm just going to wait and watch and see, and then carefully, deliberately decide who I'm going to trust with the future of my transactions.

But I'd love to know what you think. Are you all in or hard out, and why?

Rene Ritchie is one of the most respected Apple analysts in the business, reaching a combined audience of over 40 million readers a month. His YouTube channel, Vector, has over 90 thousand subscribers and 14 million views and his podcasts, including Debug, have been downloaded over 20 million times. He also regularly co-hosts MacBreak Weekly for the TWiT network and co-hosted CES Live! and Talk Mobile. Based in Montreal, Rene is a former director of product marketing, web developer, and graphic designer. He's authored several books and appeared on numerous television and radio segments to discuss Apple and the technology industry. When not working, he likes to cook, grapple, and spend time with his friends and family.