The 101 best iPhone apps in 2026

Get up and running with the best iPhone apps right now.

- Books, Comics and Reading

- Cloud Storage

- Dating

- Drawing and Painting

- Education and Learning

- Fitness

- Finance and Money

- Gaming

- Health

- Home and Garden

- Learning musical instruments

- Meditation and Relaxation

- Messaging

- Music

- Music Creation

- Movies and TV

- Navigation and Driving

- News

- Photography and Camera

- Podcasts and Radio

- Productivity

- Recipes & Food

- Ridesharing

- Shopping

- Social Networking

- Sport

- Video Editing and Content Creation

- Travel

- VPN and security

- Weather

- How to choose

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

The best apps for every iPhone

These days, the best iPhone apps can be a challenge to find, due to there being almost two million apps available to download in the App Store. You're usually reduced to checking the top charts to see if some apps could help you in some way or using the search feature to see if something almost meets your needs.

To save you the bother, we've compiled a huge list below of the top 101 iPhone apps, both free and paid, that you can download right now for the best iPhones.

These apps are split into many categories, such as Dating, Fitness, Gaming, Health, and lots more. We're constantly refreshing this list to add and remove the apps we think deserve to be on this list, so make sure to keep checking this page for the latest updates. We should mention, however, that if you're only interested in the free apps, take a peek at our best free iPhone apps list instead, as well as our dedicated best iPad apps guide.

Best iPhone apps: Books, Comics and Reading

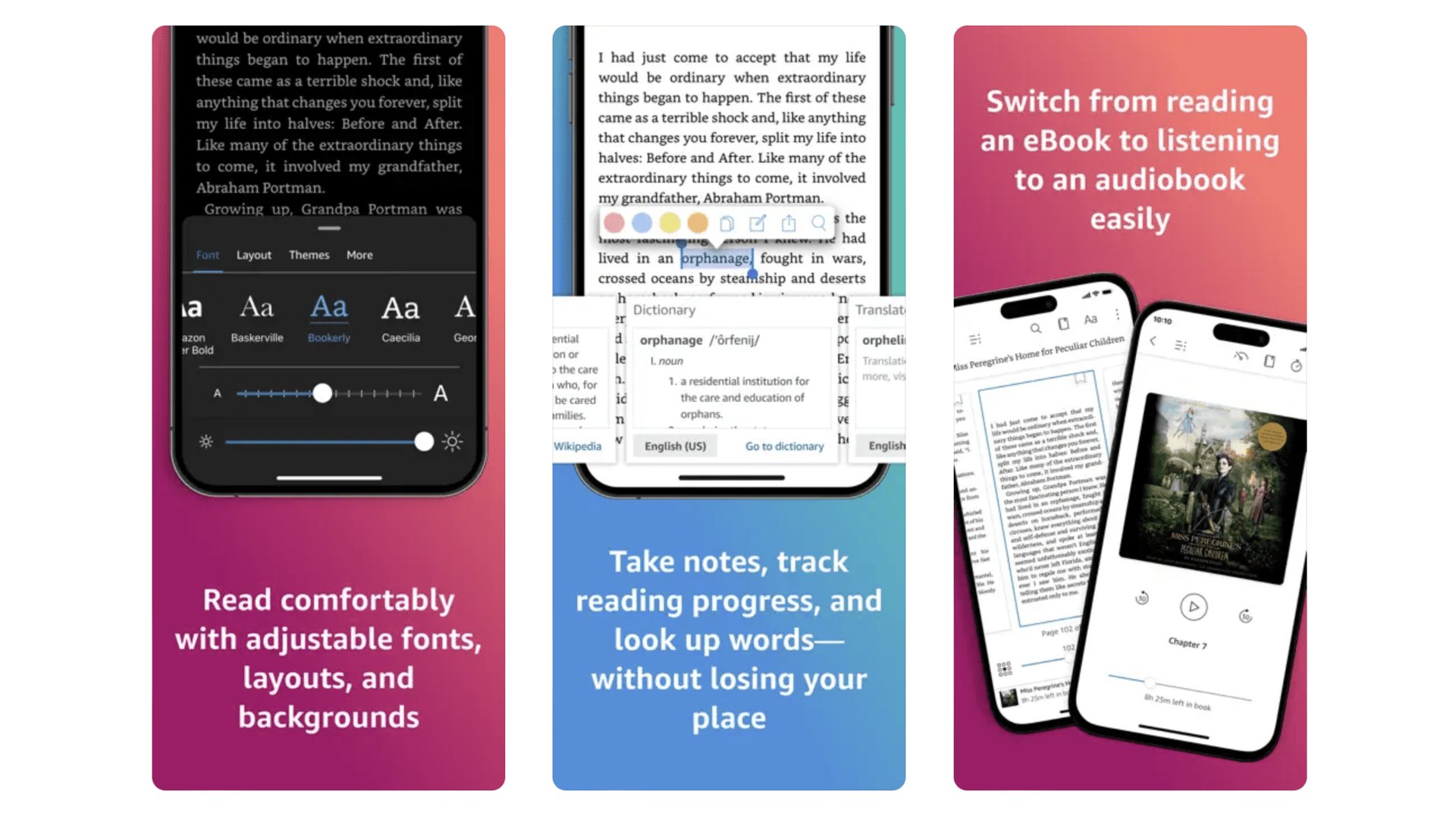

Amazon Kindle

We’re going to assume most of you have heard of Amazon Kindle. It’s not just a series of ebook readers. It’s also the entire Amazon bookstore, which is fully accessible from your phone. It’s great as a discovery tool, particularly as Amazon lets you try out samples of books, to get a taste of the

writing style before you commit to buying. You don’t actually buy books through this app, but on the Amazon app. Once purchased, the books then appear in this Kindle app.

Amazon Kindle

Amazon Kindle is the closest you’ll get to the Kindle ereader experience on your phone

Download here: App Store:

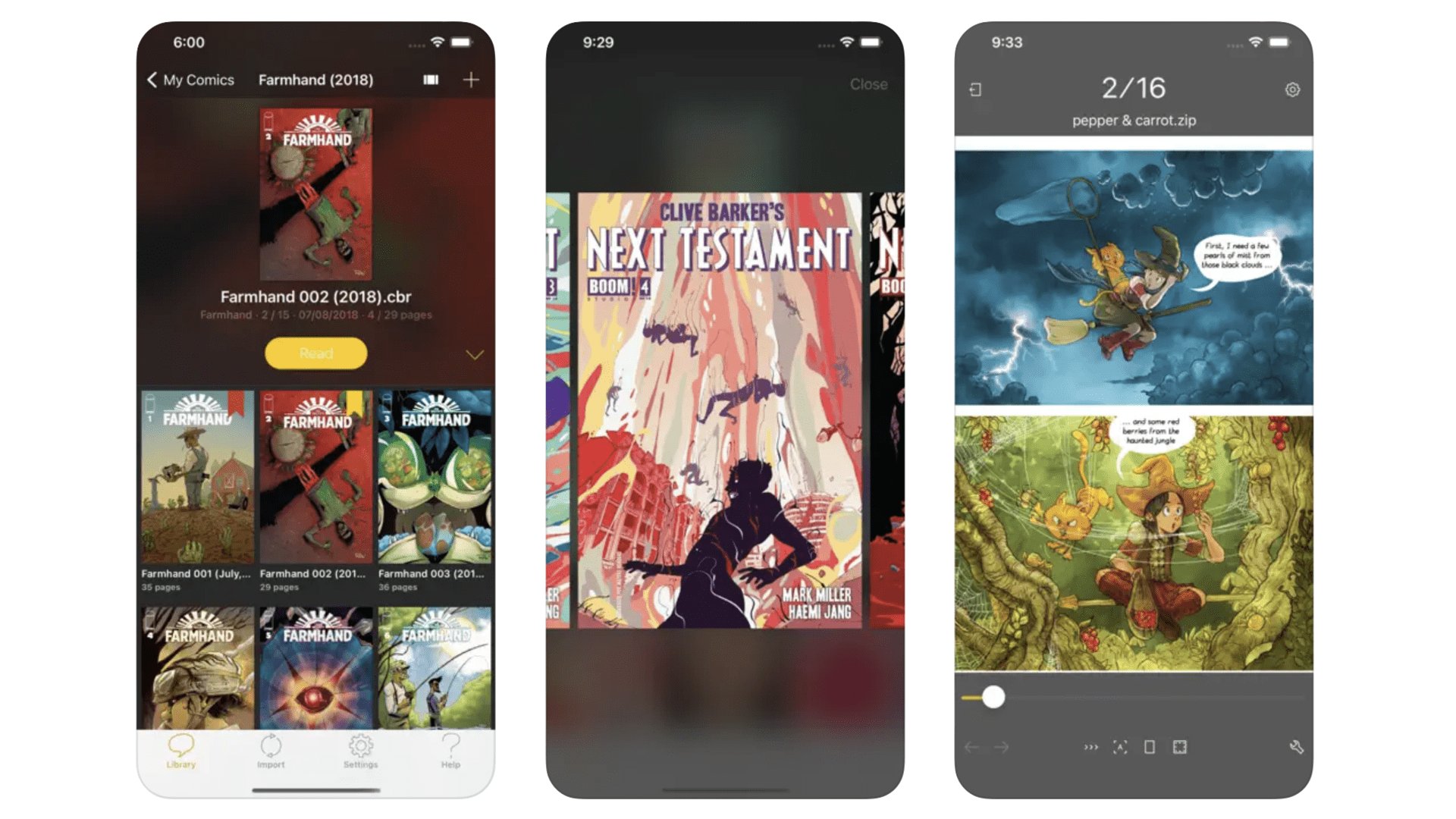

YACReader

This no-nonsense comic book reader app lets you add comics and graphics novels through a whole load of methods, indulging cloud services like Dropbox, the Files app and the YACReader app for PC and Mac. There’s no comics store here, but as long as you have a digital comics library, that means you get a cleaner, less clutter-filled experience. The panel view is the special feature of this particular reader app, letting you read graphics novels panel-by-panel. It’s not free, at $4.99, but is worth the investment if you like reading comics on your phone.

YACReader

A comic book reader that makes it easy to get graphic novels on your phone, that’s YACReader

Download now: App Store

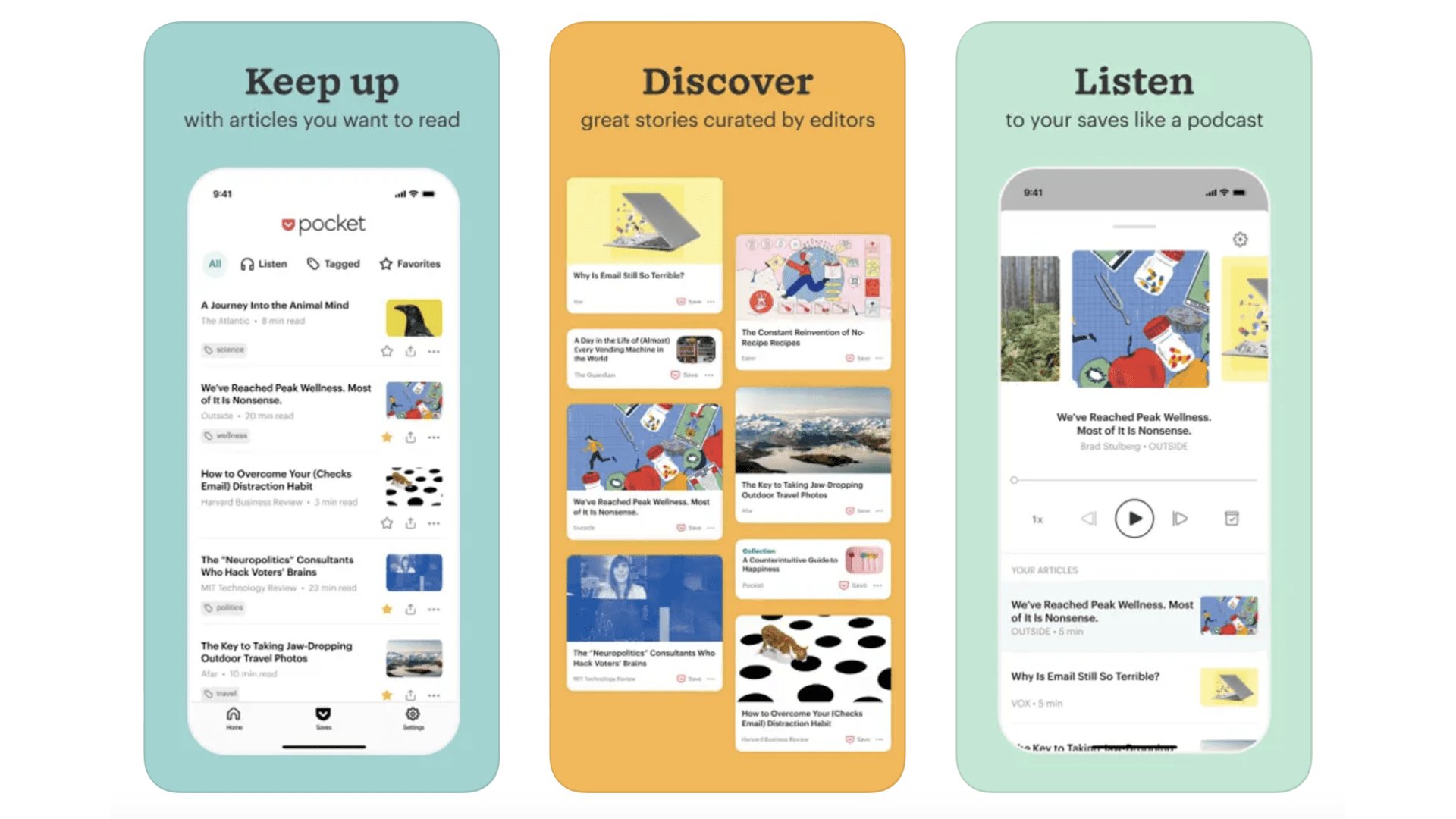

You know when you mean to read an article you saw online, but you end up forgetting where it was by the time you find the time to do so? Pocket is out to fix that. It’s an app you send links to, just as you might share a story with a friend over WhatsApp. Pocket then works it up into a super-readable format for later reading. And you can change the font size, and the font. There’s also a glitzy front end to the app, which lets you discover stories other folks are reading on Pocket. You can use this app for free, but to get rid of ads, unlock text searching and loads of fonts, you will need to subscribe. It costs $4.99 a month or $44.99 a year.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Read and archive your favourite online articles and reviews with Pocket, owned by Mozilla.

Download now: App Store

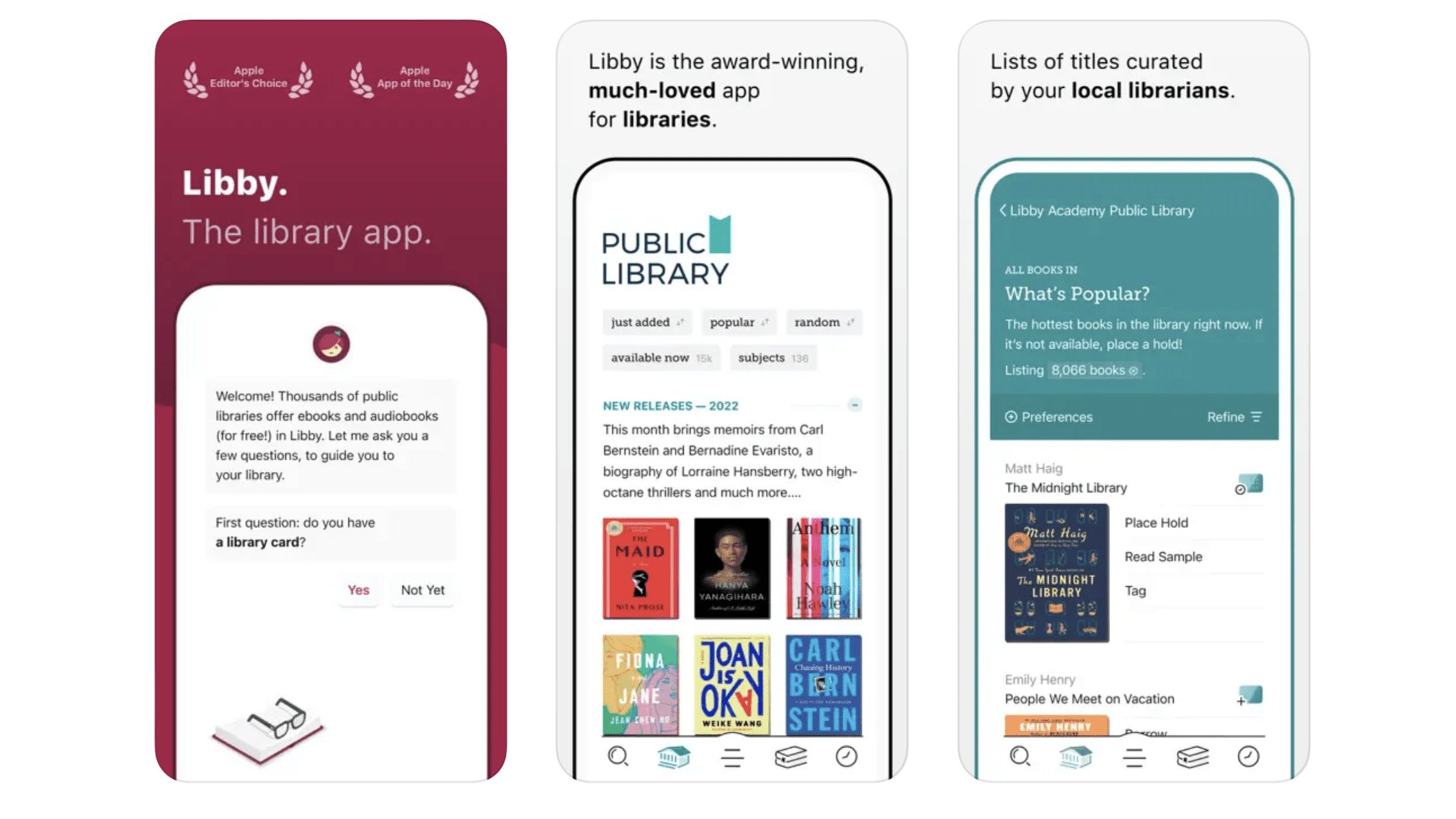

Libby

Did you know there’s a good chance you can borrow digital books and audiobooks for free through your local library? There are two key apps these services use in our experience: Libby (aka Overdrive) and Borrowbox. At one point we got so into borrowing audiobooks we went around the local area signing up to as many libraries as possible, just to get the widest possible array of titles. Who needs Audible? OK, Audible will get you a much broader catalogue, but Libby is well worth checking out, following a trip to your local library, folks. Use it or lose it.

Libby

Get access to countless ebooks and audiobooks, completely for free, with Libby

Download here: App Store

Best iPhone apps: Cloud Storage

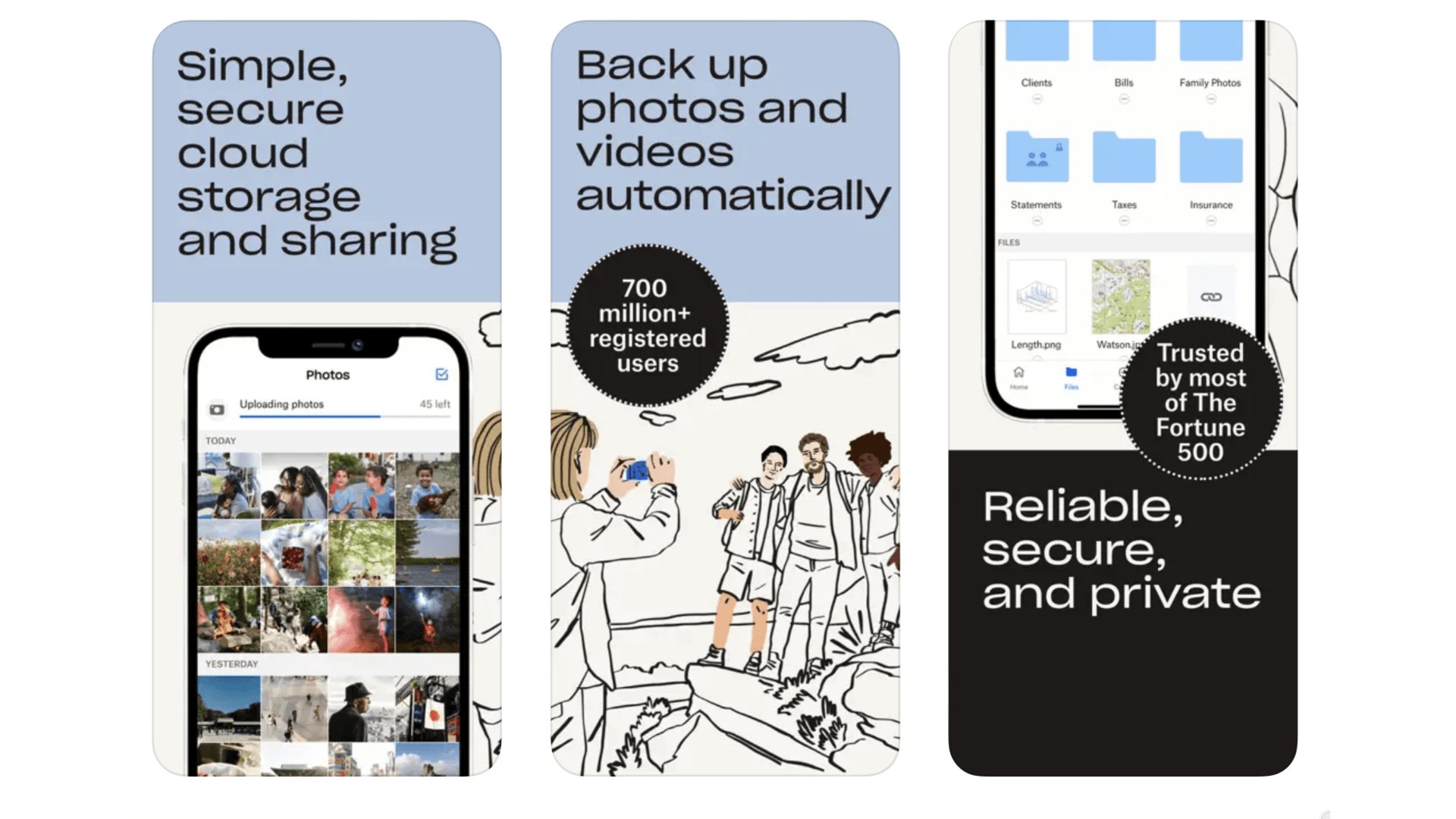

Dropbox

Sometimes it’s a good idea to have a cloud storage provider not run by the folks who handle your emails, as they end up sharing your storage allocation. Dropbox offers 2.75GB storage for free. We use it all the time to share files, for work or just among friends. The app lets you create folders, and you can then share just specific folders. Or even specific files, so people don’t get access to your entire Dropbox library. It’s not a mega-exciting app, but useful? Absolutely. You can then access your stored files from anywhere, including the Dropbox web interface.

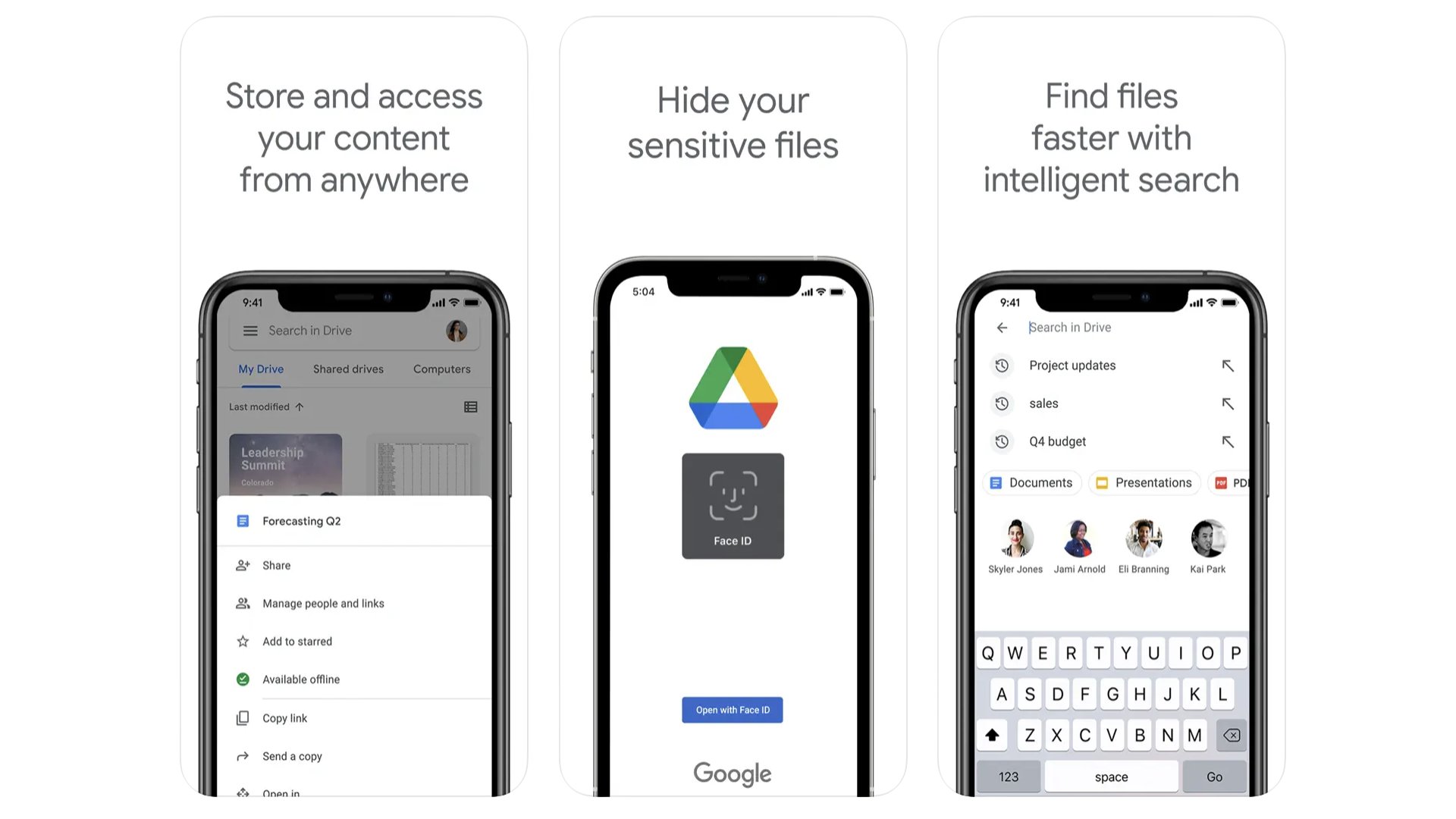

Google Drive

Cloud storage apps are not the most interesting of things. But they are a way to get a tranche of free server space without signing up for a paid subscription. You’ll need a Google account, of course, but each of those comes with 15GB of space. That’s a lot better than the 5GB Apple offers. Our favourite use for this space is to store photos. And you can do so by downloading Google Photos. However, using the Drive app you can fling any old files up on there.

Google Drive

15GB of free storage to use as you want, courtesy of Google Drive.

Download here: App Store

Best iPhone apps: Dating

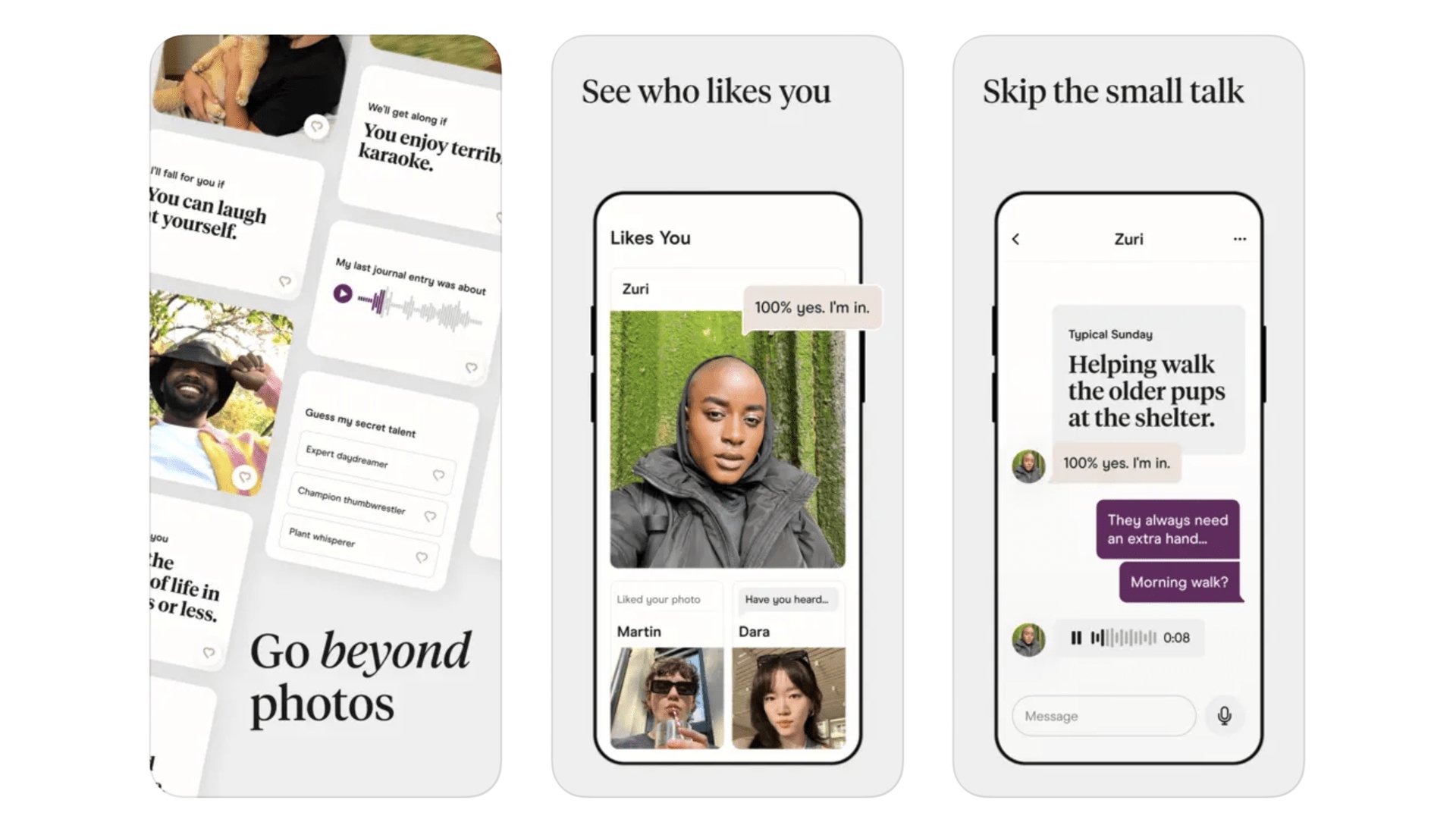

Hinge

App dating has a bad rep, largely a deserved one. But many of the daters we talk to have less scorn to pour on Hinge than most. It’s an app where you are asked a series of questions, with which you can show off your wit. Yes, even among the better-regarded dating apps there is still potential for mountains of embarrassment. Hinge also makes you pose questions to be asked of your potential matches. When perusing profiles you can “like” certain parts, to make a match-up seem more specific, and hopefully get you off the cycle of swiping.

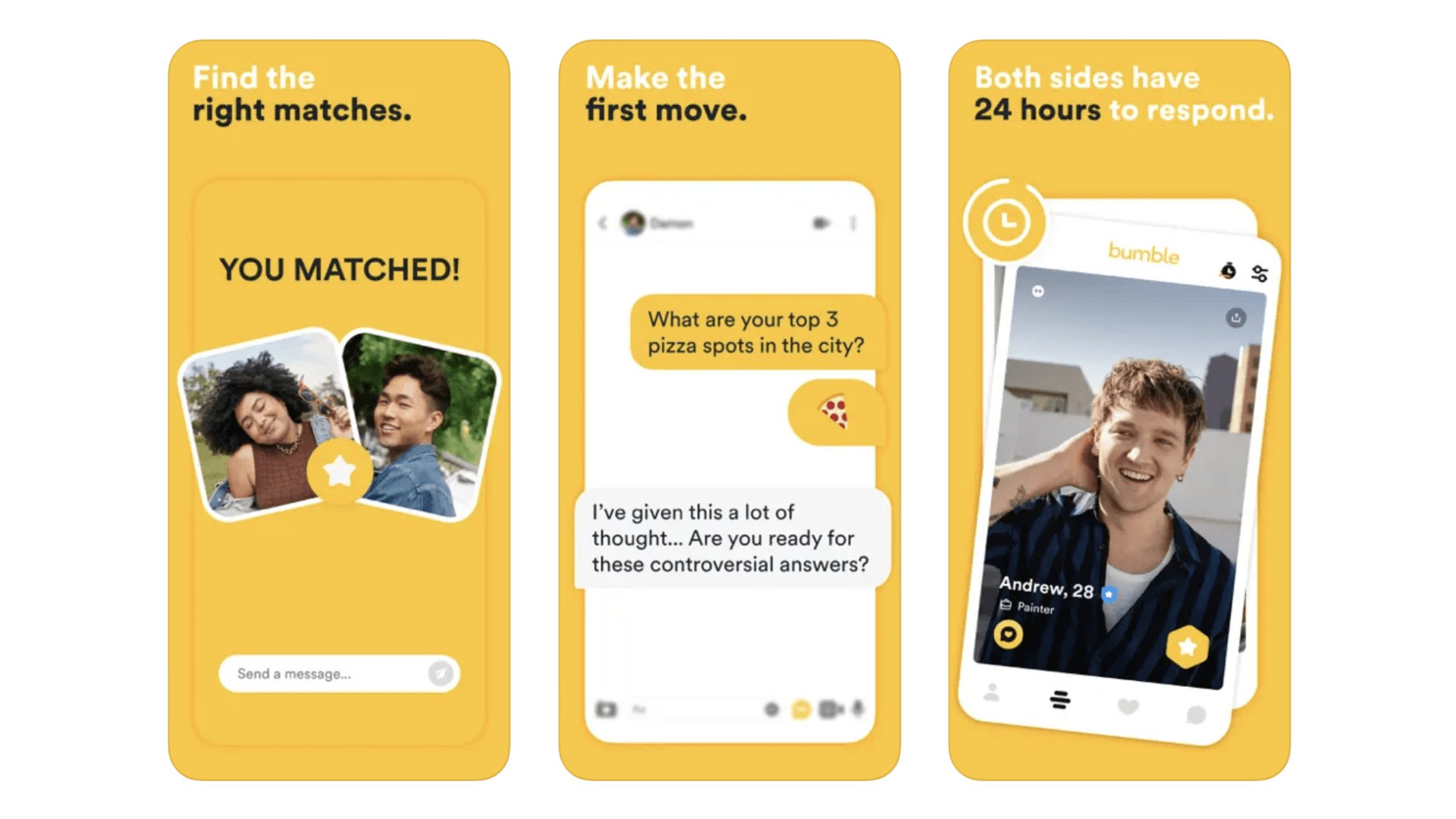

Bumble

The Bumble quirk is women message first, giving this dating app quite a different vibe to the competition. It’s not just for heterosexual folks, but the USP does rather rely on having people of the opposite sex getting involved. Bumble has also opened up beyond pure dating. You can list your account as being out for friendship or business connections too. Responsiveness is part of the equation, as matches expire after 24 hours if no contact is made.

Best iPhone apps: Drawing and Painting

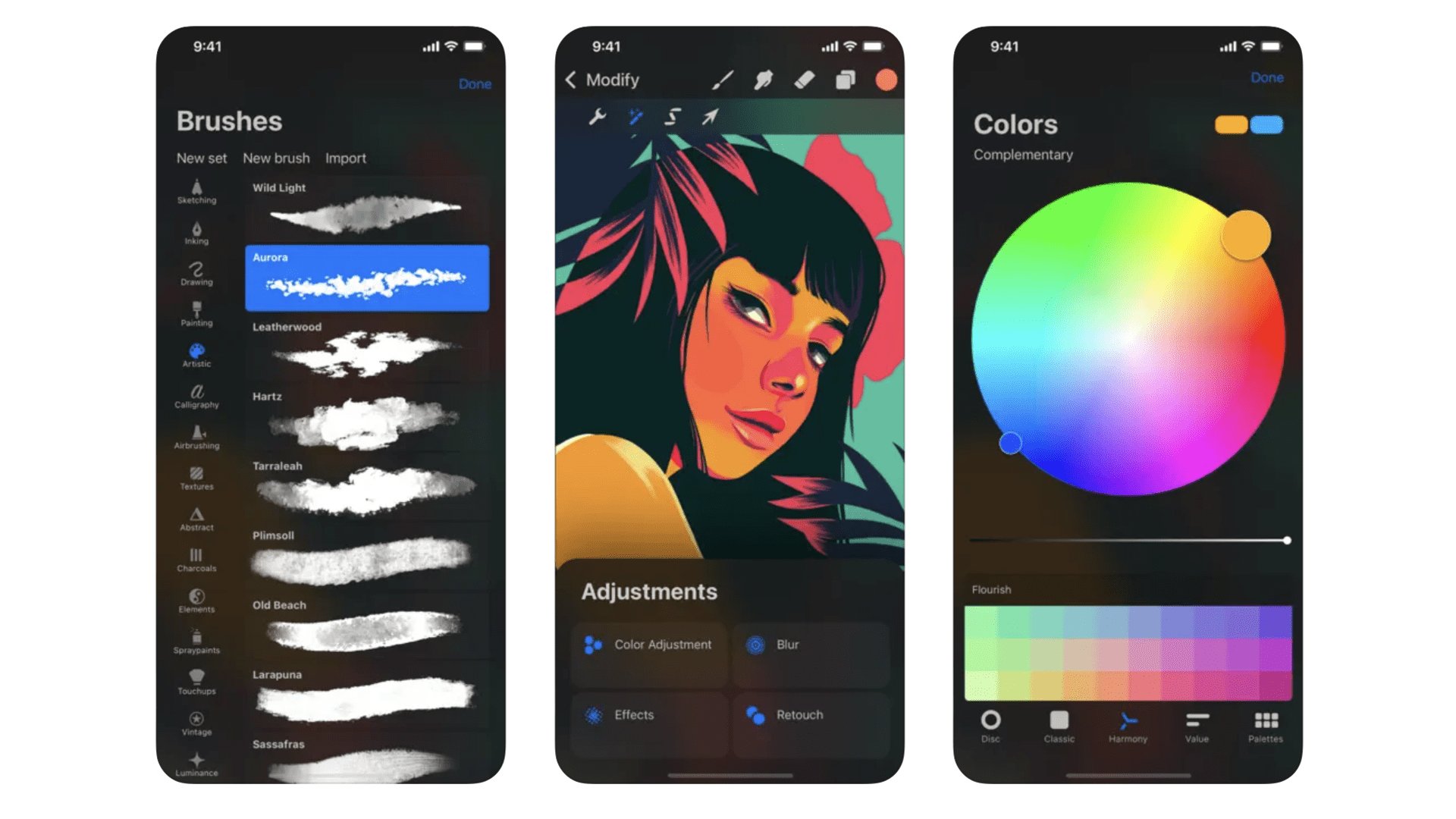

Procreate Pocket

The ultimate version of Procreate lives on iPad, but we’re not throwing shade at Procreate Pocket’s creators. iPhones have smaller screens and do not support the brilliant Apple Pencil stylus, two elements that pair so beautifully with a digital painting app. However, aside from that, and the lack of support for 3D model painting (seen in the iPad version), this does feel just like the full version for iPad. Lots of professional artists swear by Procreate.

Procreate Pocket

Procreate Pocket is the industry standard iPad art app shrunk down to iPhone size.

Download here: App Store

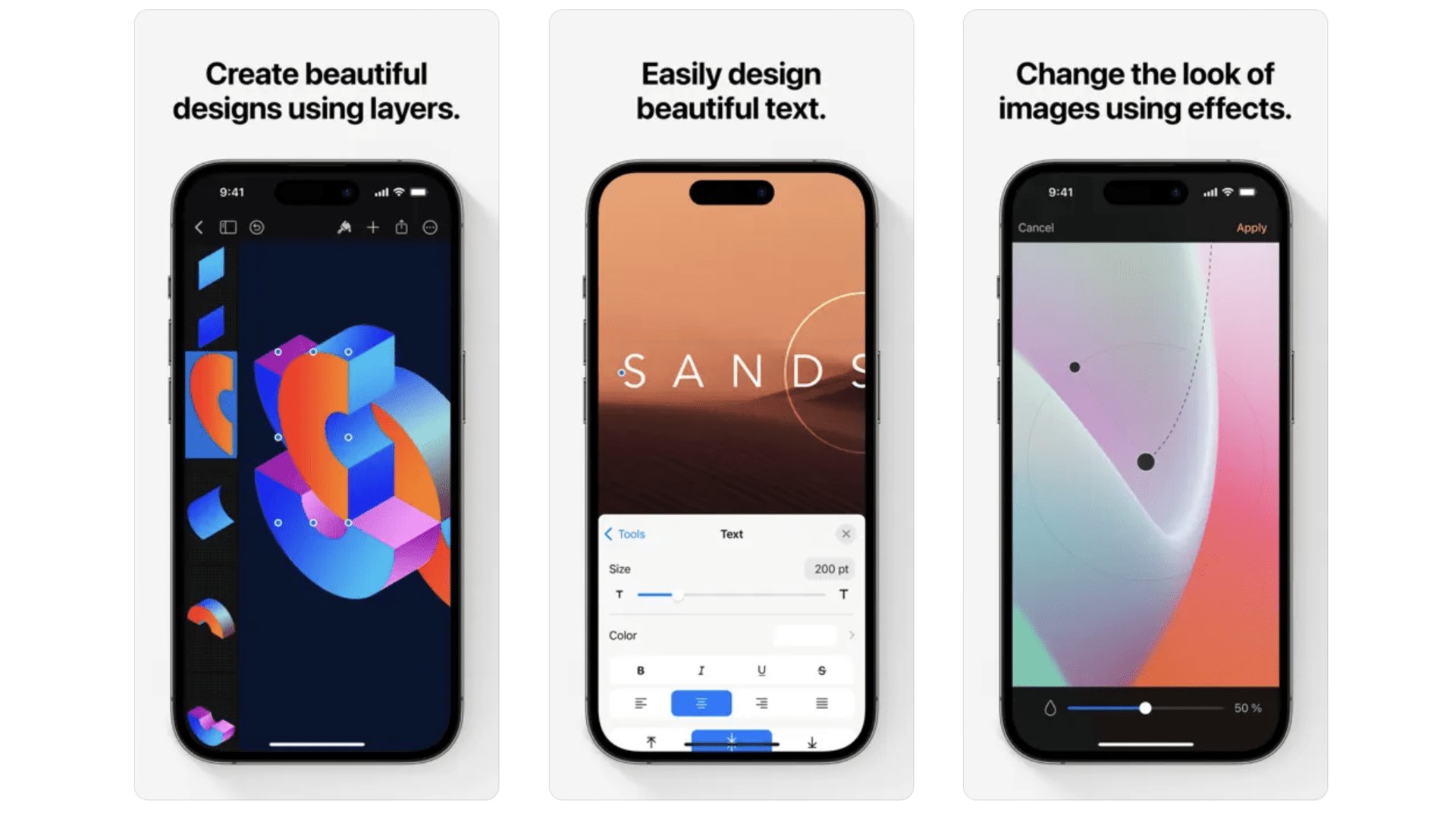

Pixelmator

This sleek and stylish design and drawing app can be used as a photo editor or a full-on drawing and painting suite. It’s packed with brushes, effects and advanced manipulation features like warp and pinch. Pixelmator reminds us of a mobile version of Photoshop. Crucially, it supports layers, making it suitable for fairly serious work. We’re impressed by how much has been packed in here, without making the app seem remotely unwieldy or unfriendly.

Pixelmator

This app is like having Photoshop in your pocket. Pixelmator is powerful.

Download here: App Store

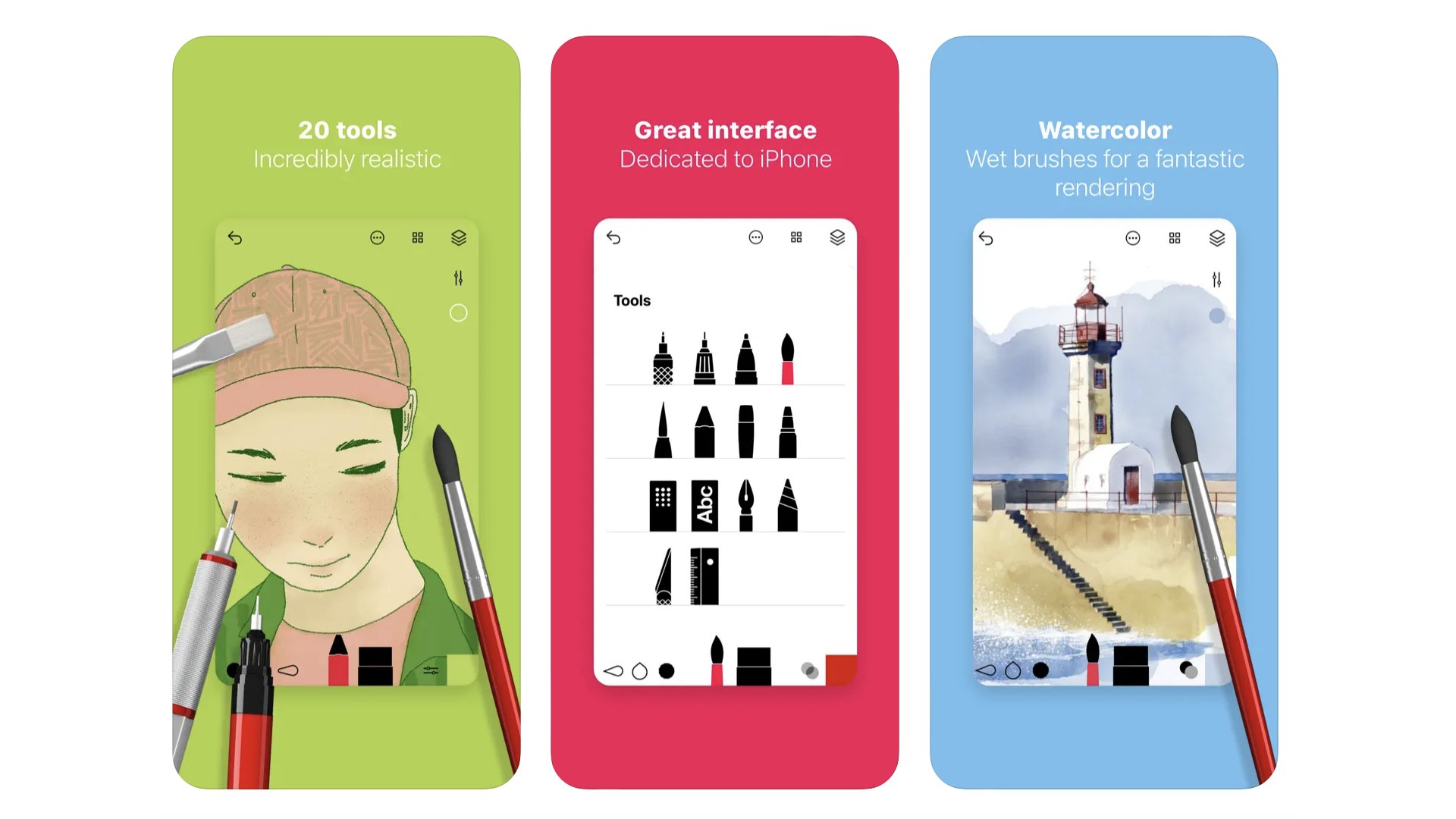

Tayasui Sketches

While Tayasui Sketches is a technically impressive app, it’s the vibe of the thing that proves so appealing to us. Developer Tayasui has managed to get away from the the slightly cold feel of some digital drawing/painting apps. It relies more on graphical depictions of pens and brushes when you pick your tool. And the way they interact feels fairly natural. You can get by for free with this app, but a Pro upgrade ($7.99) unlocks different brush patterns and styles. The free version still has layers, though, so you can create pretty advanced art, gratis.

Tayasui Sketches

Expertly modelled virtual pens and brushes aim to make digital drawing feel more natural in Tayasui Sketches.

Download here: App Store

Best iPhone apps: Education and Learning

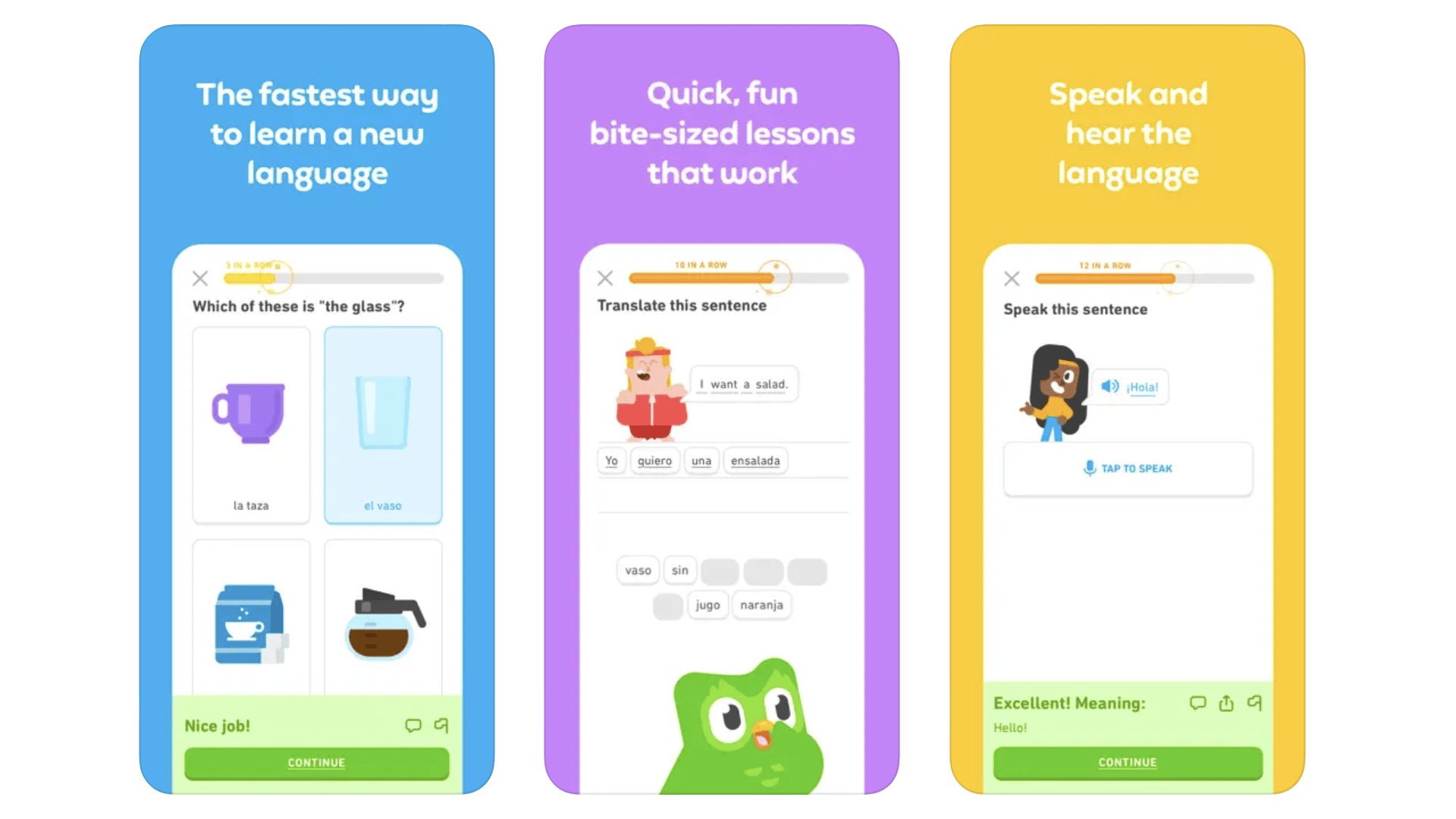

DuoLingo

How do you foster good habits? Make doing the healthy stuff fun. DuoLingo does that for language learning, with a veneer of gamification. The idea is you practice a language for a few minutes a day, in order to maintain your DuoLingo streak. Even if you don’t end up remotely fluent, a daily dose of this must be good for your grey matter. It’s free to use, while the SuperDuolingo subscription gets rid of ads and stops mistakes from blocking your daily progress. More than 30 languages are supported, from Japanese to Swahili, and even the High Valerian, a language constructed for Game of Thrones.

DuoLingo

Brush up on your foreign language skills in a just a few minutes each day with DuoLingo.

Download here: App Store

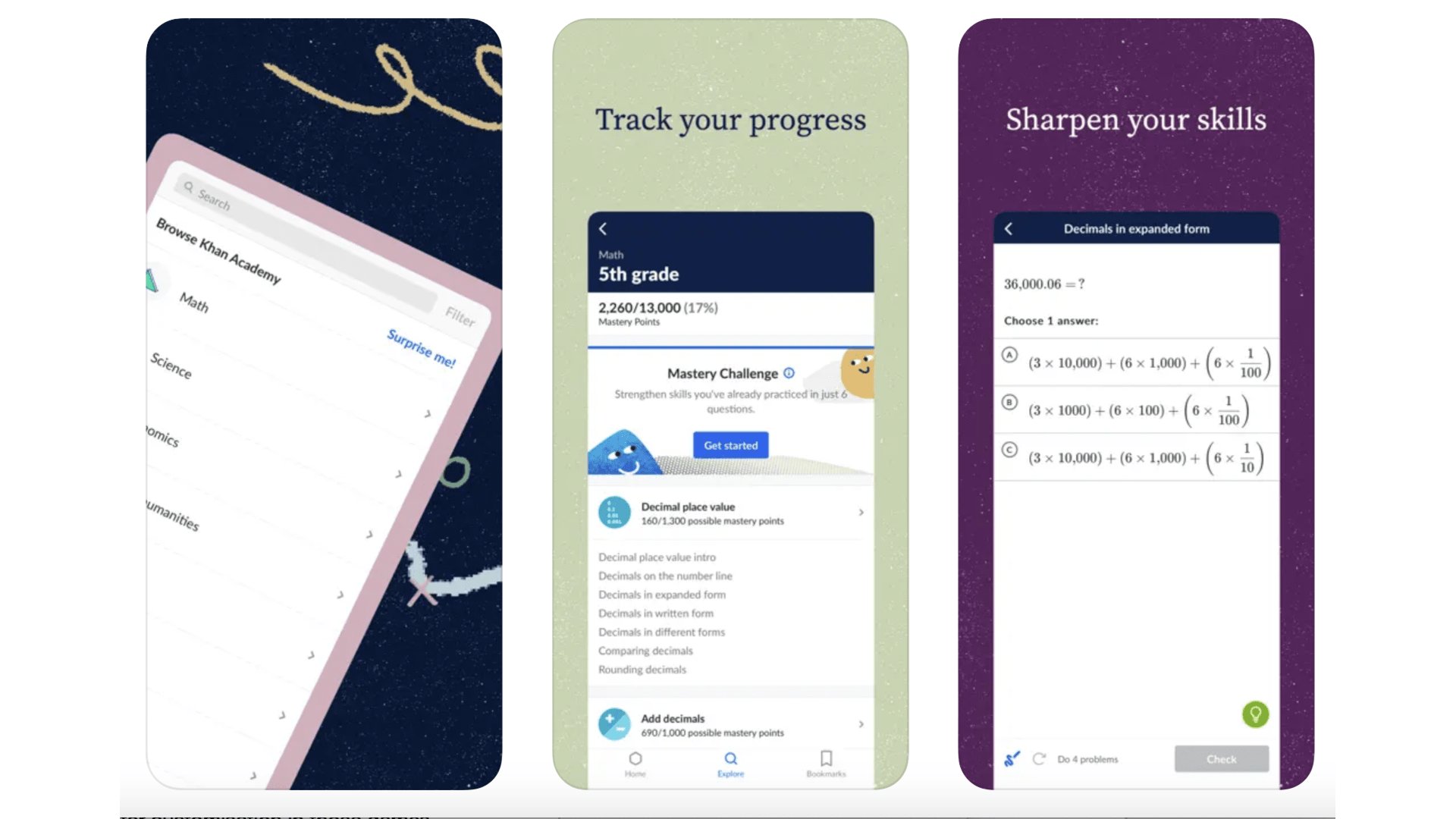

Khan Academy

Learning shouldn’t top when your leave school. Khan Academy brings a massive treasure trove of video sessions in math, science, economics, arts & humanities and computing. Each subject is broken down into digestible chunks, and you earn mastery points to let you keep track of how much of each area you have covered. You’ll find everything from the Realism art of Manet to the molecular structure of ionic solids in here. And as it’s mapped against the US school system, in terms of being middle school, high school or college grade (or above), you have an idea of what to expect. It’s all free too. This is a real treasure trove of an app.

Khan Academy

Khan Academy is an epic learning resource that lets you discover more about the wider world, past, present and future.

Download here: App Store

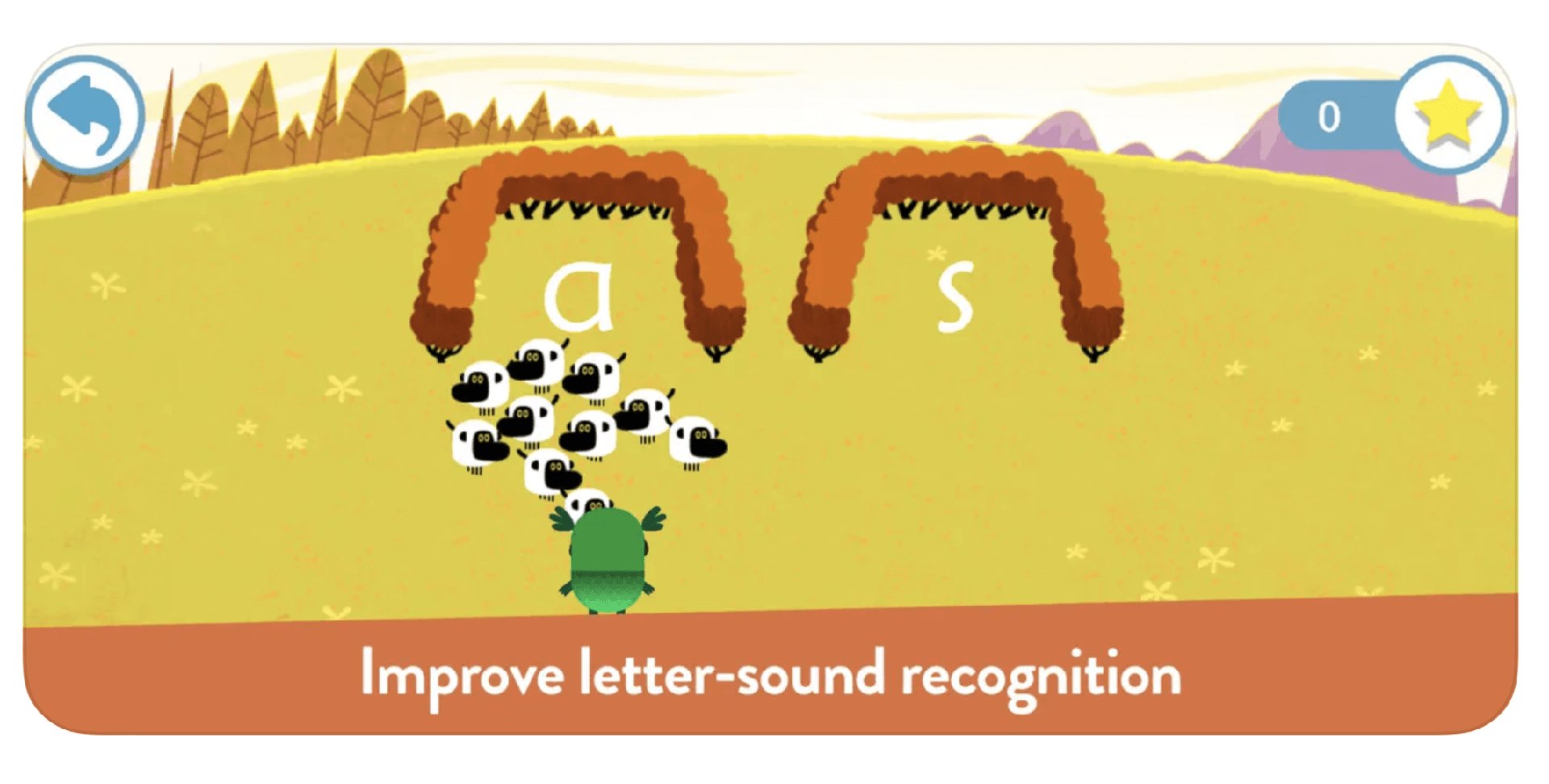

Teach your Monster to Read

This utterly charming app developed in collaboration with the UK’s University of Roehampton teaches your kids phonics and reading. But it’s no dry purely education-driven experience. It’s inspired by kids’ cartoons, games and, in particular, the character customisation in those video games many kids love. The experience of reading becomes part story-book, part interactive adventure. And Teach Your Monster to Read splits the learning process into three chapters: First Steps, Fun with Words and Champion Reader. Free to download, $8.99 to unlock the full app. Once your child is up to speed, don’t miss the follow-up, Reach Monster: Reading for Fun, which includes 70 free story books, which cycle around day after day (three available per day).

Teach your Monster to Read

Make your kids enjoy learning to read with Teach Your Monster to Read.

Download here: App Store

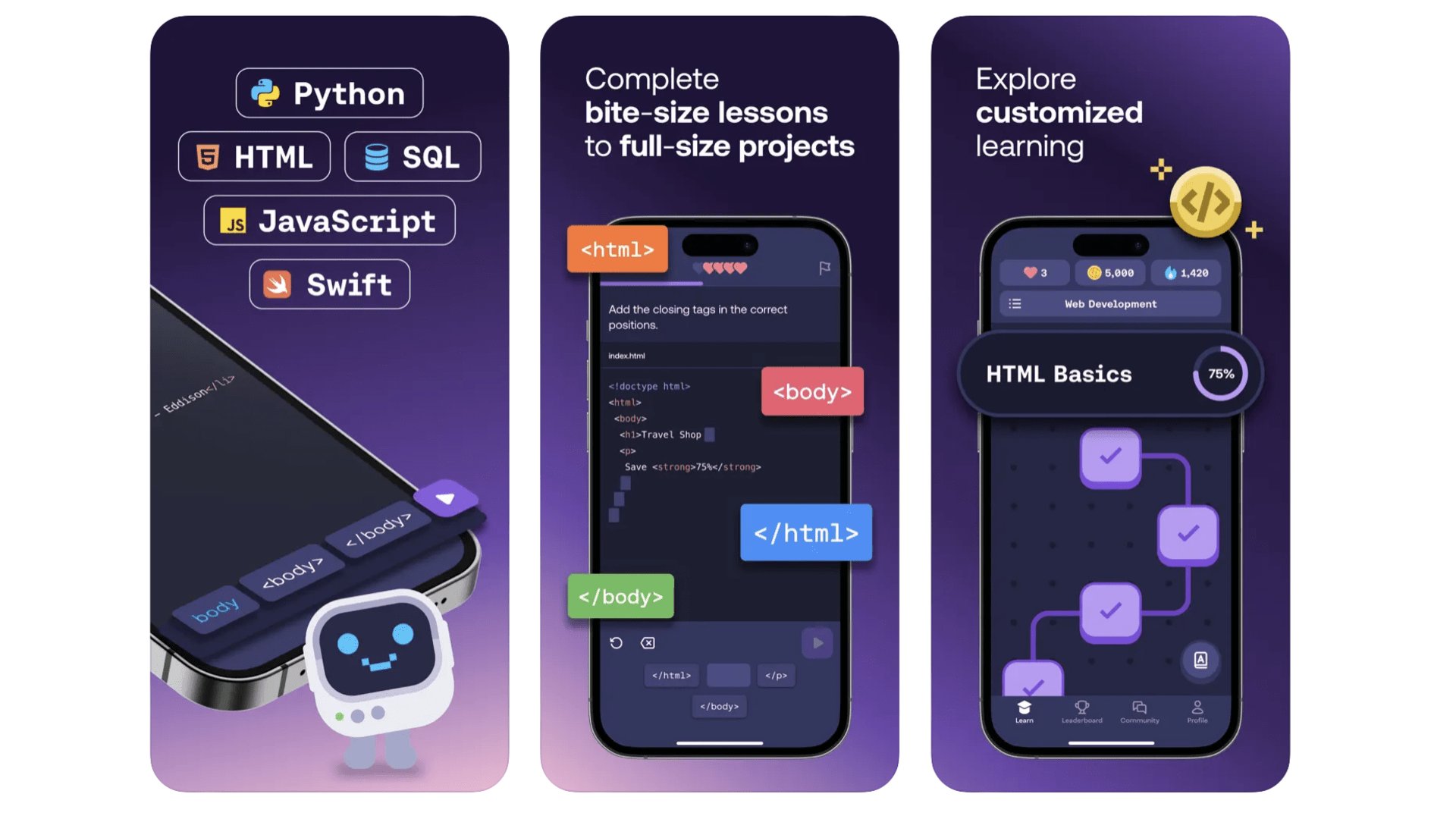

Mimo

Every wanted to learn to code? Us too, but it doesn’t half take a lot of time and brain power. Our latest (maybe last?) hope is Mimo. This is the coding equivalent of DuoLingo. It breaks down the process of learning coding of all types into teeny-tiny tasks you can digest in sessions of just a few minutes on your phone. There are modules on Python, SQL, Swift, Javascript and HTML. You can try out the first handful of lessons in each discipline for free, but will then have to pay up for a subscription. It costs $99.99 a year. If that’s too steep, check out Encode, which is similar but perhaps slightly less glossy, and costs $6.49 a year.

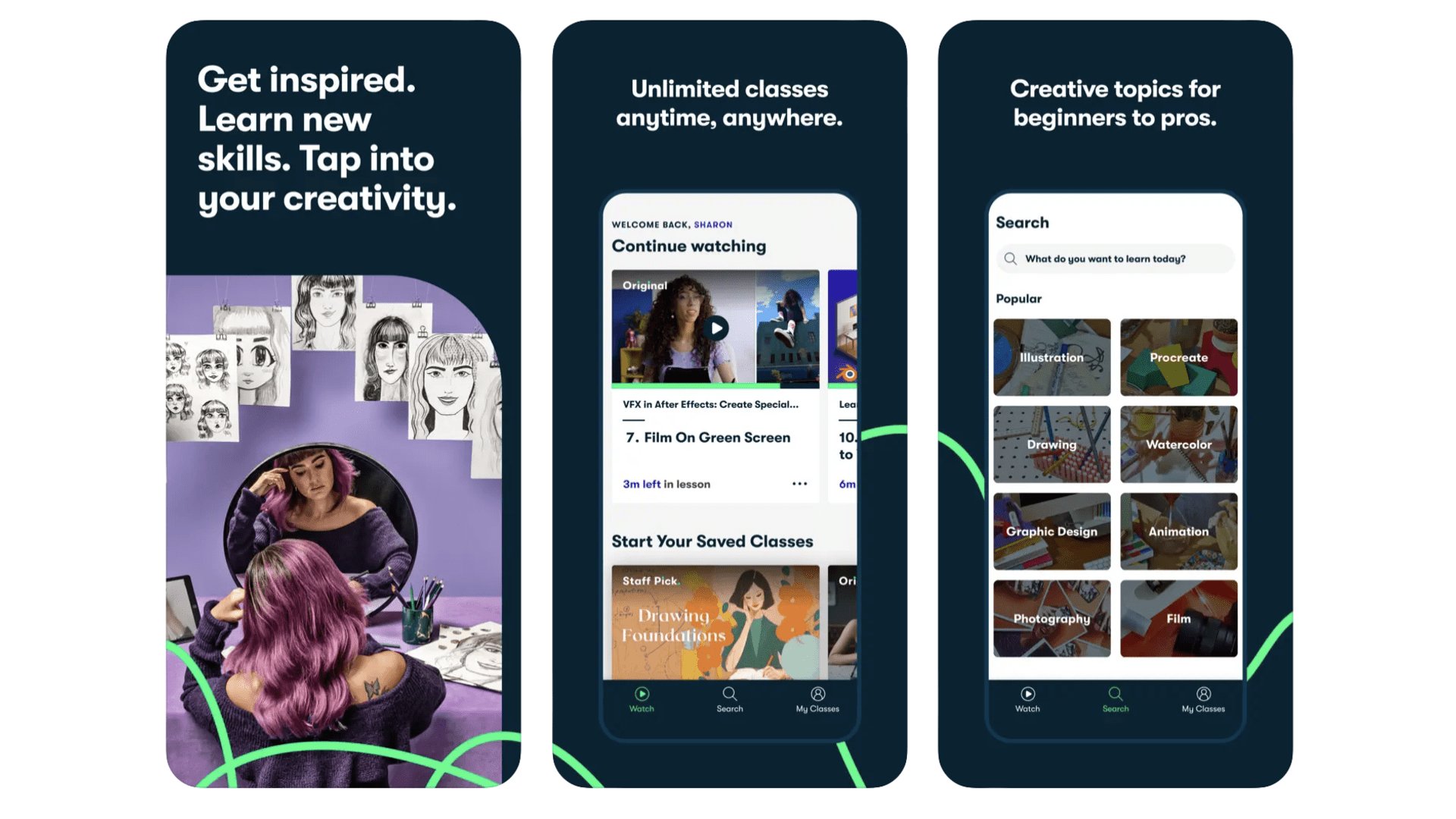

Skillshare

This may sound odd, but SkillShare is basically Netflix but for learning creative skills. You sign up for $31.99 a month or $169.99 a year, and get access to thousands of video courses across fields like creative writing, illustration, painting, film-making and photography. While there’s a lot of great tuition available for free over on YouTube, the smarter presenters clue up to their value and make courses people can sign up for. As they should. However, these are often quite pricey, while Skillshare lets you dabble in a bunch of fields to see what takes your interest.

Best iPhone apps: Fitness

Strava

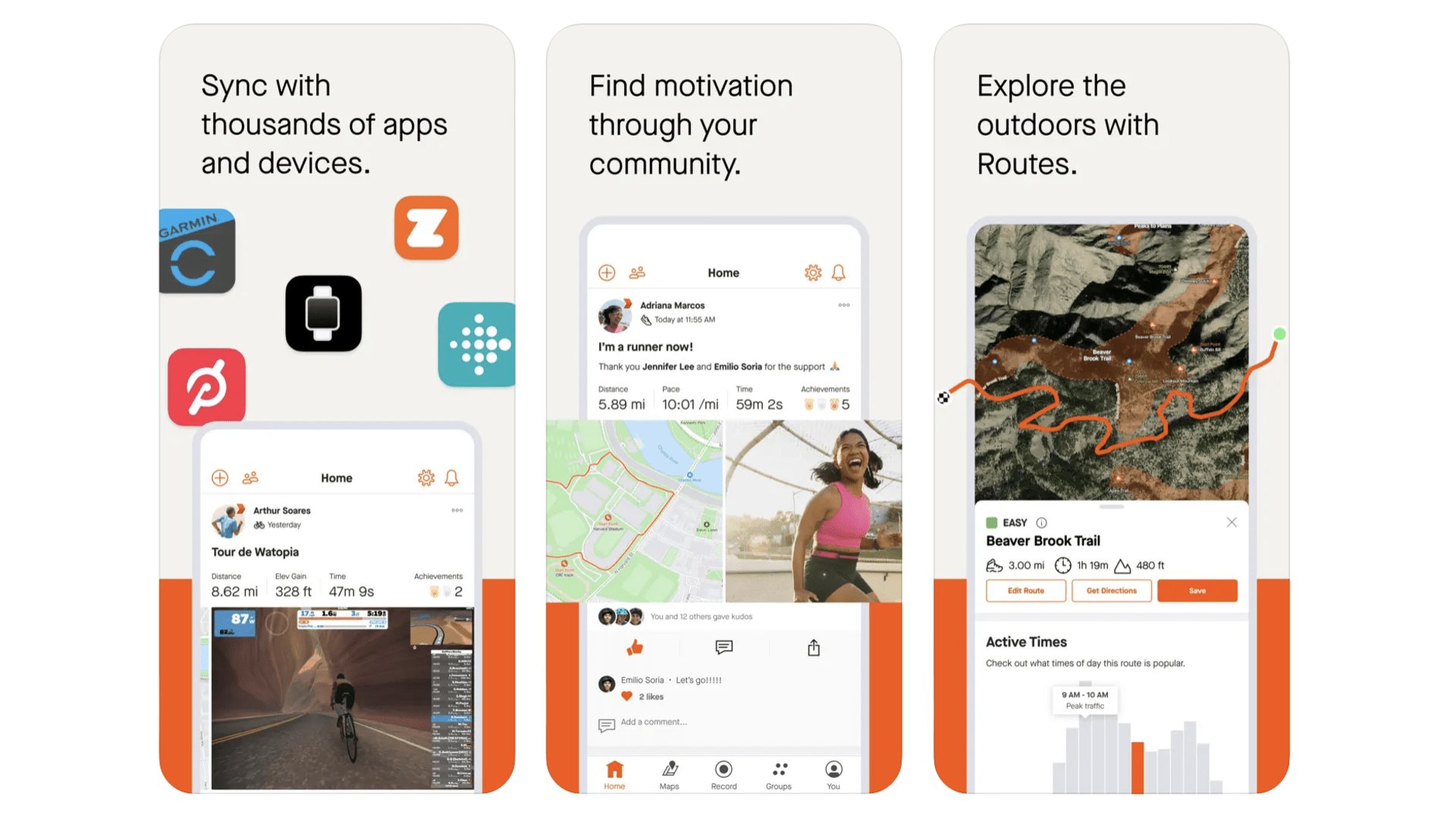

If it’s not on Strava, it didn’t happen. It’s a popular saying. This app has become so ubiquitous, it is basically the default pick for exercise logging, particularly among cyclists. It can be paired up with many wearable platforms to log your run, ride and gym (and more) data. Or you can log outdoors sessions using the phone app itself, thanks to your phone’s GPS. This is effectively a giant social network for active folks, and is at its best when you add friends or find a group to join within Strava. It’s free to use but a paid subscription unlocks stats like your weekly intensity. $11.99 a month, or $79.99 a year.

Strava

Keep an eye on your workouts and performance with an exercise-logging app like Strava.

Download here: App Store

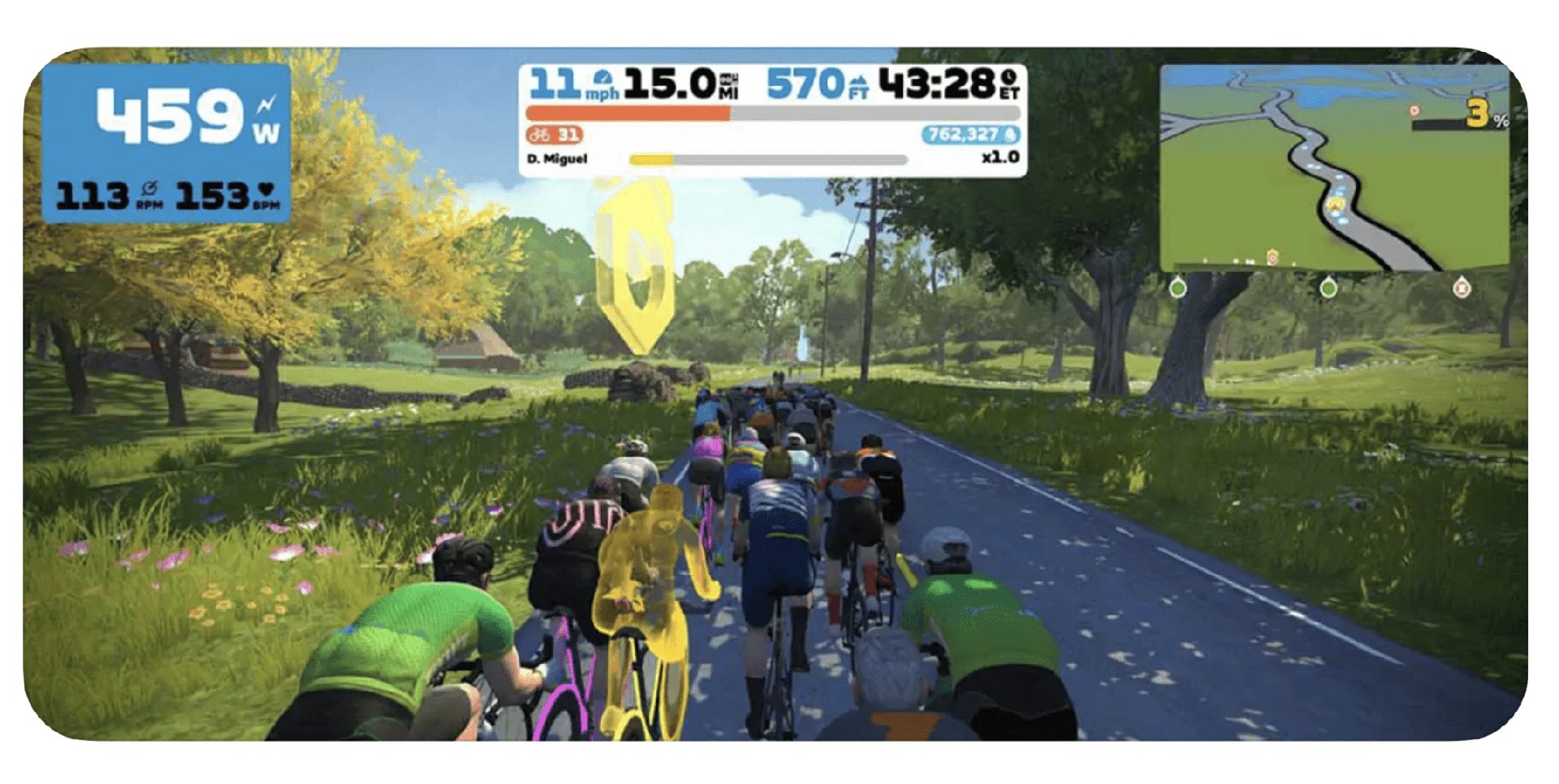

Zwift

OK, so this one requires some extra equipment. Zwift is an awesome cycling platform, or game if you like. It lets you ride around a virtual world called Watopia, and other game worlds inspired by Japan, France, New York and London, among other places. You compete with other real cyclists if that’s your bag, potter around or take part in structured workouts. You need a bike and a smart turbo trainer to get the most out of Zwift, but there’s a runner’s mode too. This is a must-try if you are into indoor bike riding. There’s a free trial, after which you’ll pay $14.99 a month.

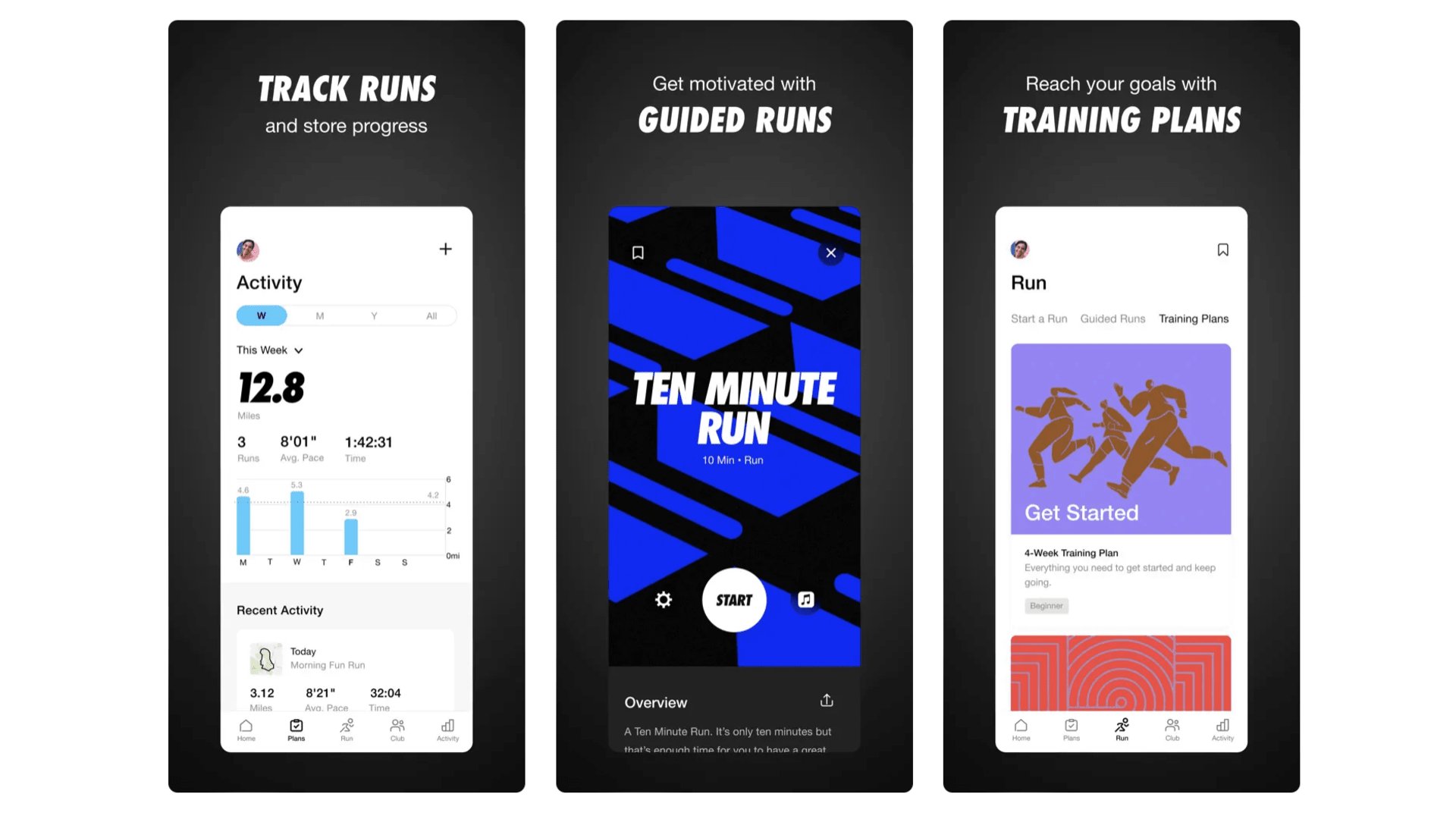

Nike Run Club

Nike doesn’t just care about selling expensive trainers. It also produces this rather neat runner’s app. Sure, Nike Run Club doesn’t generally have the clout of Strava among the athlete classes. But it is ideal if you are just starting out and have no idea what you‘re doing. It features “guided runs” and training plans including a classic “couch to 5K” style program for beginners. While we tend to see people migrate on from Nike Run Club in time, it does even have a marathon training program. That ain’t for beginners. Well, aside from the very boldest of ‘em.

Nike Run Club

Nike Run Club can help you into the running groove if you find it pavement pounding intimidating.

Download here: App Store

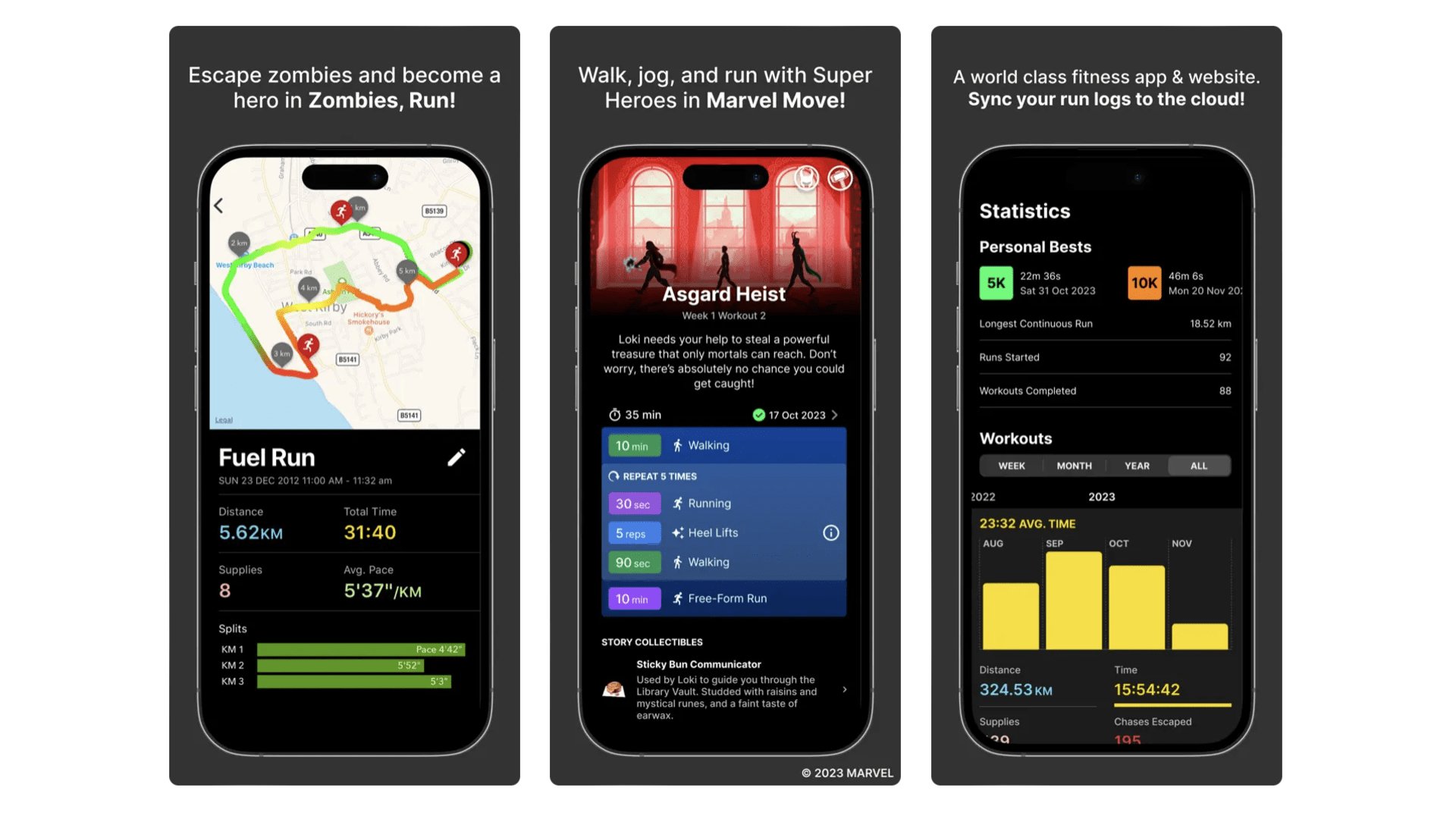

ZRX

Also known as Zombies, Run!, we’ve been recommending ZRX for what feels like forever. It turns your runs into audiobooks of a sort, with the action mapping onto the structure of the workout itself. It started off with just the zombie theme, but now there’s a Marvel module inside ZRX called Marvel Move. And Venture, which is home to hundreds of genre stories, including horror and sci-fi ones. If you find running terminally boring, this is one way to spice up those sessions. To unlock all episodes you’ll need to subscribe ($5.99/month). There’s a separate subscription one for the Marvel stuff ($7.99/month).

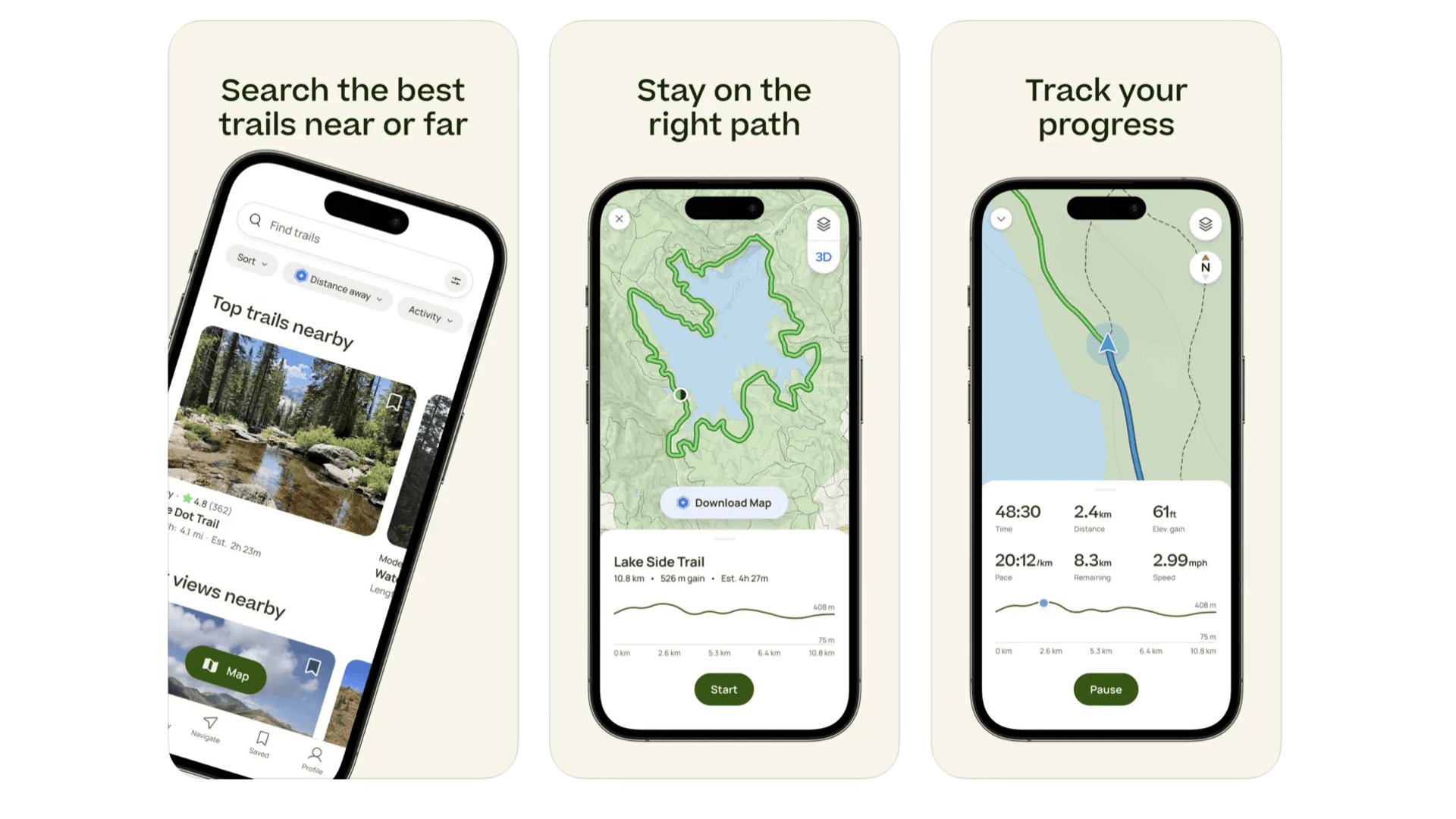

AllTrails

This was Apple’s iPhone app of the year 2023, despite being a core part of the app landscape for outdoorsy types for many years. It’s a brilliant hiking, running and cycling app that helps you find routes worth taking, mostly on cross-country trails. It feels a vibrant place too, as routes will have comments, reviews and photos taken by other AllTrails users. You’re also given a difficulty rating for each route, and roughly how long it thinks the walking time is. You can use AllTrails for free, but will need to pay $35.99 if you want to access features like 3D mapped previews and, much more important, offline downloaded maps.

AllTrails

Discover more of the country around you with iPhone app of the year 2023 AllTrails.

Download here: App Store

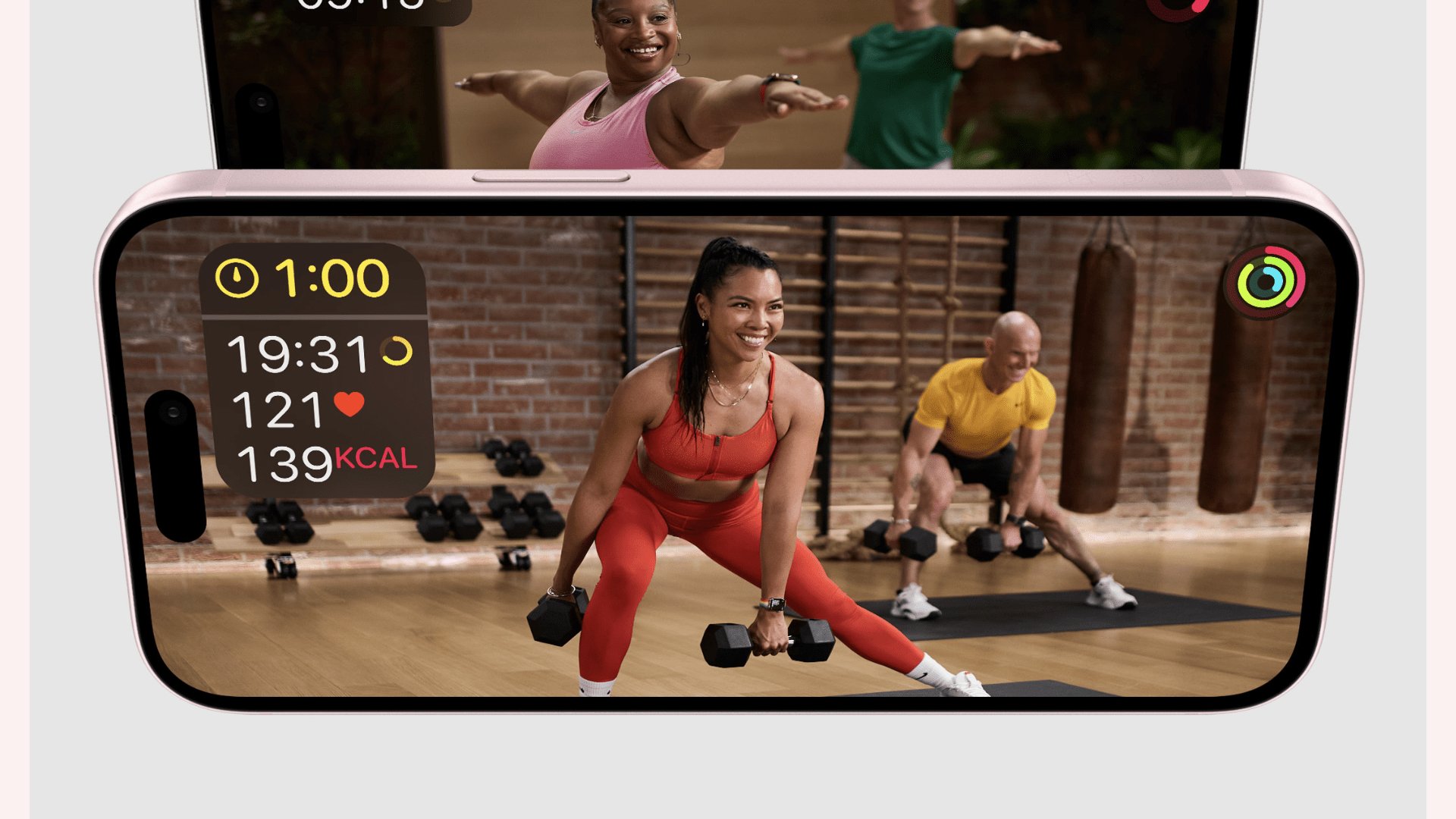

Apple Fitness+

When Apple Fitness+ launched in 2020 you needed an Apple Watch to even use it. That policy was dropped in 2022, but we highly recommend it for use with Apple’s wearable. Fitness+ provides a massive library of video workouts across a bunch of disciplines including yoga, weights, treadmill, kickboxing and mindfulness. And it puts your vital statistics on-screen, relayed wirelessly form your Apple Watch. We also recommend using AirPlay to get the video from your iPhone to a bigger screen if possible. So, yeah, some extra equipment required for the best experience. But Fitness+’s $9.99 a month subscription is still affordable compared to the average city gym.

Apple Fitness+

Get fitter the Apple way with Fitness+ library of video workouts.

Download here: App Store

Best iPhone apps: Finance and Money

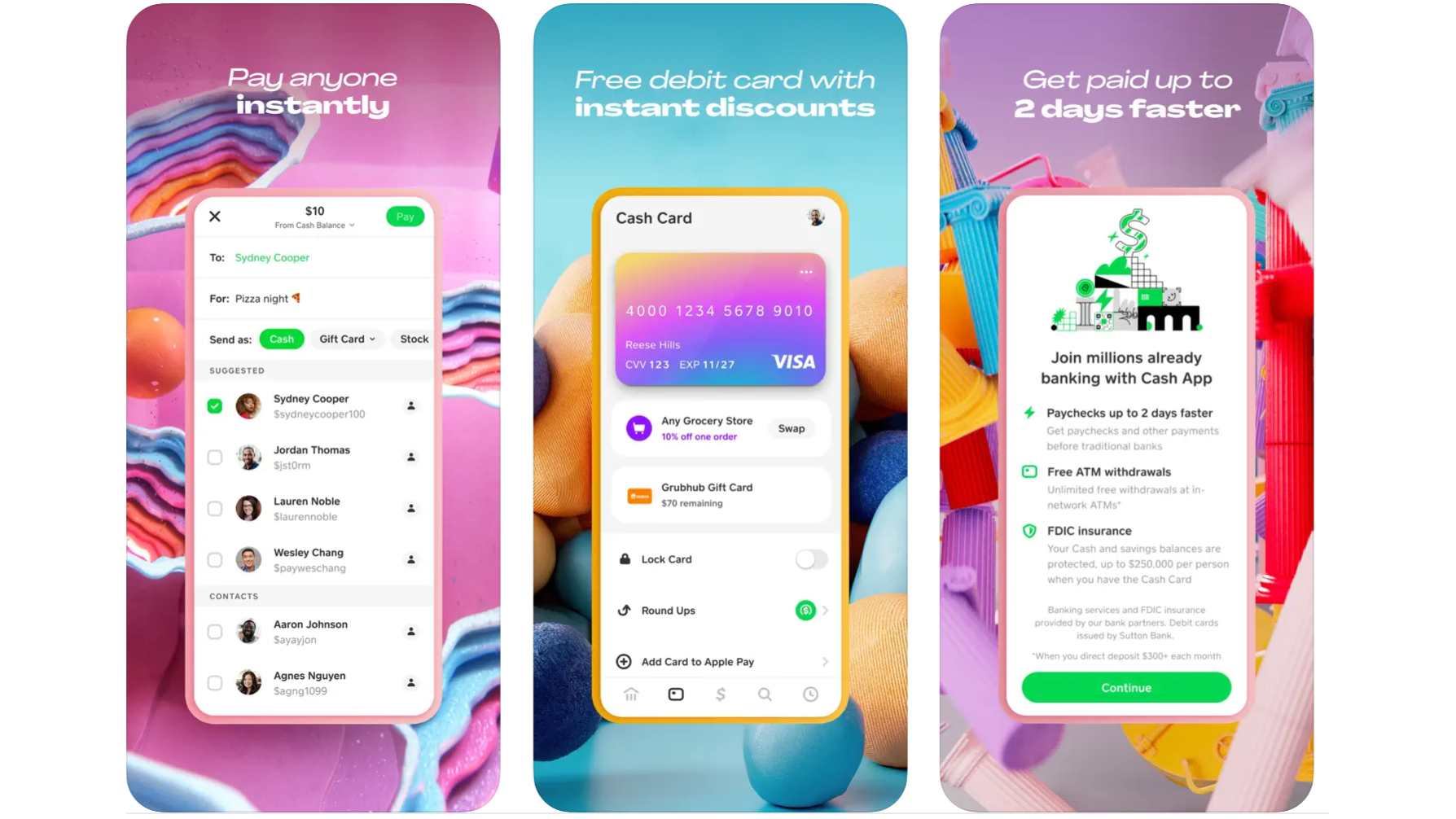

Cash App

You’ve probably already heard of or used Cash App, at least if you live in the US. It’s the app that lets you send money to other people, handy if you go out for dinner and need to split the bill, or if you owe someone cash for concert tickets. It can also be used like a digital debit card. We don’t recommend this next bit to many, but you also also use Cash App to trade in Bitcoin.

Cash App

Send money to friends and family without headaches using Cash App.

Download here: App Store

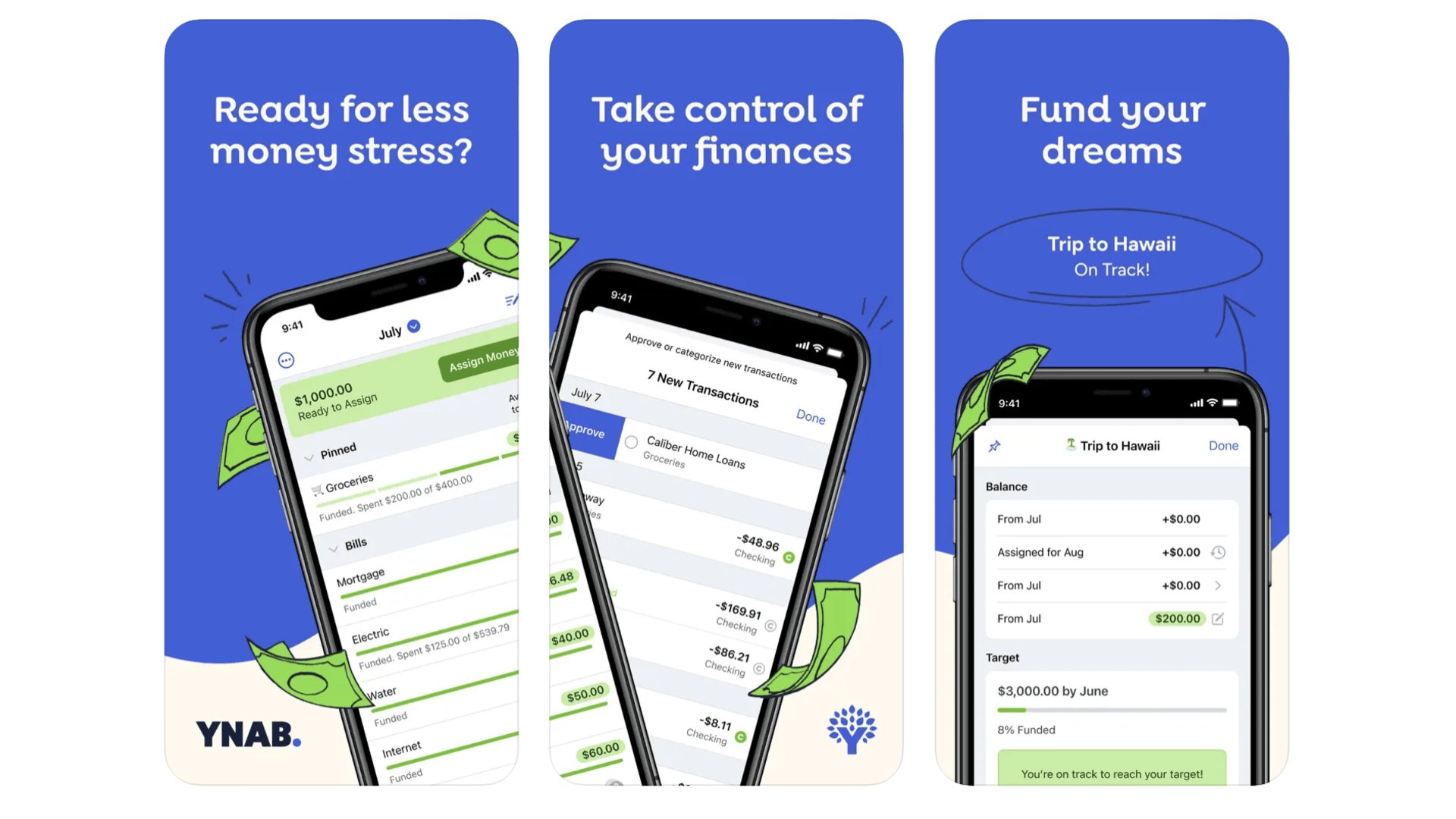

YNAB

You Need a Budget. That’s what YNAB stands for. It’s a no-nonsense outgoings calculator that works out how much you are spending in each category, from nights out to clothes to hobbies. The idea is you’ll be able to see what your spending is really like, rather than just fooling yourself. Its maker claims folks save "$600 in their first two months, and more than $6000 their first year.” Savings don’t appear out of nowhere, but if it helps you avoid debt, maybe the $14.99 a month ($99.99 a year) is worth it. UK readers might want to try out MoneyHub, which is much cheaper at £14.99 a year.

Best iPhone apps: Gaming

Delta

Back in April 2024, Apple changed a rule that allows retro-gaming emulators onto the App Store. Soon after, a bunch were available to download, with Delta being the standout. Developed by Riley Testut, this free app mimics a variety of consoles and handhelds, such as Nintendo Game Boy, Nintendo 64, and more.

Delta features save states, enabling you to resume your progress at any time, along with cheats, cover art, iPad support, and more. It's an essential app if you want to use your iPhone as a retro-gaming emulator.

Delta

Turn your iPhone into a retro-gaming emulation powerhouse with Delta.

Download here: App Store

Gamma

Gamma is another emulator, but it focuses on one system that Delta doesn't support — the Sony PlayStation console. Originally released in 1994, the PlayStation introduced countless iconic games, such as Tomb Raider, Metal Gear Solid, Tekken 3, and more.

Thanks to Gamma, you can play all of these, as well as some free games, right on your iPhone! Developed by Zodttd, the emulator features hardware controller support, analog controls, cheats, save states, ad-free options, and more. Gamma is already one of the best emulator apps out there, and most of all, it's free!

Gamma

Turn your iPhone into a Sony PlayStation emulation powerhouse with Gamma, featuring save states, multiplayer support, and more.

Download here: App Store

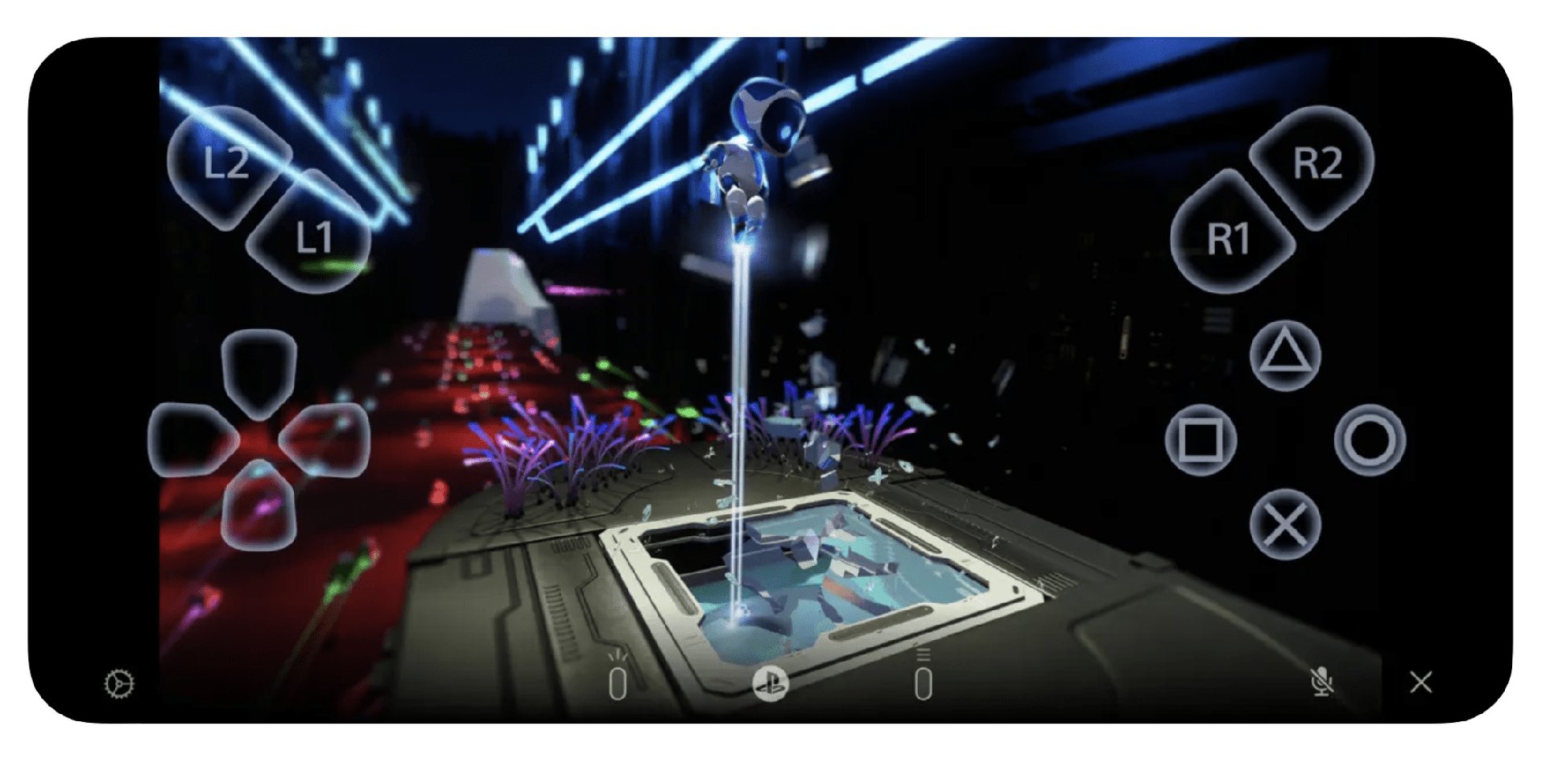

PS Remote Play

If you’re a PlayStation 5 gamer, you may have encountered Sony’s PlayStation portal, a handheld designed to stream games from your console. You can do this with your iPhone and the PS Remote Play app. Full disclosure: you need a great internet connection for this to work well. And your PlayStation 5 should ideally be plugged directly into your home internet router. Any opportunity to reduce latency and lag should be taken. Xbox fan? You can also use Xbox Game Pass Cloud gaming on your iPhone, but you do so through your phone’s internet browser. Fun fact: did you know Remote Play began more than 15 years ago with the Sony PSP and PS3?

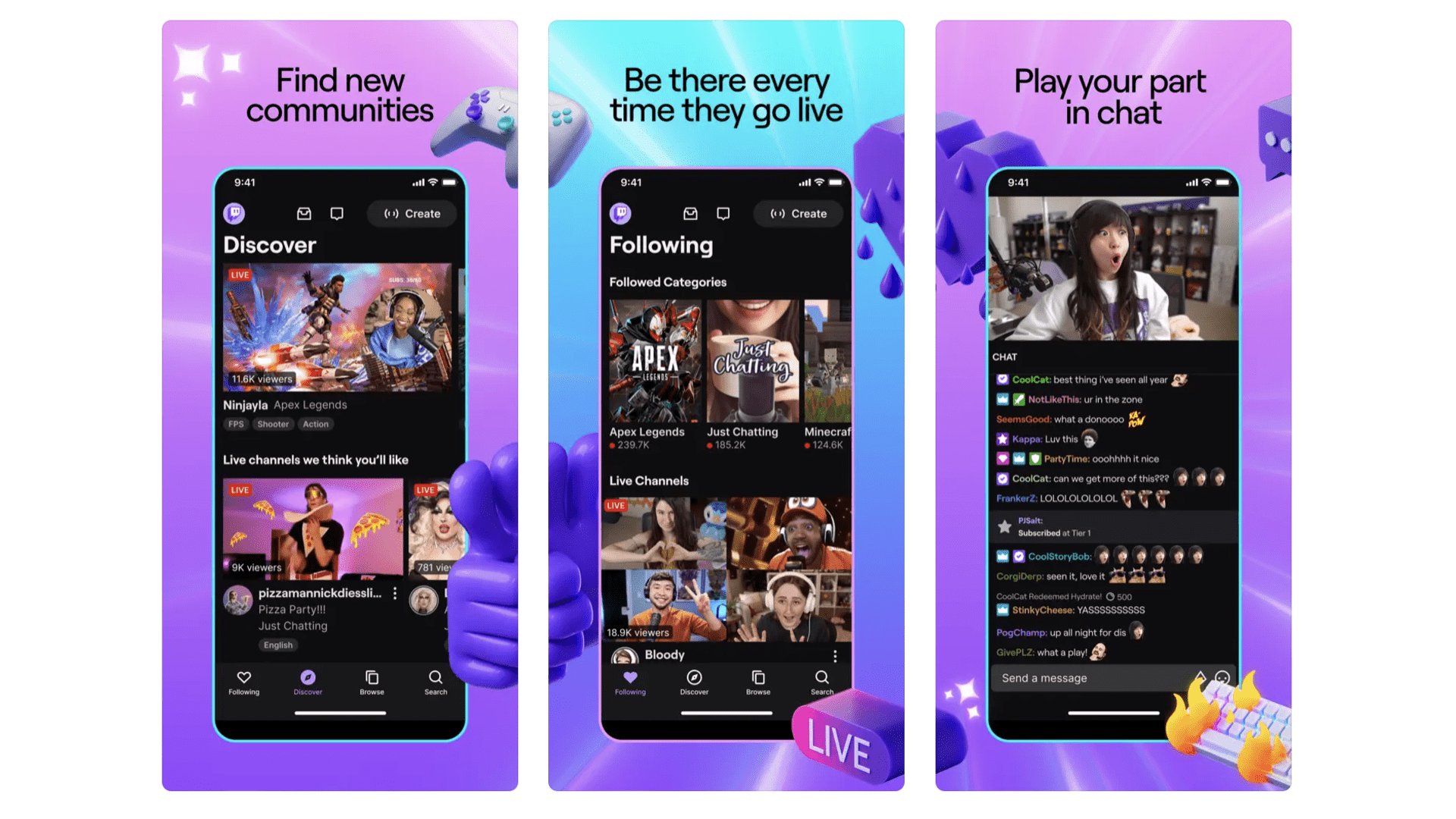

Twitch

If you enjoy games and haven’t tried Twitch, where have you been? Twitch is a bit like YouTube if it were made almost solely for live video game streaming. Find a creator you like and their streams will quickly start to feel like hangouts with a good friend, often one who is funny and charming to boot. You can easily lose hours to Twitch streams, so careful how you go. But if you have a work commute that could do with a cheer up, this app can help. It’s free to use, but Twitch relies on audiences supporting their favourite creators through subscriptions.

Twitch

Feast on endless hours of streamed video game joy over at Twitch HQ.

Download here: App Store

Best iPhone apps: Health

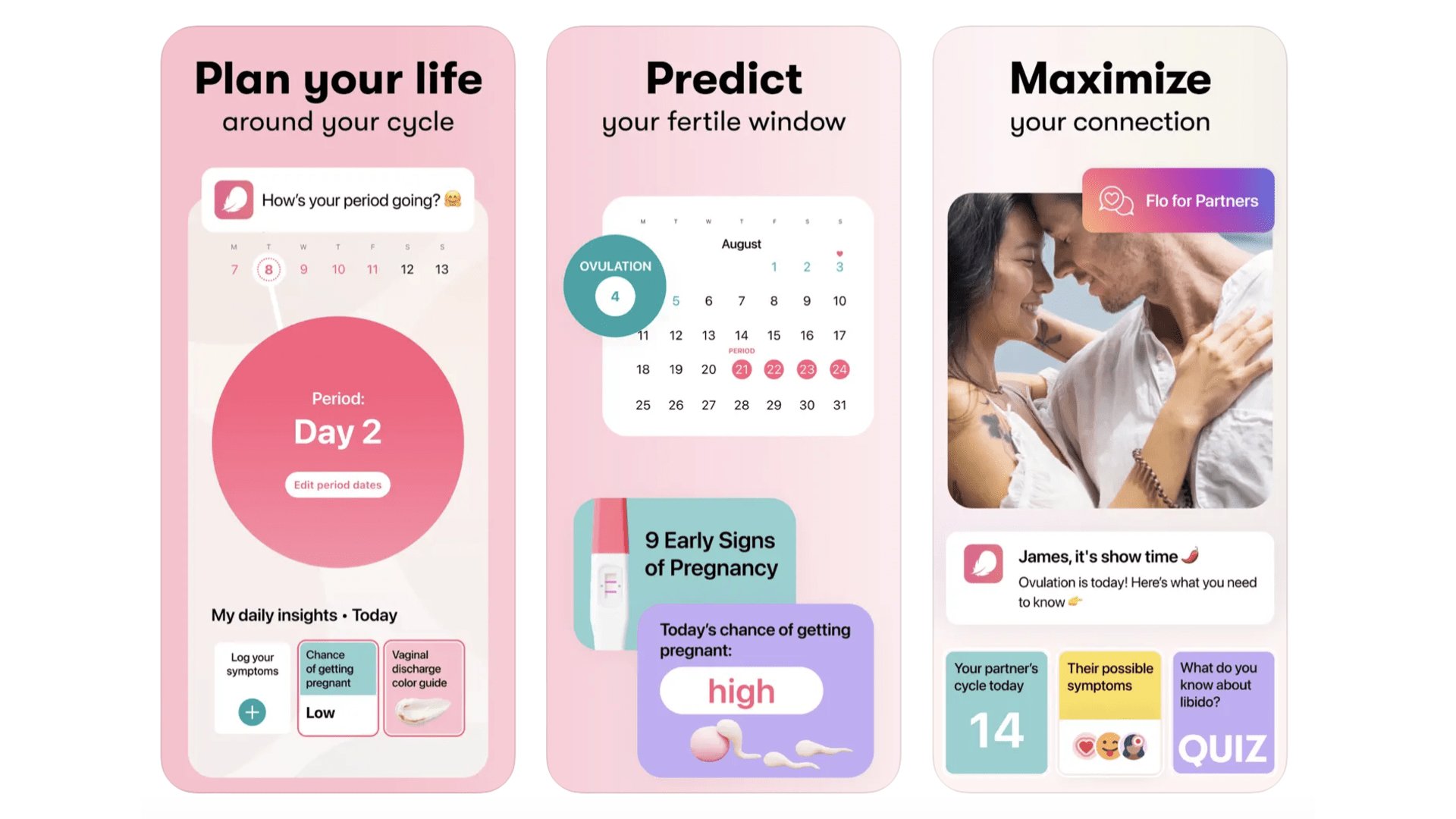

Flo Period & Pregnancy Tracker

The most popular period tracking app at the time of writing, Flo Period & Pregnancy Tracker monitors your ovulation cycle and estimates what your chances of pregnancy are on any particular day. You input your symptoms, sex drive, and even exercise and water intake, if you choose to go all-in. Its estimates are generally well regarded. And you can use Flo for free and get the core experience. A paid subscription ($11.49 a month or $39.99 a year) unlocks more data analysis, community features, a daily advice feature and more.

Flo Period & Pregnancy Tracker

Track your fertility through the month with Flo Period & Pregnancy Tracker.

Download here: App Store

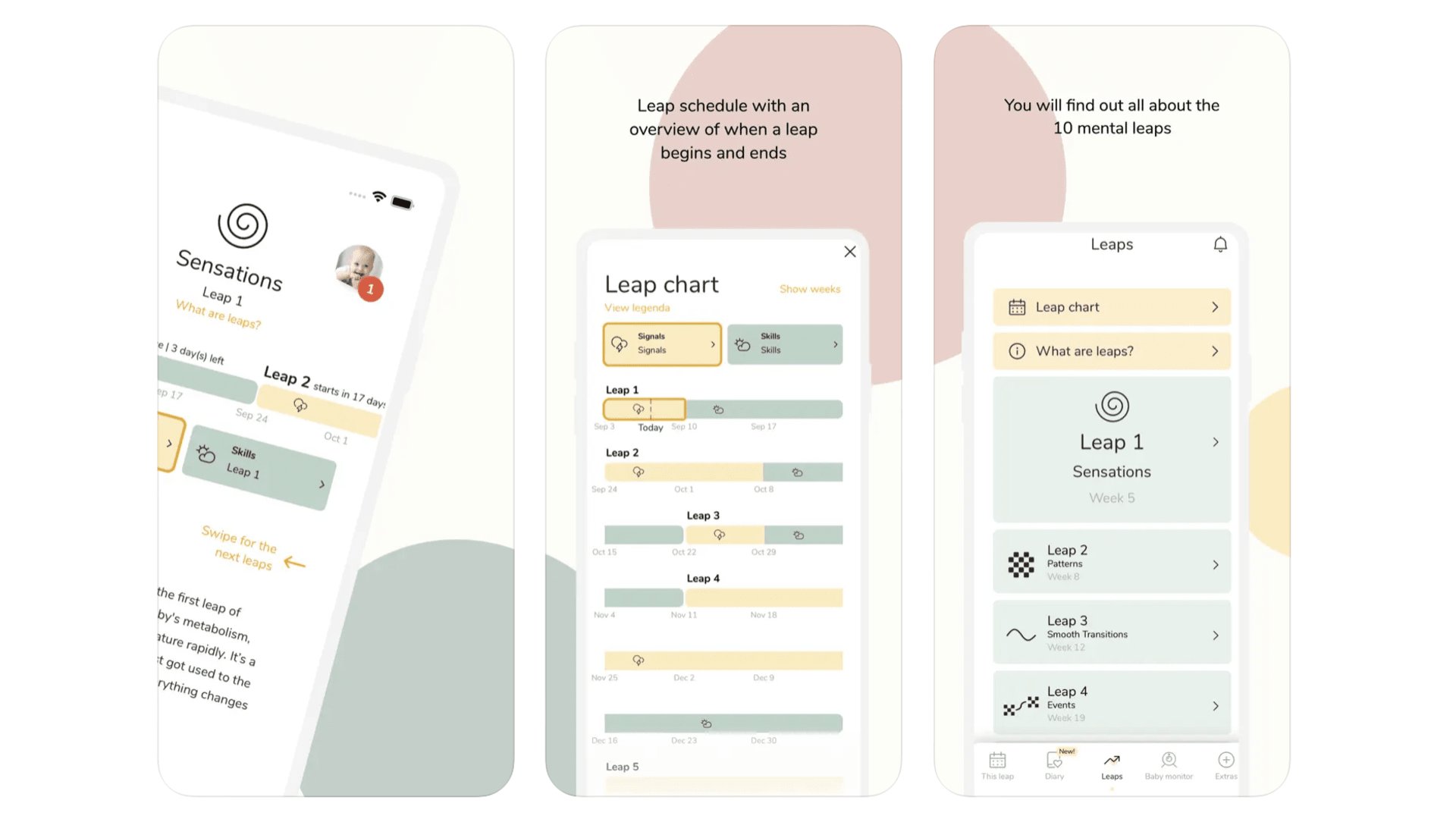

The Wonder Weeks

The first few weeks (and perhaps years) of parenthood are a potentially scary, intimidating place to be. The Wonder Weeks app ($5.99) attempts to insert a bit of predictable structure into your potentially sleepless life by mapping out the “leaps” in development of a young baby. You log all of your child’s own milestones in their virtual “diary”. You can also use one of the developer’s add-on apps to turn a spare phone or iPad into a baby monitor. That’s a $3.99 upgrade, or you can get a $1.99 subscription for access to that and an ebook.

The Wonder Weeks

Try to make sense of your child’s early weeks in The Wonder Weeks.

Download here: App Store

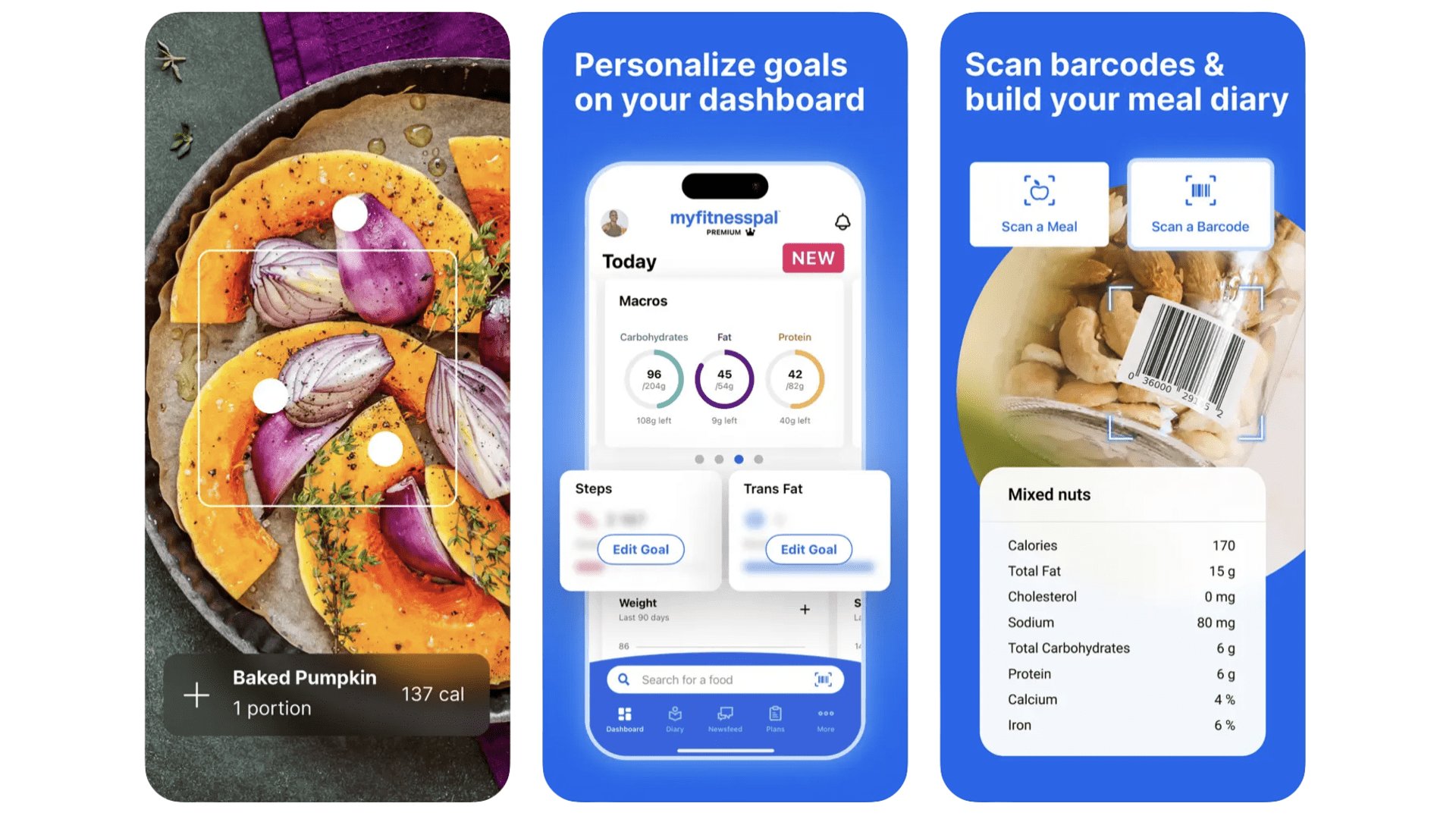

MyFitnessPal

From a look at its icon and name you might guess MyFitnessPal is an exercise logging app. While it can be used for that, steps and exercise are largely used to more correctly calculate your calorie deficit or excess. The idea is you’ll use the app to log all your food, and make sure your calorie consumption is on point, and that you are getting all your required macros in. Yep, it’s not the most fun job and it’s not the most healthy thing to do for some folks. But it is a pretty foolproof way to make progress in your weight and health goals. It’s free to use, but if you want to get rid of the ads and be able to barcode-scan foods, you need a sub. It costs $19.99 a month, but go for a year if you can, as it costs $79.99.

MyFitnessPal

Tracking calories isn’t for everyone, but MyFitnessPal makes it easier and less time consuming.

Download here: App Store

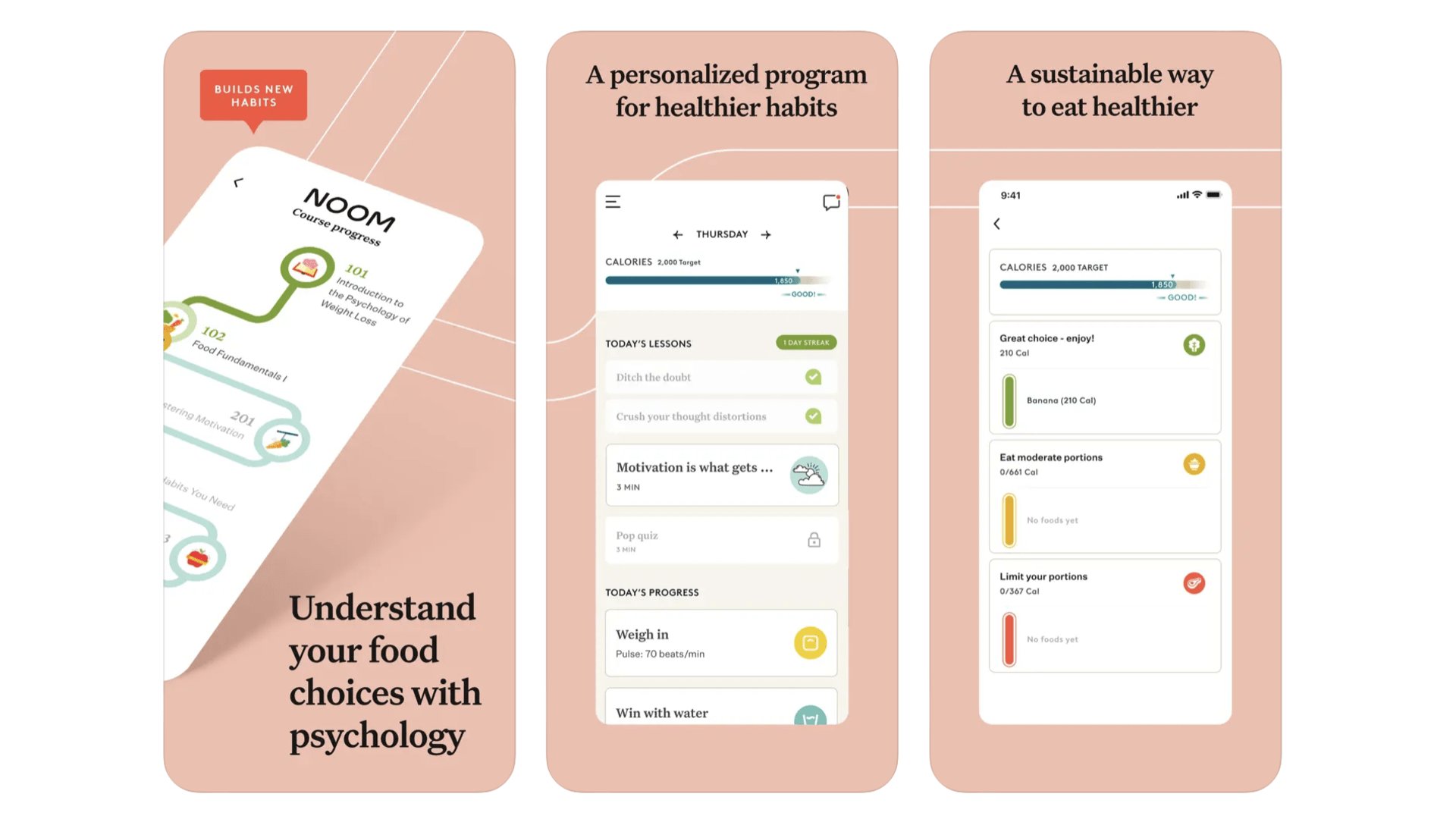

Noom

This big-money weight loss program gets rave reviews from its users, and does legitimately seem to be a cut above most other diet apps. Yep, there’s the usual food-logging and calorie counting involved, but Noom is more about changing your behavior and thinking, rather than a quick fix. That’s the idea anyway. You get paired with a “coach” when you sign up, who can be messaged for advice or reassurance. Noom has had a rough time of it of late, with rounds of coach lay-offs. But, as far as we can tell, these are still real people. Noom is a pricey subscription, though, the cheapest solution being $209 for a year, rising all the way to $70 for a one month rolling subscription.

Noom

Noom is a weight loss app that says it can help people take control of their health for good.

Download here: App Store

Best iPhone apps: Home and Garden

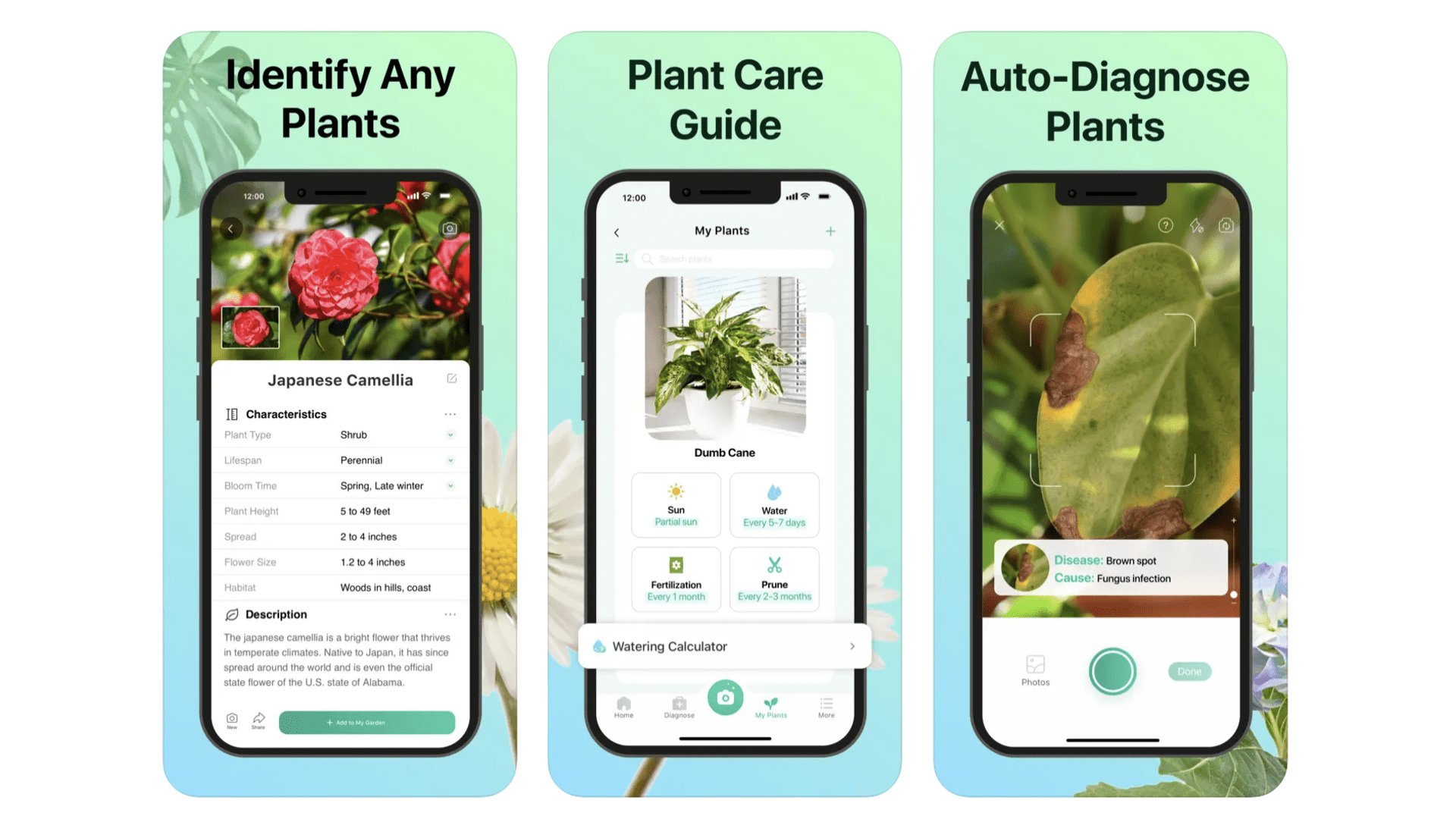

PictureThis

Are you a little bit green-fingered? PictureThis is a must-download. It is a plant identification app. You point the phone camera at a plant and, in all likelihood, this app will be able to successfully identify it. It’s super-useful if you come across something you’d want to grow yourself, but have no idea what it’s called. Tens of thousands of species are in its database. PictureThis will also show you collections of plants you should be able to see growing in your local area. It’s a charming app that can even attempt to diagnose the health of plants. Free to use, but an ad-free, unlocked membership is $29.99 a year.

PictureThis

Discover more about the natural world around you with plant identifier PictureThis.

Download here: App Store

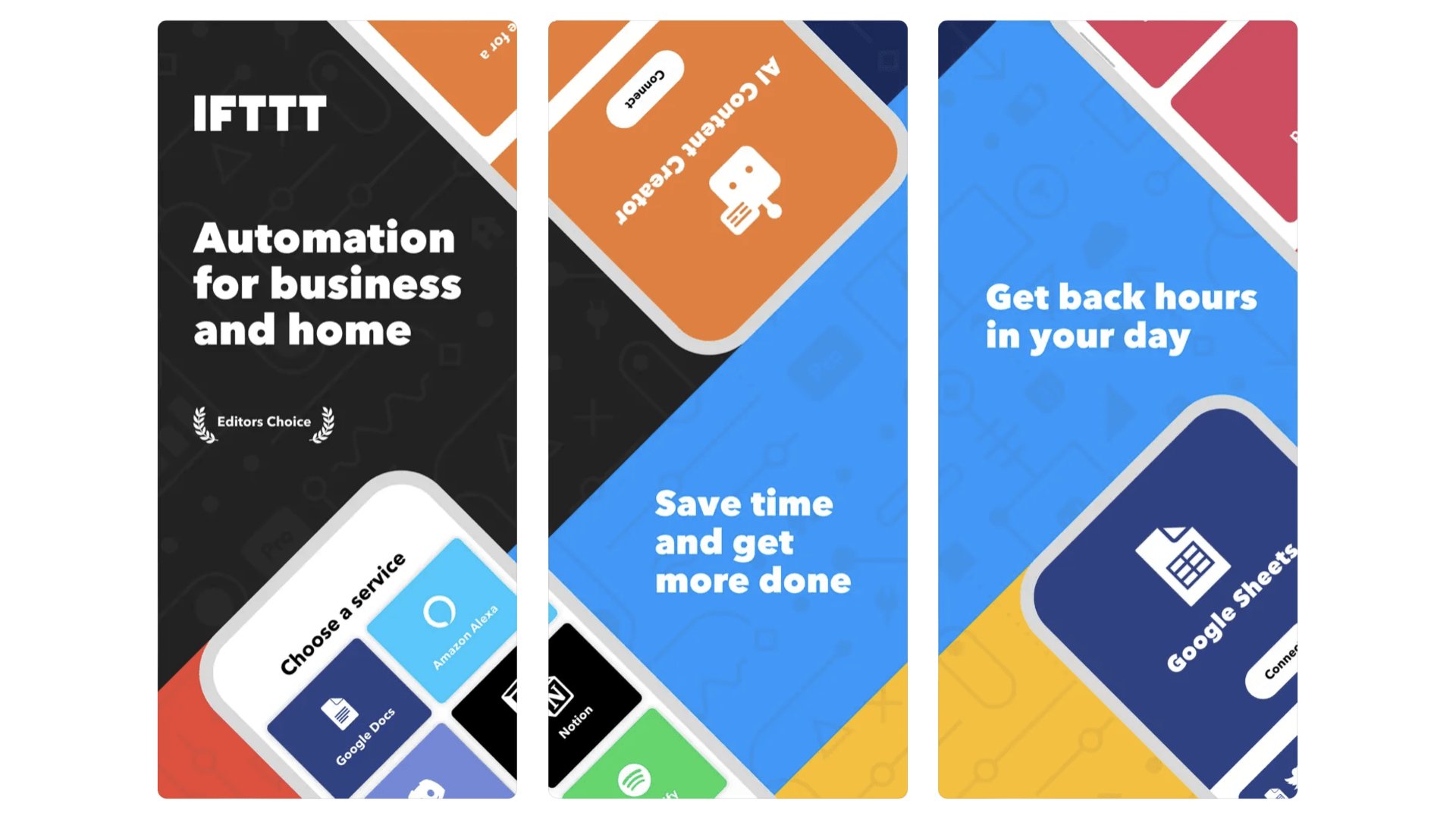

IFTTT

IFTTT stands for “if this then that”, and has been around since 2010. It seems kinda dorky on the surface, as it’s form of programming. But it also opens up countless neat possibilities. IFTTT lets you program your own automations based on all sorts of events, from you reaching a certain location to someone tagging you in a Facebook post. So many smart home systems are hooked up to IFTTT, you can run pretty much all your smart home gear through this app. You can create three automations, dubbed applets, for free. After that you have to pay for a Pro ($2.75) or Pro+ ($5.50) subscription, which lift that limit to 20 applets, or remove the limit altogether.

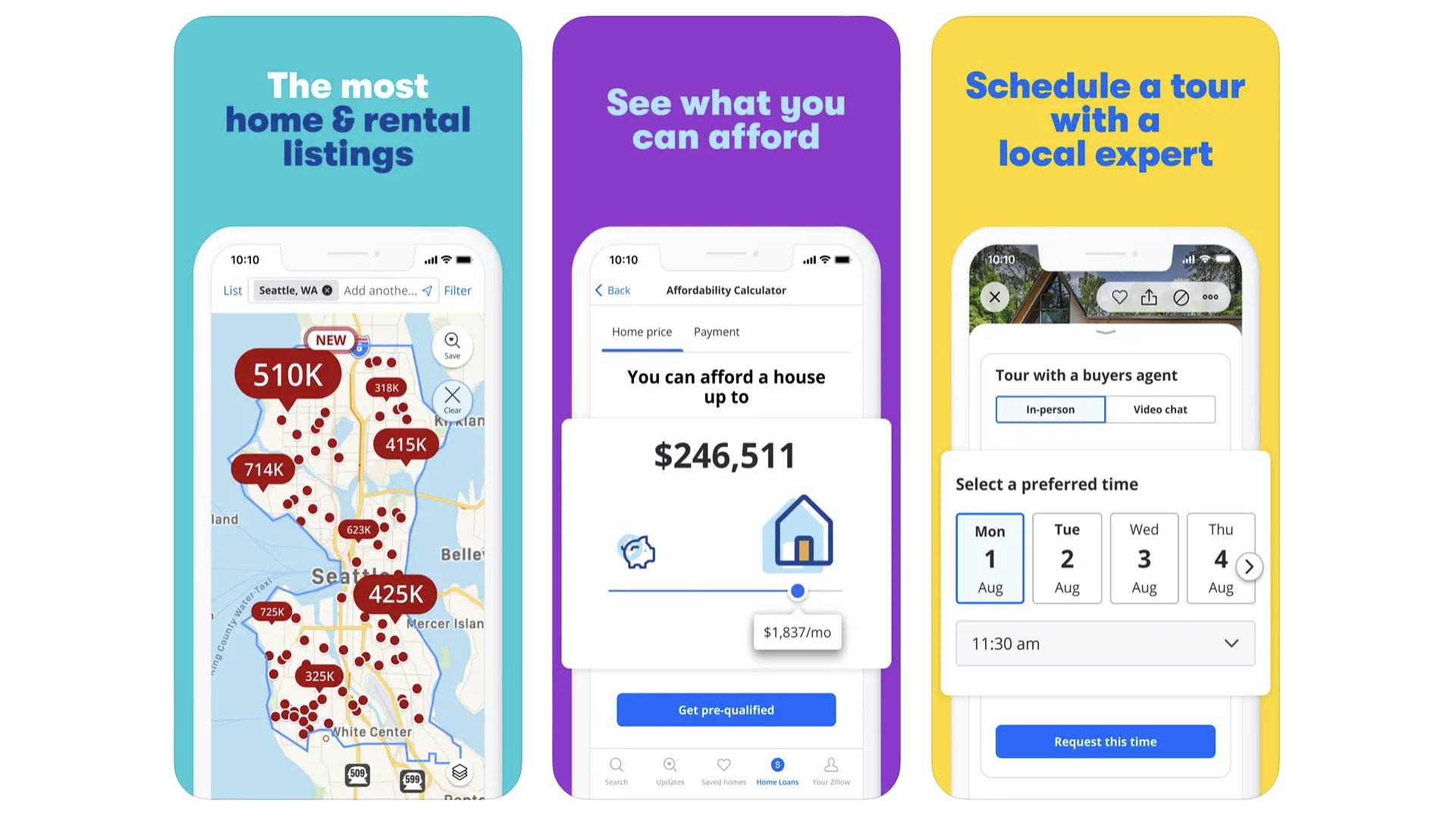

Zillow

The real estate app you should download depends on where you live, but Zillow is the clear pick in the US. It collates listings from all over the US, letting you snoop on home for sale even if you have no real intention of buying. It’s fast to scoot across the map to explore homes, some listings have 360-degere photos, and the layouts are coherent and clean-looking. Even if some of the homes aren’t. In the UK? Use Rightmove. Australia? Try RealEstate.com.au.

Zillow

Zillow lets you snoop around other people’s homes, in a virtual sense.

Download here: App Store

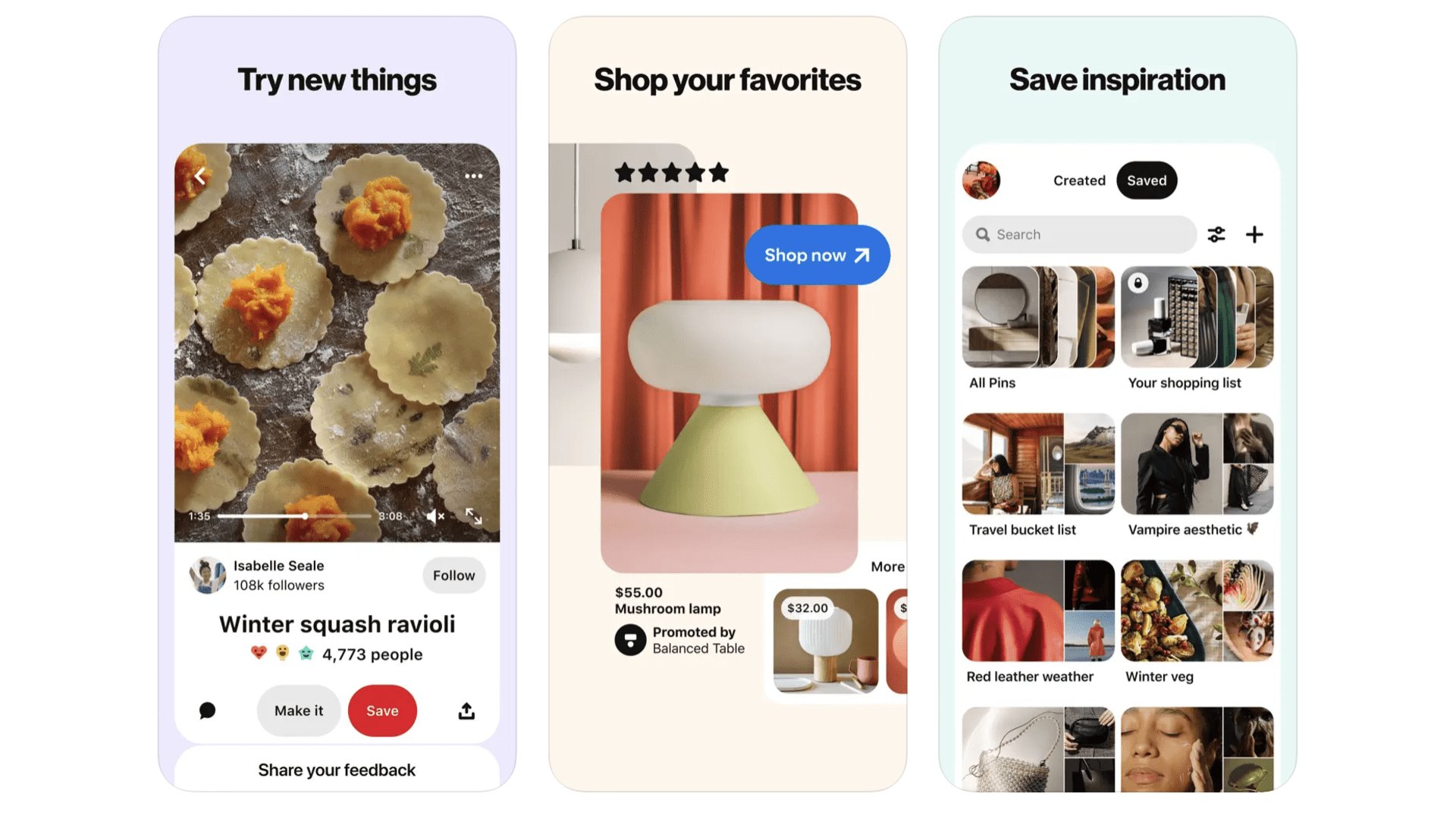

We think of Pinterest as the place to go for home interiors inspiration. That may help explain why it ballooned in popularity so much over the pandemic, when many of us were stuck at home. The place to start is with a mood board, which is like a digital scrap book of ideas or styles you come across posted by other accounts on Pinterest. These aren’t just pictures either. They can link through to interior design DIY guides, for example, or YouTube videos. We used it recently when working out the color scheme for a kitchen, and it easily beats loitering around Google Images.

Get some inspo for your home redecoration with this style and ideas-themed Pinterest.

Download here: App Store

Best iPhone apps: Learning musical instruments

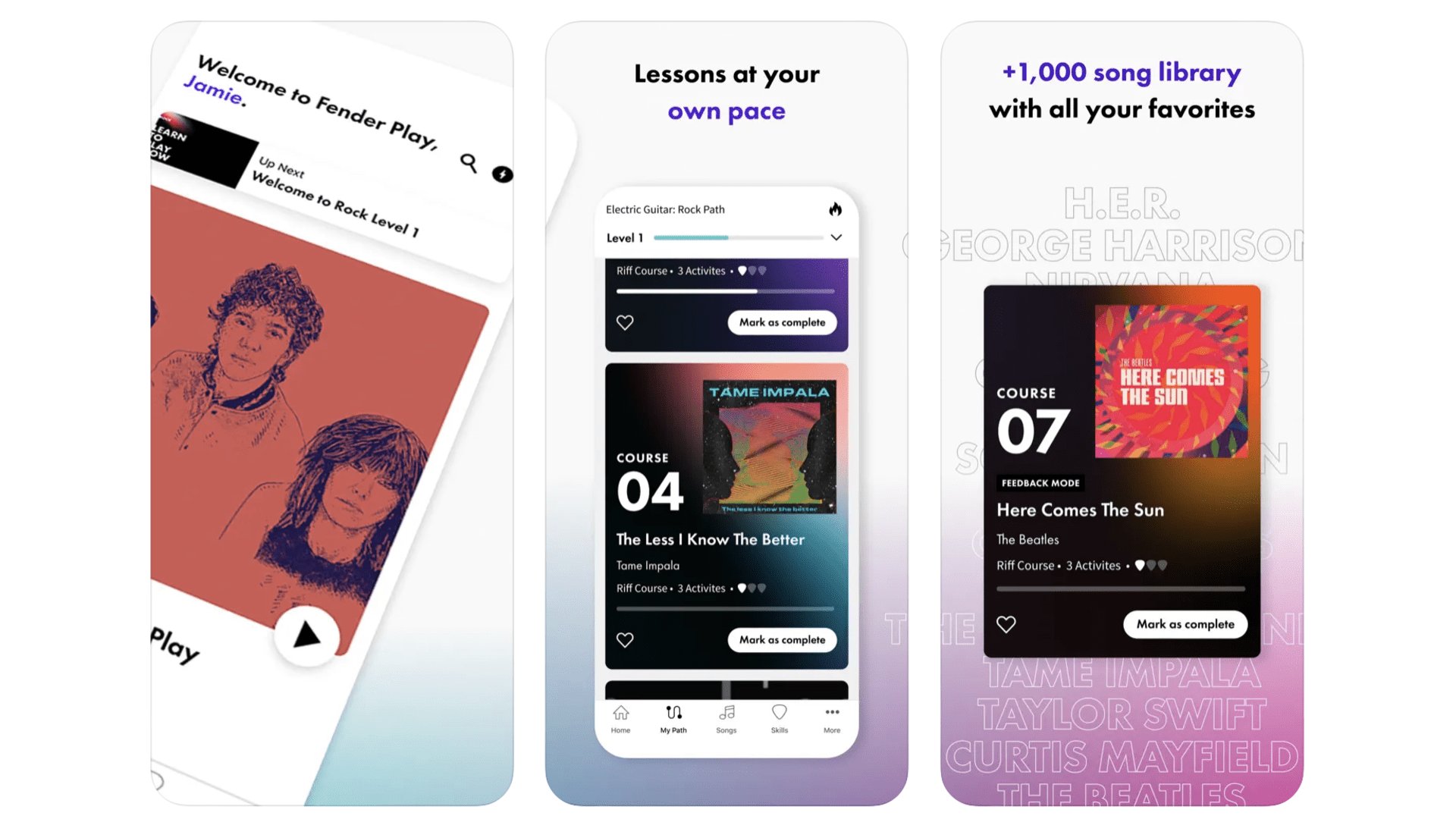

Fender Play

One of the most famous producers of guitars also makes one of the best apps for learning guitar. Fender Play is a video-led learning platform, one particularly well-suited to beginners. The app will teach you the basics (and plenty more) through learning songs from recent years, and those decades old. Each song (of which there are more than 1000) also includes clearly laid-out tablature, and a MIDI-syle rendition of each guitar line. This means you don’t have to head back to the instructor-led video whenever you want a reminder of how it’s meant to sound. There are also “play along” modes for full songs, as well as “riff” lessons when you want something quicker to learn. Access costs $9.99 a month, $89.99 a year. Guitar is the main attraction, but Fender Play has ukulele and bass guitar lessons too.

Fender Play

Learn sings on guitar and bass, through video lessons and tablature.

Download here: App Store

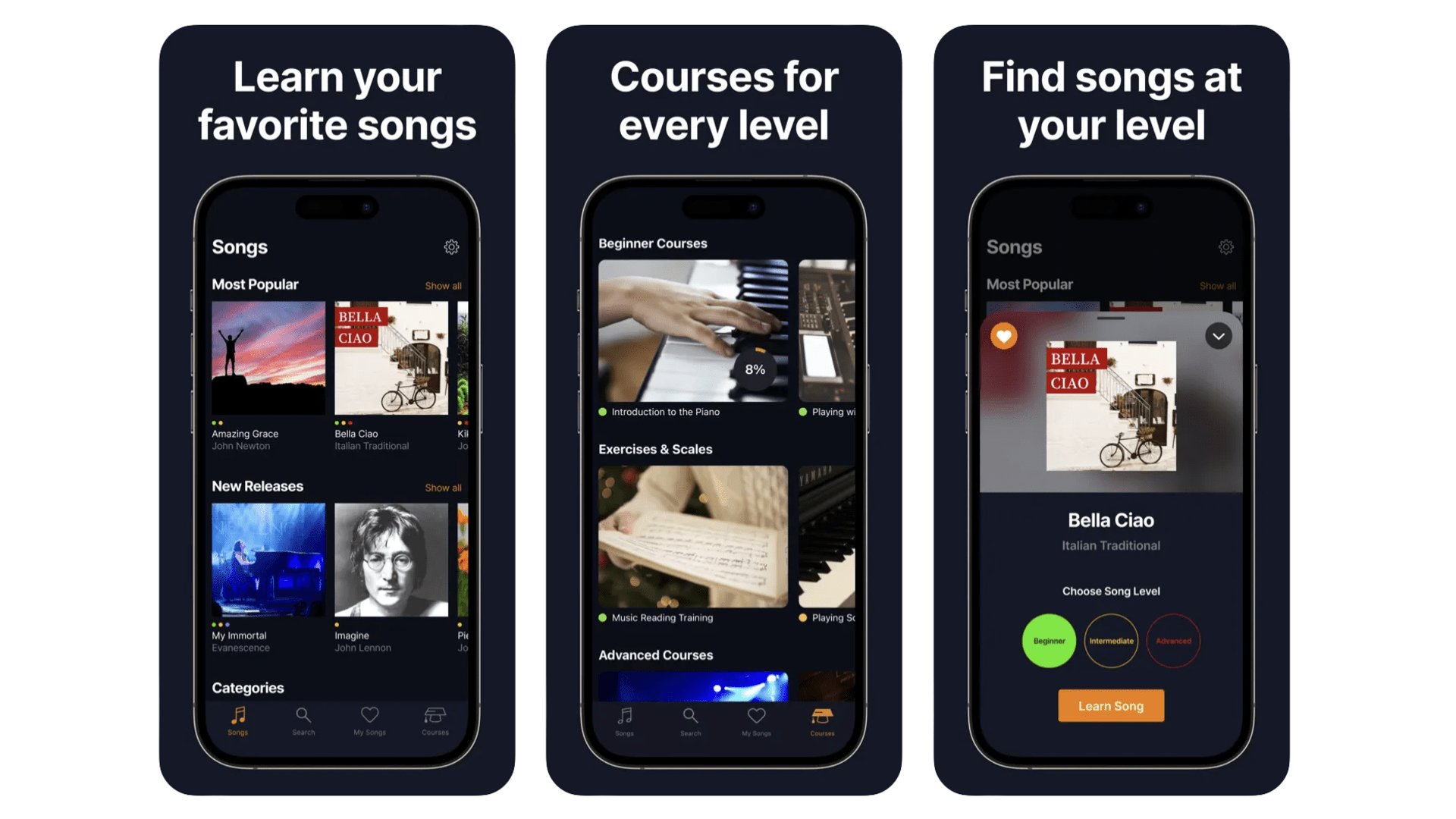

Flowkey

If you want to learn to play piano, Flowkey is one of the very best app-based places to start. There are two rough sides to the experience here. There are courses, that show you how to play the piano, right from first approaching the keys. The other side is a huge library of songs to learn. We love the way Flowkey breaks many of these songs down into three difficulty levels. We’re not there yet, but we imagine being able to return to a song and “level up” your performance is hugely satisfying. Learning the songs comes in the form of both a video and scored music. The app can listen out for your own played notes, to check you’re getting it right. Flowkey costs $19.99 a month (or $119.88 a year) for a single account, or $29.99 a month for a 5-profile Family account (or $179.88 a year).

Flowkey

Get to grips with the piano through Flowkey’s song-learning lessons.

Download here: App Store

Songsterr

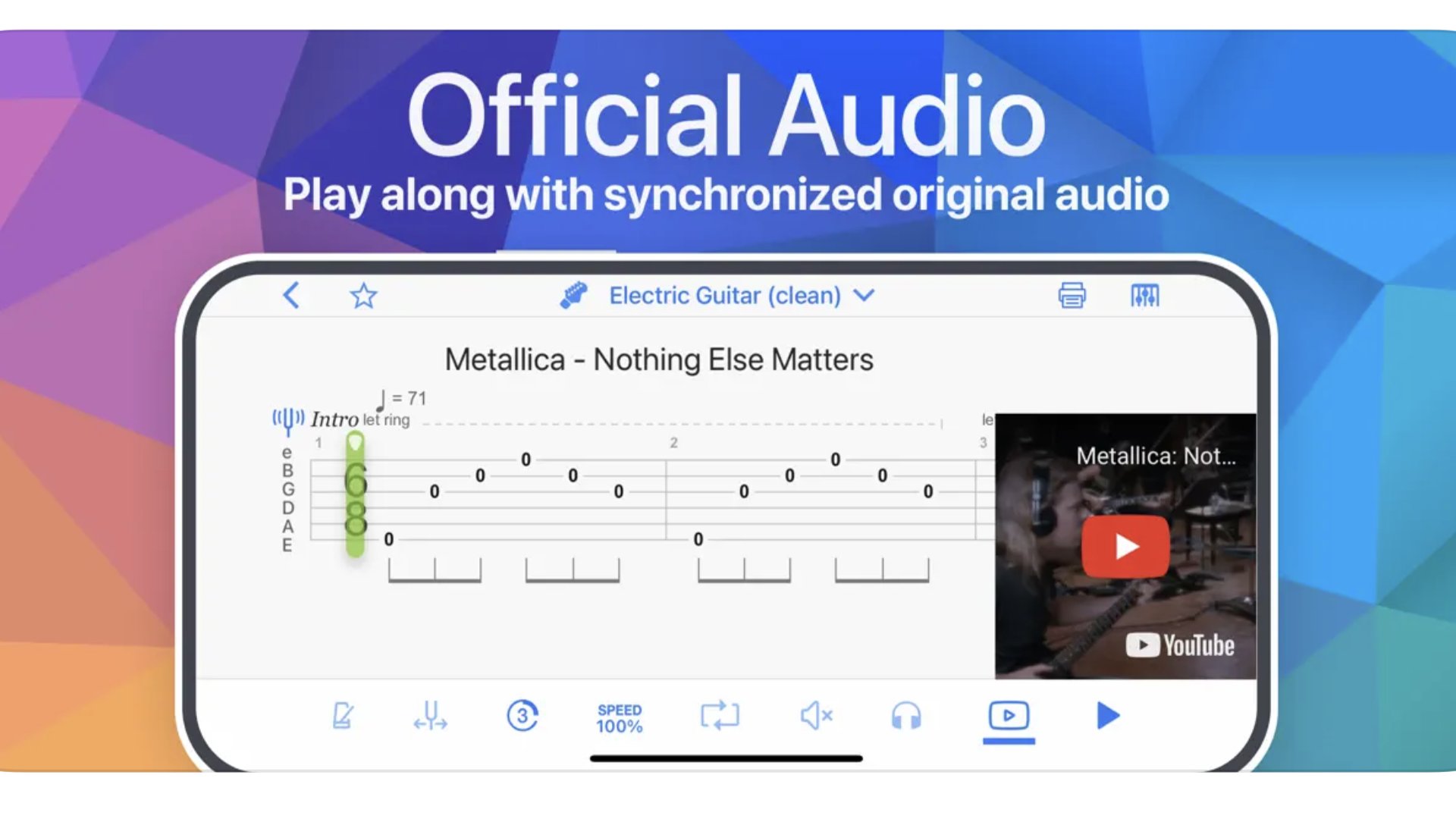

Learning guitar? Once you feel confident with the basics you might want to try out an app like Songsterr. It offers hundreds of thousands of guitar tabs. The experience here is light years away from rifling through websites for tabs cobbled together by who-knows-who. You can listen to a digital recreation of each track, and as different parts of the arrangement are separated out (with tabs for each), the part you’re currently learning can be given prominence in the mix. More advanced guitarists can probably get by with Songsterr’s free service. But the $9.99 a month paid version is, granted, a lot better. You can listen along to the actual live track as well as the MIDI-style recreation, alter the tempo and even the pitch. This transposes songs to different keys, should you need to play alongside a singer whose vocal range is different to that of the original.

Songsterr

Learn the songs you’ve always wanted to on guitar through Songsterr’s massive database.

Download here: App Store

Tenuto

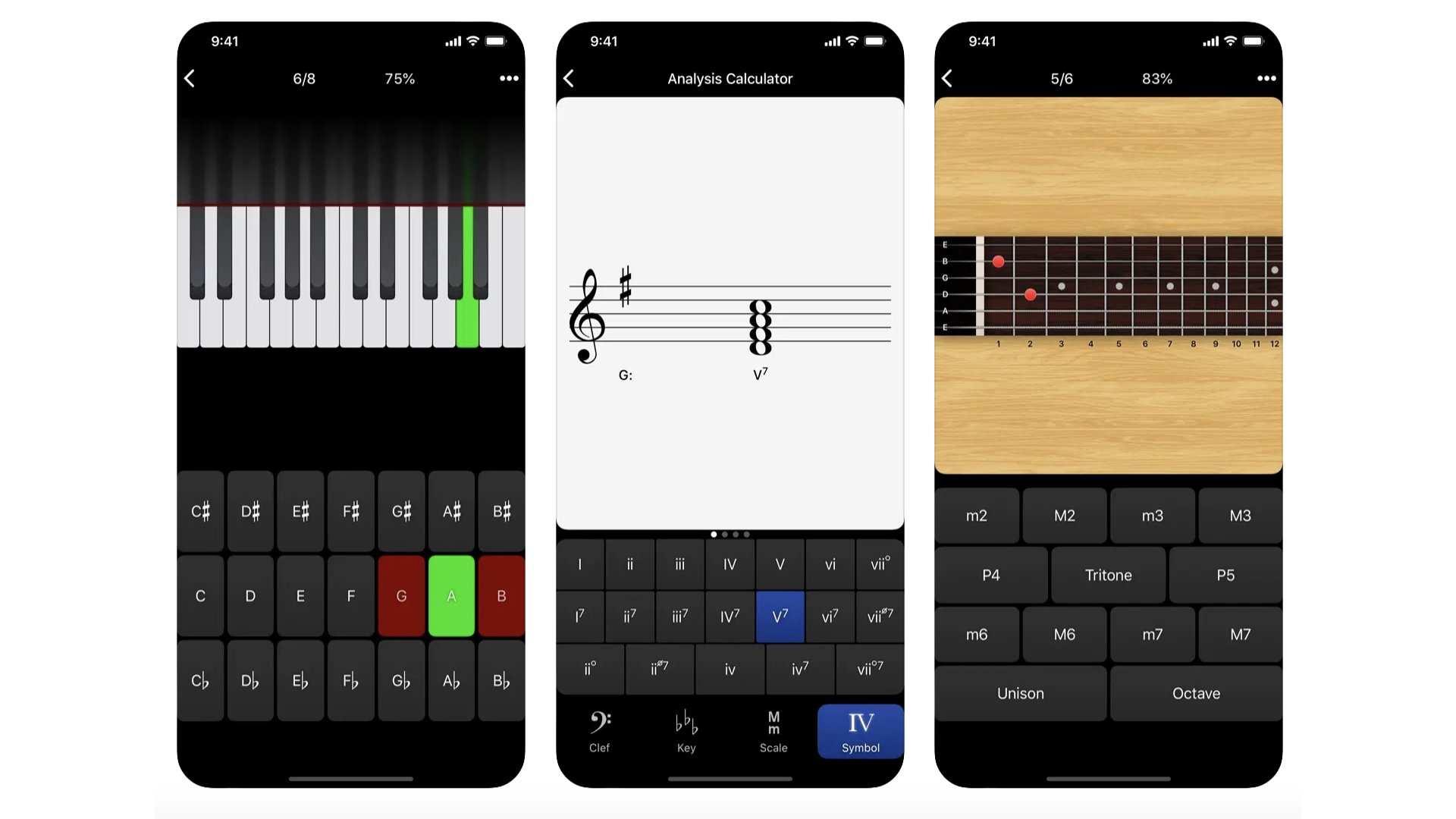

There are pitfalls to using apps to learn to play instruments. They often give you a crutch, to make the process feel more seamless. And you end up relying on that crutch. Tenuto ($4.99) is a sort-of antidote to that kind of thinking. It is a music theory app that helps you brush up on your fingerings, intervals, chord constructions and more, for guitarists and pianists. There are 24 exercises in total. And if you need to learn the basics in the first, there’s also a companion Theory Lessons app. You can actually access all of this on the developer’s website for free, at music theory.net, but this sort of endeavour is worth supporting if you ask us.

Tenuto

24 exercises designed to tighten up your music theory and knowledge.

Download here: App Store

Best iPhones apps: Meditation and Relaxation

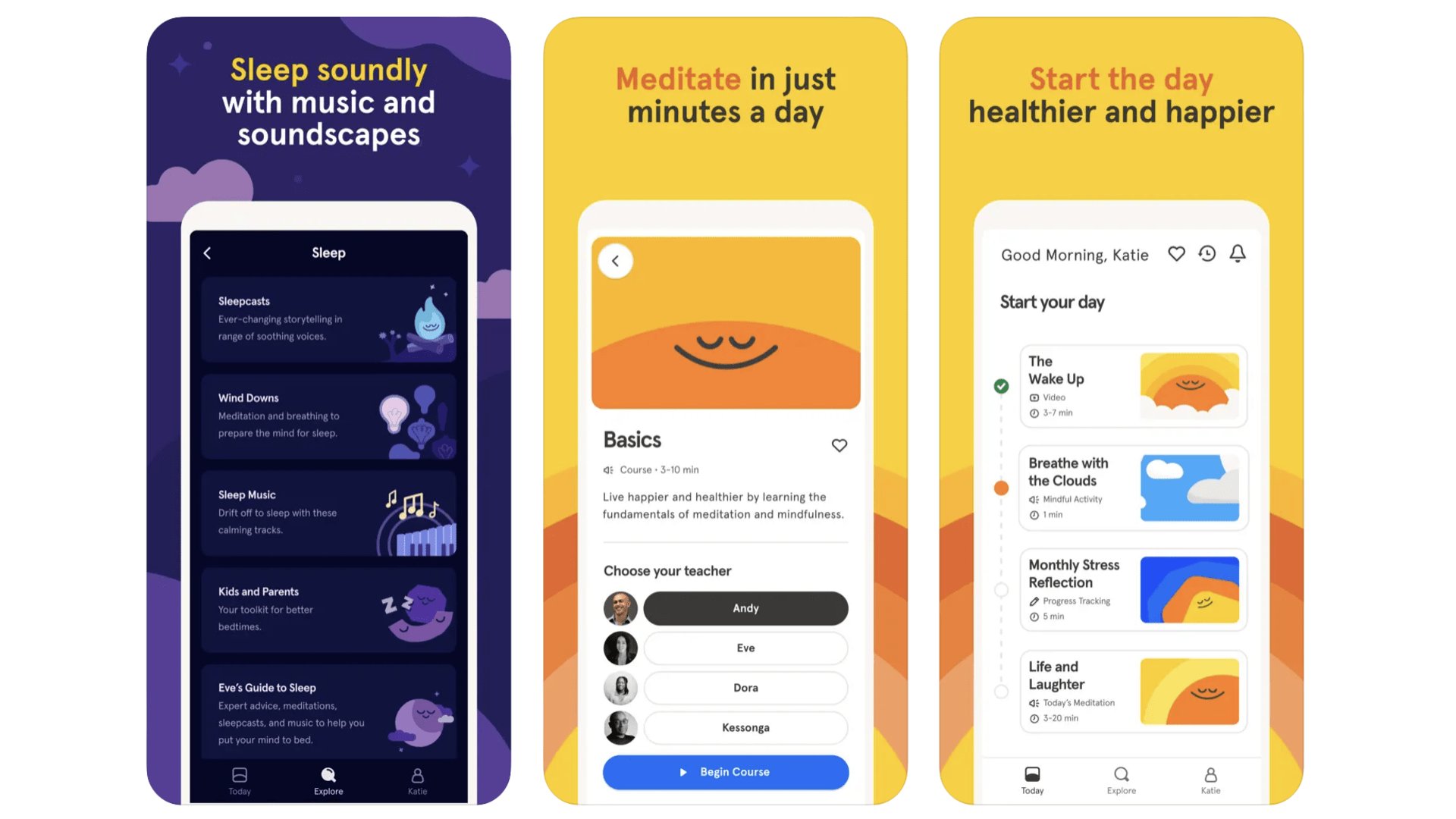

Headspace

This app made meditation truly mainstream, at least among people we knew at the time, back in 2017-2018 when it started to pick up a lot of attention. It’s a guided breathing app that looks at meditation from a mindfulness perspective. That means less of the spiritual, more focus on what’s going on in your body, or around you. If you’ve ever tried Headspace, you’ll know the voice of Andy Puddicombe. He co-created the app, and is the iconic voice behind the app’s guided meditations (you can choose another voice too). A few sessions are available for free. A full membership is $12.99 a month ($69.99 a year).

Headspace

The app that made meditation more approachable and mainstream than ever before.

Download here: App Store

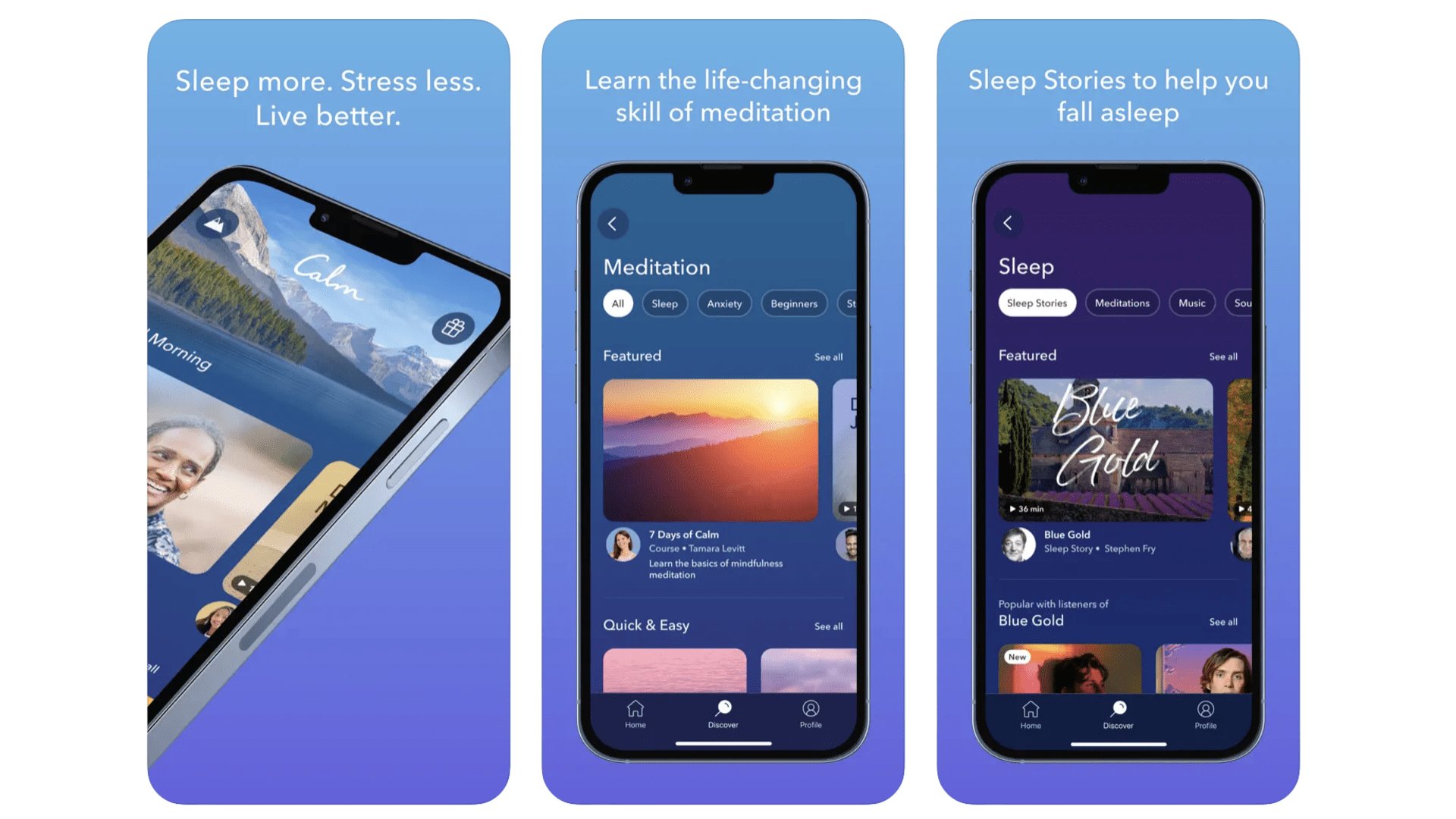

Calm

This is the key rival to Headspace. It’s a slightly less focused experience where your relaxation and meditation tools are split into a whole bunch of categories. As well as fairly classic guided meditations, there are sleep stories, calming music tracks, soundscapes and “tools” to help you regulate your breathing using visual and audio cues. This app has a particular focus on improving your sleep, although it’s good for general relaxation, and even concentration during work. A few taster bits in each category are available for free, and a subscription is required for full access. It costs $12.99 a month, $69.99 a year. Or you can pay $399.99 for “lifetime" access. Trying both Calm and Headspace to see which you prefer is a good idea.

Calm

A meditative wellness app that aims to get you sleeping better, among other things

Download here: App Store

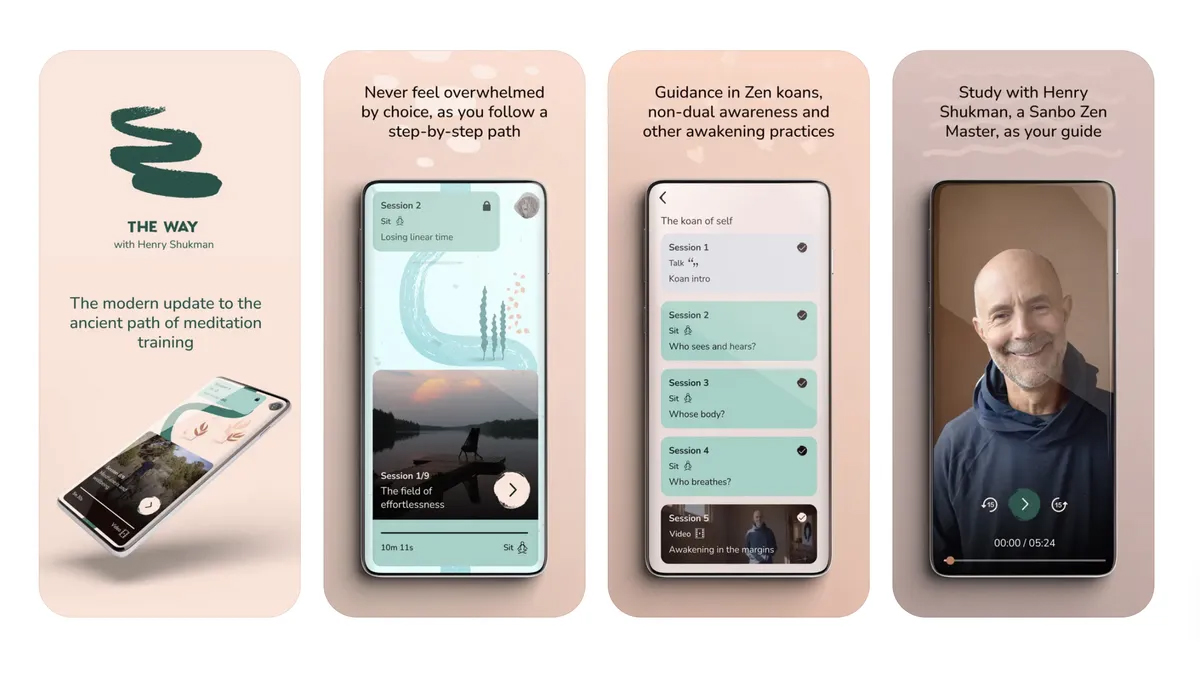

The Way

If you've tried the Headspace app but didn't get on with it or found the huge amount of choice in the calm app too overwhelming, you need to try The Way. This simple and beautiful meditation app is ideal for both beginners and seasoned meditators. It takes you on a journey through the different elements of meditation, encouraging you to practice each and every day. Each practice is visualized as a step in your journey towards better understanding meditation and reaping its benefits.

The Way

A simple and refreshing approach to meditation that takes you on a journey of transformation one step at a time.

Download here: App Store

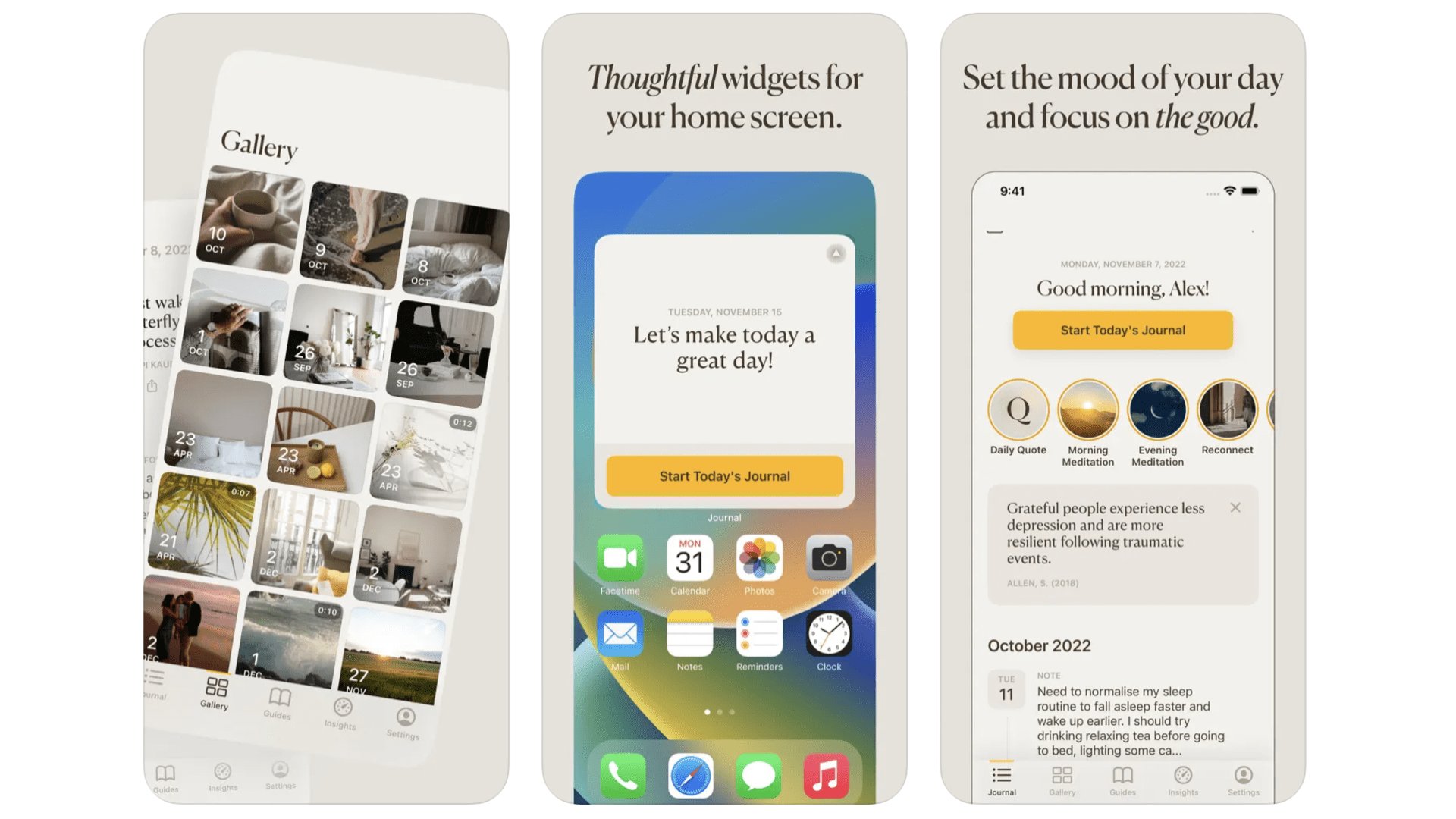

5 Minute Journal

A gratitude journal? While this may sound like flowery mumbo jumbo if you are looking for concrete ways to improve your mental health, the concept behind 5 Minute Journal is sound. Making journaling into a regular hobby takes you out of the rush and stress of the work day, makes you reflect a bit and focus on the present. And, sure, forcing yourself to not think everything is terrible the whole time might help some folks too. You can append photos to entries, and can lock them all behind biometric security so others can’t read into your feelings. Phew.

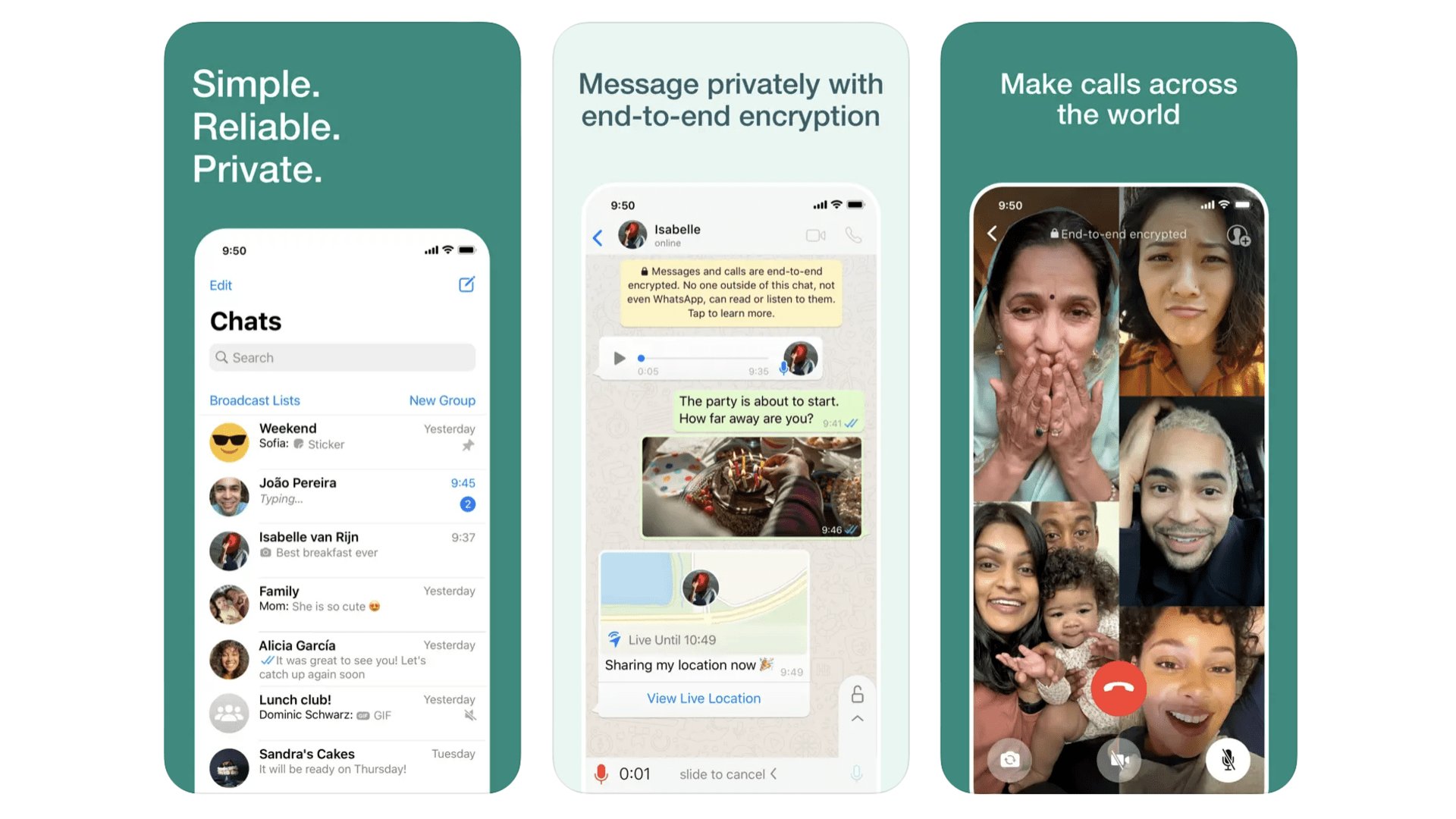

Best iPhone apps: Messaging

The latest figures suggest WhatsApp has upwards of 2.7 billion users. We’re guessing most of you know about this app already. Migrating chats is the first thing we sort out when switching phones. And it’s a big part of why changing phones is no longer that much of a chore. It saves your messages and image history in the cloud, so all your memories are transferred through a simple download. It’s also a brilliant bridge between iPhone and Android users, getting rid of those pesky “green bubble” messaging issues.

It’s the obvious choice in cross-platform messaging, it’s WhatsApp.

Download here: App Store

Telegram

This messaging app was released in 2013 and fast became known as a more security and privacy-concerned version of WhatsApp. As such, it is a favourite among journalists looking to protect their sources. Curiously, you actually need to select “secret chats” to enable end-to-end encryption, which is on by default in the more mainstream WhatsApp. Surprising, right? Telegram also supports absolutely massive groups, with up to 200,000 members. We typically use Telegram for these public-style groups, because most of our friends are still on WhatsApp instead.

Telegram

Telegram is the WhatsApp alternative not owned by one of the social media giants.

Download here: App Store

Best iPhone apps: Music

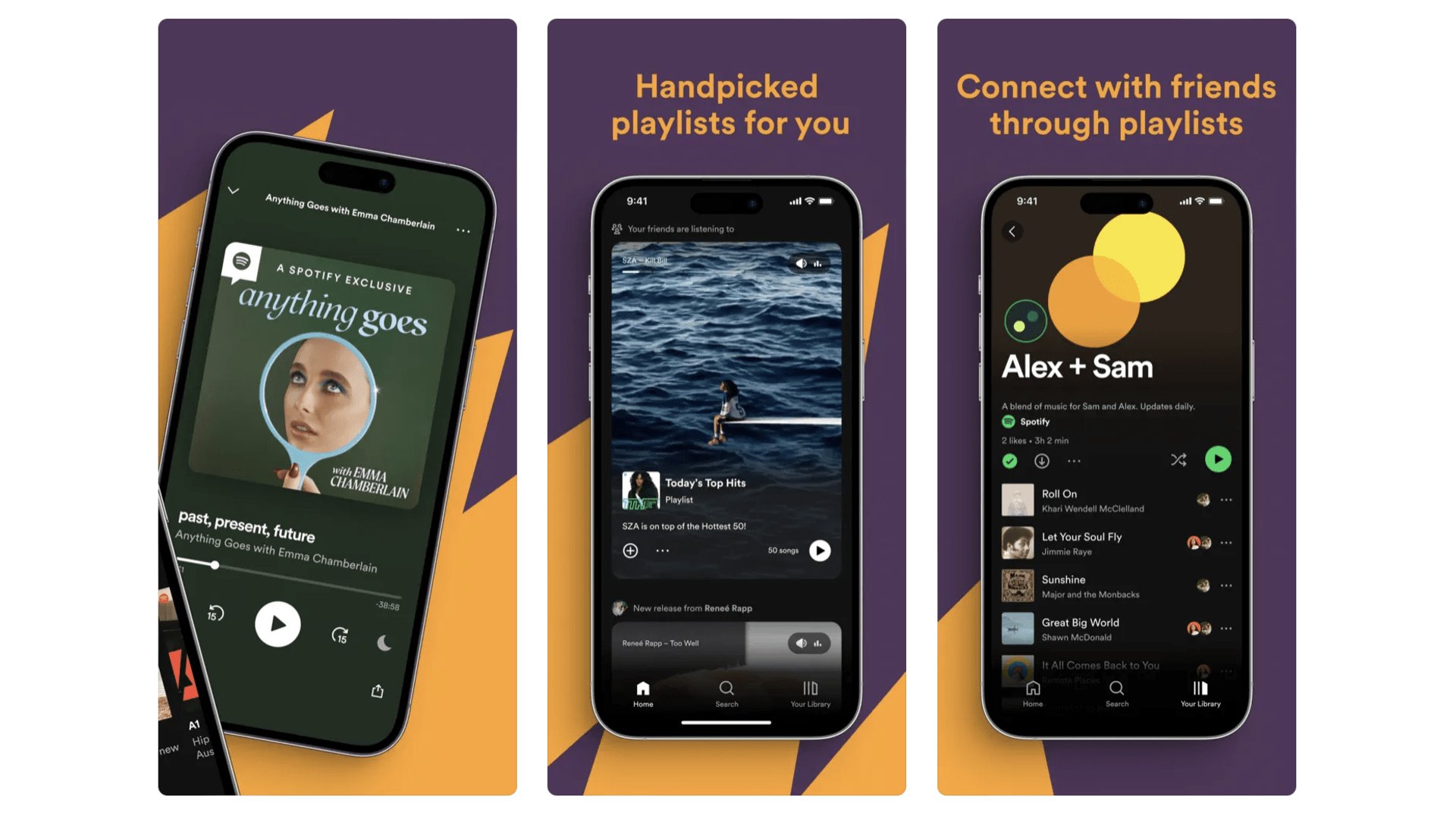

Spotify

With more than 200 million paid-up users, Spotify is the most popular music streaming service. Its main strength was getting in there early, arriving a whopping seven years before Apple Music. We like Spotify for its music discovery services, and sound quality is good when maxed out, if not “high res” like Apple Music and TIDAL. There’s more than music too. Spotify went big on podcasts in 2020, and even bundles 15 hours of audiobook listening per month with a subscription.

Spotify

Spotify is still the go-to streaming service for folks not keen on signing up for Apple Music

Download here: App Store

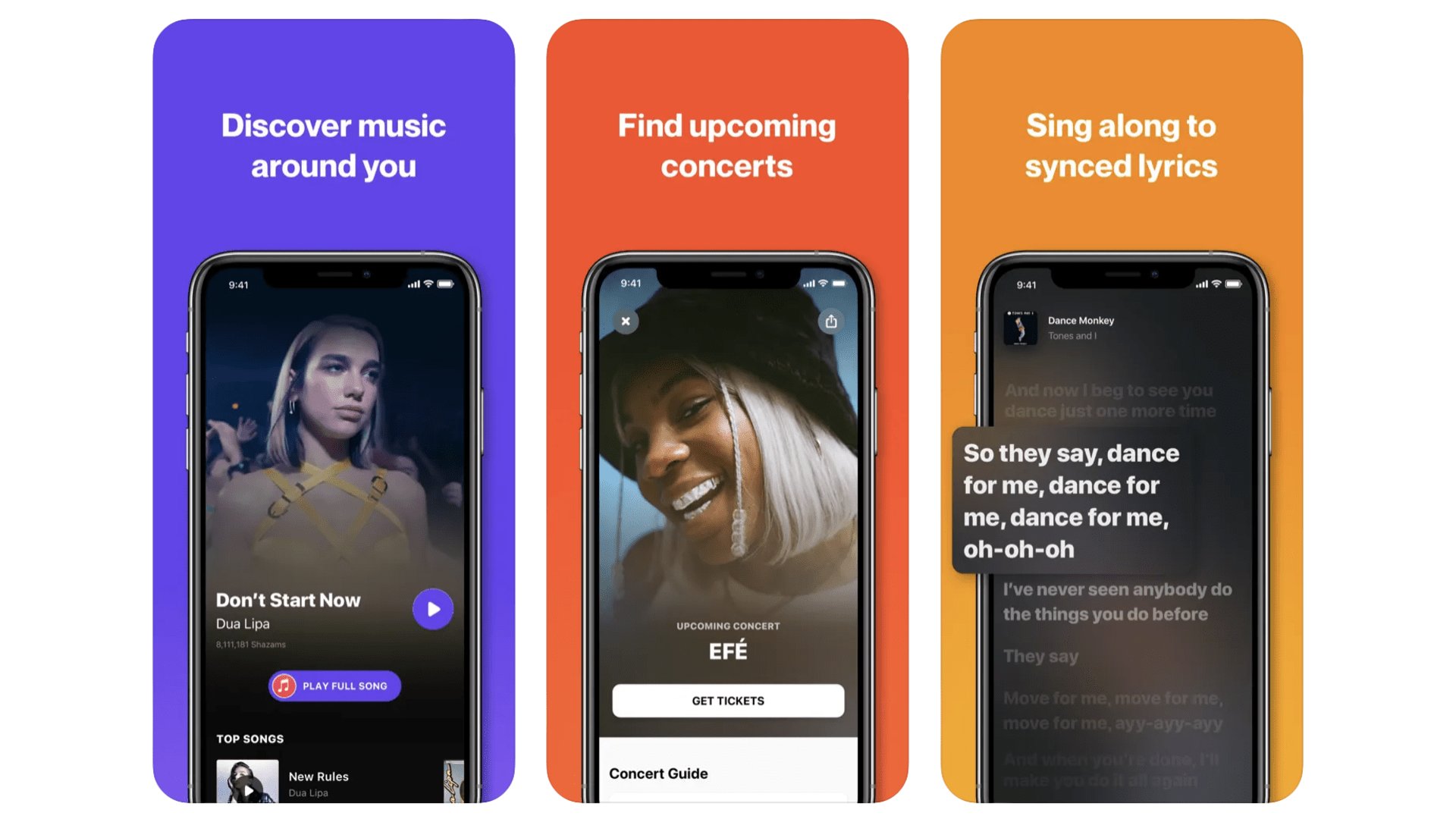

Shazam

This was one of the original demos we’d used to persuade smartphone skeptics that apps were neat. You know the Shazam deal, right? You open the app, start it listening when a song is playing and, after just a few seconds, it will tell you what the song is. Simple as that. The app has become a lot richer since those early days in 2008, though. You can see song lyrics, buy that song or look for concert tickets. Fun fact: Apple owns Shazam, and has done since 2018 when its $400 million acquisition was finalized. Big bucks. And as it’s now Apple tech you can also just ask Siri to identify a song instead of using Shazam if you like.

Shazam

It’s the music-identifying app of our earliest app memories from 2008.

Download here: App Store

Best iPhone apps: Music Creation

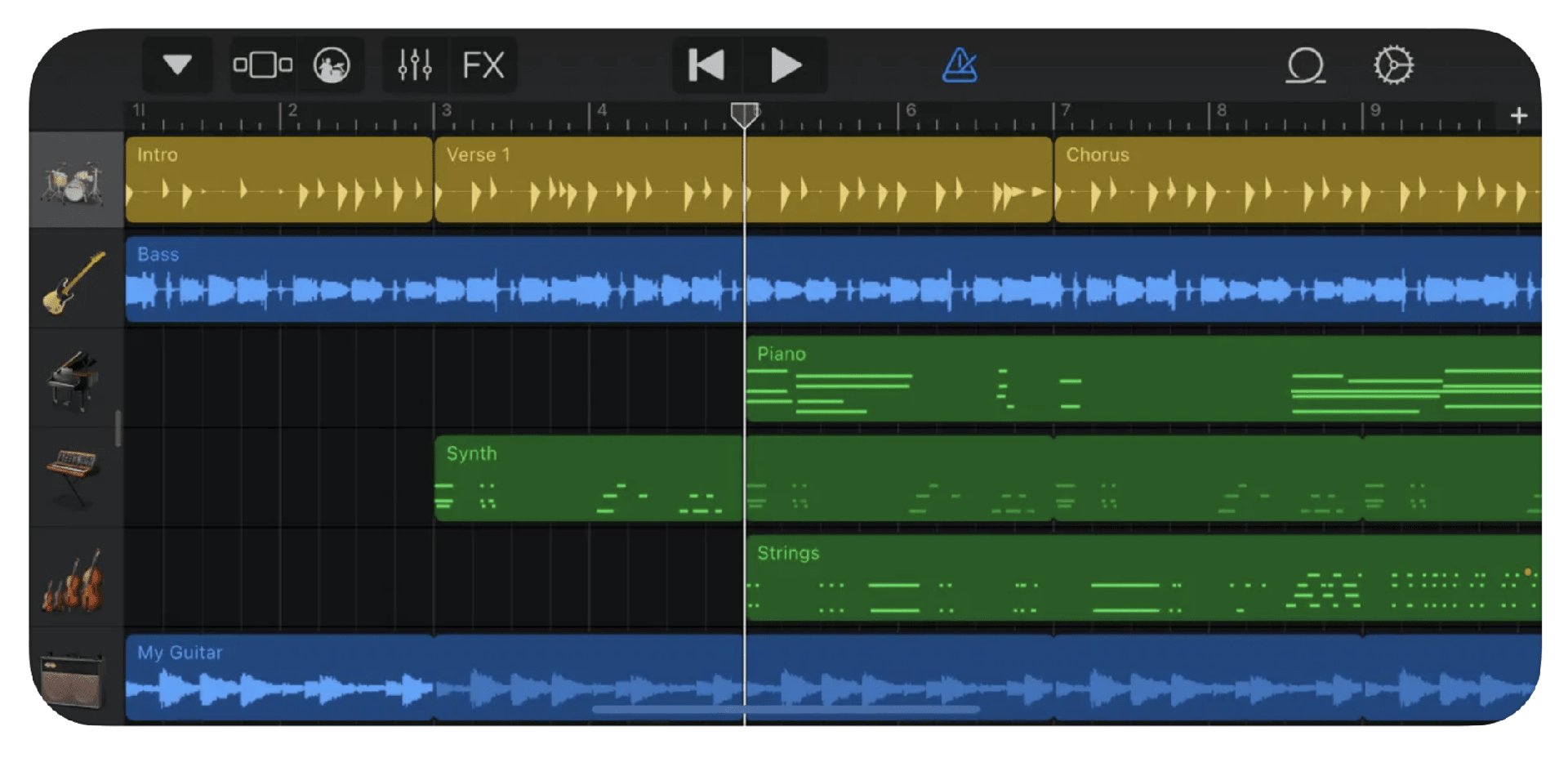

Garageband

How many music careers began with GarageBand? Where industry standard music DAWs, digital audio workstations, often cost hundreds of dollars and are almost impenetrable to new users, GarageBand is free and easy. Within minutes you can be laying down tracks, and downloadable (still free) modules offers lots of extra virtual instruments. It’s an amazing toybox, and also a pretty serious creative tool for those who want to work faster, and simpler, than Apple’s pro alternative Logic Pro allows.

Garageband

Make a music master piece without spending a dime thanks to Garageband.

Download here: App Store

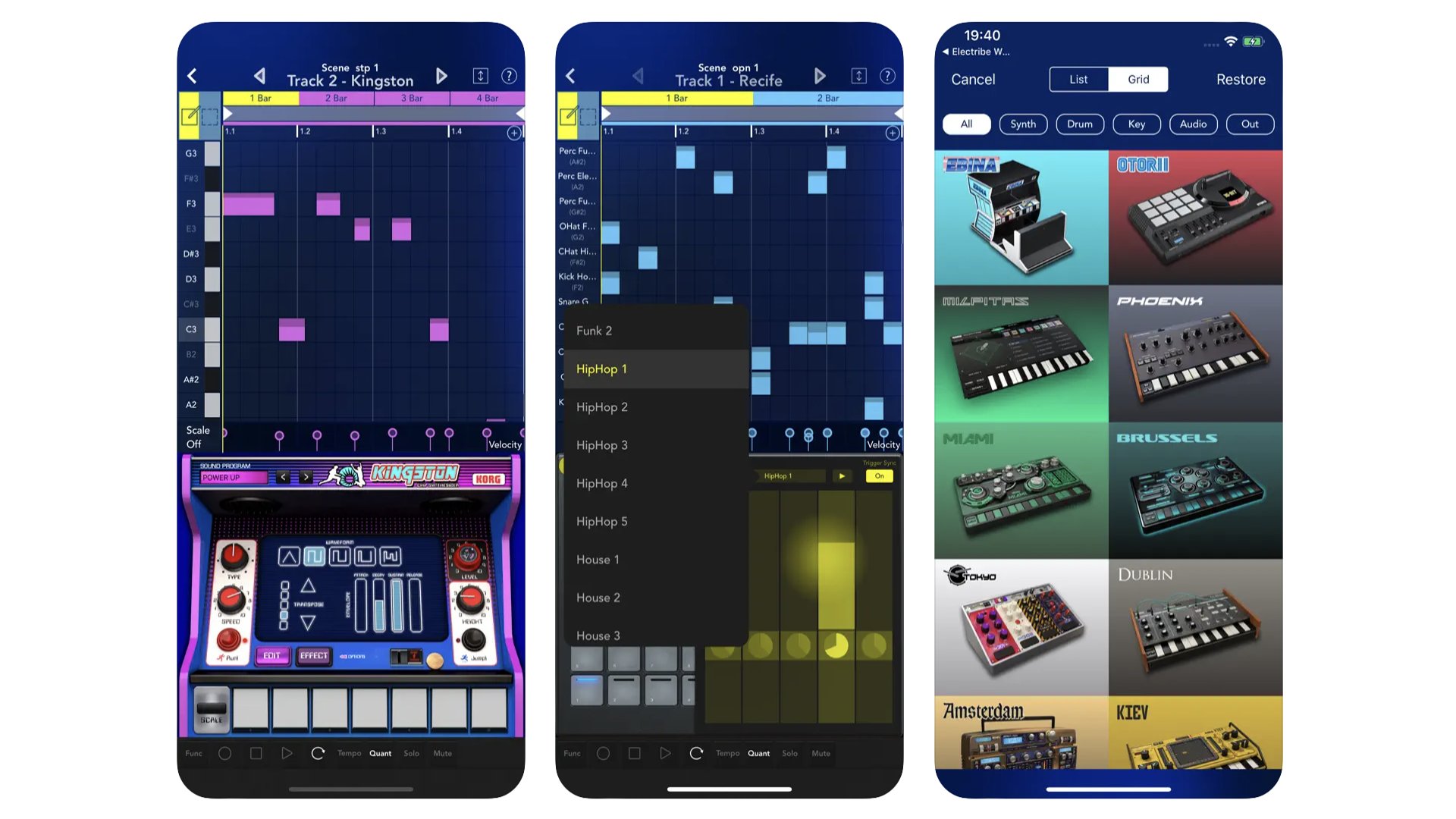

Korg Gadget 2

Korg’s mobile digital audio workstation (DAW) often gets ignored in favor of FL Studio, but this one is powerful in its own right. It features digital odes to real Korg synths, ones made to be fairly easy to operate on a phone screen, as well as other “gadgets” that work as samplers or recorders. They sound excellent. Much like the popular desktop electronic/dance DAWs, Gadget 2 breaks your creations into “scenes”, the building blocks of a song.

Korg Gadget 2

Make authentic-sounding electronic music on your iPhone with Kong Gadget 2.

Download here: App Store

Best iPhone apps: Movies and TV

Netflix

Is recommending Netflix a cop-out? Sure, but you can think of it as a stand-in for Prime Video, Apple TV+, Hulu, Disney Plus, Paramount Plus and so on if you like. Netflix represents all the mainstream movie and TV streaming services we tend to dart between, making use of their no-contract approach to do what serves us best month-on-month. Netflix does have a great library, though, much as it catches seem flack these days for cancelling shows left, right and centre.

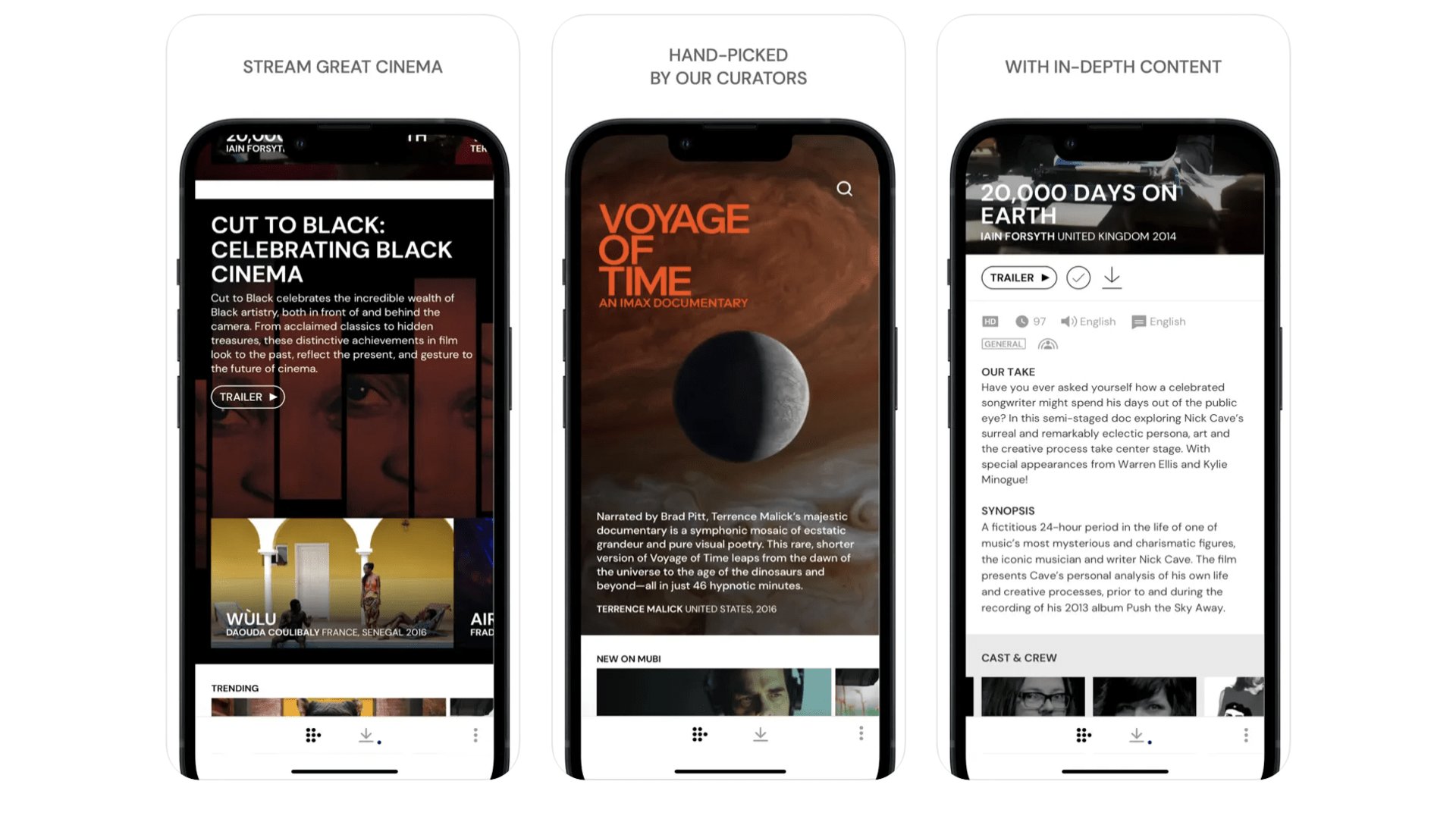

MUBI

MUBI is our pick of the second tier of streaming services — but it’s still a number one service in our hearts. This is your cineaste’s take on a Netflix alternative. It’s packed with world cinema and arthouse movies. You’ll pay $12.99 a month or $99.99 a year at the time of writing. Or for $17.99 you can sign up for MUBI Go, which includes a cinema ticket a week too. Check if you're local to a supported cinema, though, as it’s only available in a handful of big US/UK cities, and far from all cinemas inside them. We also have to give a shout-out to Shudder here, a horror-only streamer genre fans shouldn’t miss.

MUBI

MUBI is the antidote to Marvel stagnation, offering access to hundreds of great arthouse movies.

Download here: App Store

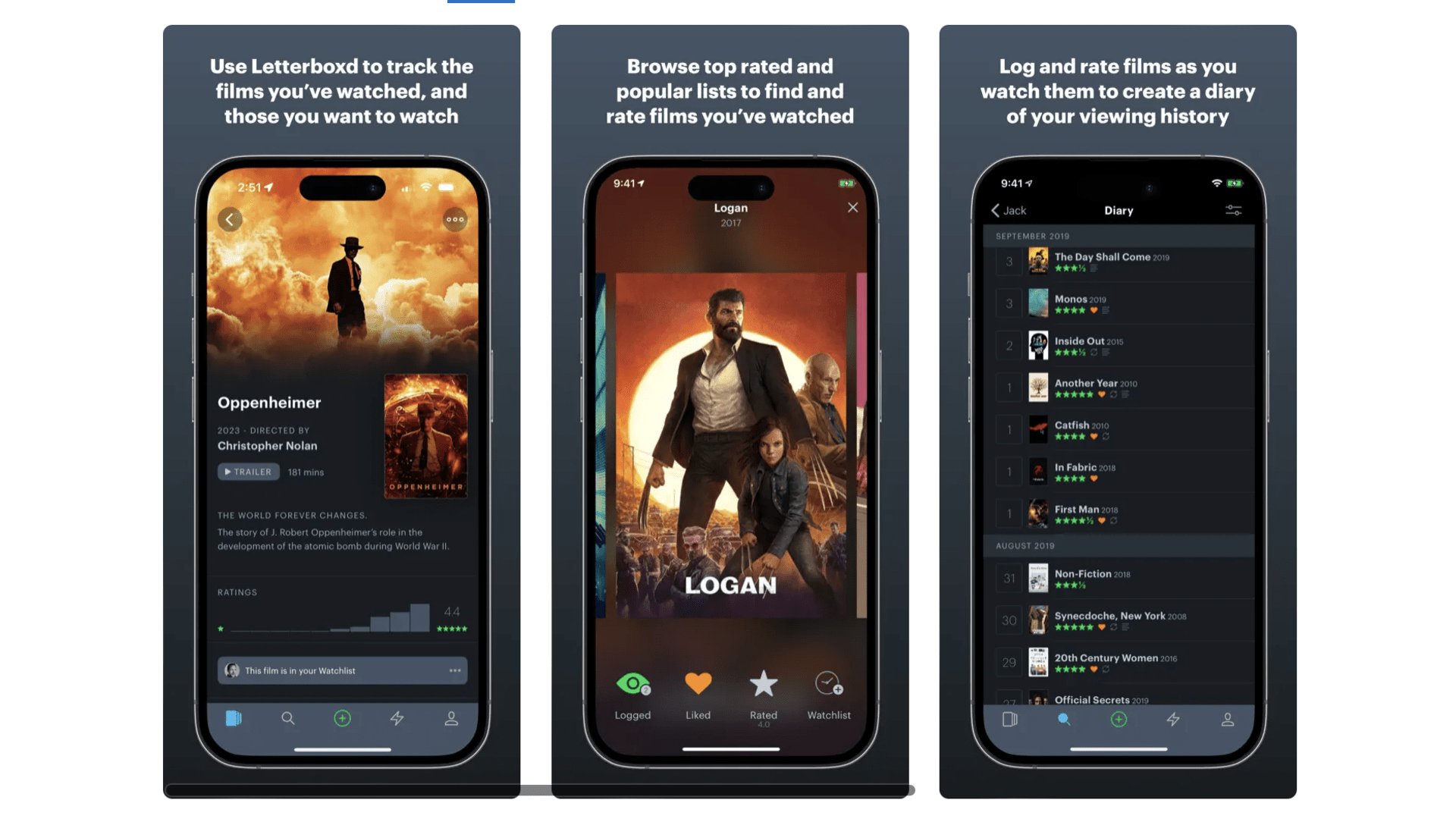

Letterboxd

Writing a journal can help you appreciate where you are, where you’ve been and where you’re going. Letterboxd offers that, but for movies. OK, perhaps that’s a bit highfalutin, but it does let you keep track of films you’ve seen, give them a star ranking and, if you really want to get into it, write a review. These can also be shared among the Letterboxd community, broadcasting your opinions to the masses. We’re in it purely as a little personal project, though, one that helps you get a view on what your year in cinema has really been like.

Letterboxd

Keep track of the films you watch through the year with Letterboxd.

Download here: App Store

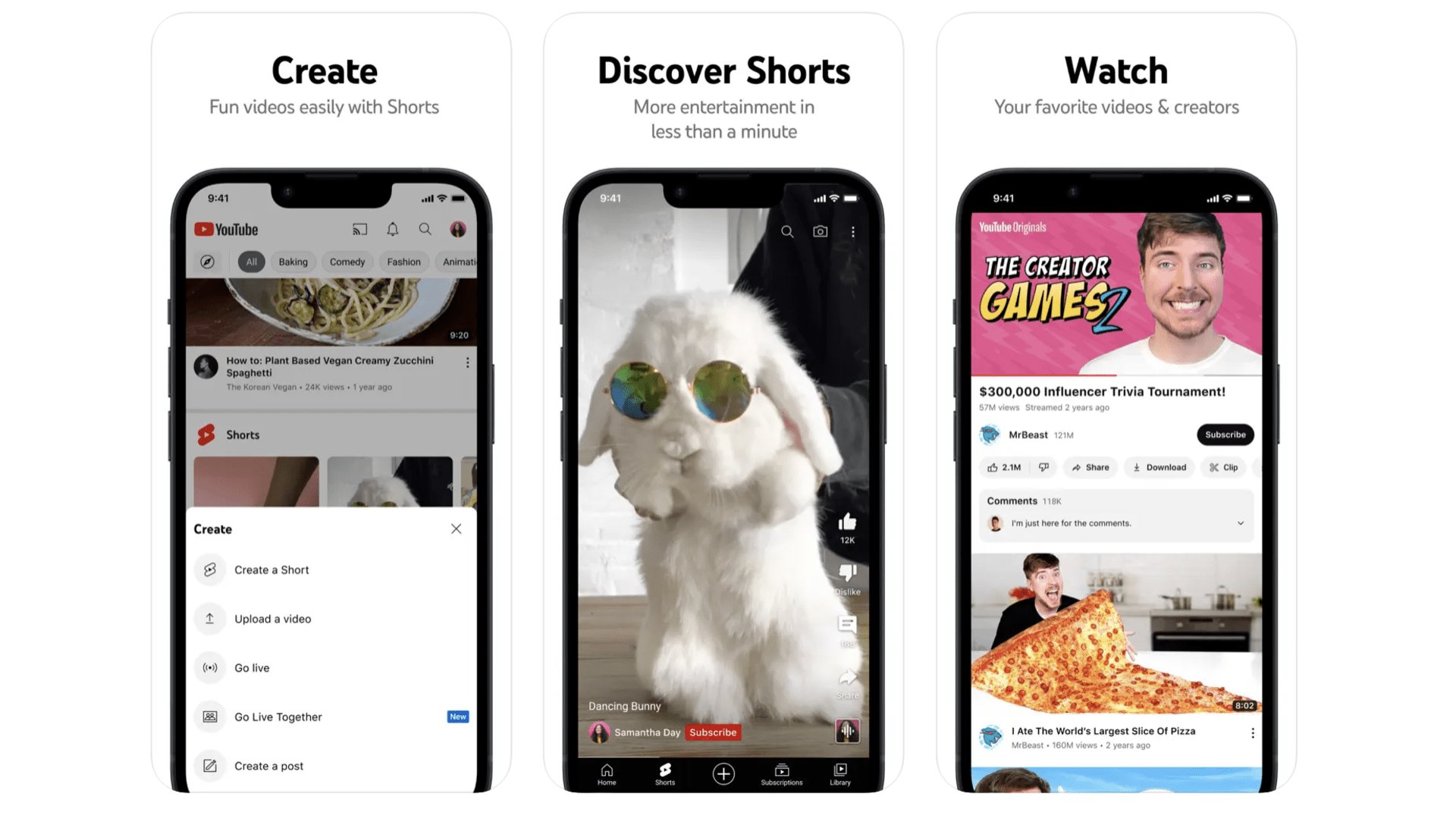

YouTube

If you’re one of the few people who still think YouTube is just full of short junk videos, it’s time for a rethink. It’s an incredible platform where more than a billion hours of video are watched each day. There’s short-form comedy, long-form video essays and everything in-between. The trick is in finding the right content among the morass, and guiding the YouTube algorithm to show you stuff you actually want to watch. One way is to search for recommendations for content creators or channels, and you can be sure someone will have asked already. Probably on Reddit.

YouTube

Join the 100 million-plus ranks of people who watch YouTube each day.

Download here: App Store

Best iPhone apps: Navigation and Driving

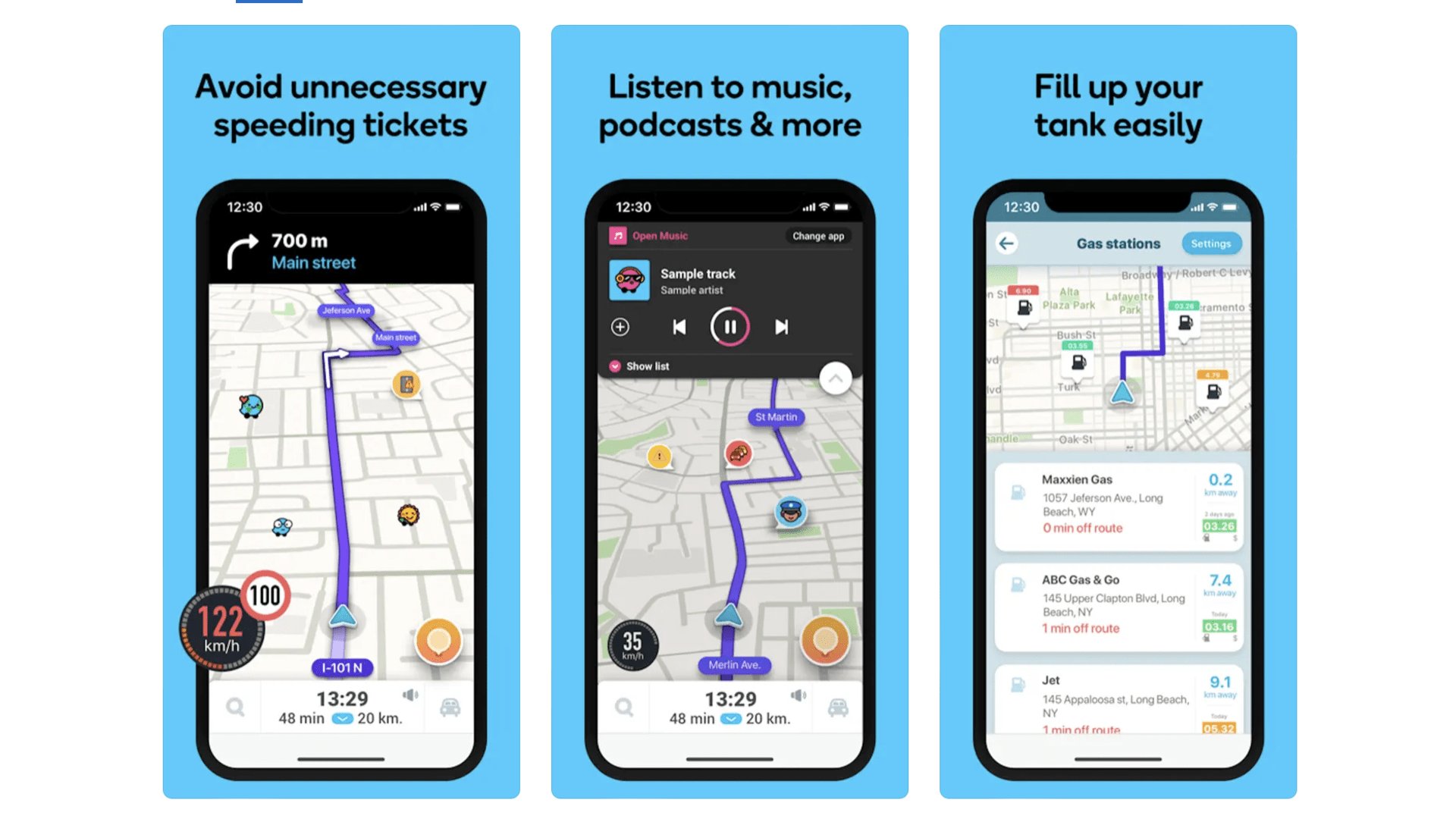

Waze

This is the best car navigation alternative to Apple Maps and Google Maps, and it’s actually owned by Google. The Waze special sauce is it makes very concerted use of active data from other Waze users, to judge where traffic is, or is forming, and where an accident may have taken place. The experience of using it is much like that of a classic in-car GPS system. You put in your destination, Waze works out the route and you get turn-by-turn nav. We recommend trying it out alongside Google Maps and Apple Maps to see which you like the best.

Waze

Find your way from A to B with Waze, Google’s Maps alternative for drivers.

Download here: App Store

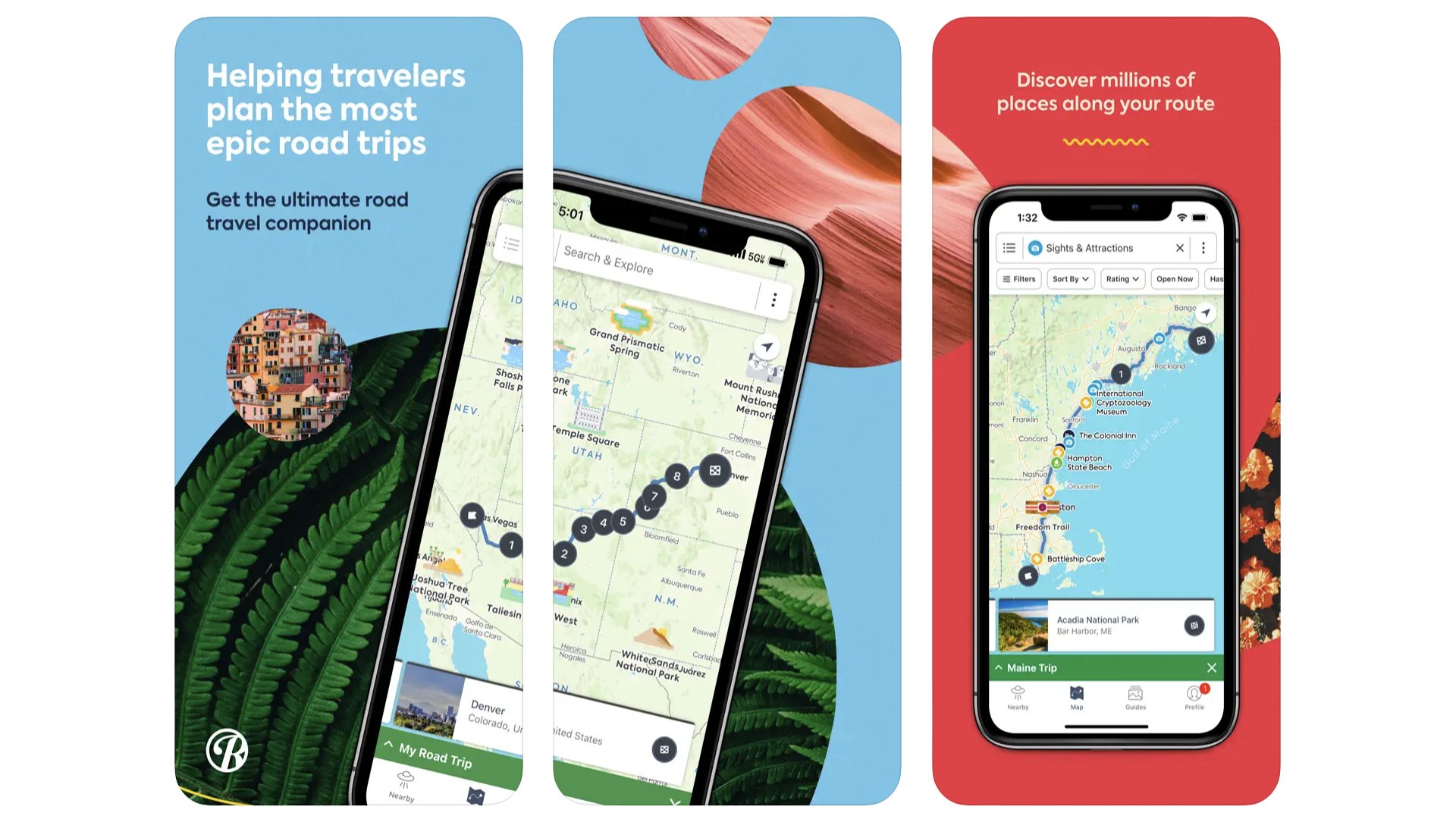

Roadtrippers

Planning a route is one thing. Planning a road trip is something else. We need sights, we need memories. It has to be a good time. That’s what Roadtrippers is all about, working out a route along which some fun can be had. The only issue is Roadtrippers only really works in the home of the epic road trip, the US of A. If you want to work out a basic route, it’ll do that, but you won’t see the many possible attractions on the way elsewhere, like the UK’s Fleet motorway service station.

Roadtrippers

Proof that long road trips don’t have to be boring, courtesy or Roadtrippers.

Download here: App Store

CityMapper

Scores of city dwellers we know swear by CityMapper. It’s our top app for navigating the public transport systems of the world’s biggest, most intimidating cities, across the west, Asia and Australia. It also collates multiple forms of getting around, and not just trains, buses, trams and tube systems. If there’s a bike or scooter rental system in a city, there’s a good chance CityMapper integrates its availability info. And we also rate its on-foot directions. Sure, there are some ads, but not ones that get in your way too much.

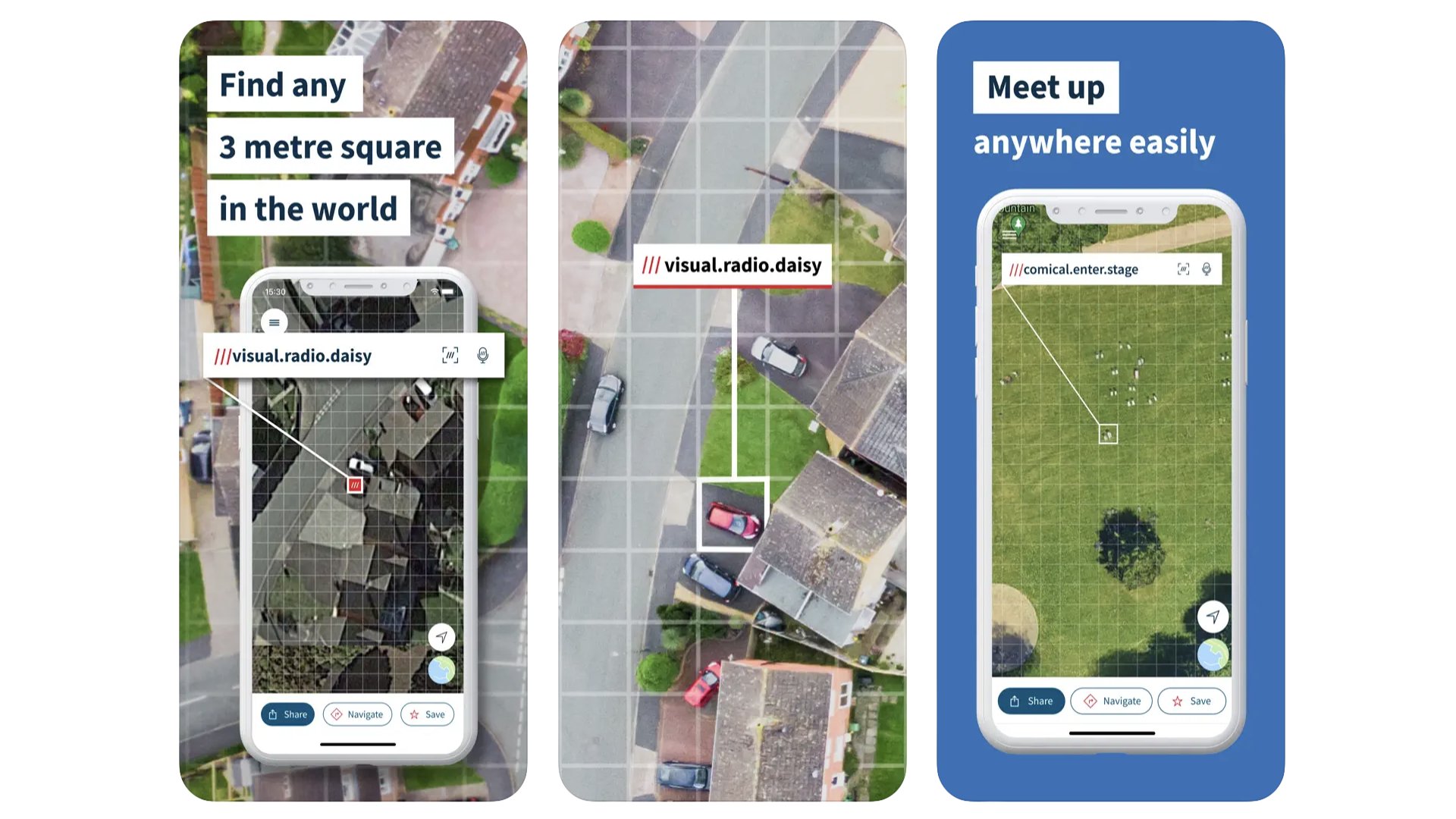

What3Words

Here’s an alternative to sharing a screenshot of your location on Apple Maps or Google Maps when trying to meet up with someone. What3Words lets you locate any place in the world using, you guessed it, a string of three words. A local cinema? Why that’s film.hogs.feeds, suitably enough. You just give the string of words to the other person, and they can then use What3Words on their end to find where to meet. Each block, which you select on a map view is 3 meters by 3 meters. We have read it’s not a great idea to use this system in an emergency, perhaps due to the prevalence of homophones. But we’re talking about meeting up with friends here, not calling an ambulance.

What3Words

Locate friends and family without dealing with complicated coordinates thanks to What3Words.

Download here: App Store

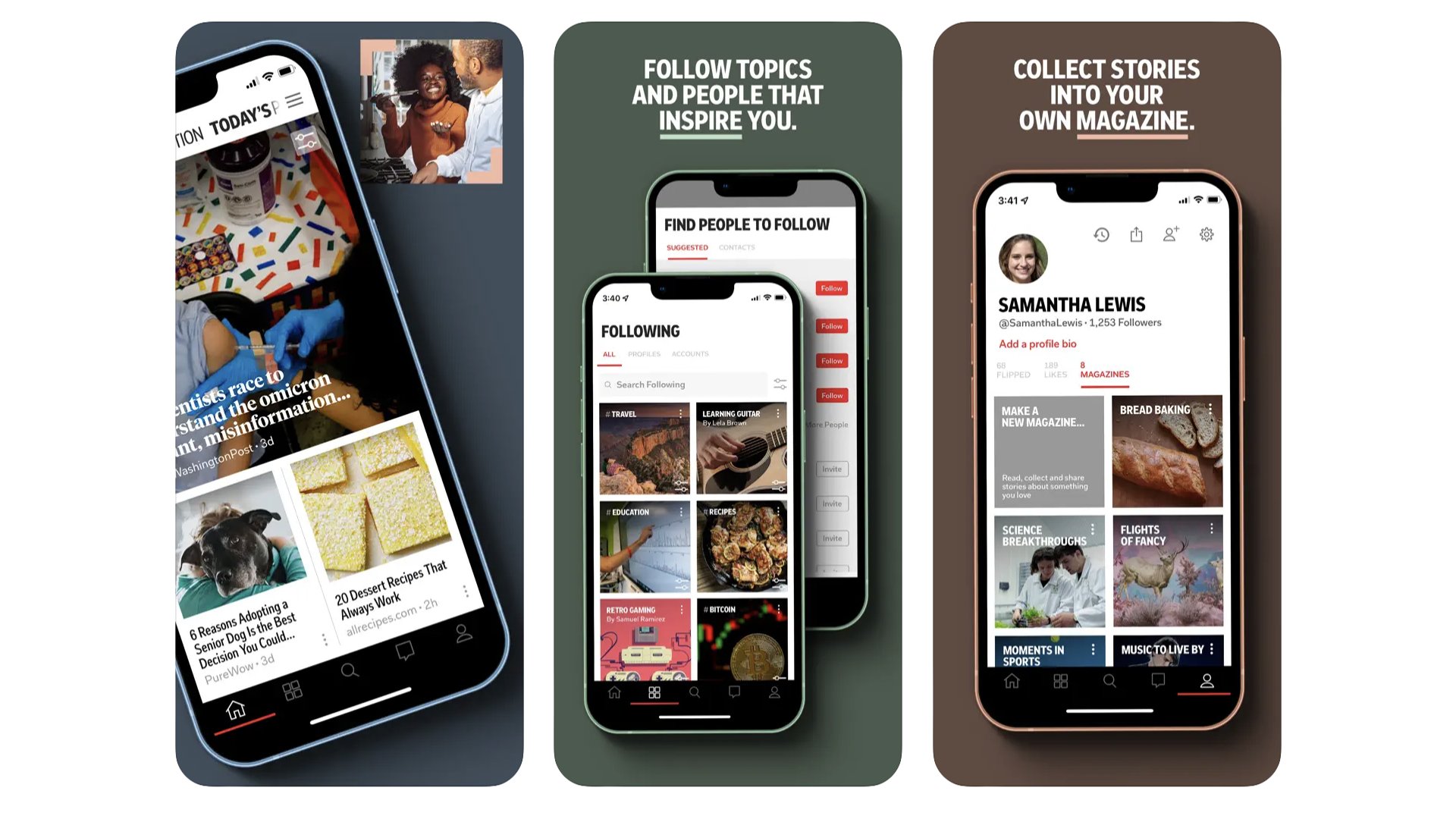

Best iPhone apps: News

The idea behind this long-standing app (released in 2010) is it makes a magazine-like interface out of stories taken from the internet. You pick your topics, which are displayed as hashtags. Flicking through your daily stream of stories feels more like turning the pages of a, yep, flipboard, than scrolling through the average social network feed. It takes some fiddling to make Flipboard feel your own — you’ll want to “follow” your favourite publications — but we like it a lot for one-handed use while on public transport.

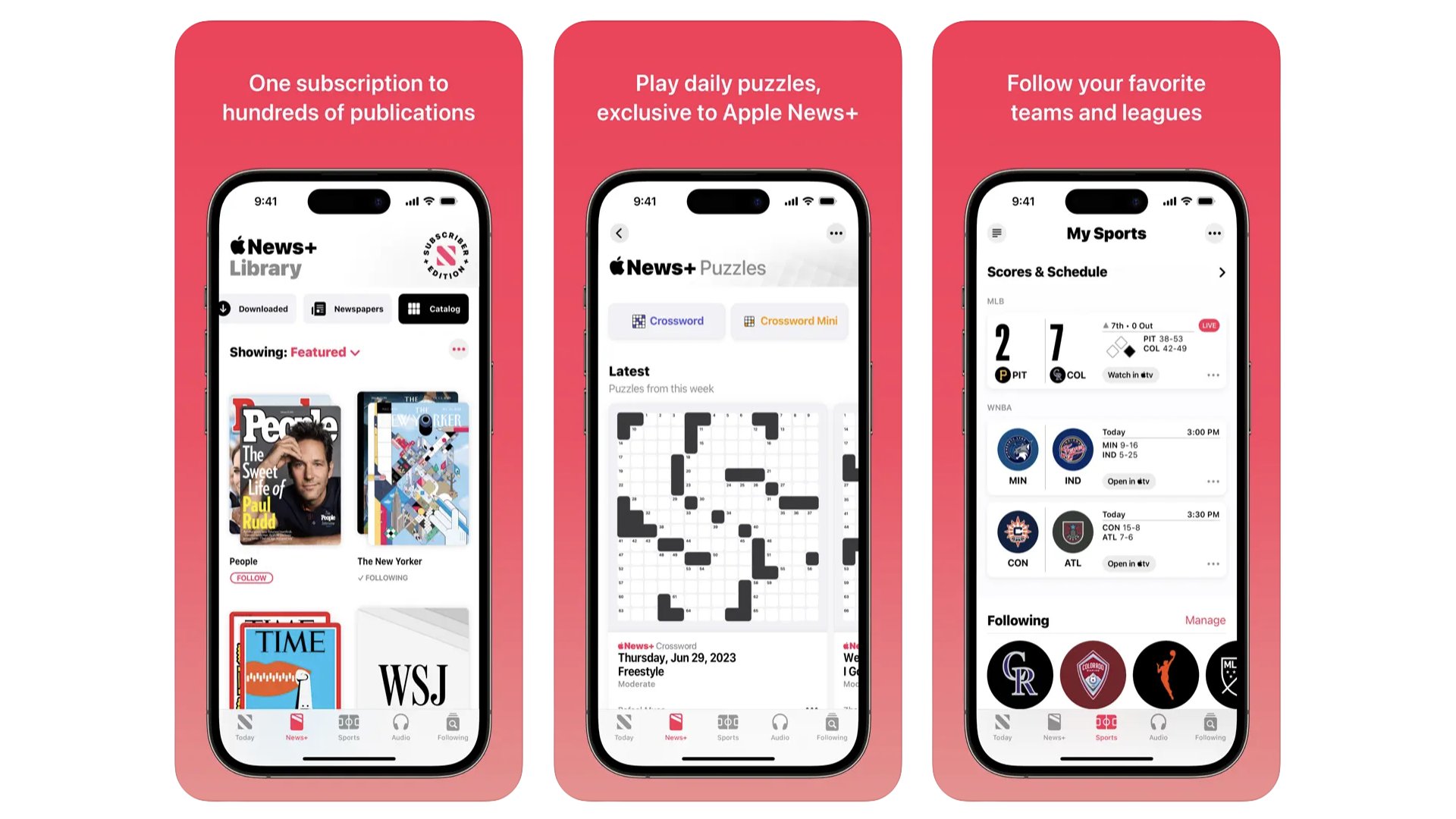

Apple News

Apple’s own news aggregator app works best if you’re willing to splash out for Apple News+. If you don’t, your beautifully formatted news feed may well end up peppered with stories only available to premium subscribers. News+ grants you access to loads of magazines and paywalled sites like The Wall Street Journal and The Sunday Times from the UK. You can save more by spending more, as News+ is available as part of the top Apple One subscription, which bundles Apple services together. On its own, News+ costs $12.99 a month.

Apple News

Get access to paywalled websites and digital magazines with Apple News+.

Download here: App Store

Best iPhone apps: Photography and Camera

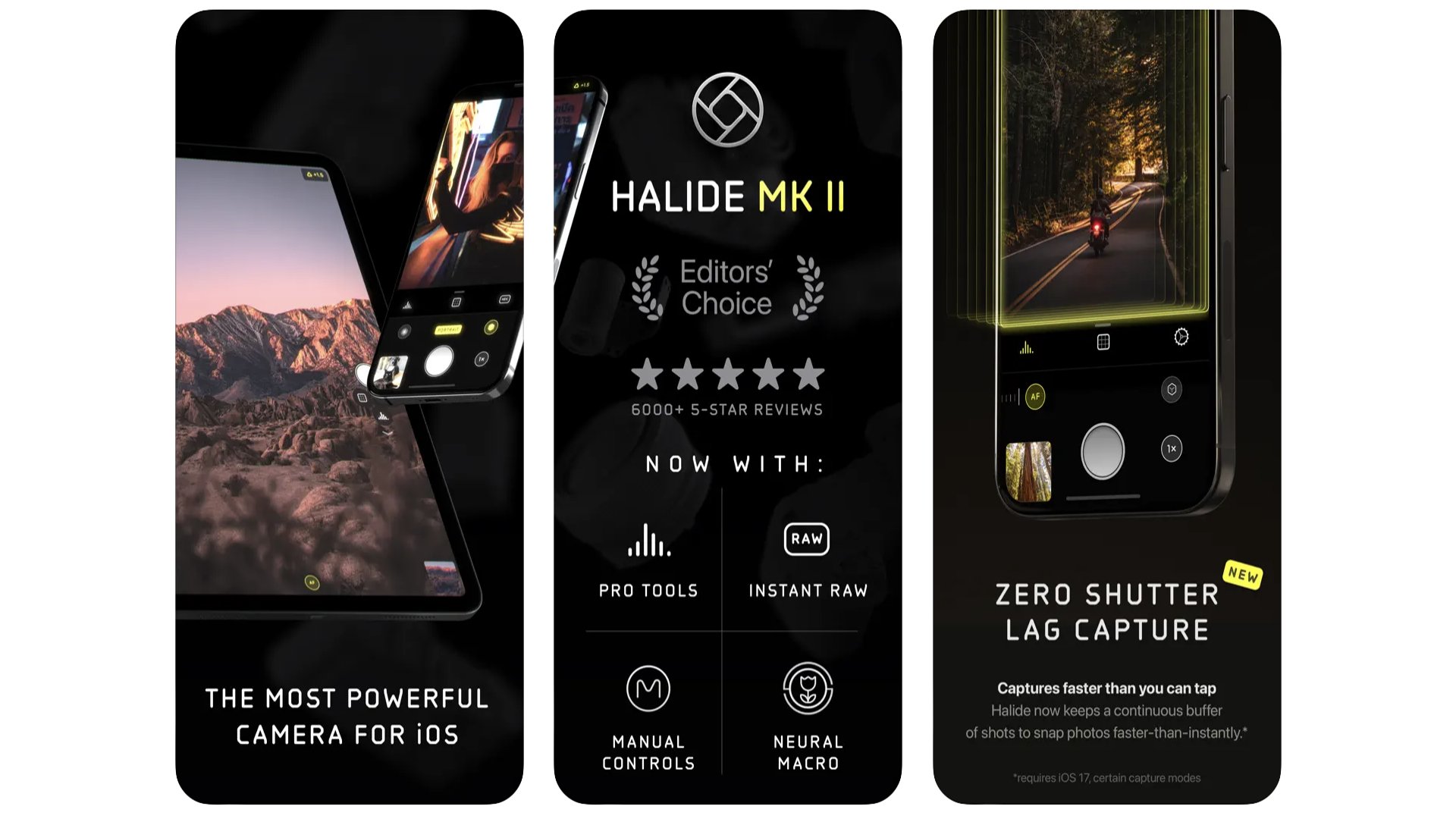

Halide Mark II

Some folks overestimate the usefulness of third-party pro-style camera apps for iPhone. They talk as if the JPEGs an iPhone spits out are the equivalent of a toddler’s crayon rendition of what the camera actually sees. They aren’t, but Halide Mark II does offer a different take on the camera app. It offers more direct control over whether or not to shoot RAW images, minimally processed files that can offer greater control over detail and noise. The app has “zero shutter lag” in certain modes because it buffers image data. And it includes widgets for the home screen that take you directly to ultra-wide, standard and zoomed camera views. It’s a paid app, though. $11.99 a year.

Halide Mark II

Unlock features not seen in the default iPhone camera app with Halide.

Download here: App Store

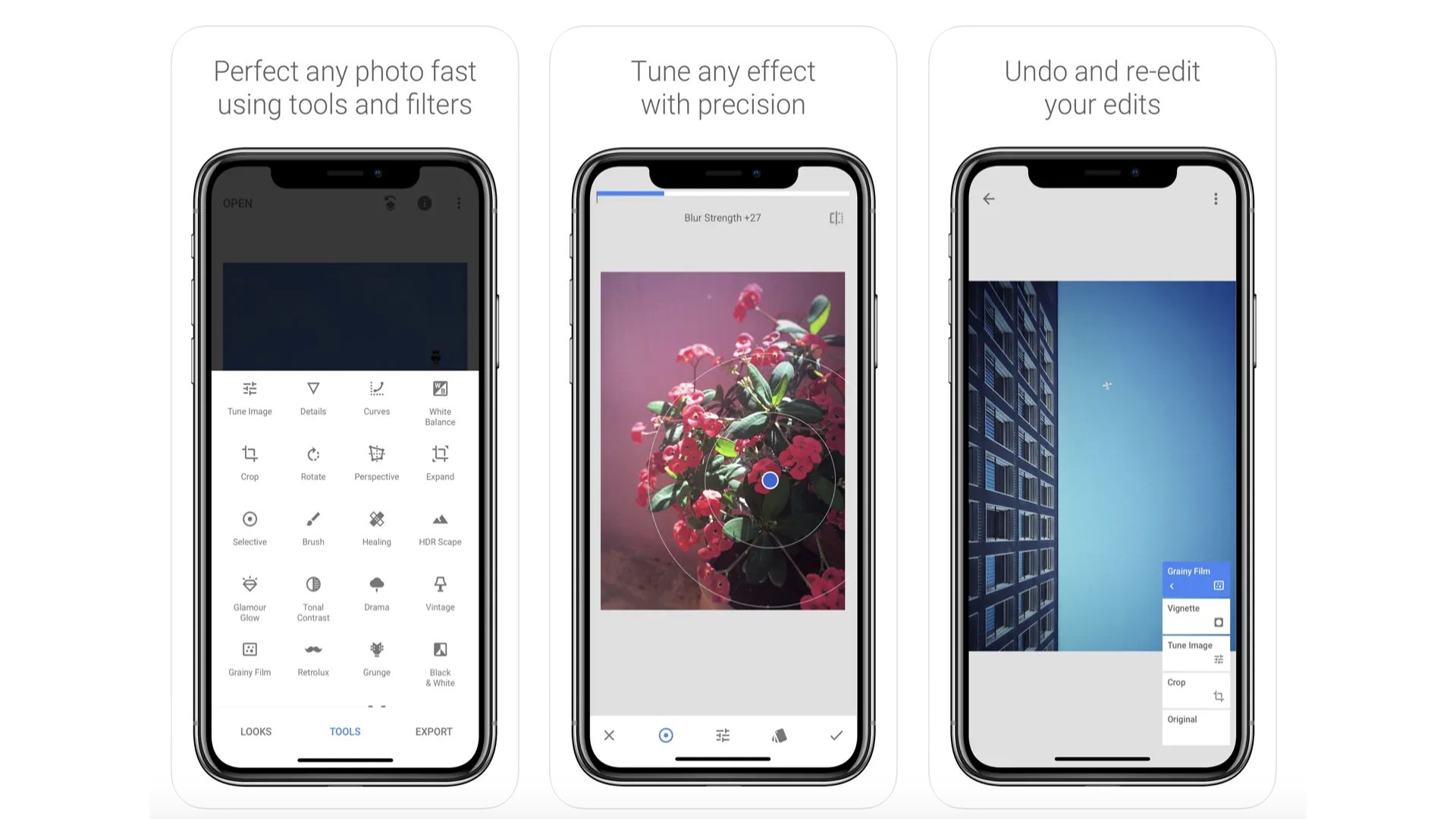

Snapseed

This app is as old as the hills, having been released in 2011. However, it’s still one of the best for fast, effective image editing. It has rotation, cropping, some good-looking filters, solid picture tuning. And each step of the process comes with loads of control. There are typically multiple sliders to control the style and intensity of every change you make. This is quite old-school image editing, not the kind of AI-driven that generates so much attention today. But there are some more advanced effects like lens blur an a (admittedly not amazing) heal tool. Google owns Snapseed, and has done since 2012.

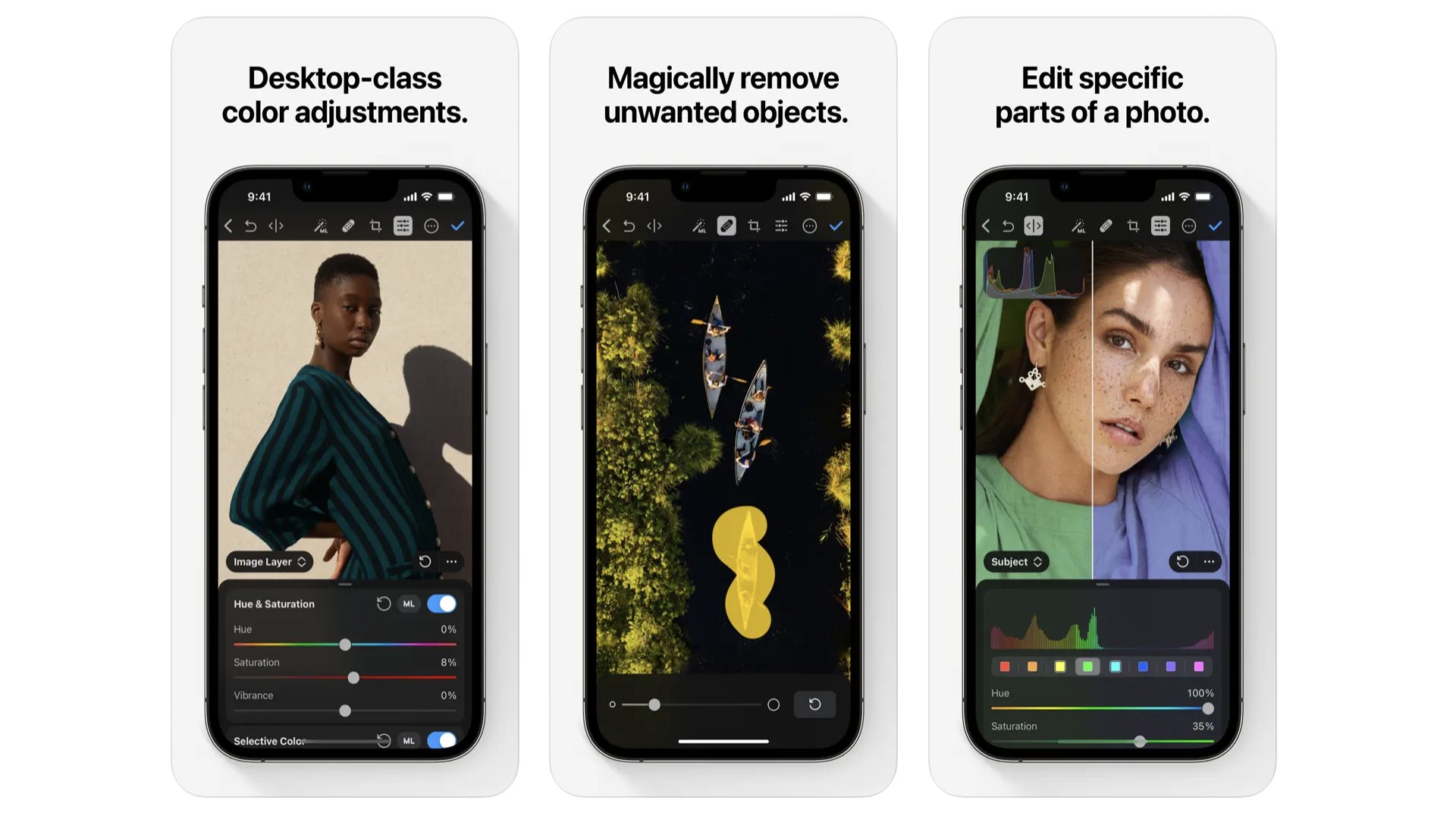

Photomator

This is one of the best photo editing apps out there. At first it looks pretty familiar. You can auto-enhance images using the “machine learning” tool, apply filters an use the “heal” brush to remove blemishes. However, look closer and you’ll realise there’s some more special stuff going on here. For example, as well as having Photoshop-grade control over image tone and colour, Photomator can automatically separate out images’ subject, background and sky. This lets you make specific adjustments to each, with no fuss. You can also save editing styles to work out a signature look for photos. It’s multi-platform too, but isn’t free. It costs $29.99 a year, or $99.99 for a lifetime sub.

Photomator

Photomator makes high-end photo editing on a small screen feel natural.

Download here: App Store

Faceapp

Next to our other photography editing apps, Faceapp is pretty fluffy and insubstantial. But it is a blast, particularly when you play with photos of friends. With their permission, of course. You may have come across this one when it went viral in 2019. You use it edit photos of people, changing their gender, making them older or younger, and changing their makeup and hair. Most of the filters are locked behind a subscription paywall, but a handful of the good stuff, including gender swap, is available for free.

Faceapp

Ever wondered what you’d look like as another gender? Faceapp can guess.

Download here: App Store

Best iPhone apps: Podcasts and Radio

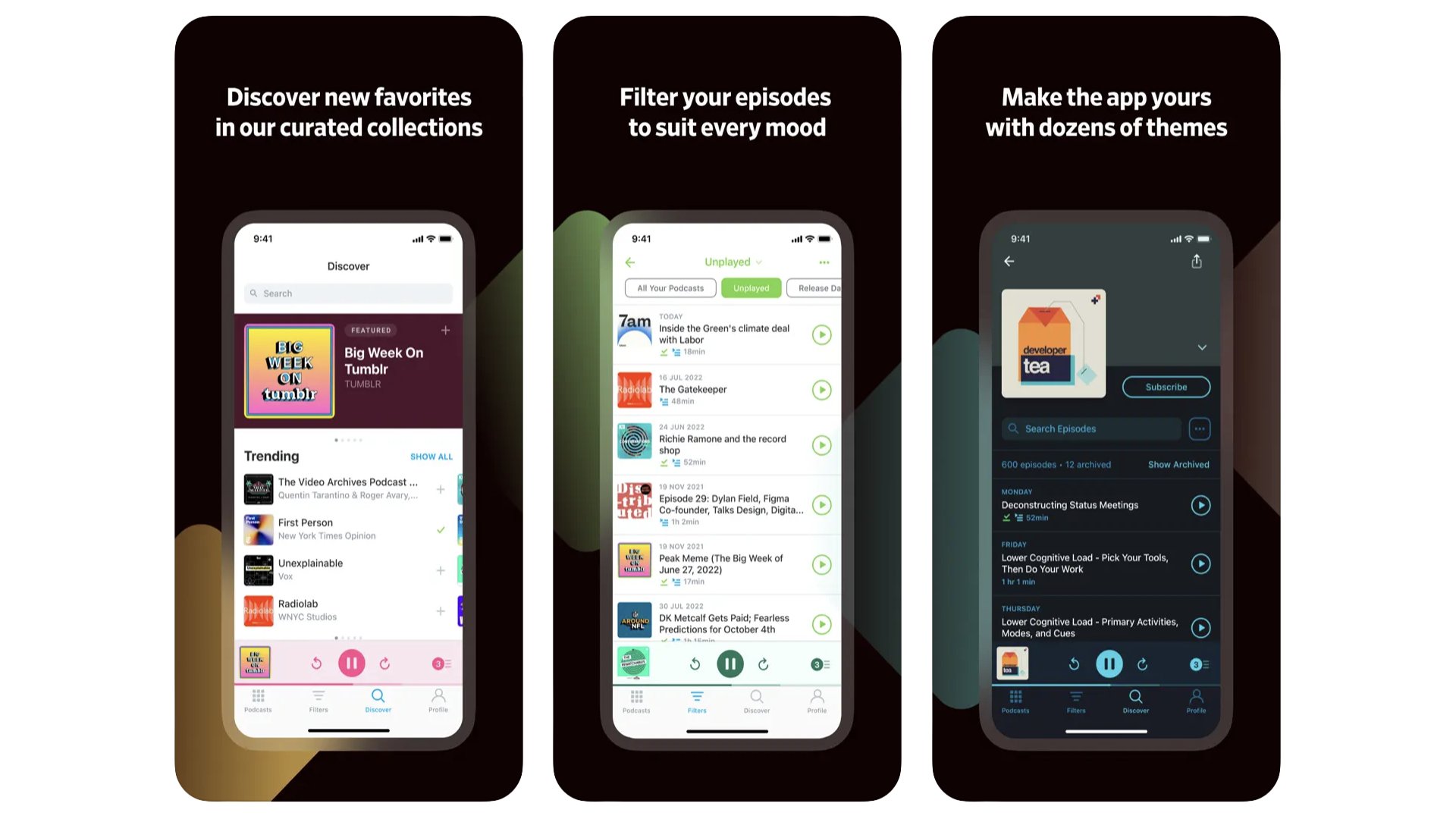

Pocket Casts

If you are bored of Apple Podcasts and fancy trying something else, you have at least two key options. They are Pocket Casts and Overcast. We’ve picked Pocket Casts this time as it has a slightly glossier interface. Slick as anything, this one. But at its core it is an intuitive and direct way to access your favourite pods. It also has some useful extra features like speed control and a sleep timer, if you want to fall asleep to the voices of podcasters.

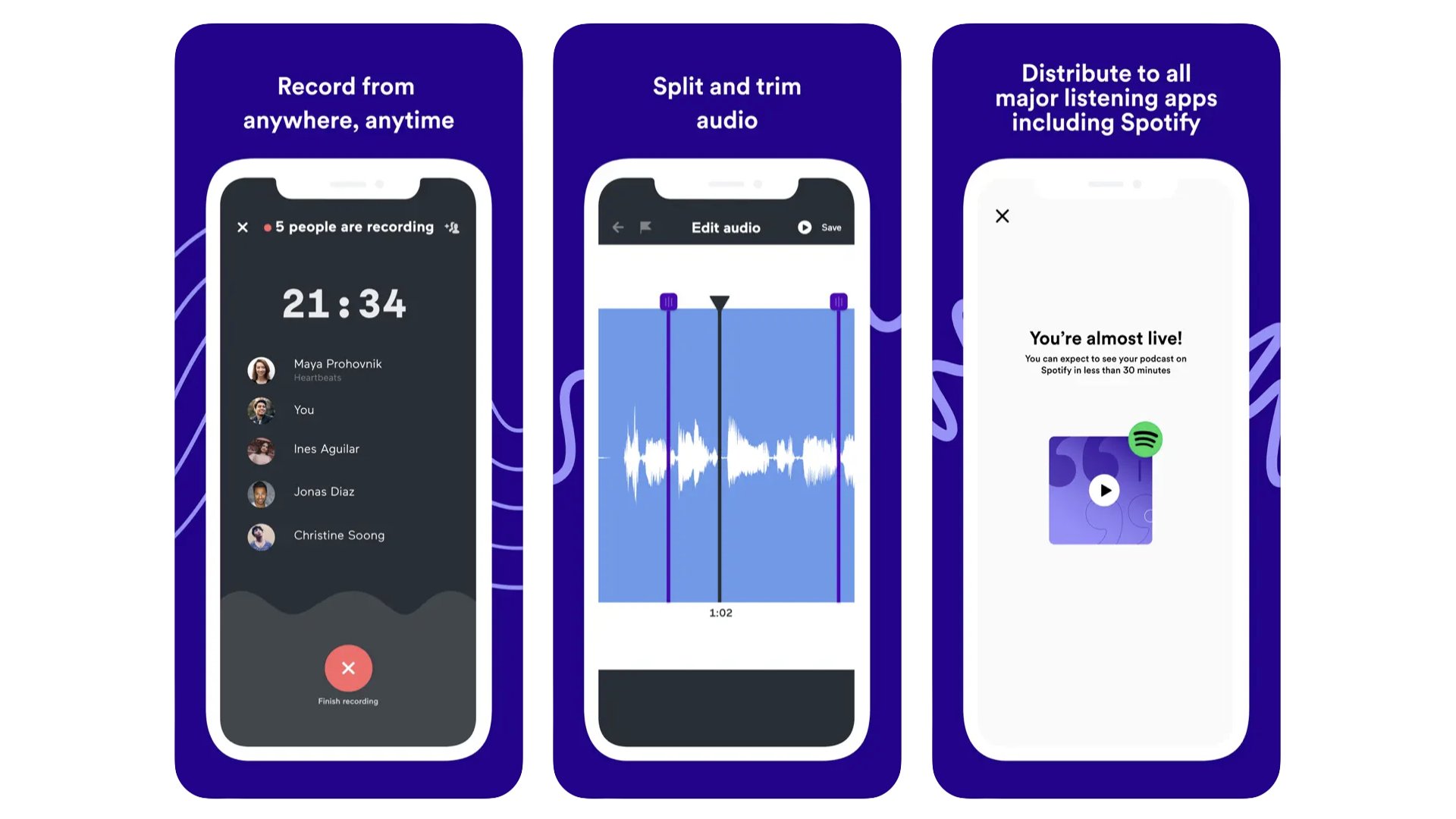

Spotify for Podcasters

This app isn’t for listening to podcasts. It’s for people who make them. Spotify for Podcasters is a bit “on the nose” as names go, but it was once called Anchor, a company acquired by Spotify in 2019. The app lets you record and edit audio files, upload them to the most popular podcast platforms and see metrics on how many people have played your podcast, and your total audience size. It’s a neat way for beginners to try out the medium, there’s a library of royalty free background sounds and music, and you can get free hosting for your episodes.

Spotify for Podcasters

Spotify for Podcasters is an app for the makers of content, not the consumers.

Download here: App Store

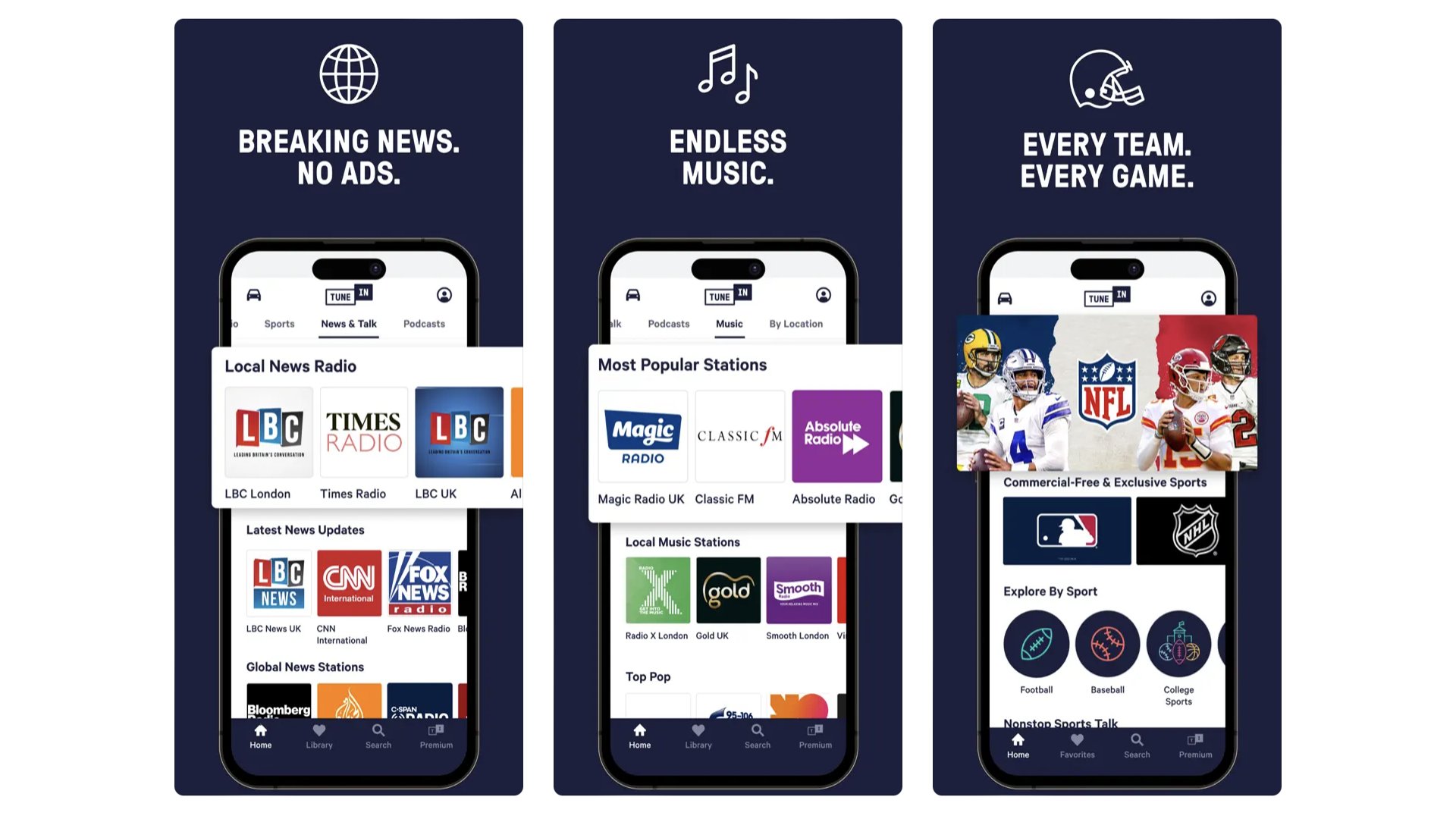

TuneIn

The number of radio stations current broadcasting around the world as you read this is mind-boggling. There were 44,000 in 2016 according to the latest UN figures we could dig up. TuneIn lets you listen to a good chunk of them over the internet. As well as just searching for your favourites, you can scan around a world map to discover stations for across the globe. UK user? You’ll find stations outside the UK blocked due to licensing restrictions. These can be unlocked using a VPN, or you can try another (admittedly less fun) app like Simple Radio.

TuneIn

Go on a journey across the world, leap-frogging between radio stations with TuneIn.

Download here: App Store

Best iPhone apps: Productivity

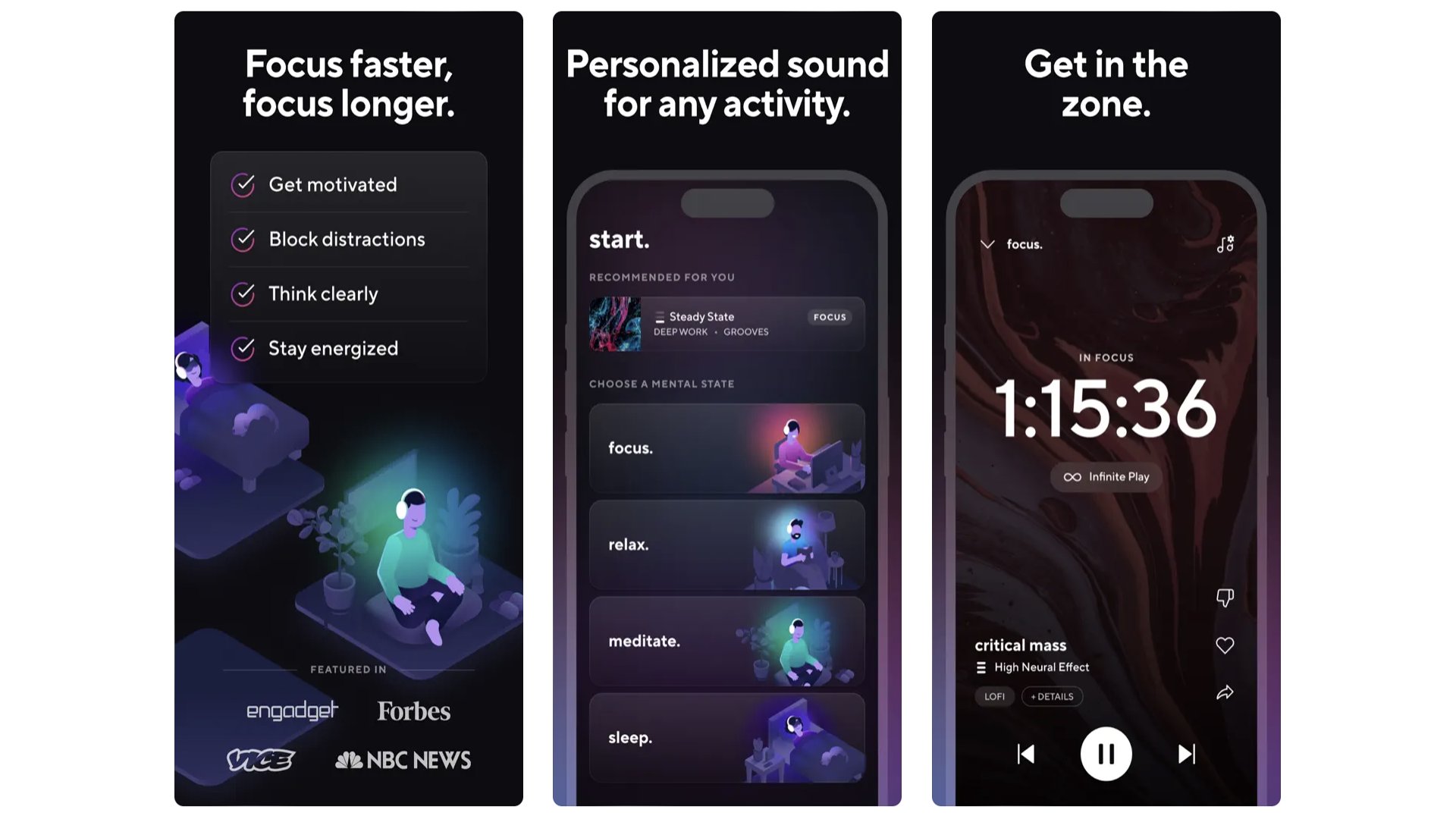

Brain.FM

This app could have featured in the Music section of this round-up, or even the meditation and relaxation one. However, we use it as a productivity tool. It plays generated music, made up of semi-composed elements. You choose Focus, Relax, Sleep or Meditate, which are the four categories. Past that, though, you can customize the track by picking a “genre” or music style, from classical to post rock and electronic. Or go for a nature-inspired soundscape. We tend to go for these, as Thunder and Rainforest can really help you get in the work zone. It’s great if you end up working in a noisier environment, but find “real” music too distracting. The only bad bit: brain.fm is quite pricey at $9.99 a month or $69.99 a year.

Brain.FM

Brain.FM is a music app that helps you relax or get into the work zone.

Download here: App Store

ChatGPT

This app isn’t much more than a portal to the popular AI chatbot. But if you have’t at least dabbled with ChatGPT, you’re missing out. It is one of the most talked-about developments in tech in years. You ask ChatGPT a question, and it answers. At the time of writing, ChatGPT uses GPT 3.5, and has knowledge of the world up to January 2022. As with any chatbot, you should treat anything it produces with a level of suspicion, due to AI’s tendency to “hallucinate” facts. But it’s less egregious than it was in ChatGPT’s early days. Given how impactful AI Is expected to be, it’s a good idea to get acquainted with this most famous of AI implementations.

ChatGPT

The chat bot ChatGPT can now live on your iPhone if you want it to.

Download here: App Store

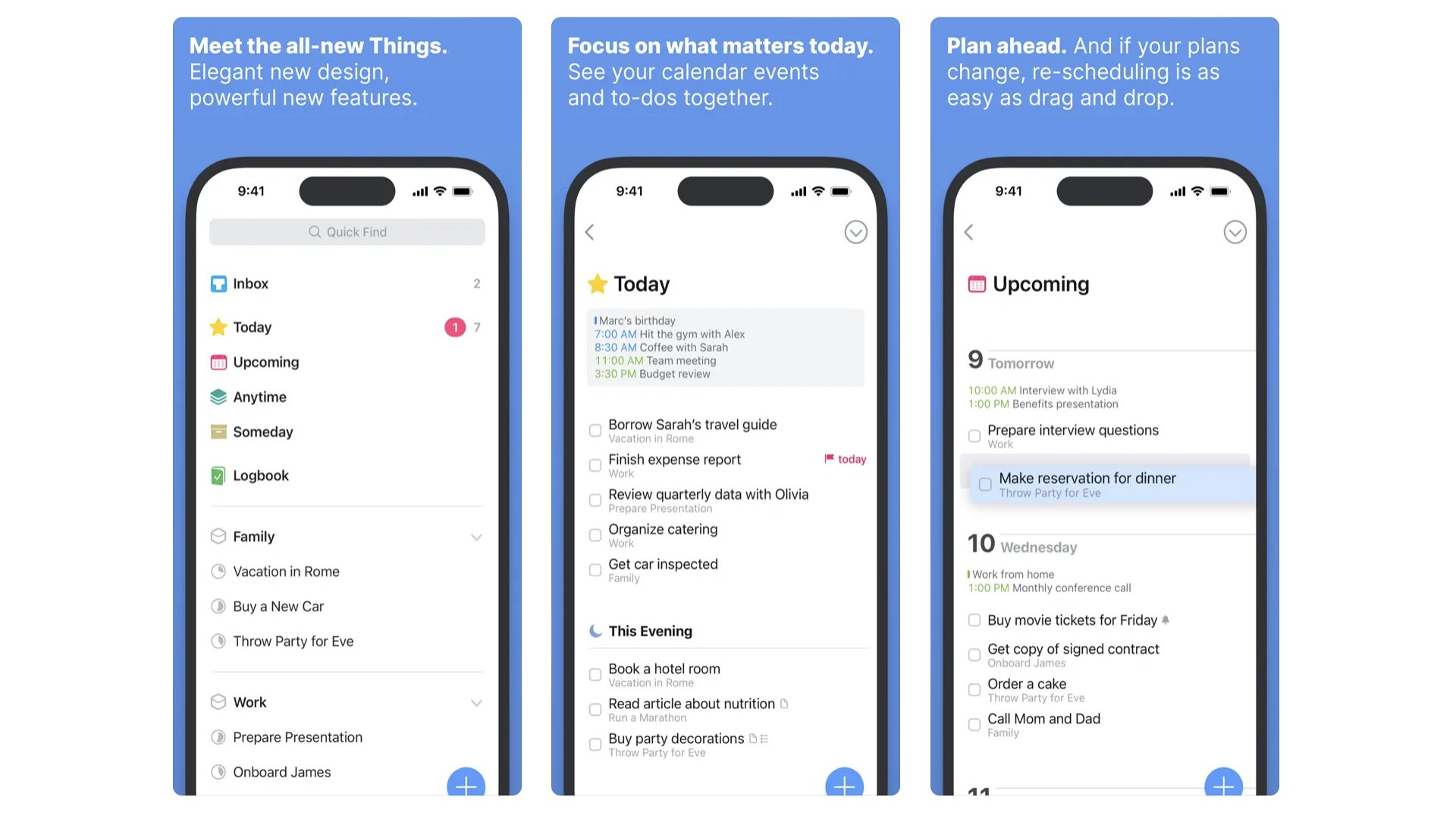

Things 3

Once upon a time, we headed to Todoist when recommending organization iPhone apps. But our head has been turned by Things 3. If you want it to be a simple to-do list app, it can do that. However, dig deeper and this becomes a surprisingly capable little project management tool. You can arrange lists within lists, breaking down big tasks into smaller jobs without leaving them as disparate tick box exercises. There’s good clarity to how Things 3 arranges your various future lists too, giving you a sense you’re in control. Even if, whisper it, you’re not actually in control at all.

Things 3

A more thoughtful take on the to-do list, Thing 3 improves productivity, reduces anxiety.

Download here: App Store

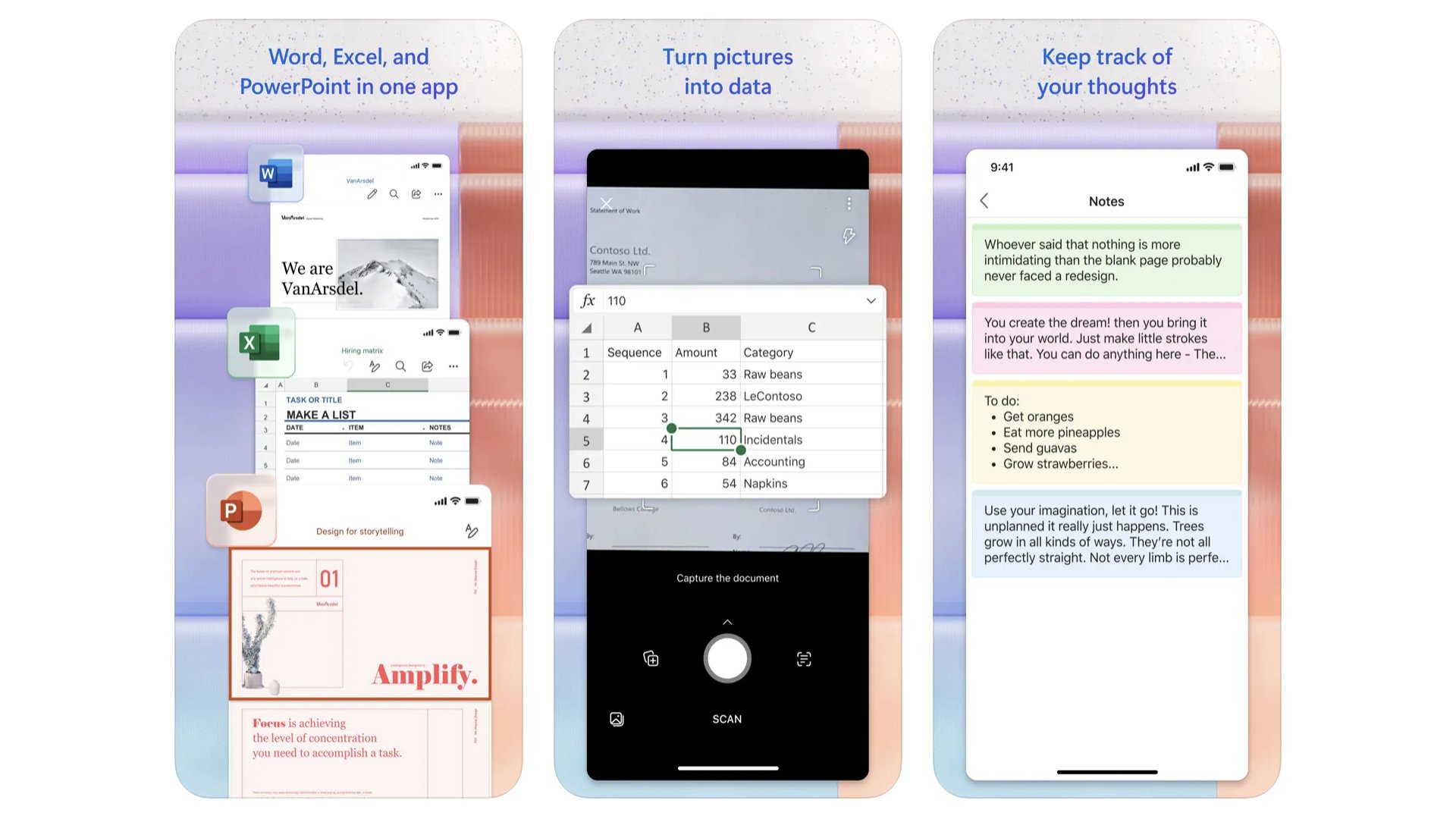

Microsoft 365

Microsoft brought its Office apps to iPhone way back in 2014. The suite of apps is now called Microsoft 365 and, unfortunately, comes with a subscription attached. You’ll pay $69.99 a year for access to the lot, or $99.99 for a family pass. This also snags you a load of cloud storage, enough to keep all your files safe. You can also use the app without a subscription, as we’re basically getting the mobile version of Microsoft’s Office web interface here. The iPhone versions of the apps — Word, Excel, PowerPoint — all live within the one app. And they are naturally pretty stepped-back compared to the classic PC versions. But they crucially feel right at home on iPhone. Try these if you don’t get on with Apple’s iWork, which comprises Pages, Numbers and Keynote.

Microsoft 365

The most famous productivity suite is known as Microsoft 365 on iPhone.

Download here: App Store

Apple iWork

If you're throwing out everything you knew about anything non-Apple, iWork is your replacement productivity bundle. It's the company's answer to Microsoft Office. Pages, Numbers, and Keynote will get the same results with a different interface. And, if your working companions are on Microsoft, it's no problem. You can export your documents to their counterparts. With iCloud, you can store all of your work in the cloud for easy access from any iOS device or on the web, whether you use a Mac or PC.

Pages

Apple's word processor app can help you get any document prepared in a professional manner.

Download here: App Store

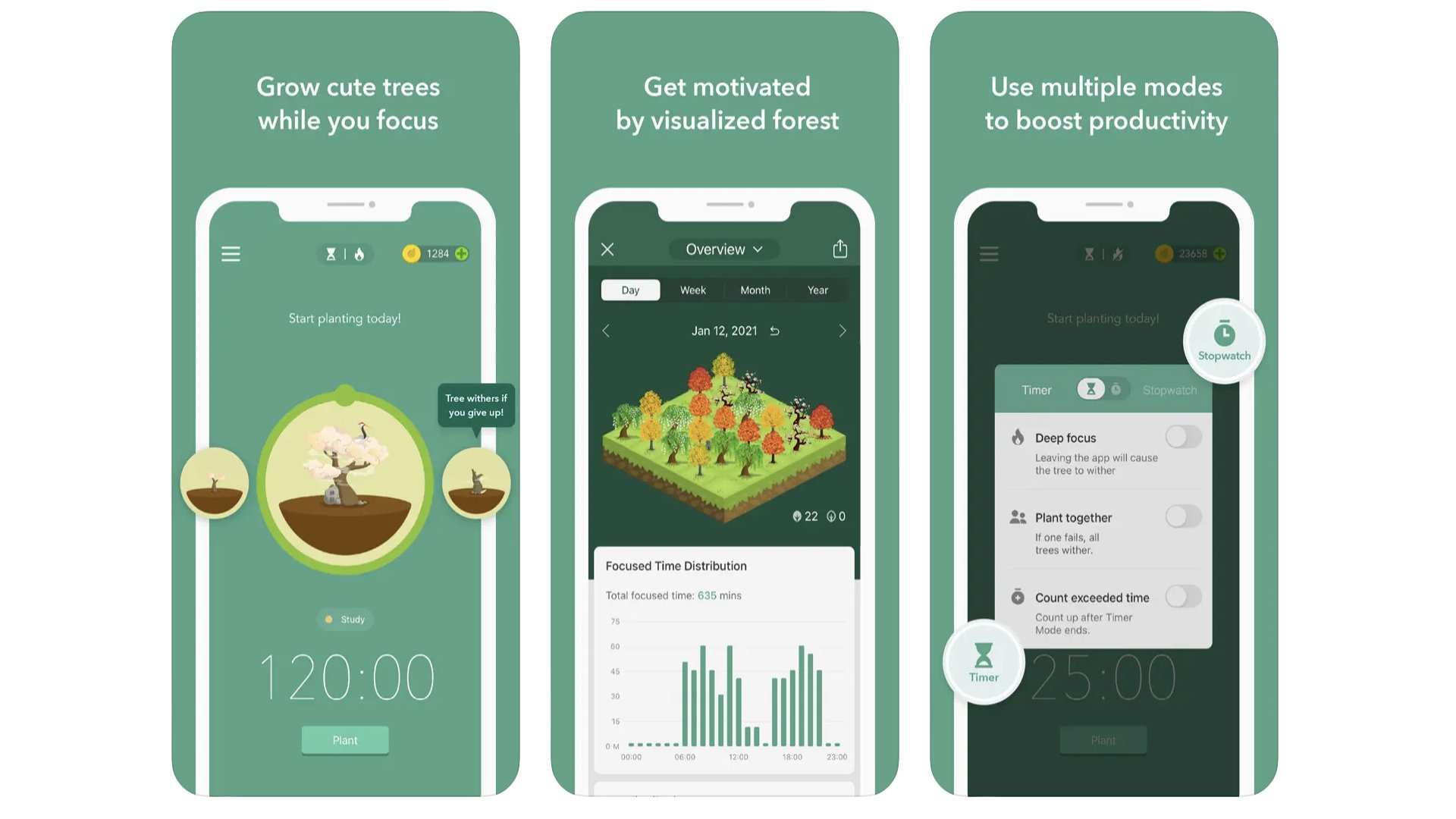

Forest

Heard of the pomodoro technique? It’s where you work in timed bursts, usually 25 minutes, and only let your concentration break in-between. That means no social media checks in that time, folks. Forest is a pomodoro timer with a difference. By following the program, you end up developing and growing a virtual forest, unlocking new trees along the way. That’s right, Forest gamifies concentration. There’s just a $3.99 entry fee to use the app, but there are elixir and crystal in-game currencies to boost the production of your forest. You can ignore all that if you’re just here to boost your work willpower.

Forest

An app that lets you work more efficiently while growing a virtual forest.

Download here: App Store

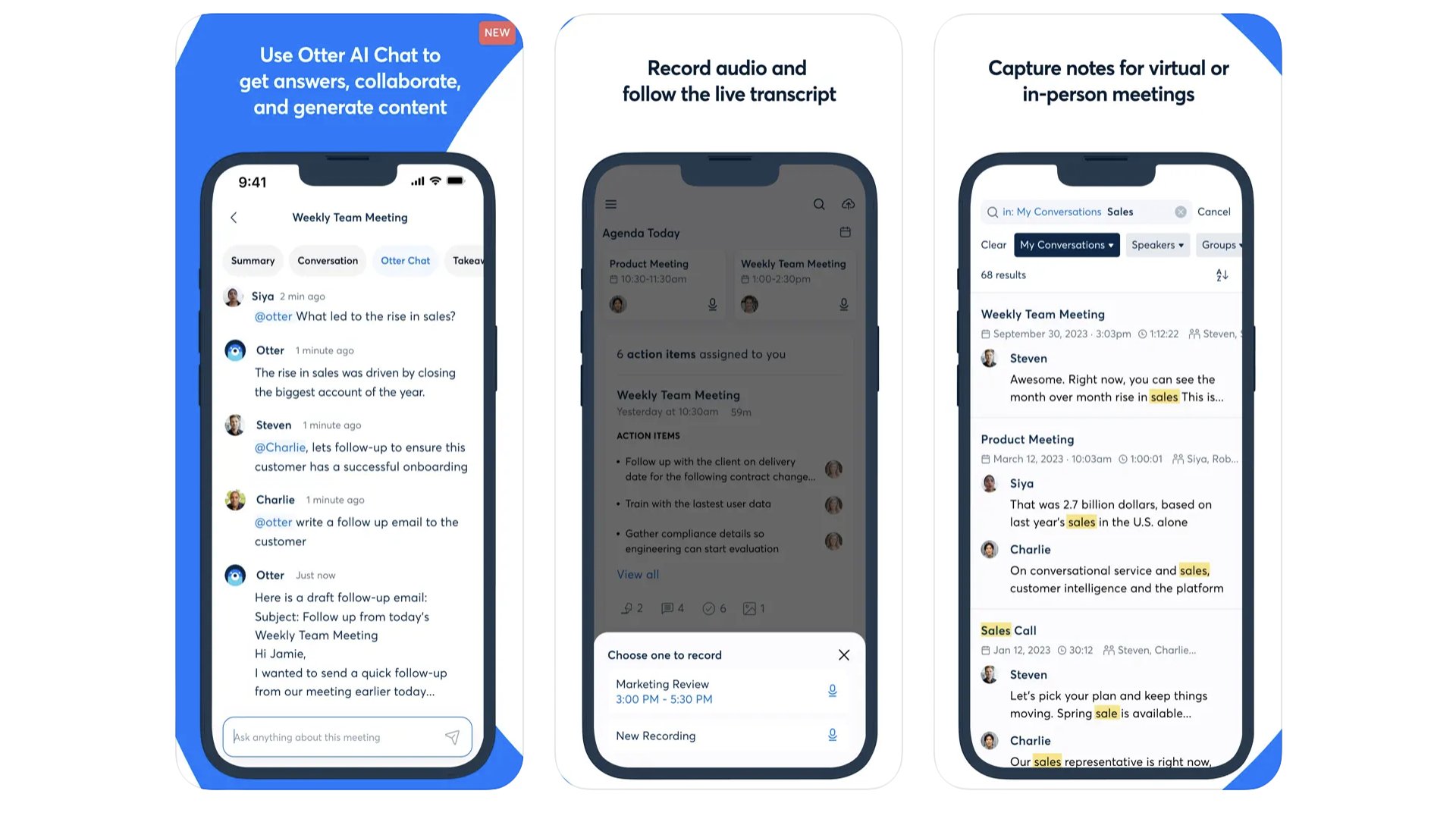

Otter.ai

If you ever have to conduct interviews as part of your work, or need to take minutes for a meeting, get Otter.ai. It’s a transcription app that works out what people are saying, and can separate out different voice in the conversation. A more recent AI addition also offers quick written summaries of what was covered in the interview/meeting. Handy. You can use Otter.ai for free, but you’re limited on the number of minutes per month, and can only import three audio files total (not per month). $10 a month bumps you up to 1200 minutes a month, and 10 imported audio or video files. More than enough for most, and you may be fine with the free tier.

Otter.ai

The days of manually transcribing meeting recordings are over thanks to Otter.ai.

Download here: App Store

Best iPhone apps: Recipes & Food

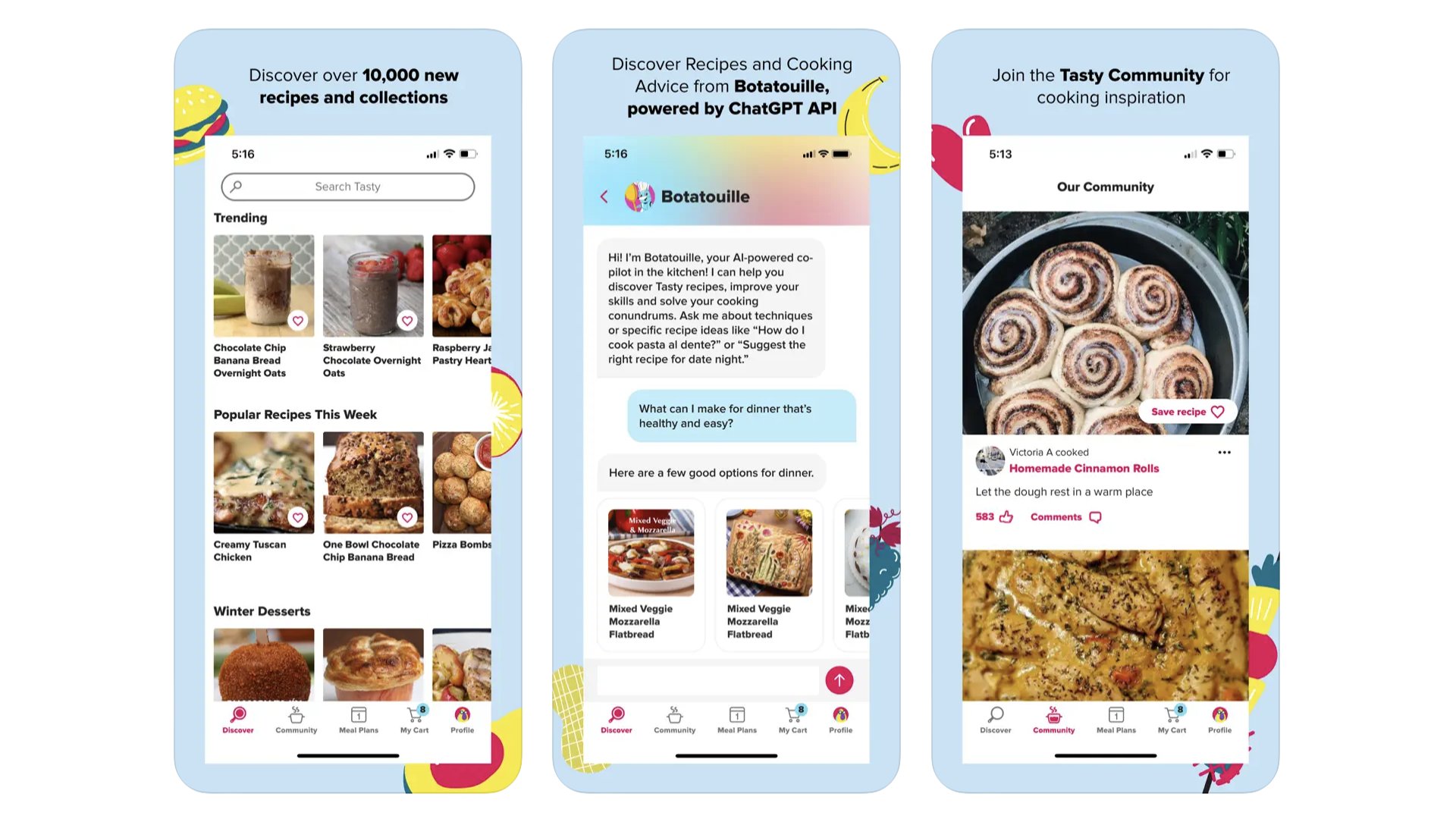

Tasty

Tasty was one of the organizations that helped define what social media cooking videos should look like. Top down view. Snappy and glossy-looking. Tasty is part of Buzzfeed, but quickly gained a whole life of its own. At the top of each recipe you’ll see one of Tasty’s classic sped-up video process guides. There’s a list of ingredients and a classic step-by-step written guide too, should these videos all be a bit “Gen Z” for your tastes. We like the formatting. We like the recipes. We’re kinda hungry now.

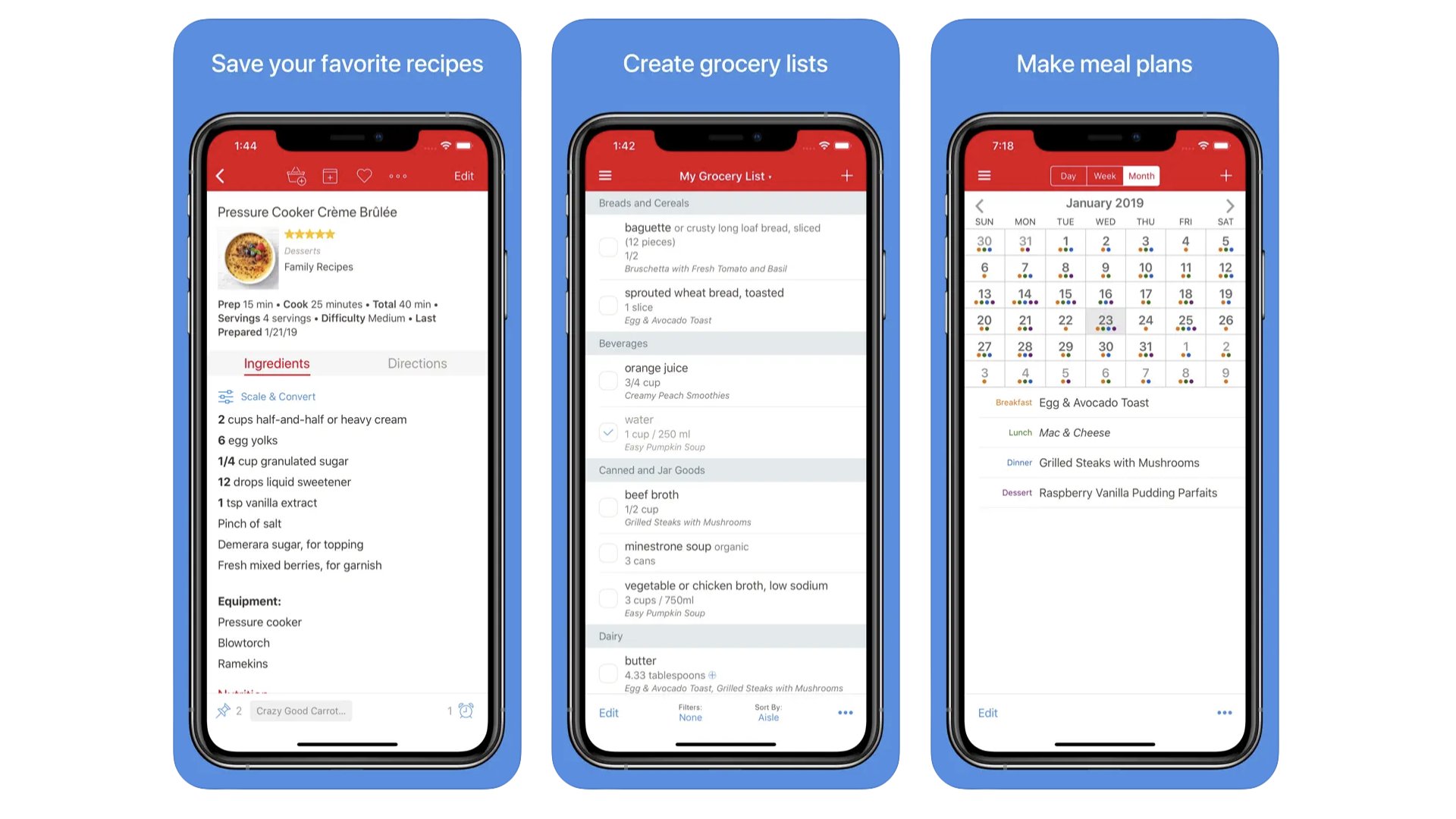

Paprika

Paprika is not just a recipe app. It lets you “download” recipes from across the internet, and automatically processes them to extract the ingredient list and instructions. All that guff about how the writer discovered this recipe while on holiday in Sardinia? Excised. And as you do end up visiting the origin websites in the first place on hunting down the recipe, we don’t even feel bad about it. Paprika will automatically work up shopping lists, and you can arrange meal plans into a calendar. You can be super-organized if you like, or just treat the app like a recipe encyclopaedia you build yourself.

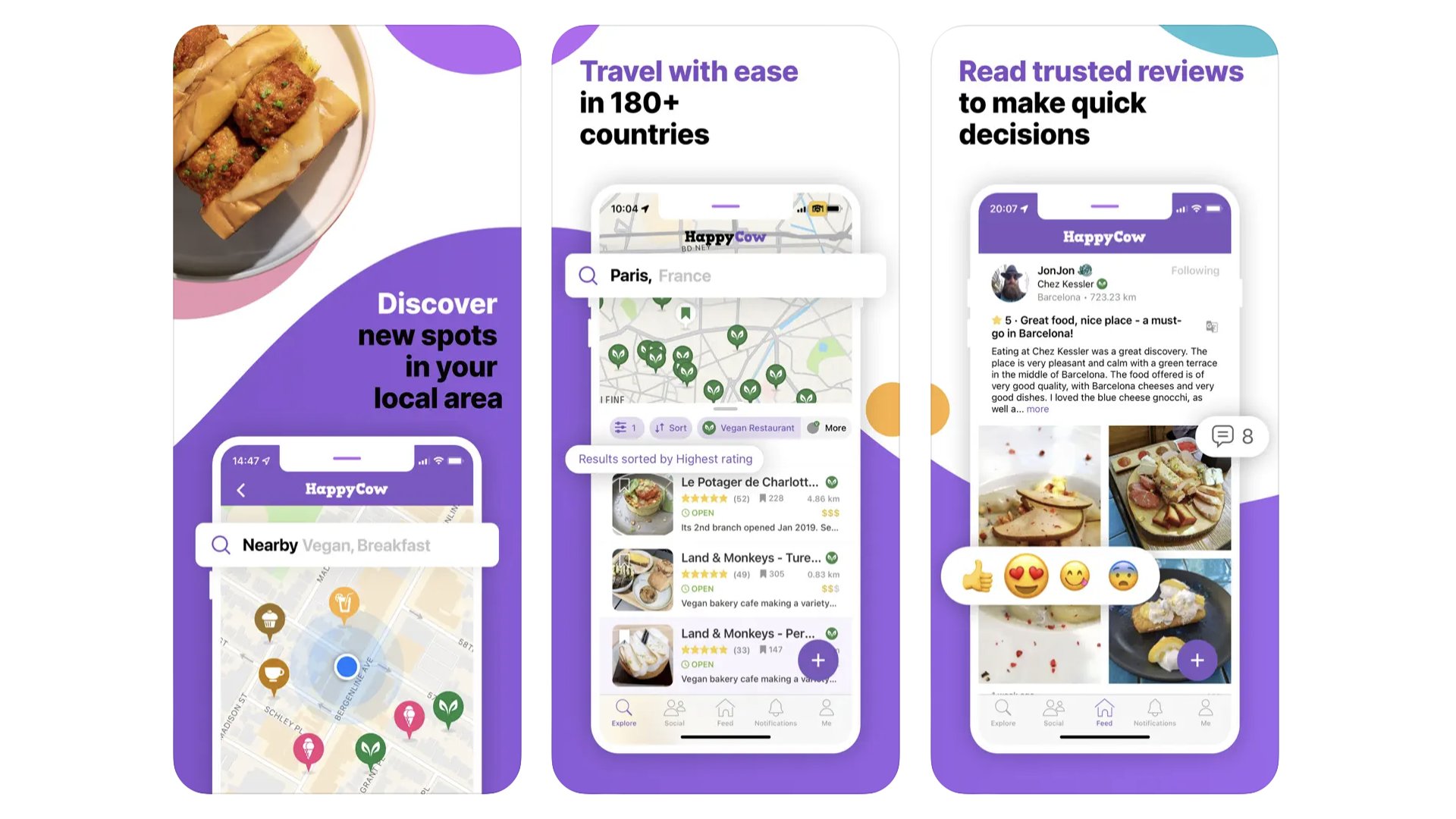

HappyCow

The closest the app sphere has to a vegan and vegetarian restaurant bible, HappyCow is a must-have for veggies on holiday, or just in a new area. It’s a way to find near restaurants with good vegetarian food, based on user reviews from the HappyCow community. You’ll find plenty of “normal” restaurants on there that simply have vegetarian and vegan options. But the map does have an icon based system to clearly delineate the pure vegetarian and vegan spots. There’s a small outlay for the app, $3.99, but it’s a quicker solution than endless Googling. And you can be sure the user-posted pics inside are actually of veggie food — bonus. You don’t get that on TripAdvisor.

HappyCow

Happy Cow is an easy way for vegetarians to find restaurants when travelling. Or just hungry nearer home.

Download here: App Store

Best iPhone apps: Ridesharing

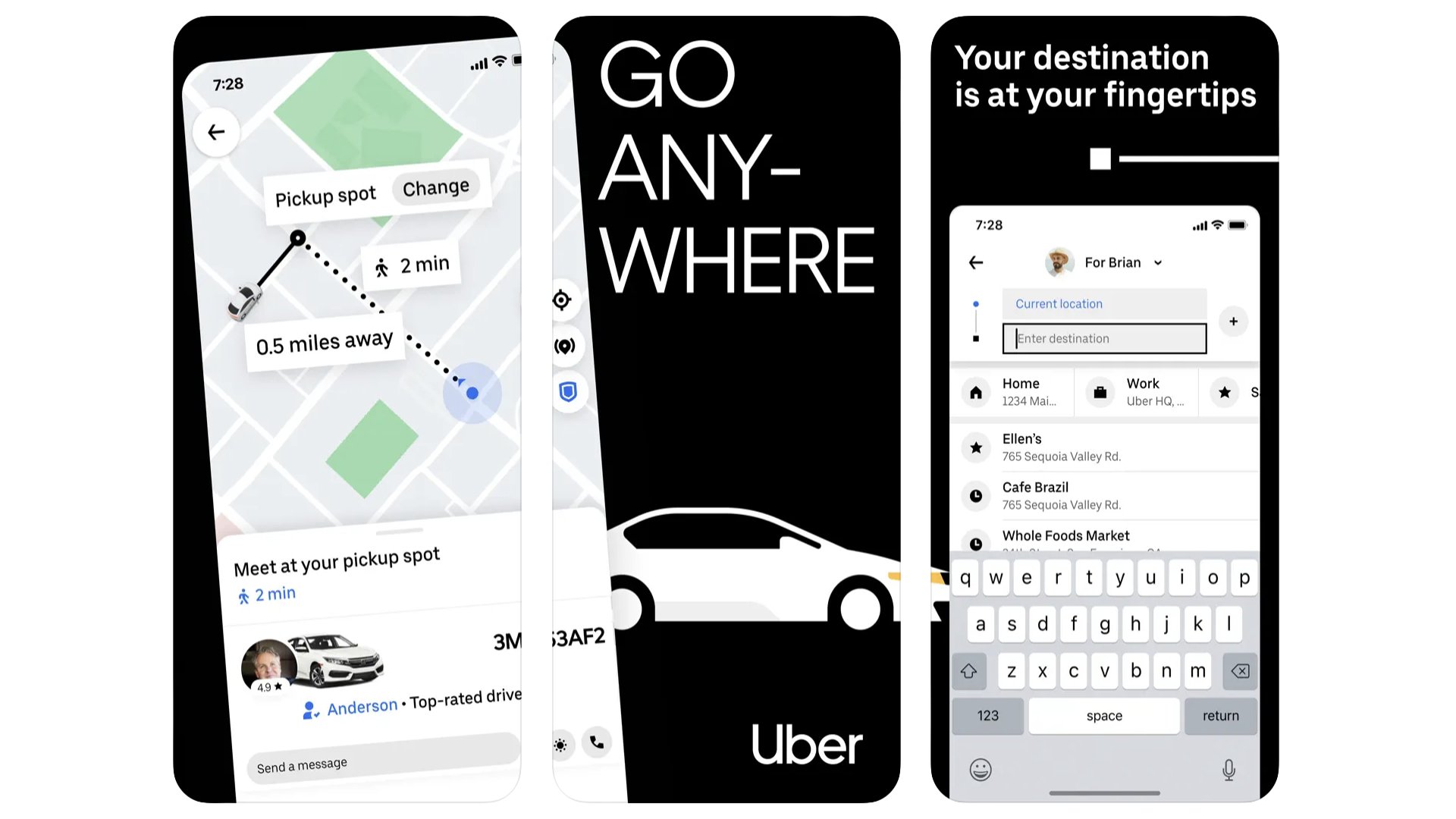

Uber

Is the golden age of Uber over? Uber rides seem to routinely cost more than they used to. But that’s what you get when a service was based on swallowing up the entire market through oodles of VC funding, rather than a sustainable business model. That said, Uber can still generally be relied upon to have more active cars in an area than most other competing services. In the UK you can even use Uber to buy train tickets these days.

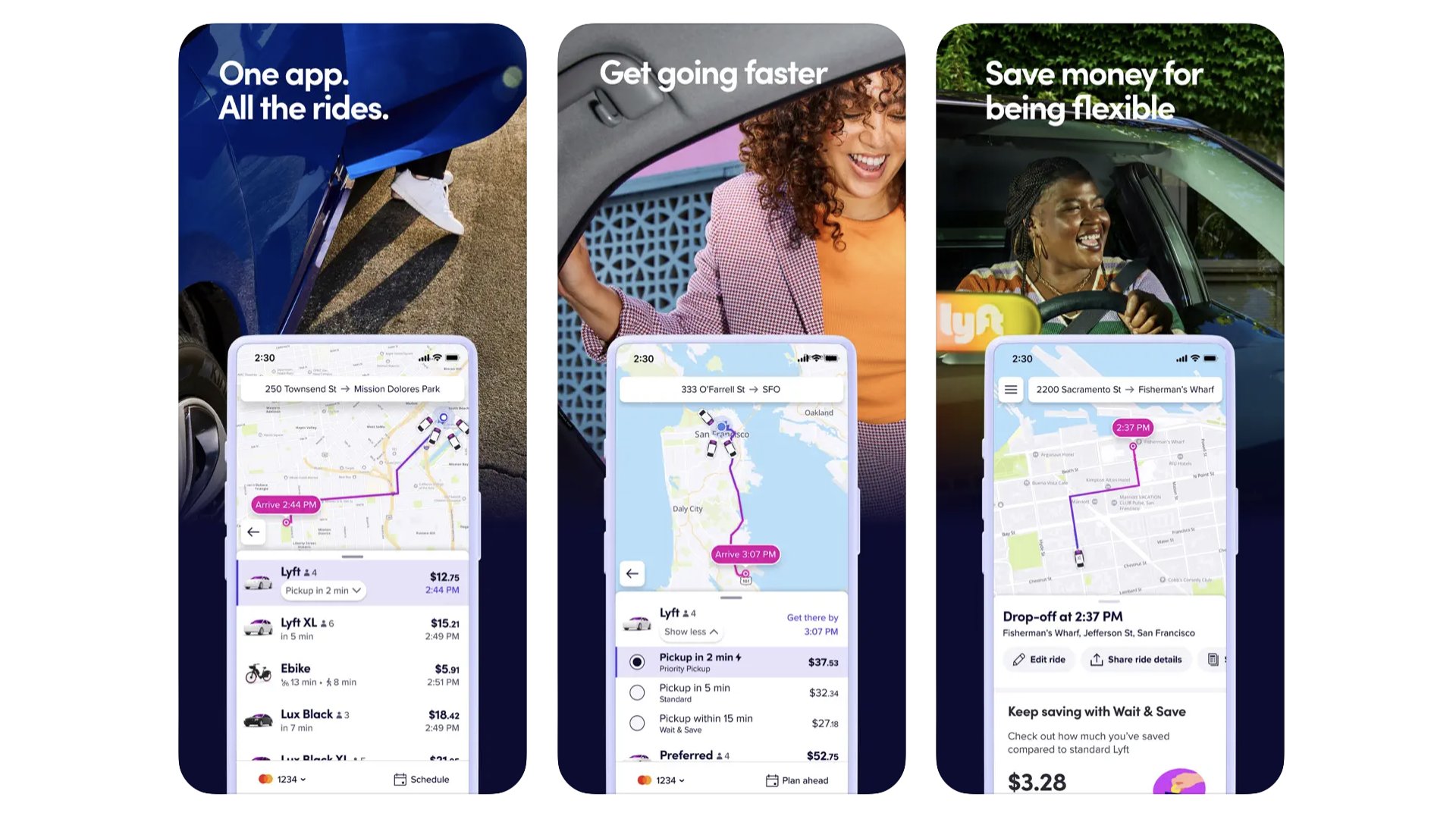

Lyft

It’s worth checking out taxi service Lyft if there’s surge pricing on Uber, as its price jumps can be less extreme than Uber’s. Lyft has also attracted fewer negative headlines than Uber over the last few years, at least regarding the corporate culture within the company. The basic deal is the same, though. You plan a route and are given an estimated cost for the journey. We find Lyft cars tend to be a little less readily available than Ubers. But this is likely to vary based on location.

Best iPhone apps: Shopping

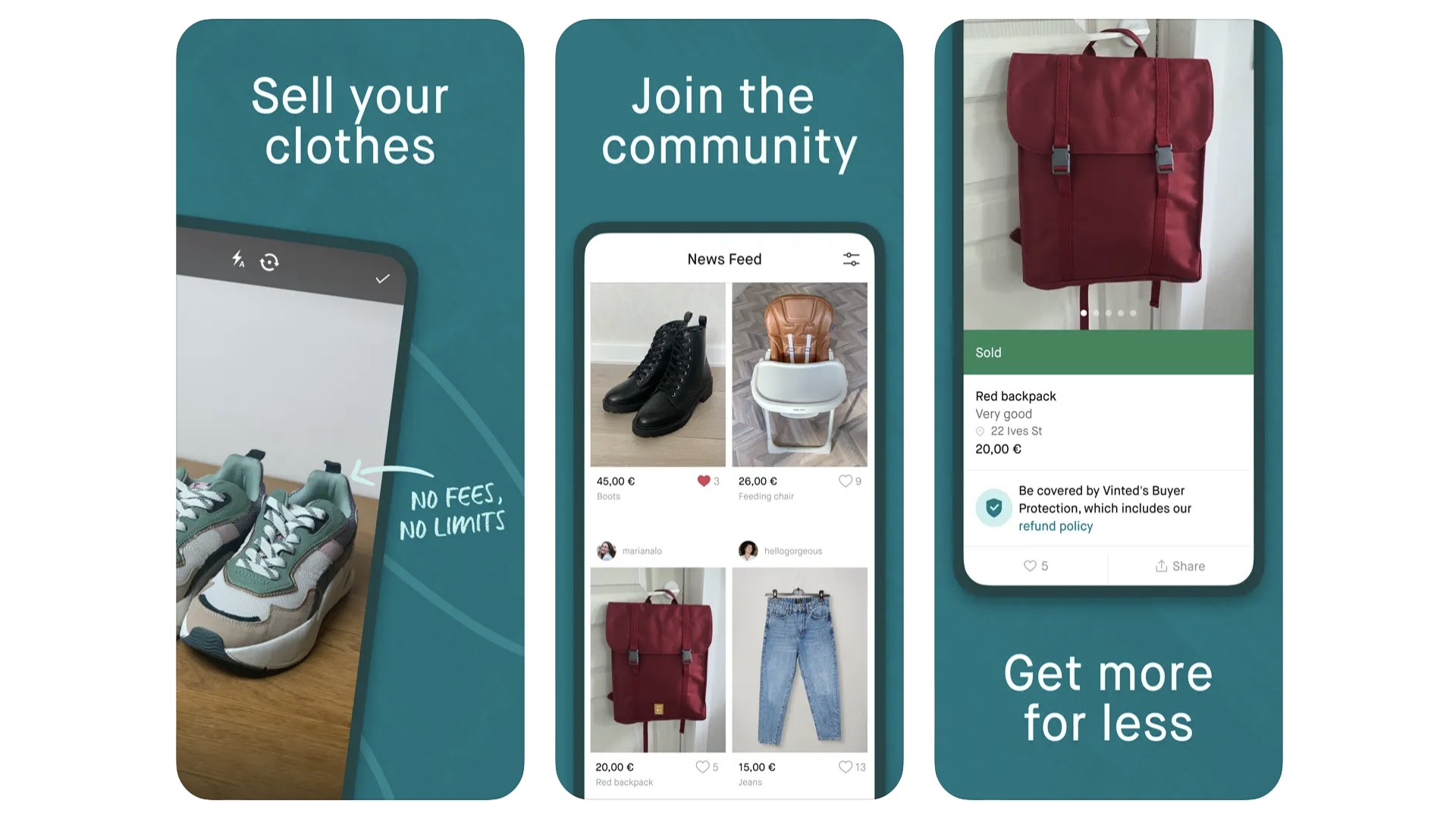

Vinted

Used clothing giant Vinted has been around since 2008, but it took about a decade for it to truly take off, and the last couple of years have seen its momentum stronger than ever. It’s basically a less corporate-feeling alternative to eBay or Facebook Marketplace. There’s no bidding on Vinted, you simply buy at the asking price, or make an offer. It’s not just clothes on sale here either. We once bought a Nintendo 3DS XL on the Vinted app. No joke.

Vinted

Get pre-loved wares, shop for Vinted bargains. And it's just not clothes (but it's mostly clothes).

Download here: App Store

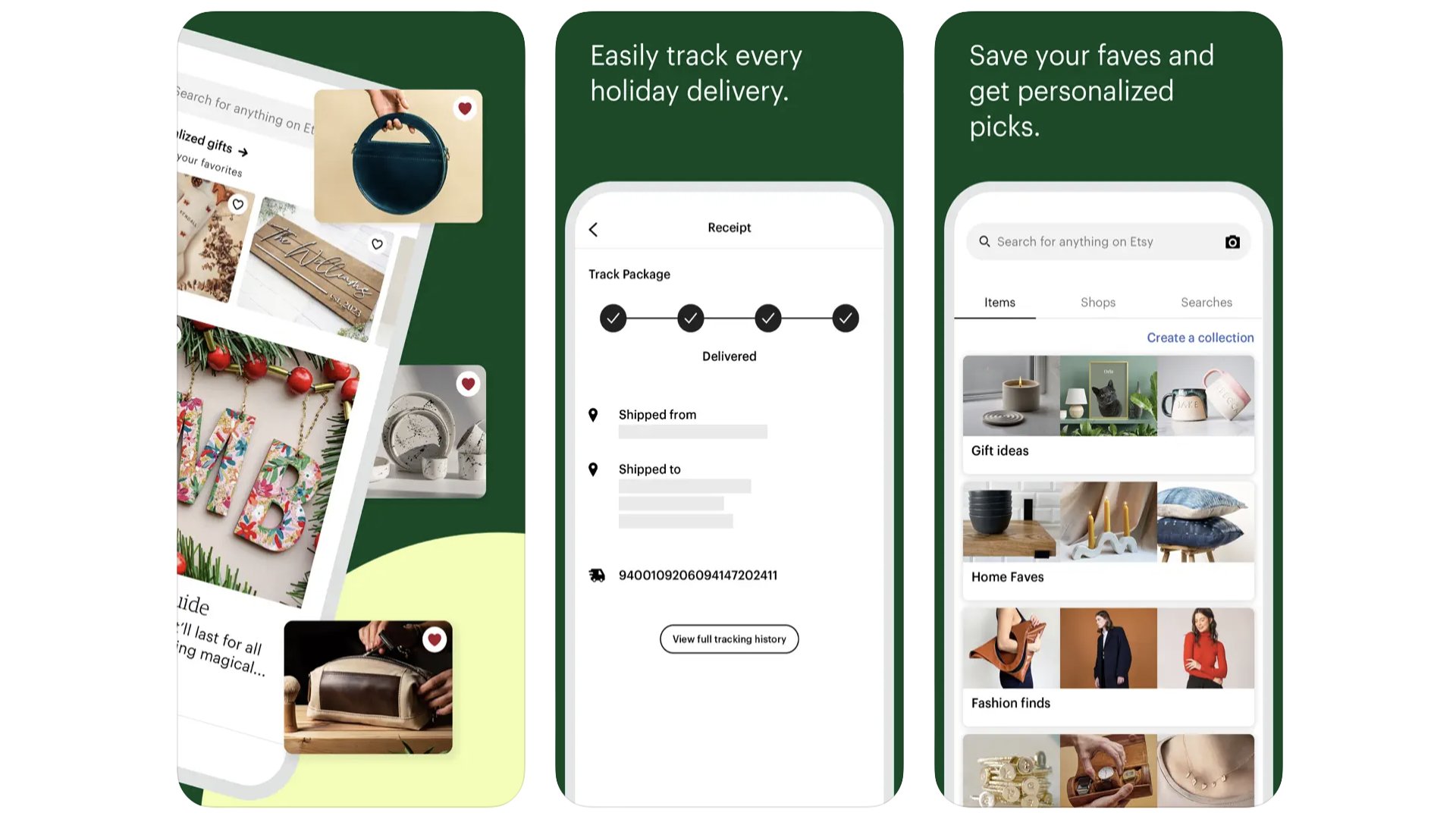

Etsy

If you took a local craft fair, blew it up to global proportions and stuck it online, you’d get something like Etsy. It’s packed with the work of craftspeople and artists, from jewellery makers to painters and furniture restorers. Of course, now Etsy is massive, you also get your fair share of drop-shipped nonsense and mass produced junk posing as the real deal. But that just means there’s a bit of work to do to find the good stuff, of which there is plenty.

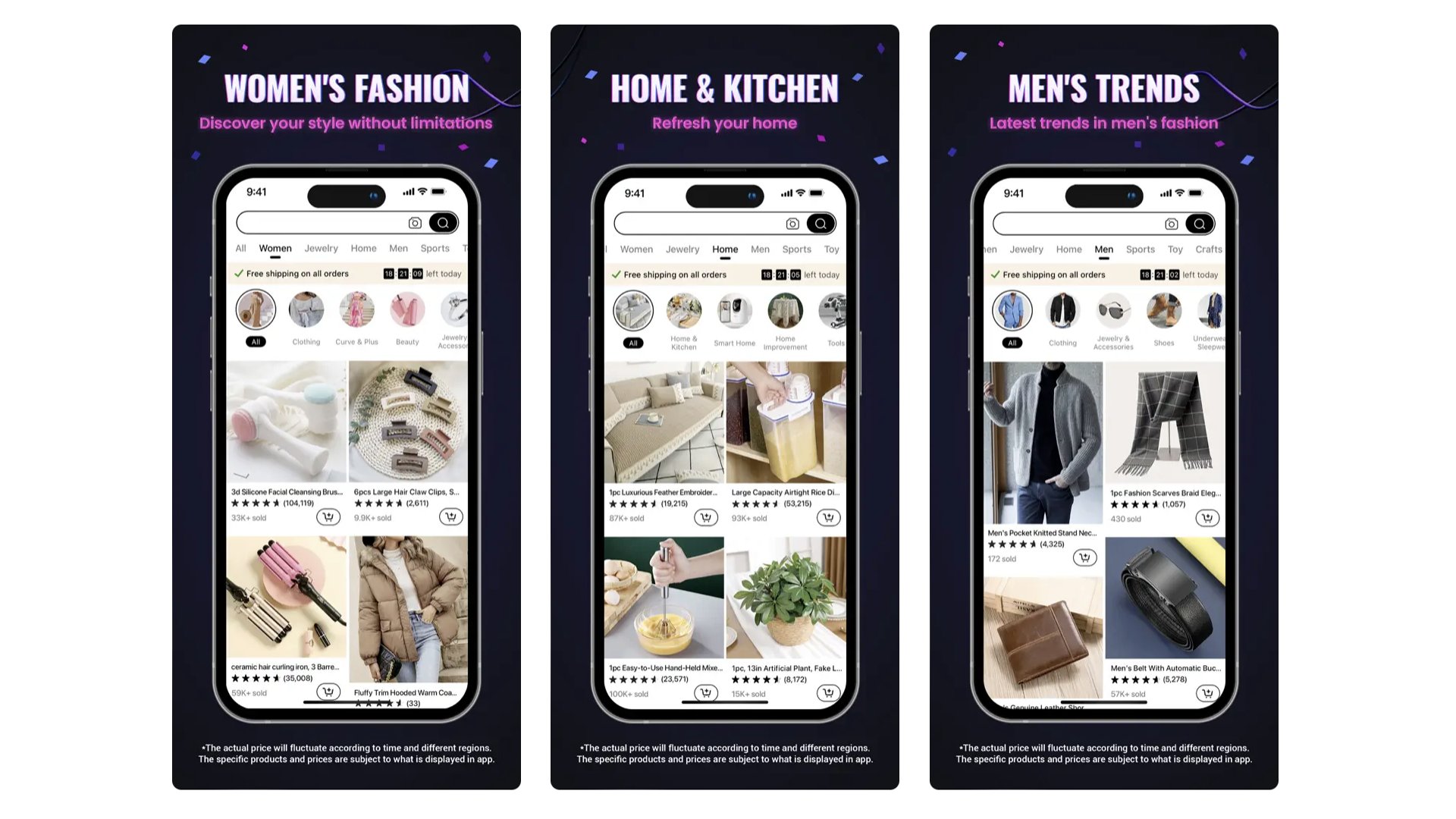

TEMU

TEMU became a bit of a viral retailer in 2023. That’s a strange phrase by itself, right? A viral… retailer? Nevertheless, it went big online thanks to the massive array of items (some would say tat) at incredibly low prices. It does this by shipping direct from China, where the stuff is manufactured. Much like the grandaddy of this kind of shopping, Aliexpress, you can get great stuff on TEMU. But it’s likely to be a little more hit-and-miss than the average local retailer.

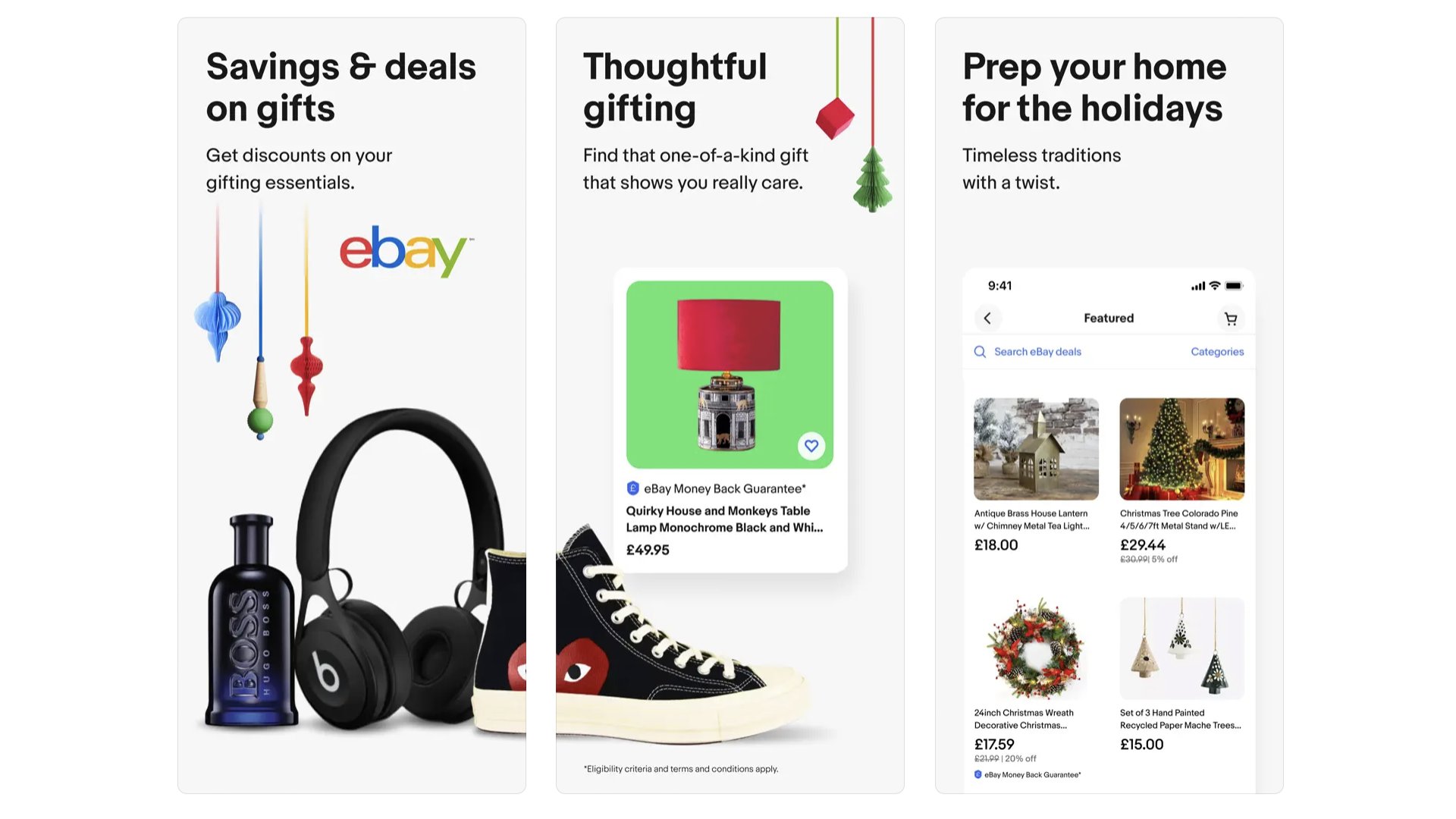

eBay

You know it. You love it? Maybe you hate it. eBay has more than 130 million active members. Some think of it as a pit of scum and villainy — from both the buyer and seller side — but it can still work for you with a bit of know-how. If you are buying from one of the big retailers, you might want to wait until a voucher appears. These are common. And if you are selling, you can wait for a discounted seller fees weekend to avoid those steep fees. They typically come around every two weeks.

eBay

The original king of online auctions, eBay, is still a powerful place to find deals on new and old goods.

Download here: App Store

Best iPhone apps: Social Networking

Discord

Discord is where the weird, wonderful and nerdy communities of the internet come to congregate. Anyone can make a server, which in this context becomes a chat room, in which you can setup different areas for specific topics. We don’t tend to establish our own servers, though, and instead find existing discord channels for content makers we like. Lots of podcasts, streamers and content creators have their own discord servers.

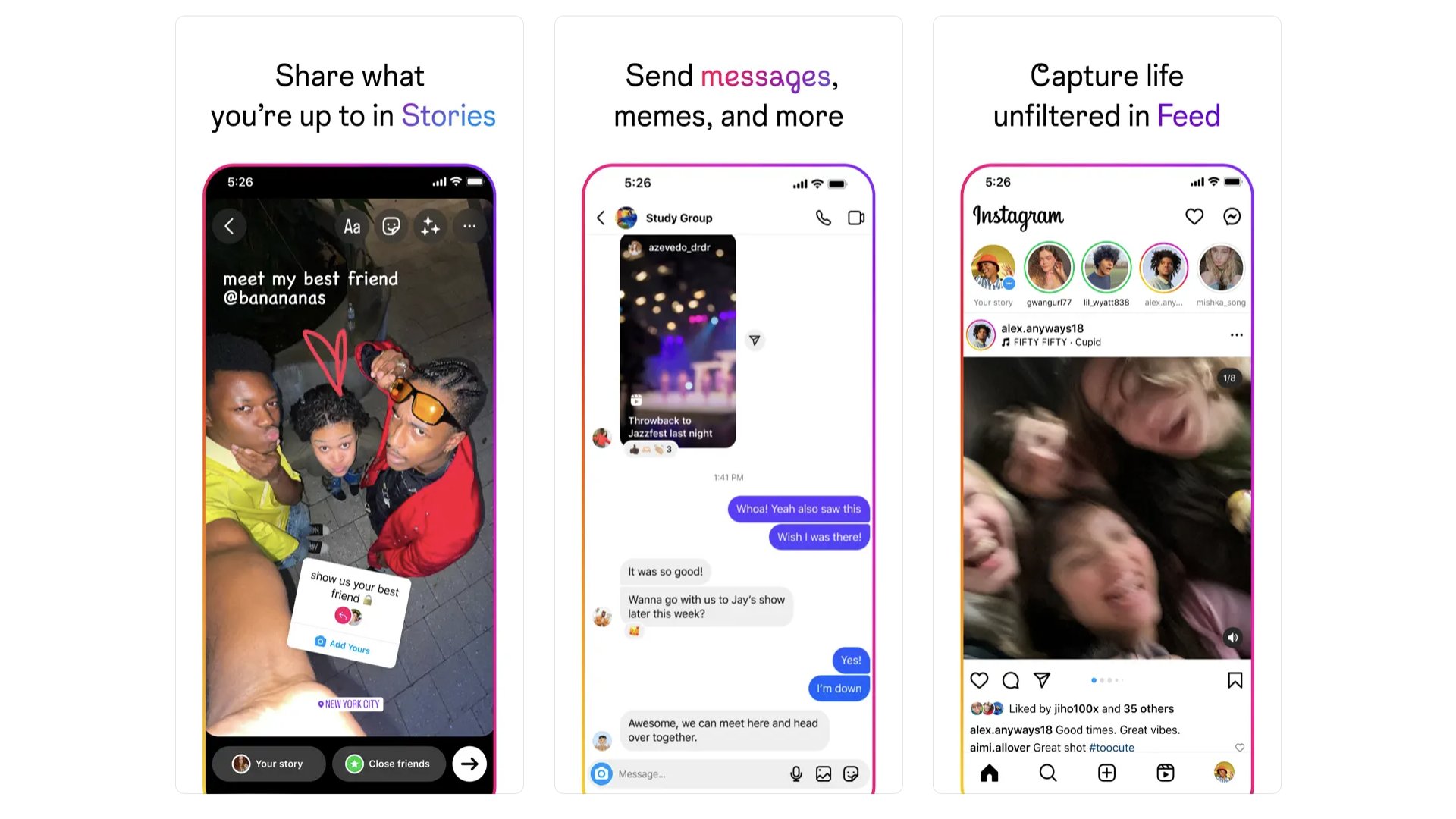

Once the social network of images and photos, now a video-first platform, Instagram bridges the generations better than many. It’s not too oldie-loaded like Facebook. It’s not quite as youth-focused as TikTok. Is it just right? It’s a social network, of course it’s not. But if you’re after short-form cute animal video or makeup tutorials, the Instagram algorithm is only too happy to serve you them.

Best iPhone apps: Sport

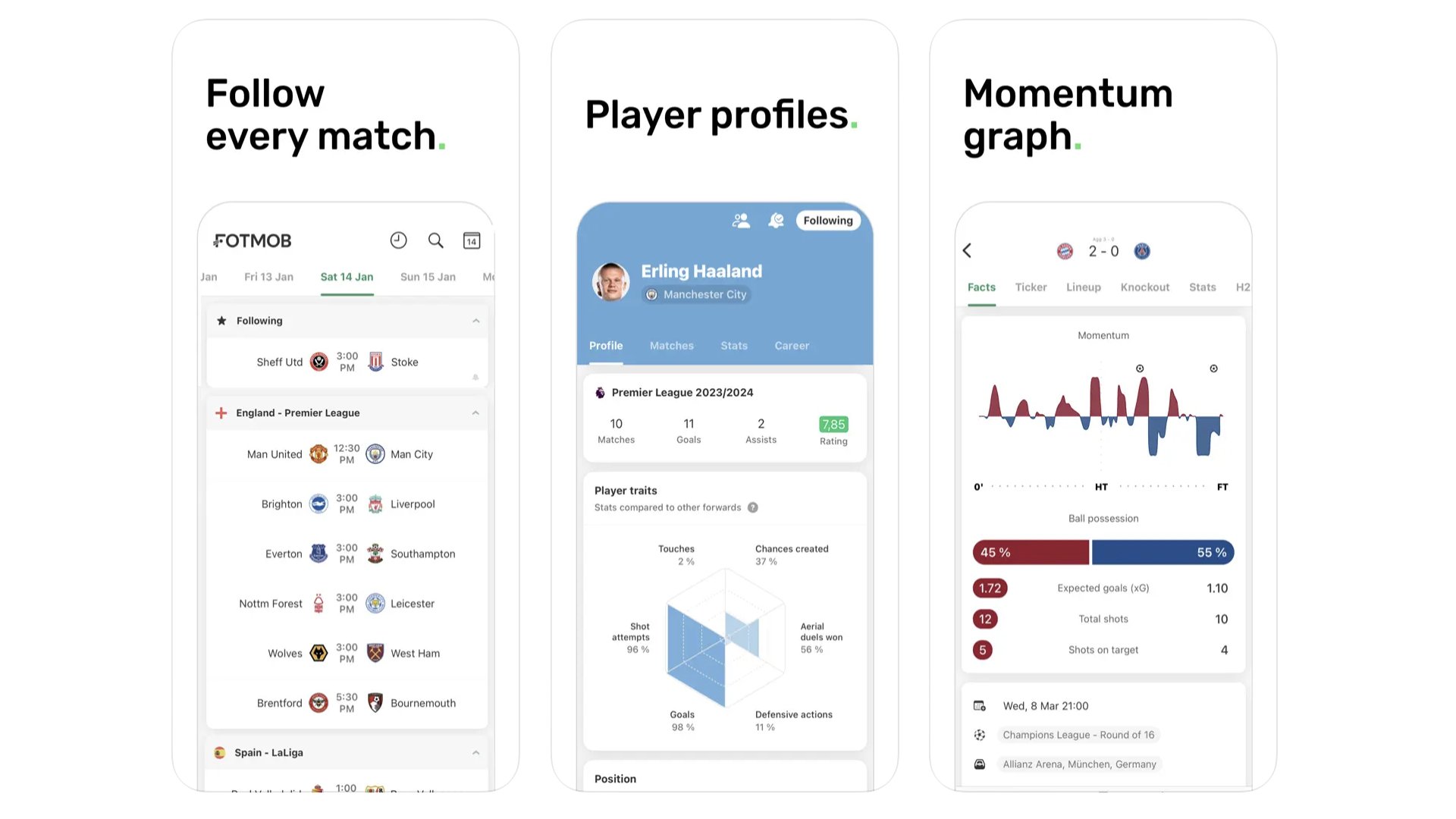

Fotmob

Stat-addicted soccer/football fans should download Fotmob. It’s a no-nonsense guide to all the upcoming and recent fixtures. But dig into those and you’ll find a whole world of data inside. There are stats on each player, including “traits" like how many goal chances they create. You can see the bookies’ odds for upcoming games and, of course, lots of info about matches already played. There are possession graphs, a live-blog-style guide to each match, and player ratings. It’s a football obsessive’s dream.

Fotmob

Is Fotmob the ultimate football app for the stat obsessive? It might just be.

Download here: App Store

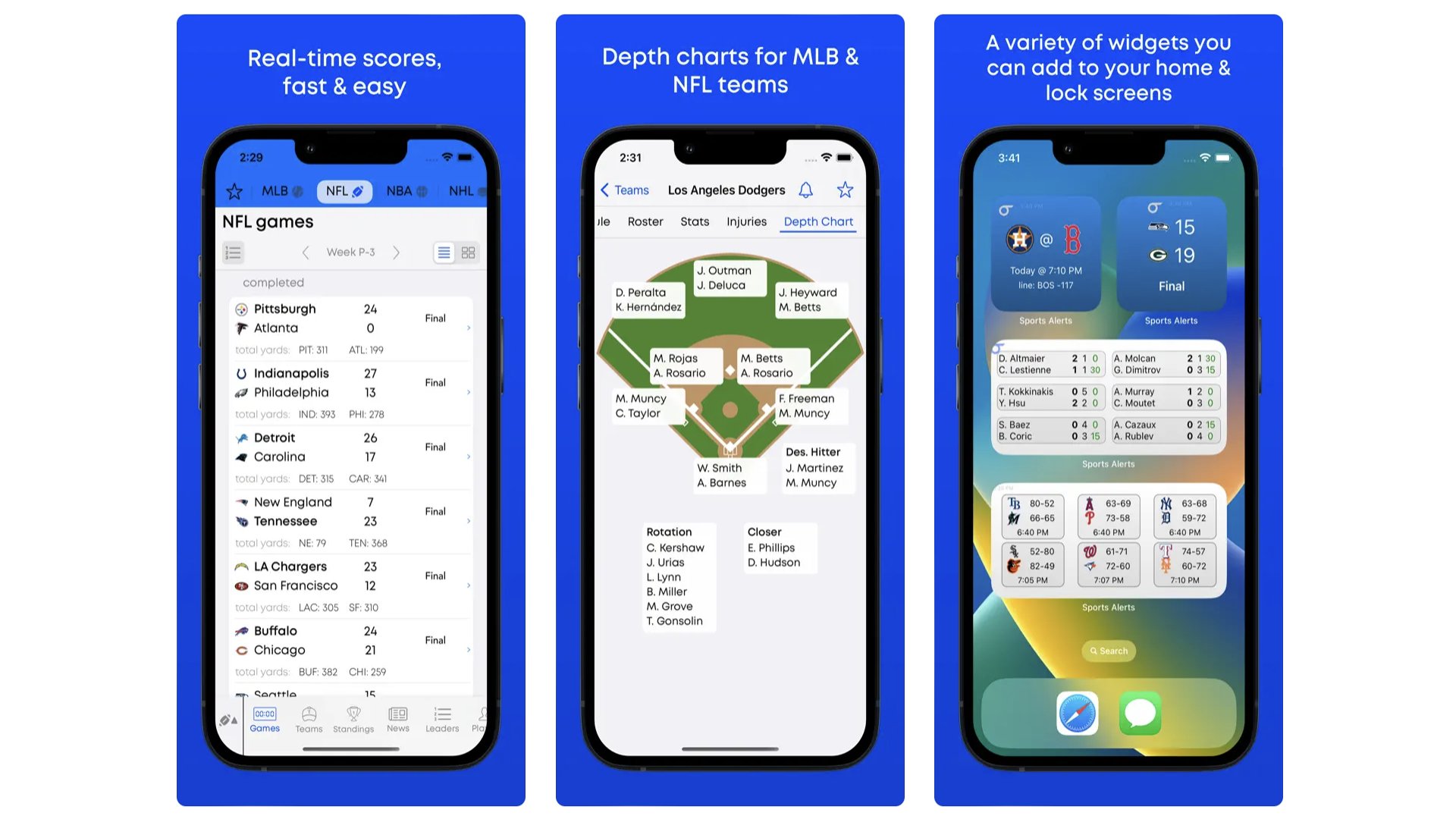

If you’re a multi-discipline sports fan who loves boxing, golf, basketball, football and soccer, Sports Alerts is an essential download. It collates all the fixtures and results from 23 leagues, including NASCAR and Formula 1. We like its fast, clear and no-fuss delivery of info, and that you can tailor the app so it only displays the sports in which you’re interested. The way the tab-based layout lets you flick from one sport to another gives us the sense this app was designed by big sports fans, for big sports fans. One bad bit: it’s quite US-centric so there’s no cricket.

Sports Alerts

Keep an eye on what’s going on in the sports world with a couple of taps.

Download here: App Store

Best iPhone apps: Video Editing and Content Creation

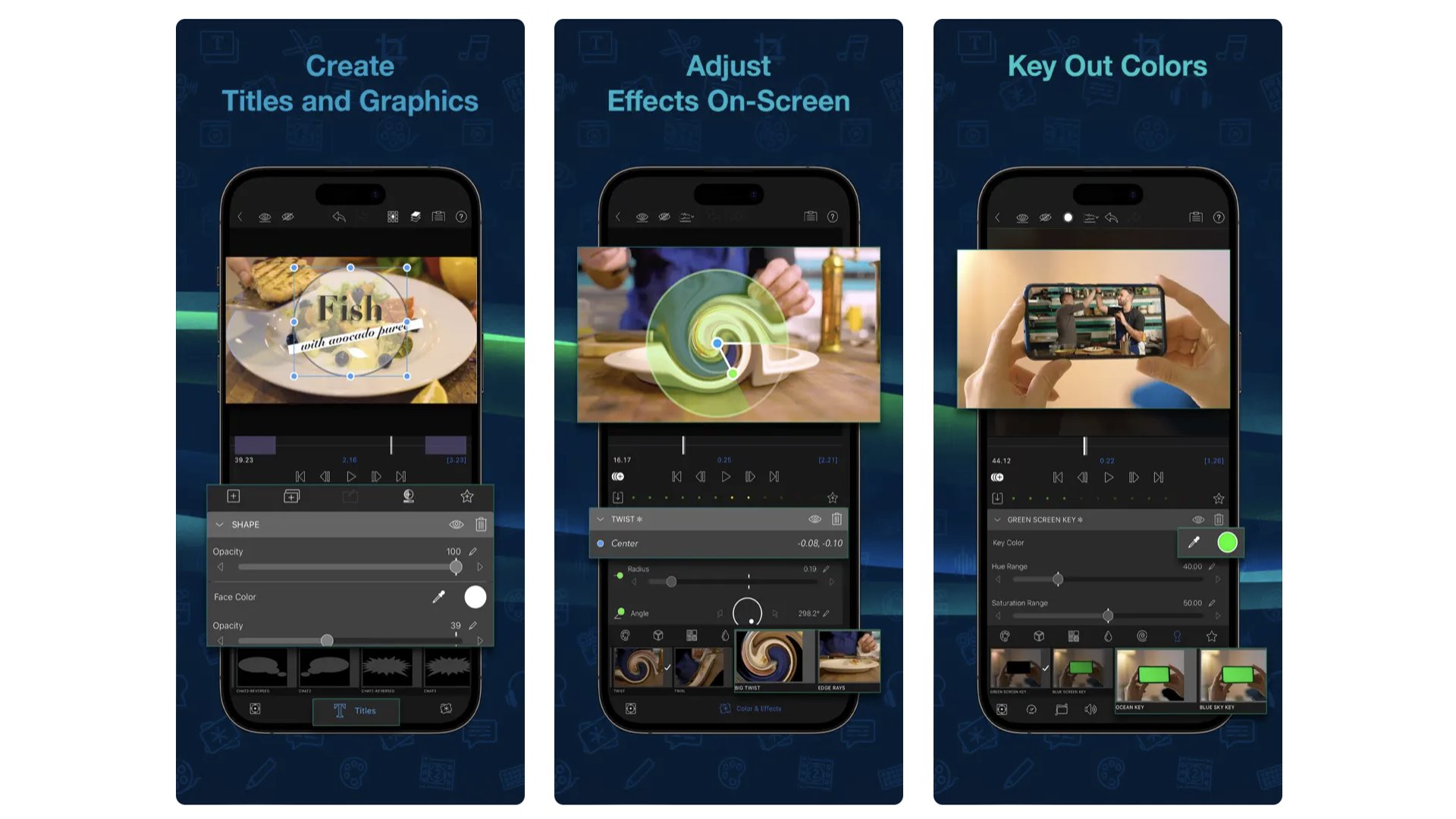

LumaFusion

Find iMovie too dumbed-down? LumaFusion is probably what you’re after. It feels like (and basically is) a full desktop-style editing suite crammed onto your iPhone screen. You get multiple video tracks for non-destructive editing, easy-to-apply transitions, titles and fistfuls of effects and filters. Want screen green? No problem. There’s even multi-cam support through a paid upgrade, to let you easily sync multiple sources into one “track”. Does the sheer depth of features here suit an iPad screen better? It sure does. Did we still manage to knock up a video in a few minutes? We sure did.

LumaFusion

LumaFusion is a full video edition production suite that fits in your iPhone.

Download here: App Store

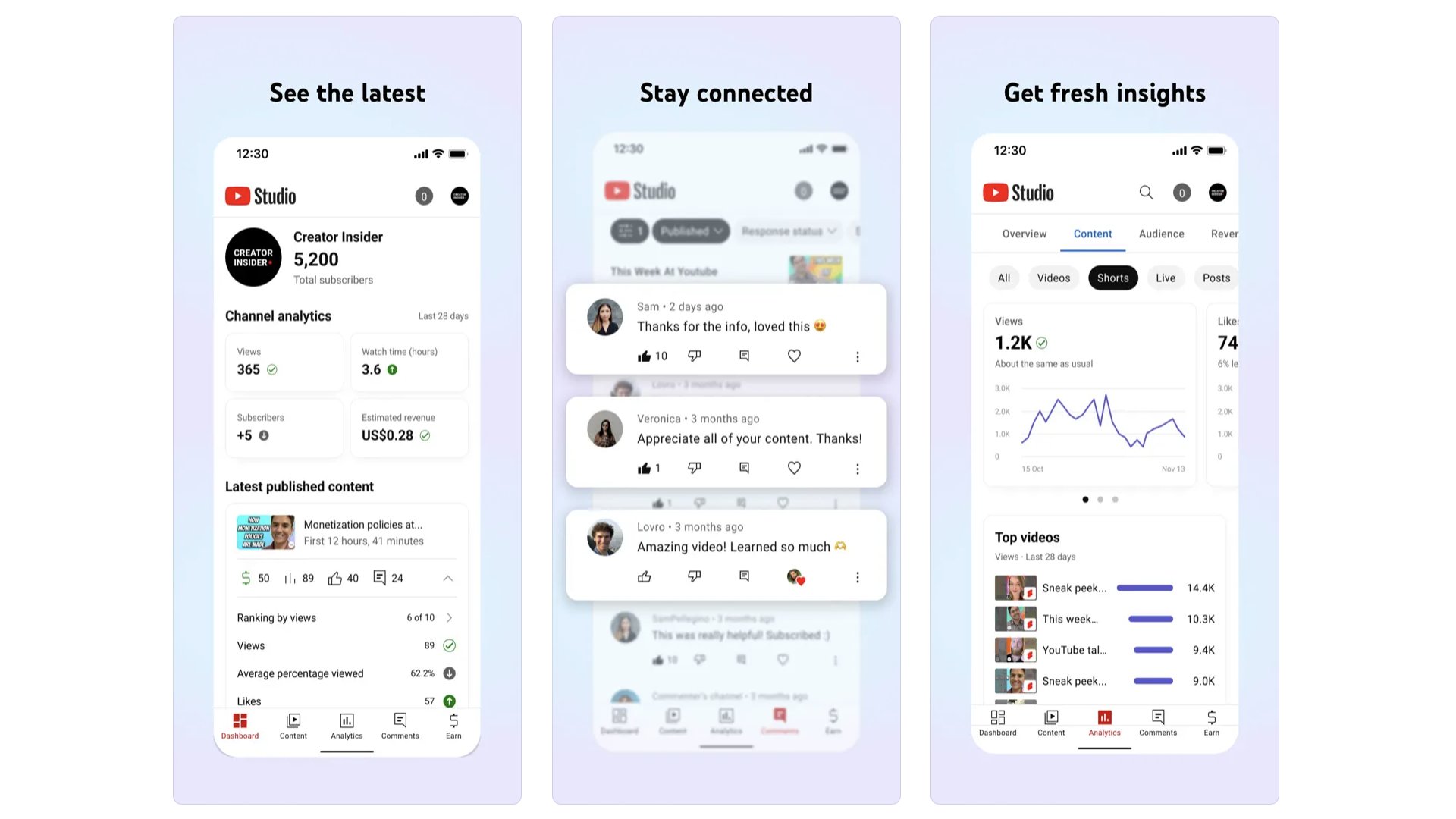

YouTube Studio

This is an essential download for anyone who wants to make it on YouTube. It’s the official app for creators, and lets you get a grip on your videos’ statistics, how people are finding your content and who those people are. Where do they live? How old are they? And what kind of other YouTube content do they watch? It’s insider intel on how other people see you as a content creator. Should that completely determine what you make? Probably not. But it tells you a lot about who YouTube thinks you are.

YouTube Studio

Get insider intent on the content you create with YouTube Studio.

Download here: App Store

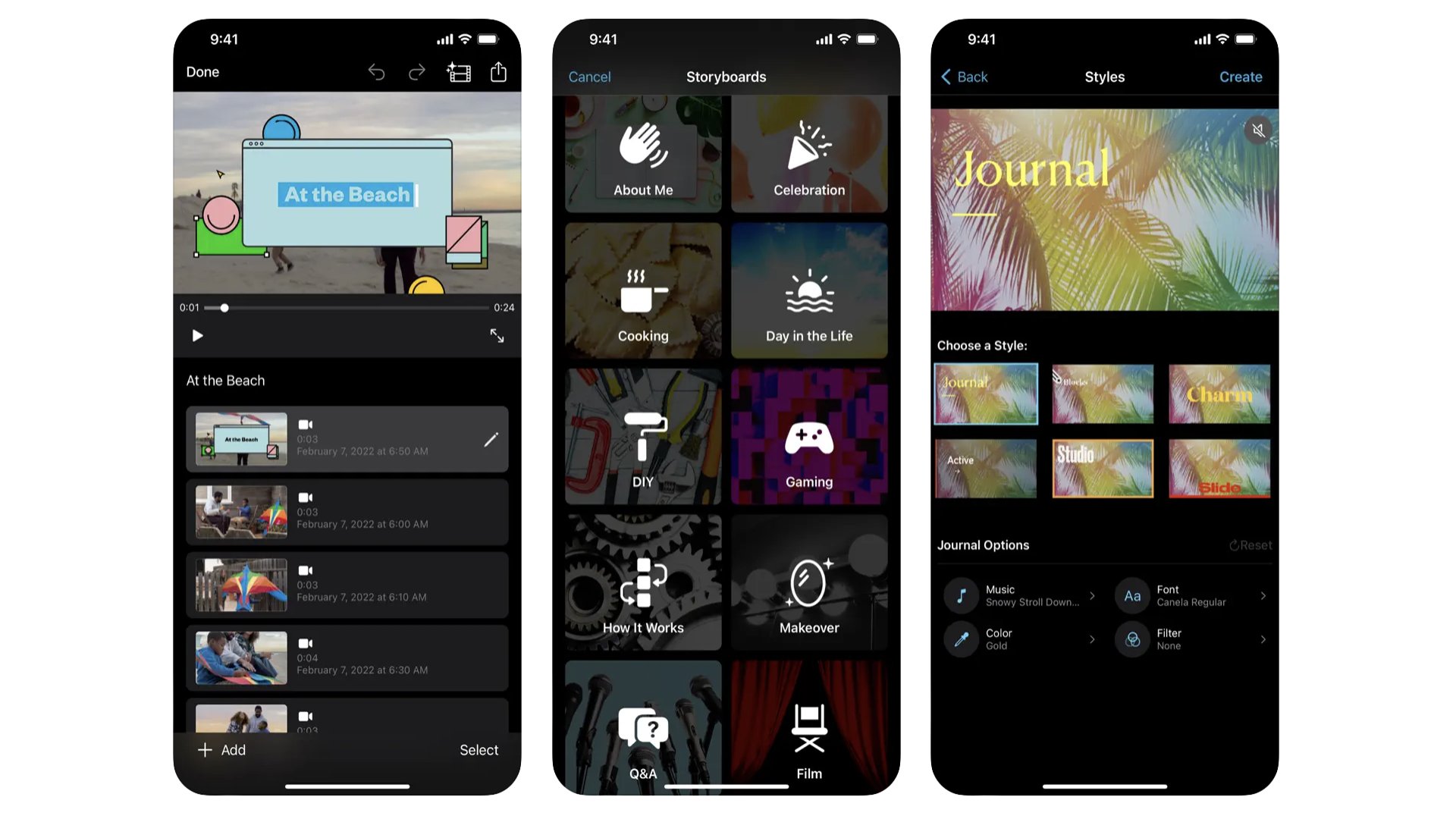

iMovie

Like Garageband, iMovie is another bundled app that shows Apple goes (or at least went) the extra mile for budding creatives. It’s a highly usable, quick, and easy video editing app. You trim and string together video clips, perhaps taken with your iPhone. And you can add titles, filters, sound effects, music and voice overs. It lets you speed up and slow down video too. Sure, this isn’t a pro-level video editing tool, but it’s a great way to introduce yourself to the basics of the practice.

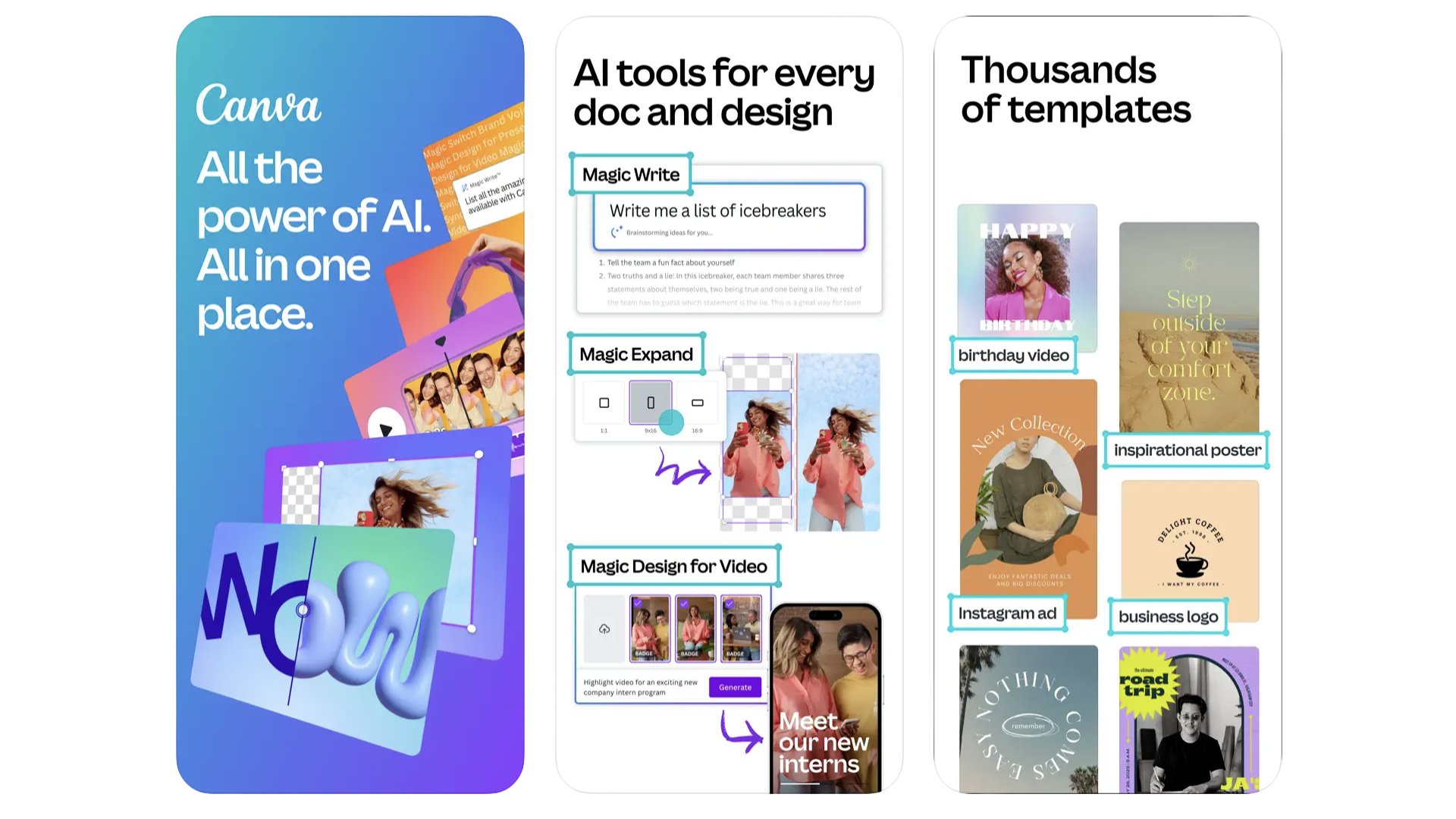

Canva

If you’re wondering how the people you follow on social network get those funky-looking graphics peppered throughout their videos, they may use Canva. It’s offers loads of templates to act as title cards for your videos. But it also works as a pretty powerful editing tool, with fun and easy animations that let you drag elements around your video canvas. If you want to get into content creation and want to add a little pizzazz to your videos, try it out. You can use it for free, or the paid-for sub ($99.99 a year) adds access to a lot more visual assets.

Canva

Make pro-looking visuals for your social media content in minutes with Canva.

Download here: App Store

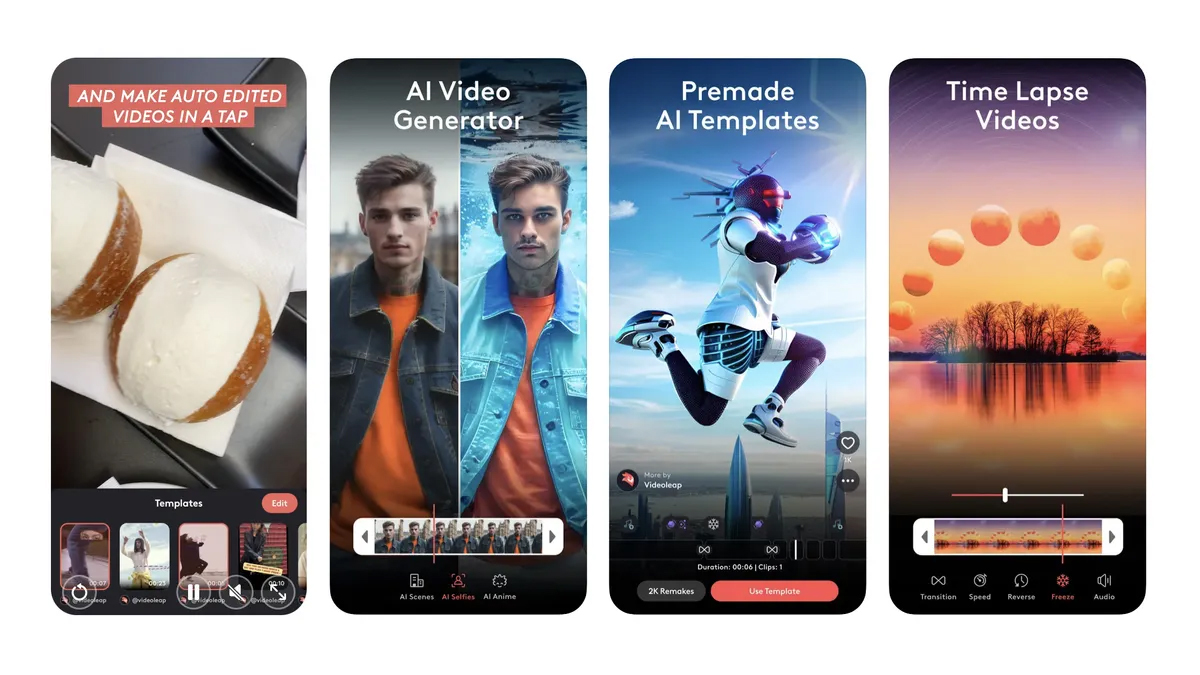

Videoleap

Videoleap has long been one of the best iPhone apps for editing videos. But more recently it's added a bunch of AI tools that take your videos to the next level. This means that you can perform the standard video editing tasks, like splicing clips, reversing videos, and adding music and filters. But Videoleap's new AI tools allow users to seamlessly add different looks and scenery to their videos, switch out faces and voices and much more. If you're looking for a way to get really creative and test out the latest AI video editing tools on offer, this is how to do it.

Videoleap

With a whole host of new AI tools, Videoleap provides a video editing experience that's not only seamless but also brimming with innovative and whimsical results.

Download here: App Store

Best iPhone apps: Travel

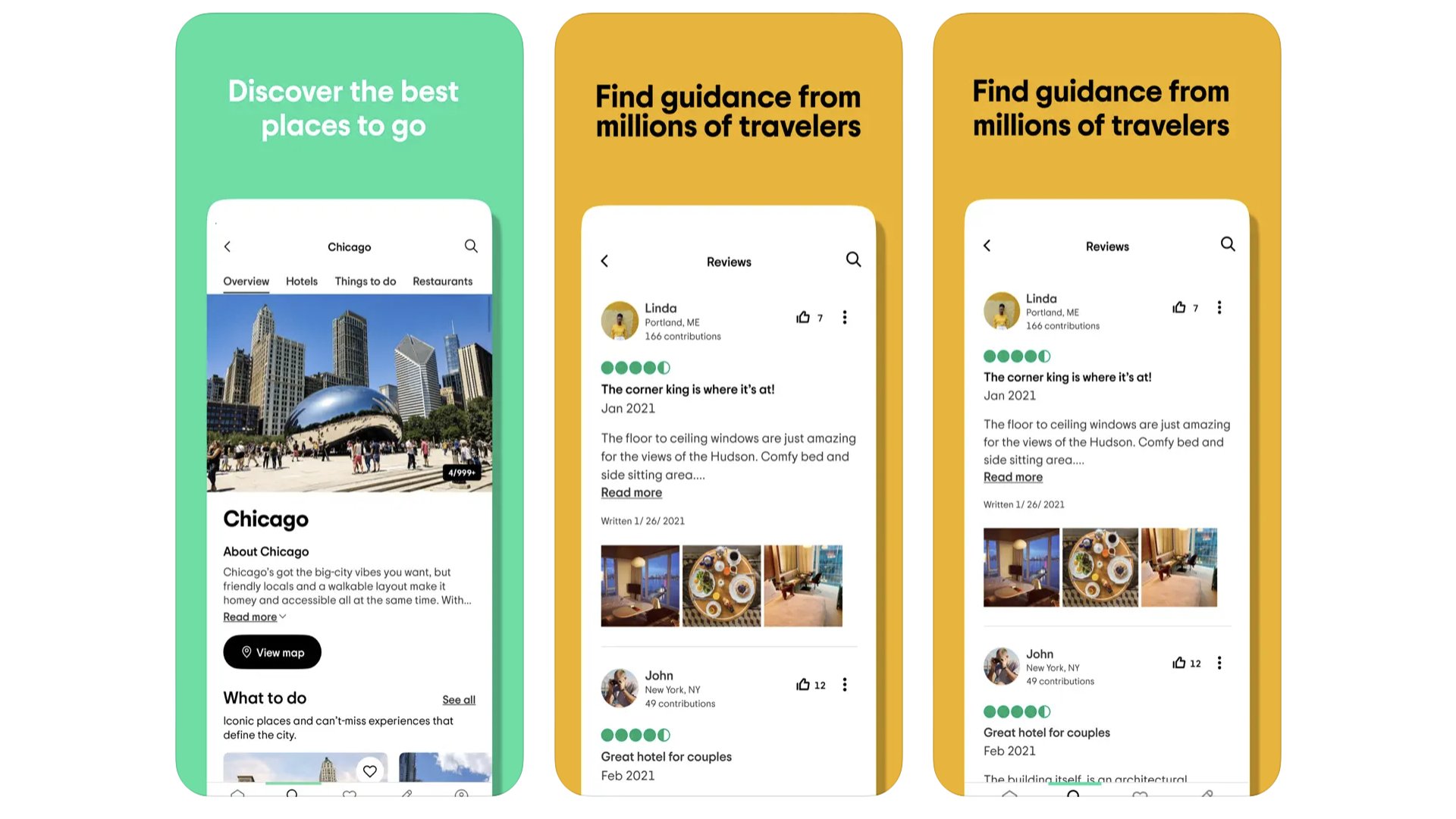

TripAdvisor

TripAdvisor is the classic travel app for phones, originally released for iPhone all the way back in 2010. It’s still one of the best ways too find local attractions and decent restaurants when travelling around in cities. It did, in our opinion, used to be a bunch better years ago. Back in the day you could download entire cities' worth of data, should you not have free data roaming. This was shelved, for obvious reasons — how is the app meant to make any revenue if you’re offline? Still, we tend to use TripAdvisor during every single holiday.

TripAdvisor

Tripadvisor is the classic app for finding out what other folks think about a place’s best restaurants and attractions.

Download here: App Store

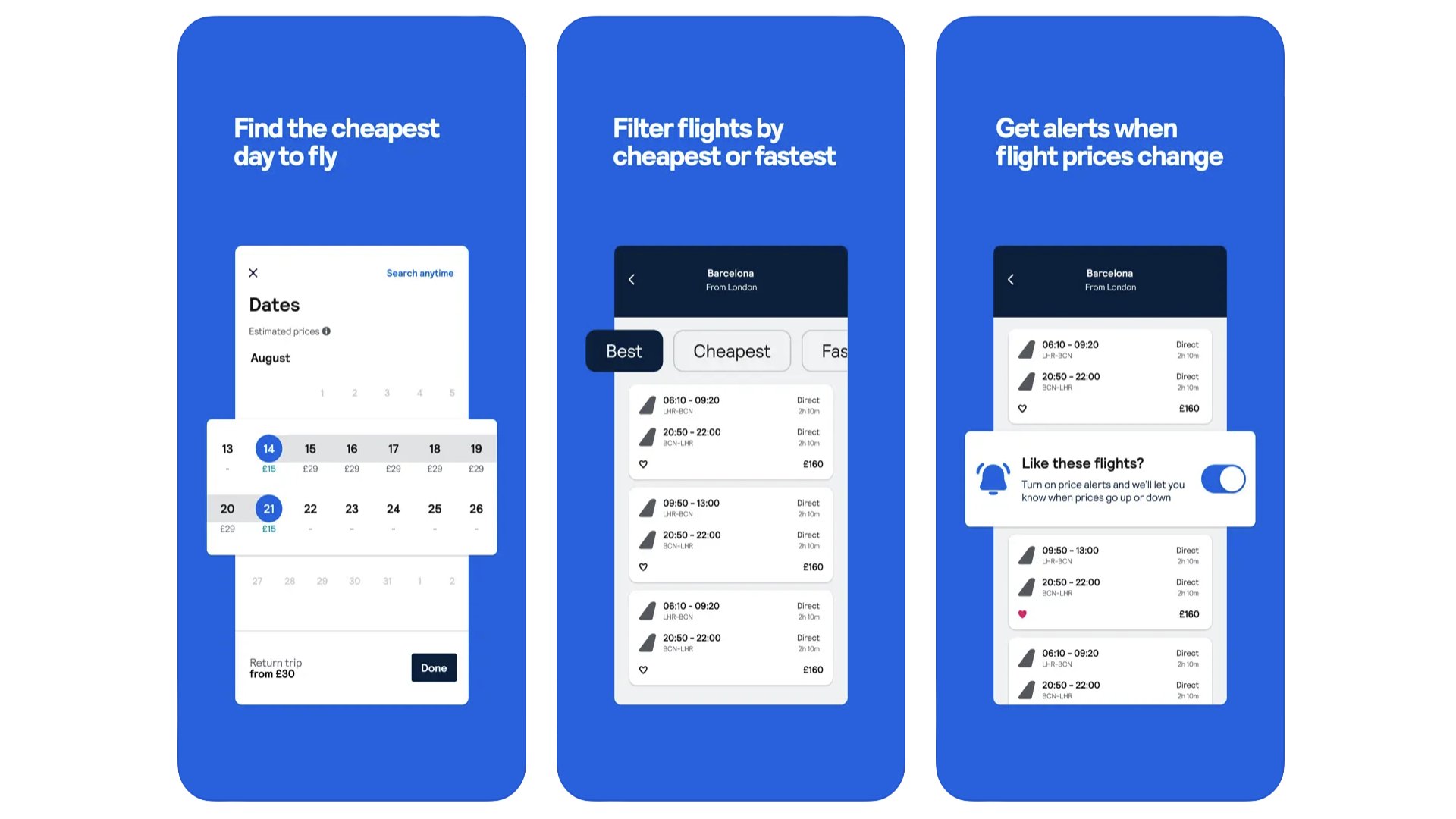

Skyscanner

This is the best-known app, and website, for hunting down the best cheapest deals on flights. However, it has become an integral part of trip planning for us. Why? You don’t actually have to search for a specific destination, meaning Skyscanner can also be used to quickly home in on the destinations that are viable. That might be down to cost, or flight times that work, particularly for those quick weekend breaks away. Flights are the main appeal here, but it does the same for hotels too, hunting down the best deal from all of the most popular aggregator sites out there.

Skyscanner

Skyscanner helps you find affordable destinations, lower-cost flights and well-price accommodation.

Download here: App Store

Packing Pro

Sure, you can use a free note-taking app to make a packing list for work trips and holidays. But Packing Pro is software made for the purpose. It’s a simple concept, an app that breaks down your list into categories, with a selectable list of items for each. This helps because you don’t need to think of everything that needs to go in your suitcase. Packing Pro makes the suggestion, you choose what you need, and then tick them off when they’re in your luggage. The same developer also makes a similar companion app, but for grocery shopping.

Packing Pro

Take the heads-scratching bits out of holiday packing with the help of Packing Pro.

Download here: App Store

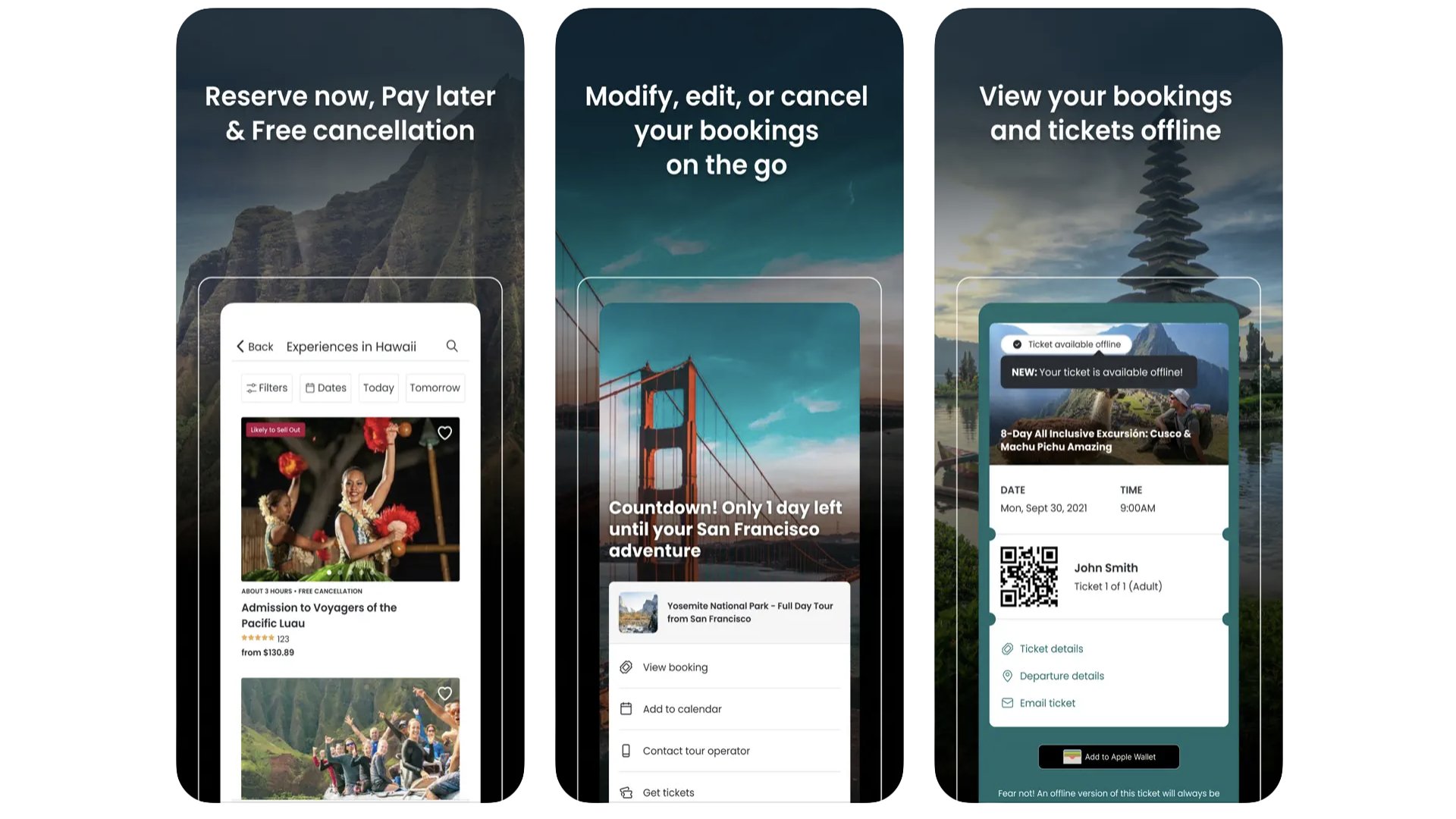

Viator

There are a few apps that collate the things you can book nearby, like trips and advance tickets to museums. We find Viator to be the most comprehensive and easy-to-search, probably helped by the fact it is owned by travel app giant TripAdvisor. We use it on the reg to scout out day trips while on holiday. However, don’t forget you can use the app to find out what’s on, and then book direct rather than through Viator. This can avoid some customer service headaches down the line, and you may even find a special offer not available through an aggregator platform like Viator.

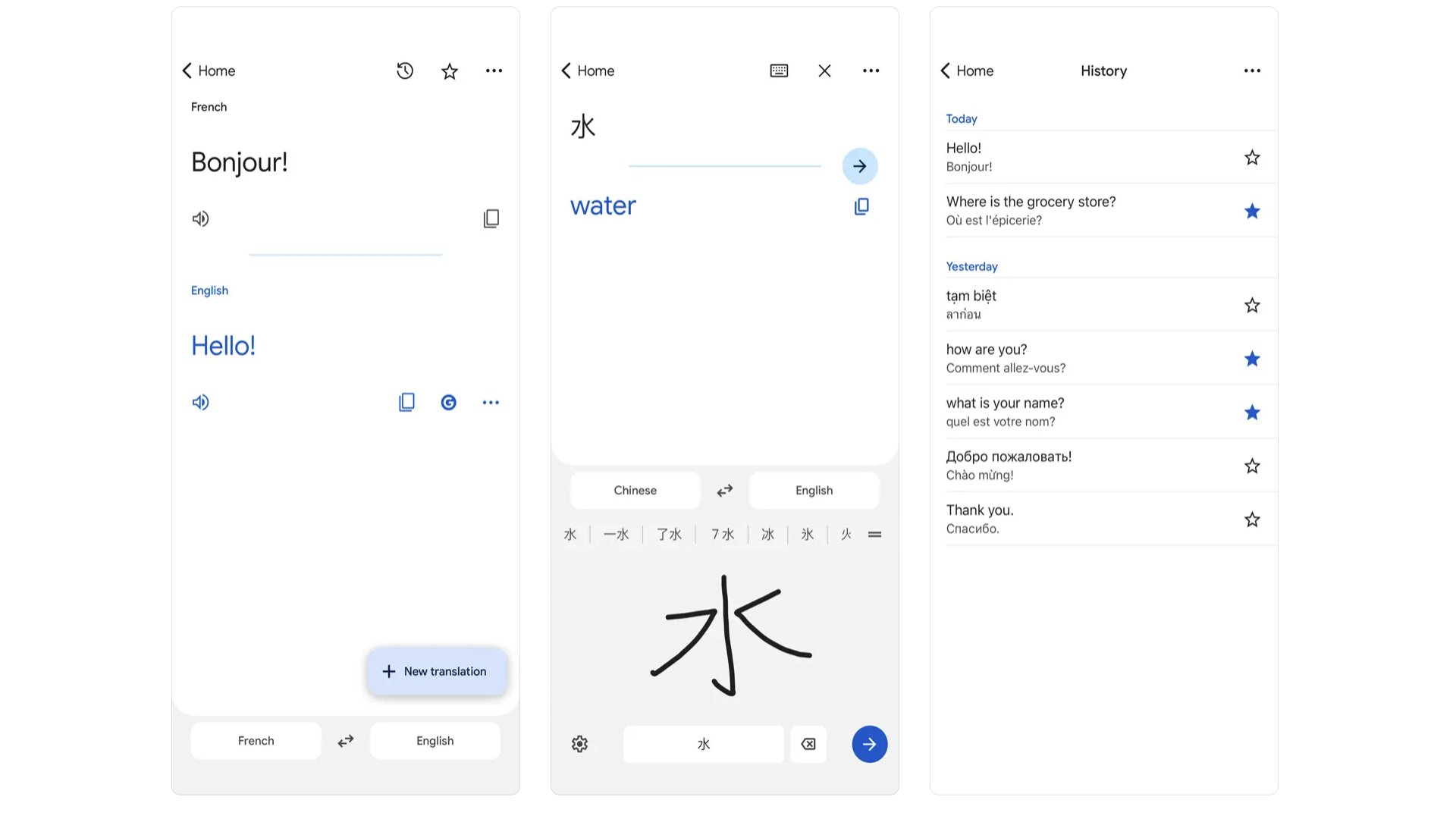

Google Translate

Translate is such a plain-looking app, but it is so remarkably powerful. It’s a speech and text translator that supports 133 languages, and can be used in multiple ways. You can type away and get a translation, or use the microphone. The conversation mode offers two-way translation, letting both people see what the other is saying. You can use the camera, which we use all the time when on holiday. And you can download entire languages for internet-free text translation. As you use Google Translate you can also build up a phrasebook of translations you’ve saved. All of that, and it’s totally free to use.

Google Translate

Totally free translation service that supports more than 100 languages and advanced features.

Download here: App Store

Best iPhone apps: VPN and security

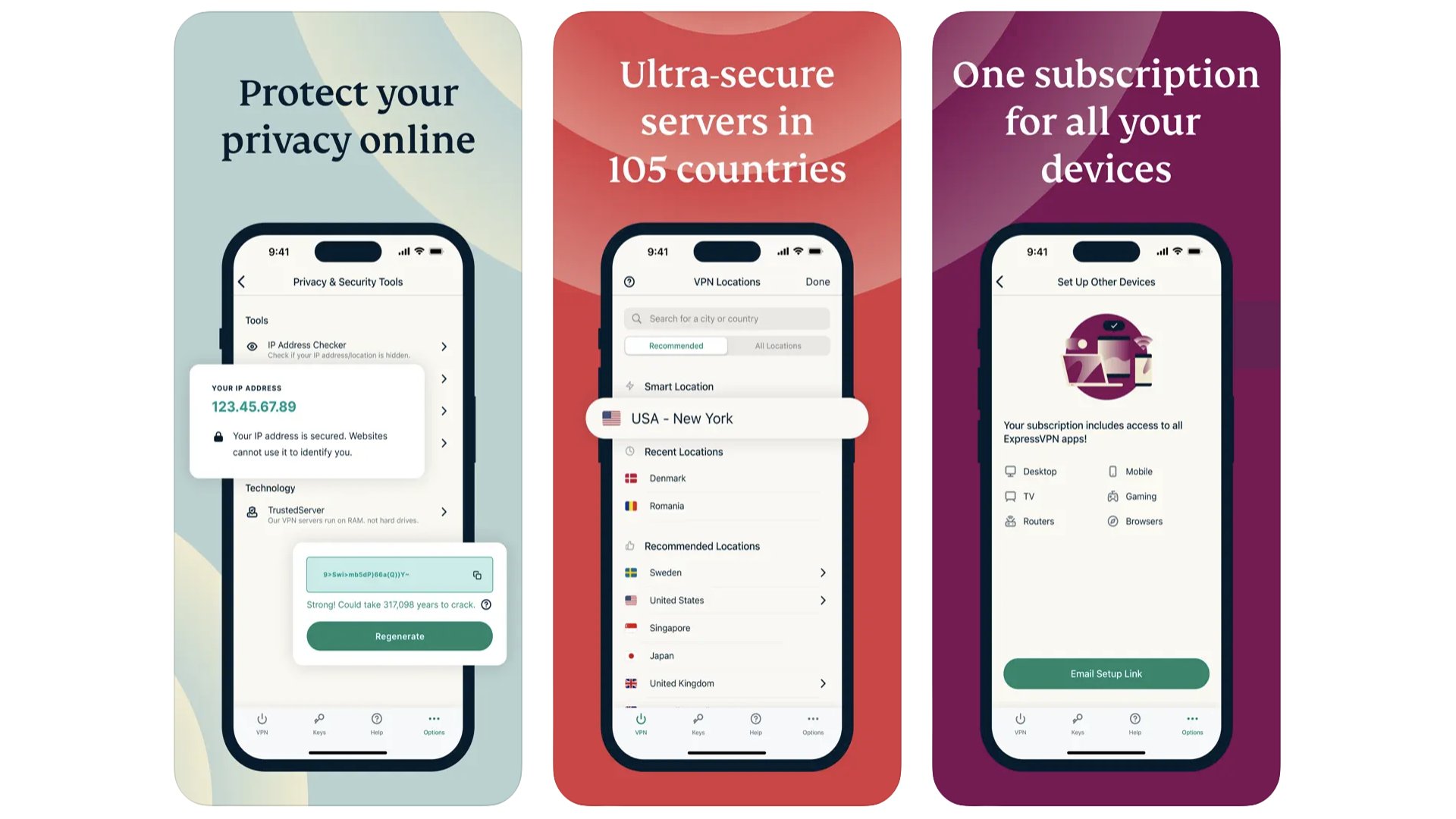

ExpressVPN

The key advice when shopping for a VPN is not to trust free ones too readily, and to make sure a VPN provider has servers in the areas you need. While you’ll often want a VPN to spoof your location — something we use all the time to see what websites look like in different countries — for best performance you’ll want to pick a nearby server. In all honesty, we could probably have recommend standard favourites like NordVPN or SurfShark here too. However, ExpressVPN is the provider we’ve used for the last year, so find it easiest to vouch for this long-standard VPN master.

ExpressVPN

A VPN like ExpressVPN lets it appear as though you are half-way across the world.

Download here: App Store

1Password

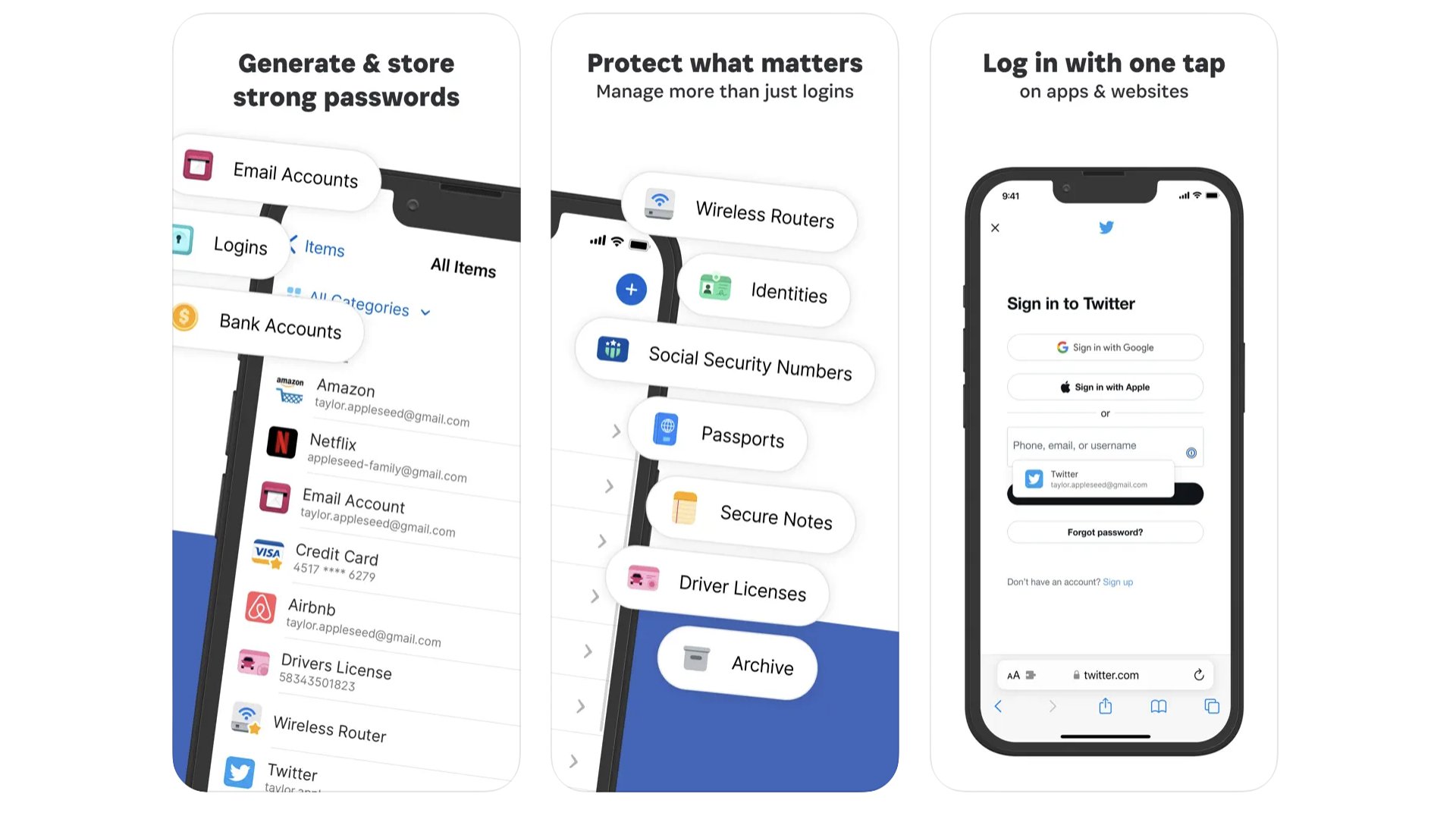

If you run an all-Apple household, we think Apple’s baked-in Keychain password manager software is sufficient. But if you want to be able to use one password manager across multiple platforms, try out 1Password. This highly regarded app keeps all your logins in one place. And more. It’s designed to be a secure vault for all your important details, from your passport and bank account details to your router’s Wi-Fi password. You then only need to remember your one master password. 1Password also lets you login using an iPhone’s Face ID or Touch ID biometrics.

1Password

Keep your passwords secure without remembering a million of the things.

Download here: App Store

Best iPhone apps: Weather

Carrot Weather

One of our favourite ever weather apps, Dark Sky, has been discontinued. It was bought by Apple, its features largely subsumed into the standard Weather app. But if you don’t like that too much, try Carrot Weather. It’s a weather app with a bit of personality, a touch of barbed sarcasm to its delivery. And if you don’t like that, you can tone it down. That’s right, this is a weather app with multiple personality modes. It is also super feature-rich.

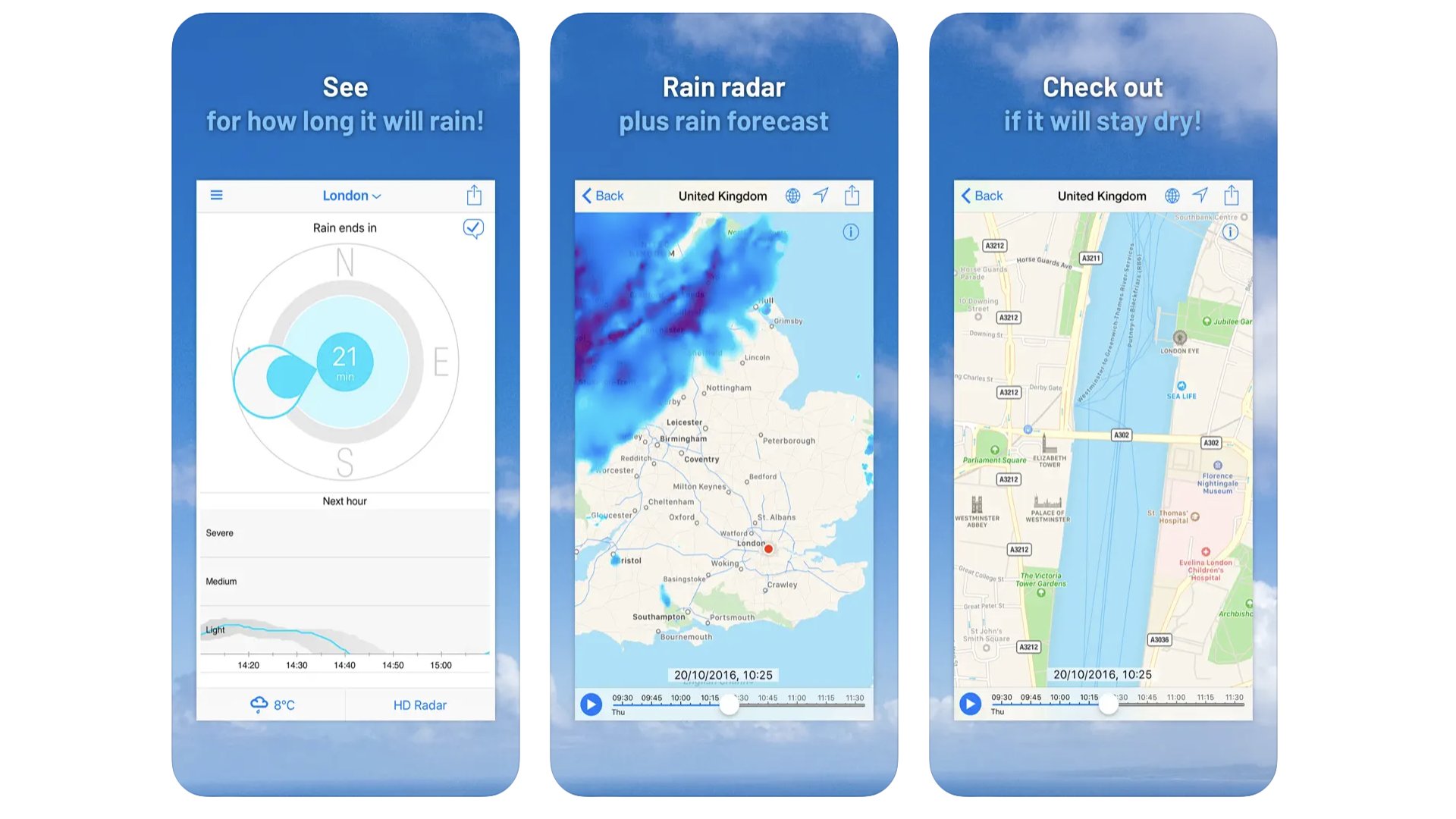

RainToday

You know when you see a percentage chance of rain, it actually means it’ll be raining in that much of your local area at that time? Well, a rain radar is perhaps our favourite way of getting a visual look at whether it’s likely to rain in, say, the next hour. It’s where you can see the current rainfall on a map, and go back in time to see where those rain clouds are travelling. RainToday offers an intuitive view of such a rainfall map. Using a slider you can go back in time, and see an hour into the future based on currently predictions. A great way to avoid getting soaked.

RainToday

RainToday will stop you getting caught out in the rain, fingers crossed.

Download here: App Store

How to choose the best iPhone app for you

There's a huge amount of choice these days when it comes to finding the best iPhone app. What's more, many people are choosing to streamline their digital lives rather than add to them. But that doesn't mean it isn't worth considering which new iPhone apps and digital tools might be worth adding to your collection.

The best thing to do is browse all of the apps we've included in our guide above and see if any sound like they're worth your time. If that sounds like too much effort, consider if you've had a nagging problem recently that you want to address.

Maybe you're bored of your current job list app and feel like it's negatively affecting your productivity. Or maybe you're keen to try yoga but don't want to go to a studio yet and need an option to learn from home. In the guide above we've divided each of our best apps into categories, so you can quickly find the right iPhone app for you.

Andrew is a freelance contributor who has written about tech and entertainment since 2008, and covered the rise of the iPhone first-hand. Today he writes about audio, fitness tech, computing and TV/film, as well as mobile tech. Publications in his back catalogue include WIRED, Ars Technica, TechRadar, T3, Stuff, What HiFi and Forbes, among others.

- Daryl BaxterFeatures Editor

- John-Anthony DisottoHow To Editor

- Becca CaddyContributor