Elon Musk says Twitter deal 'on hold', share price plunges

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Elon Musk says his deal to buy Twitter is temporarily on hold.

- It comes after Twitter estimated that spam and fake accounts make up fewer than 5% of users.

- Musk has previously stated that defeating the spam bots was a top priority if he succeeded in acquiring the company.

Elon Musk says that his bid to buy Twitter is "temporarily on hold" after the company revealed estimates that less than 5% of accounts on the platform are spam bots or fake accounts.

Musk tweeted early on Friday:

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuynTwitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuyn— Elon Musk (@elonmusk) May 13, 2022May 13, 2022

Musk was tweeting in response to a Reuters report from May 2, where Twitter estimated in a filing that fewer than 5% of its monetizable daily active users were fake or spam accounts. The company wrote:

We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the first quarter of 2022 represented fewer than 5% of our mDAU during the quarter. The false or spam accounts for a period represents the average of false or spam accounts in the samples during each monthly analysis period during the quarter. In making this determination, we applied significant judgment, so our estimation of false or spam accounts may not accurately represent the actual number of such accounts, and the actual number of false or spam accounts could be higher than we have estimated.

The company further stated it was facing potential uncertainty regarding its future plans and strategy as a result of his takeover bid, and yesterday it emerged that CEO Parag Agrawal had fired product lead Kayvon Beykpour and general manager of revenue Bruce Falck.

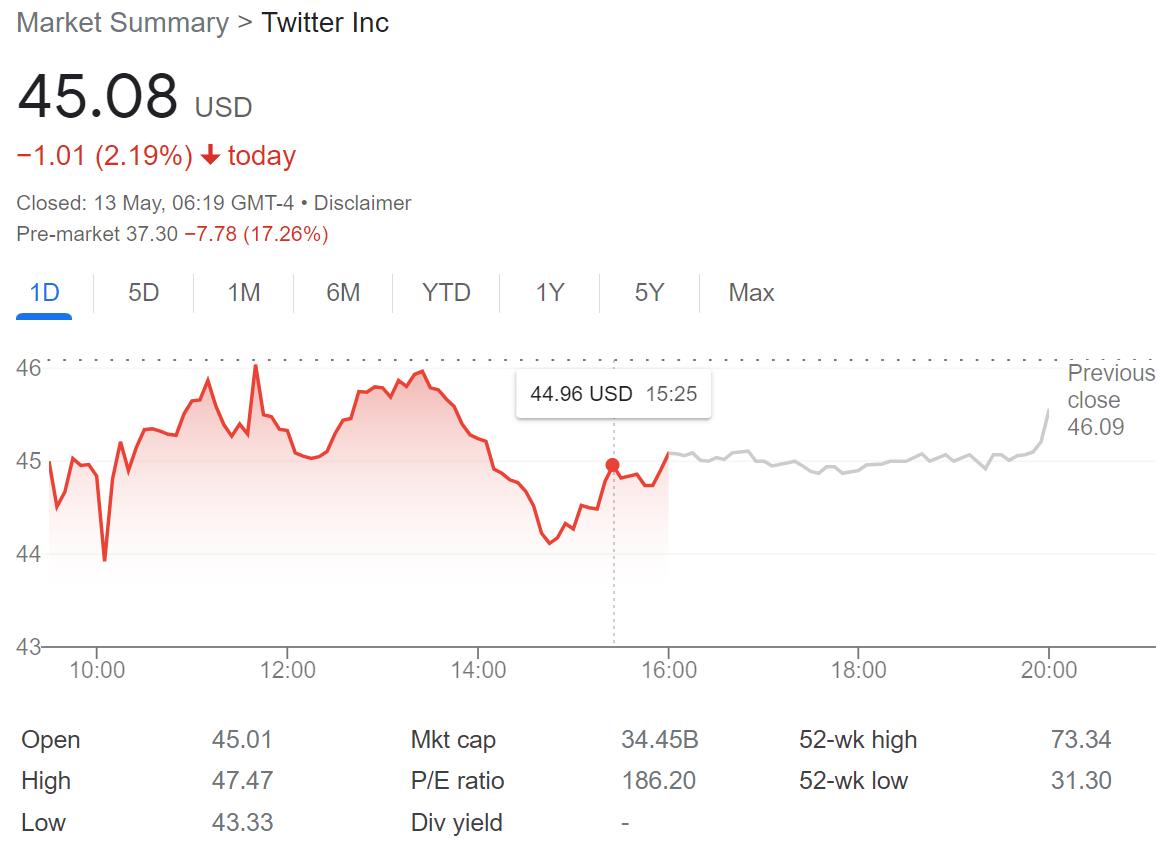

As a result of the uncertainties, Twitter's share price has plunged by 17% overnight:

Musk has not elaborated on why the deal is on hold, but has previously indicated that if his Twitter bid succeeds "we will defeat the spam bots or die trying!" It is likely that the valuation of Twitter as a brand which helped Musk arrive at his $44 billion offer is based in part on monetizable users and revenue, which might be lower than anticipated if 5% of those accounts aren't actually real. The acquisition deal includes a $1 billion termination fee should either party back out.

"The implications of this Musk tweet will send this Twitter circus show into a Friday the 13th horror show," said Wedbush analyst Dan Ives on Friday morning. Ives stated that Wall Street would not view the deal as "likely falling apart", or "musk negotiating for a lower deal price", or Musk "simply walking away with a $1 billion breakup fee." Another analyst told Reuters the 5% metric had been out for some time, and that Musk's posturing "may well be more part of the strategy to lower the price" and would be "highly frustrating for many in the company given that a number of senior executives have already been laid off."

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Stephen Warwick has written about Apple for five years at iMore and previously elsewhere. He covers all of iMore's latest breaking news regarding all of Apple's products and services, both hardware and software. Stephen has interviewed industry experts in a range of fields including finance, litigation, security, and more. He also specializes in curating and reviewing audio hardware and has experience beyond journalism in sound engineering, production, and design.

Before becoming a writer Stephen studied Ancient History at University and also worked at Apple for more than two years. Stephen is also a host on the iMore show, a weekly podcast recorded live that discusses the latest in breaking Apple news, as well as featuring fun trivia about all things Apple. Follow him on Twitter @stephenwarwick9