Apple Pay Later will max out at $1,000 — no buying a MacBook Pro for you!

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Apple Pay Later will max out at $1,000.

- Apple will reportedly use your Apple ID as part of its credit checks.

- Apple Pay Later will ship as part of iOS 16 later this year.

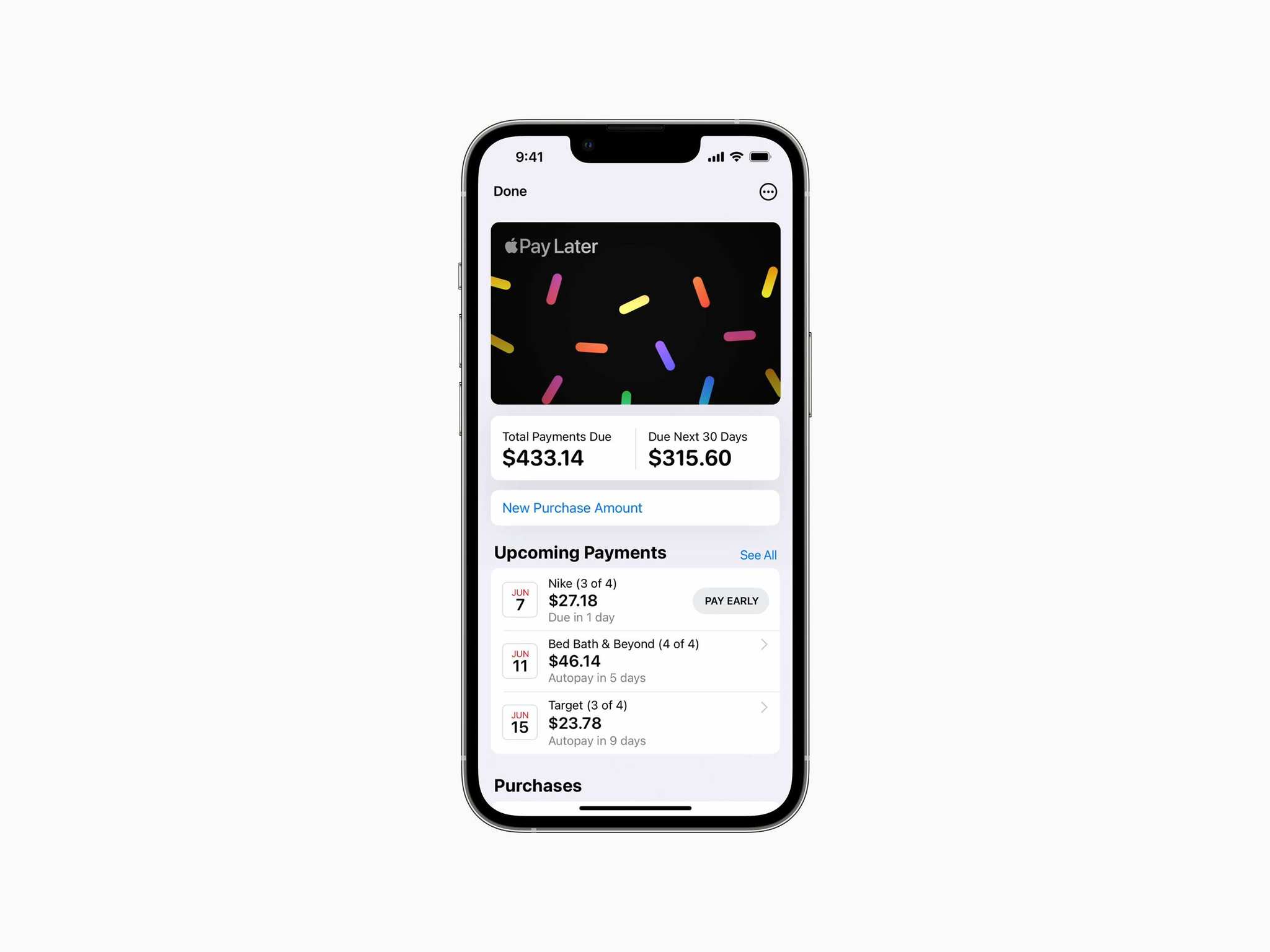

Apple's upcoming buy now, pay later service will only allow people to borrow a maximum of $1,000 based on their credit rating and other factors, including their Apple ID.

While Apple will run soft credit checks before allowing people to use its Apple Pay Later feature when iOS 16 ships this fall, it will reportedly also use the data it already holds on people to inform its money-lending decision. A WSJ report notes that Apple intends to only allow people to borrow $1,000 at most, even if their credit score is good and their Apple ID doesn't display a history of payment problems.

Payment plans per transaction will max out at $1,000, and the amount for which consumers are approved will depend on their credit reports and scores.Apple also will factor in its own information on millions of customers for identity verification and fraud prevention, the people said. Applicants whose Apple IDs have been in good standing for a long period and who have no indication of fraud are more likely to get approved.

By limiting loans to sub-$1,000, Apple is preventing people from using Apple Pay Later to buy a new MacBook Pro, some iPad Pro models, and even some of the best iPhones on the market. For those people, other options like Apple Card are of course available, although things like interest and payment fees could come into play then.

As expected, the WSJ report says Apple will "require consumers to link their debit card to its buy now, pay later service," with payments automatically taken from accounts every two weeks.

The news that Apple will handle the lending itself, rather than use a third-party provider as it does with Apple Card, was shared last week. It's said that Apple is only comfortable with the risks involved given the low values involved. If people don't make payments, Apple will likely hand things off to a specialist debt collection agency and be $1,000 out of pocket at most — something that wouldn't have been the case if it had backed its credit card in the same way, for example.

The company now feels comfortable becoming a lender in part because of the small dollar amount and short duration of the payment plans, people familiar with the matter said.

The Apple Pay Later feature will be available when iOS 16 ships later this year, likely in or around September. It'll allow customers to buy items via Apple Pay and then spread the cost across a six-week period with no interest or fees attached.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Oliver Haslam has written about Apple and the wider technology business for more than a decade with bylines on How-To Geek, PC Mag, iDownloadBlog, and many more. He has also been published in print for Macworld, including cover stories. At iMore, Oliver is involved in daily news coverage and, not being short of opinions, has been known to 'explain' those thoughts in more detail, too.

Having grown up using PCs and spending far too much money on graphics card and flashy RAM, Oliver switched to the Mac with a G5 iMac and hasn't looked back. Since then he's seen the growth of the smartphone world, backed by iPhone, and new product categories come and go. Current expertise includes iOS, macOS, streaming services, and pretty much anything that has a battery or plugs into a wall. Oliver also covers mobile gaming for iMore, with Apple Arcade a particular focus. He's been gaming since the Atari 2600 days and still struggles to comprehend the fact he can play console quality titles on his pocket computer.