Apple vs. Android: The marketshare mentality, and why it's a mistake

Last week Techpinions.com posted a really good editorial by John Kirk discussing how much of a joke it is to consider Android the winner in the smartphone space simply because they have the most market share. The very next day, Business Insider tech editor Jay Yarow pubished a post with a headline that read, “Apple Should Be Furious That It Has Such A Tiny Sliver Of The Smartphone Market.” Here's John Gruber’s response at Daring Fireball. And here's my take...

John Kirk opens with a well known joke about two farmers buying watermelons. They pay $5 per watermelon and sell them for $4 each, obviously losing money. At the end of the day they realize they’ve lost money so their conclusion is they need to buy a bigger truck; they need to conduct more watermelon-selling business.

Kirk doesn’t agree with the common, deeply flawed, logic that Android is winning because it has more market share than Apple, or that market share alone is the key to success. I agree with him 100% on this. In theory anyone can dominate any industry simply by giving away product for free. But what really maters is a company’s success in turning market share into profit.

Most tech writers don’t seem to be able to learn from the past.

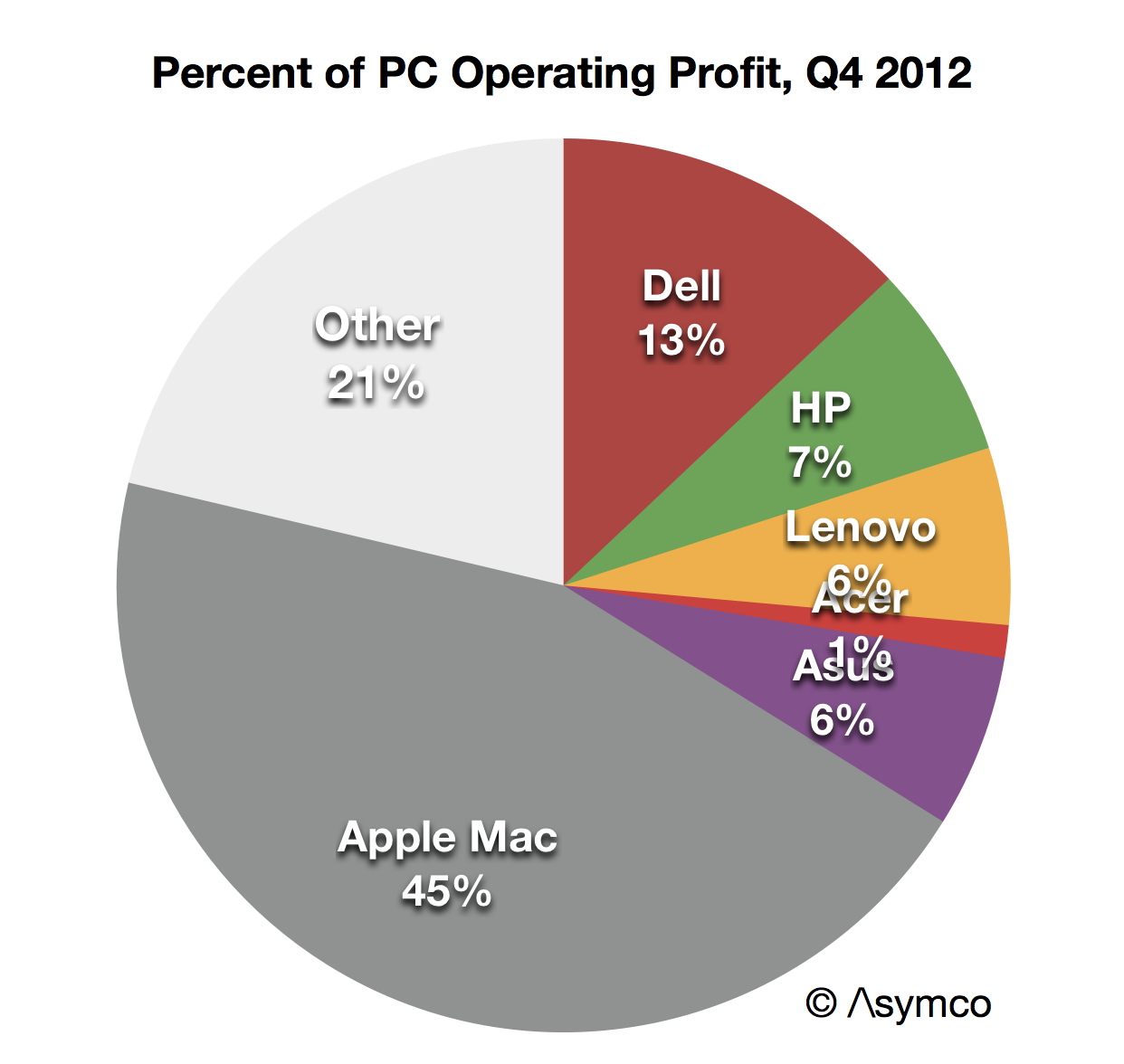

Most tech writers don’t seem to be able to learn from the past. People will make dumb comments about how Apple must be pissed off with its market share without noticing that the PC vs. Mac game has played out in the same manner already. History repeats itself and people don’t notice. Fortunately Horace Dediu over at Asymco noticed.

The graphic below is the result of Dediu’s own analysis of Q4 2012 profit share in the PC market. Apple commands an estimated 45% of the PC market’s profits. What is not shown? Apple has only 8% market share.

Why aren’t people writing about how mad Apple must be with its Mac market share? Why are we not seeing headlines about the failure of the Mac product line? Because this is old news. The PC market is an old game and the mobile industry is a new game. It’s analogous to watching live sports versus watching a recording of last year’s game.

I only wish John Kirk had spent more time talking about actual vendors rather than Android versus Apple. He points out that Android has 70% global market share and 29% profit share, whereas Apple has 18% market share and 57% profit share. Sure, this is correct. But I don’t see it as relevant. Android is an OS and Apple is a vendor. Android feeds Google’s advertising machine (and other developing business models). Apple is a fully integrated platform vendor.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

In my opinion, Google has done an amazing job of succeeding with Android. The joke about selling watermelons at a loss does not apply here. Android is software that has no cost to distribute. It has a development cost and it brings in revenue through all the users who connect to Google services.

Google makes a ton of cash from iOS users, who overwhelmingly enjoy Google’s services on their iPads and iPhones.

Is Google winning? It depends on how you define the fight. Google is not competing head on with Apple. Google makes a ton of cash from iOS users, who overwhelmingly enjoy Google’s services on their iPads and iPhones.

Apple competes head on with other device manufacturers including Samsung. And there is no debate that Samsung, having leveraged Android, is raking in the cash. Samsung has 33% market share and 43% profit share according to Cannacord Genuity. It doesn’t take a rocket scientist to realize that pretty much all the other Android vendors aren’t making money.

This takes us to back to Business Insider. They suggest that bloggers writing about Apple’s dominance in profit share are simply defensive. They agree with the math but seems to think Apple should have the most market share and the most profit. Why? Because Tim Cook said Apple’s mission is to make the best products in the world and BI tacks on the idea that Apple should also “get them in as many hands as possible”.

BI’s entire argument centers on the idea that Apple should want it’s great products to land in “as many hands as possible”, and the only way to do this is by going after market share (not profit share).

Most people probably all agree Apple should get its products into as many people’s hands as possible, but we may not all agree on what that actually means.

I don’t think getting your product in as many hands as possible means you drop your prices through the floor in order to sell more stuff. Apple is still a business that is owned by shareholders, of which I’m one. Getting your products into as many hands as possible while maintaining the Apple premium should be the goal. Otherwise Apple should be spending its billions to give away iPhones, which would be stupid.

Bottom line: I think John Kirk and John Gruber have it right. Taken to the extreme, the idea that Apple should use its cash to give away phones to the planet in order to achieve 100% market share and win the game is ludicrous. Market share does not define winning. All we need to do is look back at the history of Apple’s domination of PC profitability to see how this really works.

Former sell side analyst, out-of-box thinker, consultant, entrepreneur. Interests: Wife & kids, tech, NLP, fitness, travel, investing, 4HWW.