Apple launches its new high-yield Savings account with 4.15% APY

Get saving!

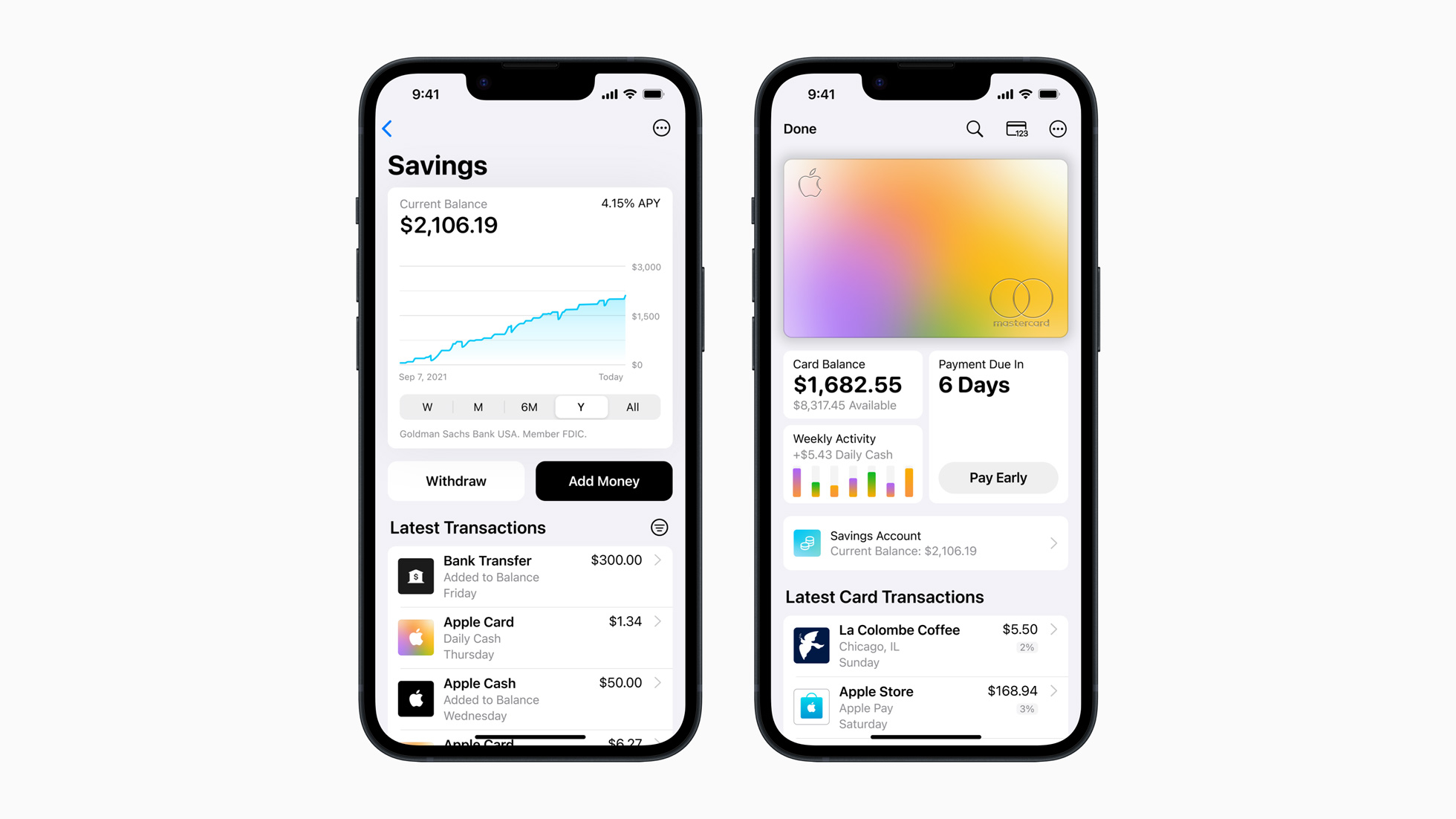

Apple has today rolled out its new Savings account for Apple Card users, offering a 4.15% APY rate.

Available today, users can now choose to save their Daily Cash rewards, earned by spending money on their Apple Card, with no fees, minimum deposits, or minimum balance.

When a user sets up their account, all future Daily Cash is automatically deposited into the account. Apple says there's no limit on how much daily cash a user can earn, but does note that maximum balance limits apply. Thankfully, the maximum balance is $250,000. Users can of course also top up their savings account by depositing additional funds from Apple Cash or a linked bank account.

Apple Card Savings

Apple Card Savings features a dashboard in the Apple Wallet app where you can track your balance and interest, as well as make withdrawals. As with Apple Card, the Apple Savings account is provided by Goldman Sachs.

To open an account, you must own an Apple Card that is in "good standing", be at least 18 years old, and have a Social Security Number.

Deposits and withdrawals are limited to $10,000 at a time and $20,000 per 7-day rolling period.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Apple Savings represents the latest string in the Apple finance bow, which now includes Apple Card and Apple Pay Later, a recent addition that lets users divide Apple Card Payments in four installments paid over eight weeks to reduce upfront costs at an amount up to $1,000.

Stephen Warwick has written about Apple for five years at iMore and previously elsewhere. He covers all of iMore's latest breaking news regarding all of Apple's products and services, both hardware and software. Stephen has interviewed industry experts in a range of fields including finance, litigation, security, and more. He also specializes in curating and reviewing audio hardware and has experience beyond journalism in sound engineering, production, and design.

Before becoming a writer Stephen studied Ancient History at University and also worked at Apple for more than two years. Stephen is also a host on the iMore show, a weekly podcast recorded live that discusses the latest in breaking Apple news, as well as featuring fun trivia about all things Apple. Follow him on Twitter @stephenwarwick9