Finance Apps

Latest about Finance Apps

Best iPhone and iPad apps for college students: Start the school year off right!

By Stephen Warwick last updated

As you head back to school, these are some of the top iPhone and iPad apps you need!

Apple Card and Apple Cash can now share data with budgeting apps in iOS 17.4

By James Bentley published

The new iOS 17.4 software update adds the ability to integrate Apple Card data into budgeting apps, with only a few taking advantage so far.

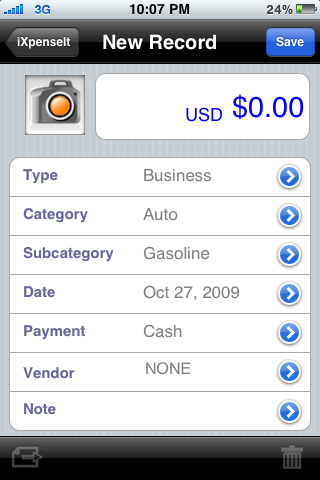

Best Personal Finance and Budgeting Apps for iPhone and iPad in 2022

By James Wang published

If you want a neat and organized way of viewing your spending and saving, check out these apps.

Easily keep track of your finances and budget with Nudget

By Christine Chan published

Struggling with keeping a budget? Yeah, it's hard. Nudget is an app that makes it a little easier.

Barclays credit card iPhone app features card lock, limits, and more

By Joe Wituschek last updated

Stocks App: The ultimate guide

By Mick Symons, Rene Ritchie published

Apple's built-in Stocks app lets you keep track of everything in your portfolio right on your iPhone. You can even ask Siri to check the numbers for you!

Apple tells developer of popular iOS 8 widget calculator to remove the widget

By Derek Kessler last updated

In a world without money and advertising, where do the artists go?

By James Thomson last updated

On The Network this week, James Thomson imagines a bleak dystopian future: In a world without advertising, your social status becomes the only currency you can use.

Add user-defined constants with PCalc RPN Calculator for iPhone and iPad

By Leanna Lofte last updated

TiPb Give Away -- 10 FREE Copies of PCalc RPN Calculator for iPhone

By Rene Ritchie last updated

Calcbot review: The best scientific calculator for the iPad

By Leanna Lofte last updated

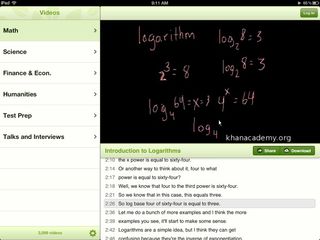

Have free access to over 2700 educational videos with Khan Academy for iPad

By Leanna Lofte last updated

Alleged Apple tax avoidance deal with Ireland under investigation by the European Commission

By Harish Jonnalagadda last updated

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!