The inimitable value of Apple Pay and what comes next

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

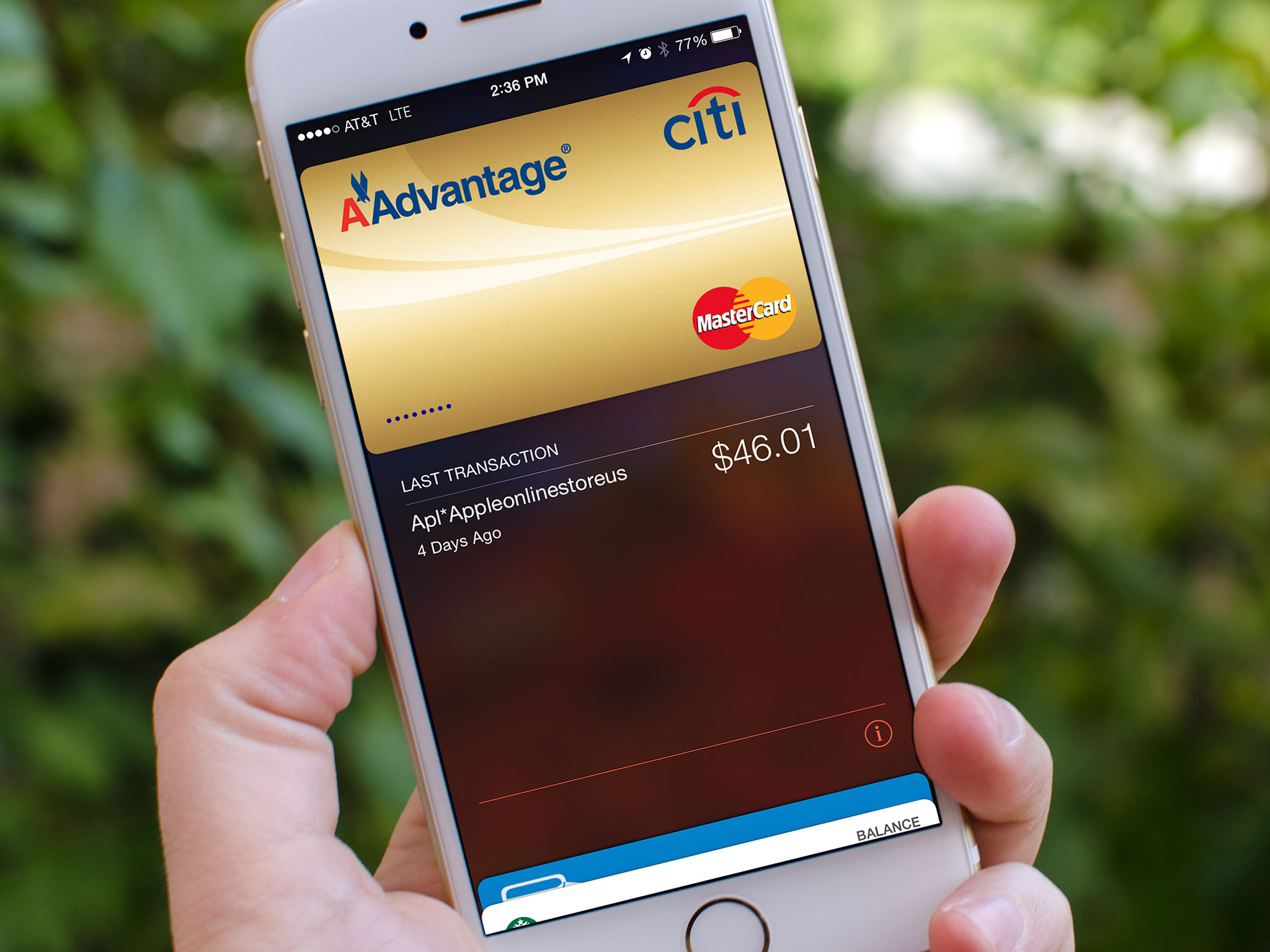

Apple Pay brought together everything from Passbook to Touch ID to launch Apple into the mobile transaction business. It was the company's first major new product category since the iPad and its been expanding steadily in the U.S. since October. As a service, Apple Pay is compelling enough that Android owners should consider switching to iPhone. It offers better security, efficiency, and experience for everyone along the chain, from banks to retailers to customers. And it could also be the first of those kinds of services "only Apple" is positioned to provide. Matt Richman:

Google does not control Android enough to create anything truly comparable to Apple Pay. Even if Google were able to add Apple Pay's software components to Android, the company would have to rely on its hardware partners to replicate Touch ID and the secure element and to seamlessly integrate everything together. They're not going to be able to do that for the foreseeable future.So that's the strategic significance of Apple Pay — it's the first time Apple leveraged its strengths to create a highly profitable yet uncopyable service that is destined for success.

Ben Bajarin, writing for Tech.pinions, highlights the value, and how it applies to other services as well:

Apple Pay is a great example of [services innovation]. As I mentioned before, retailers are jumping on board for many reasons but one of the largest is attracting Apple's customers to their stores. Similarly, when we talk to companies looking to support HealthKit and HomeKit, we hear from the services companies like health, security, etc., that they want Apple's customers.

The same way Apple Pay makes for a better transactional service for everyone involved, HealthKit, HomeKit, and CarPlay could make for better healthcare information, home automation, and driving services. (Entertainment and other areas could likewise follow.) Apple won't need to be a data company, appliance manufacturer, or car maker, any more than they need to be a bank, but they'll be able to ensure their customers get better packaged, more accessible, more approachable, and more enjoyable experiences in all those areas.

And that once again raises the value of owning an iPhone.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Rene Ritchie is one of the most respected Apple analysts in the business, reaching a combined audience of over 40 million readers a month. His YouTube channel, Vector, has over 90 thousand subscribers and 14 million views and his podcasts, including Debug, have been downloaded over 20 million times. He also regularly co-hosts MacBreak Weekly for the TWiT network and co-hosted CES Live! and Talk Mobile. Based in Montreal, Rene is a former director of product marketing, web developer, and graphic designer. He's authored several books and appeared on numerous television and radio segments to discuss Apple and the technology industry. When not working, he likes to cook, grapple, and spend time with his friends and family.