The United States still lags in mobile payments

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

What you need to know

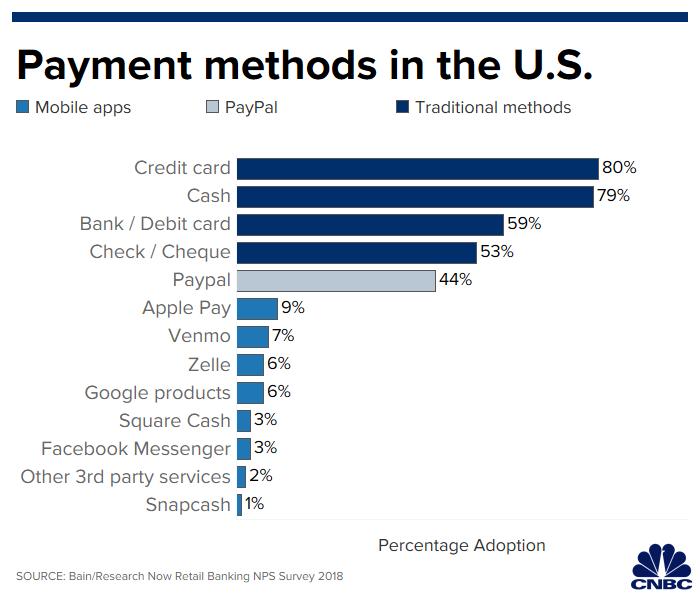

- Credit card payments are the most popular.

- Only 9% use Apple Pay.

- 53% are still using checks.

With the number of smartphones in use across the United States you could be forgiven for thinking that Apple Pay would lead the way in payments. But it doesn't, and neither does any other form of mobile payment. Instead the humble credit card takes top spot, followed by a legacy alternative, cash.

That disappointing news comes via a new report by CNBC which outlines the most popular payment methods in the country. Mobile payments are so unpopular in the United States that they're beaten out by PayPal which has 44% adoption. By comparison, Apple Pay sits at just 9% while Google's products equate for only 6%.

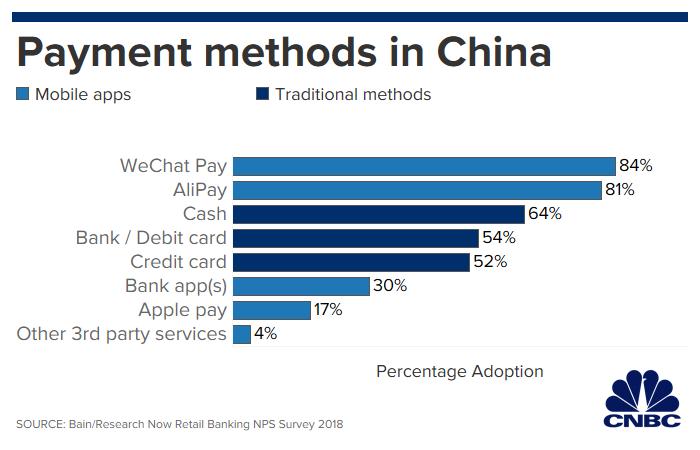

Compare those numbers with China and the outlook is very different. WeChat Pay is by far the most popular with 84% of users having availed its services. Second is AliPay with 81%. Credit cards? Just 54%.

Places such as China and India are witnessing rapid adoption of smartphone payments. In China, for example, more than 80% of consumers used mobile payments last year, according to management consultancy Bain. In the U.S., major mobile payments apps had adoption rates of less than 10%.

One of the reasons for the disparity is likely the infrastructure that's in place. The United States is still catching up to the rest of the world in terms of the availability of terminals capable of accepting contactless transactions. It may also simply be a case that customers in the United States don't see a need to try something new. Credit cards have been working just fine, so why change?

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Oliver Haslam has written about Apple and the wider technology business for more than a decade with bylines on How-To Geek, PC Mag, iDownloadBlog, and many more. He has also been published in print for Macworld, including cover stories. At iMore, Oliver is involved in daily news coverage and, not being short of opinions, has been known to 'explain' those thoughts in more detail, too.

Having grown up using PCs and spending far too much money on graphics card and flashy RAM, Oliver switched to the Mac with a G5 iMac and hasn't looked back. Since then he's seen the growth of the smartphone world, backed by iPhone, and new product categories come and go. Current expertise includes iOS, macOS, streaming services, and pretty much anything that has a battery or plugs into a wall. Oliver also covers mobile gaming for iMore, with Apple Arcade a particular focus. He's been gaming since the Atari 2600 days and still struggles to comprehend the fact he can play console quality titles on his pocket computer.