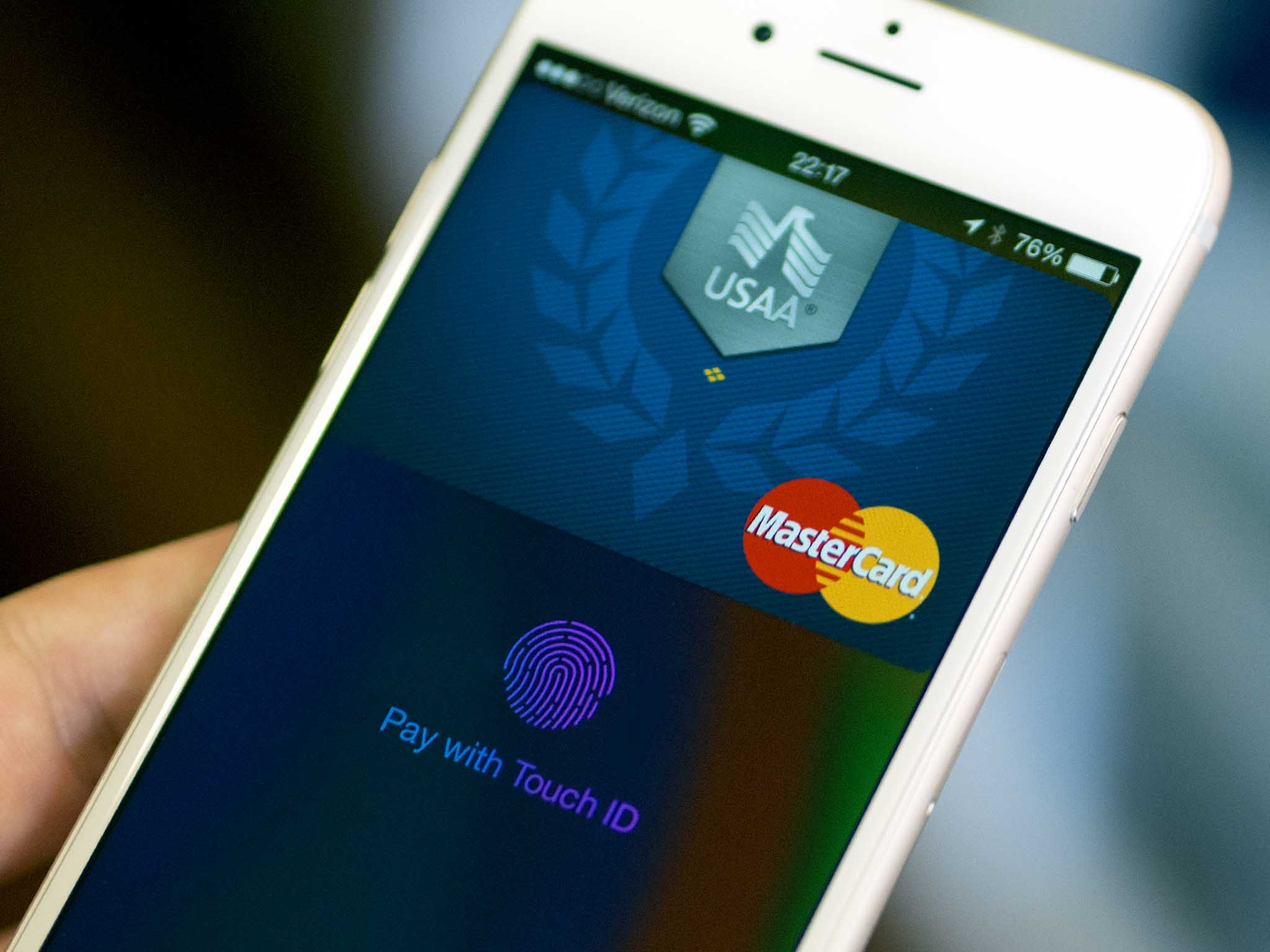

The year of Apple Pay

Apple Pay, the Touch ID-authenticated in-store and online payment service Apple started rolling out last October, has been growing steadily in terms of bank and retailer support. During Apple's Q1 2015 conference call, CEO Tim Cook said the company was getting "extremely positive" feedback on Apple Pay from both individuals and institutions. That wasn't his biggest endorsement, however — it was calling 2015 the "year of Apple Pay".

Not too long ago, Apple called 2011 the "year of the iPad 2," and that product went on to establish the category and prove experience wins the technology fight. In some ways, Apple Pay has more work ahead of it than the iPad did: It's not yet international, it's dependent on financial institutions and retailers in a way far beyond traditional carrier and reseller relationships, and it has to educate people and politicians wary of electronic transactions or who are beholden to other interests.

Yet Apple Pay promises banks better security, retailers more efficient checkouts, and customers both security and efficiency. That makes it compelling.

From our Q1 2015 Tim Cook transcript, here's what he had to say:

Today, about 750 banks and credit unions have signed on to bring Apple Pay to their customers, and in just three months after launch, Apple Pay makes up more than two out of three dollars spent on purchases using contactless payments across the three major U.S. card networks.More merchants are excited to bring Apple Pay to their customers, and adoption is strong. Just today, USA Technologies announced they made Apple Pay available at about 200,000 places where everyday payments happen, including vending machines in businesses, airports, and schools; commercial laundry machines in colleges, universities, and laundromats; and parking meters and payment kiosks in lots across the country.

In contrast, here's what Jason Del Ray of Recode brings up as some of the challenges Apple Pay faces, even in the U.S.:

Apple needs to continue to sign up merchants to accept Apple Pay, so that shoppers don't have to guess where they can use it. Right now, some of the country's largest retailers, such as CVS, Walmart and Target, refuse to accept Apple Pay in their stores in part because they are backing a competing app called CurrentC.

That feels more like a bump than a barrier. Customers are used to not knowing if American Express, Diner's Club, Discover Card, or other transactional services will be available at any given store. Some stores don't take credit cards at all, and others remain cash-only businesses. It's annoying but it's expected in today's shopping environment.

Target already takes Apple Pay in-app, so it's not hard to imagine it'll go in-store as soon as legally possible.

Of the merchants obligated to CurrentC, the still un-launched Walmart-backed QR-code scanning payment service, some of them signed up years ago on spec and their exclusivity agreements will soon begin to expire. A few, like Target, already take Apple Pay in-app, so it's not hard to imagine it'll go in-store as soon as legally possible.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Walmart could remain a self-interested holdout, but customers can go elsewhere if it better suits their interests, or we can use other methods at Walmart the way those of us with American Express cards use other methods at VISA and/or MasterCard-only retailers.

Recode's Del Ray also includes loyalty programs and enhanced security as necessary steps to increase Apple Pay adoption, though the security issues he cites are on the banks' end, not Apple's, and seem part-and-parcel with larger steps banks need to take to combat fraud in general.

What makes me so bullish about Apple Pay is this: in-store, it currently requires an iPhone 6 or iPhone 6 Plus, which Apple sold 74.5 million of last quarter. Yet that number represents only a portion of the billion iOS devices sold to date. Apple will continue to sell more iPhones 6 and future iPhones, but come April the company will also start selling the Apple Watch.

With the Apple Watch, in-store Apple Pay will also become available to the hundred-plus million iPhone 5 and iPhone 5s owners. That increases the potential user base for Apple Pay in both directions — not only for future devices, but for past ones as well. The Apple Watch will also be new and it will be fun, and just like loyalty programs, both of those things tend to drive adoption.

With the Apple Watch, in-store Apple Pay will also become available to the hundred-plus million iPhone 5 and iPhone 5s owners.

Also, rumors of Apple Pay rollouts in the U.K. and Canada persist, and there's no doubt the service will eventually go international. Many countries outside the U.S. have widespread infrastructure already in place for contactless payments; for years now I've been able to use my NFC-chipped Canadian credit and debit card to tap-to-pay at retailers like Sears, restaurants like McDonalds, major gas stations, and more.

Moving to Apple Pay should be incredibly easy here, and I expect that to be true in other mature contactless payment markets. That will only add to the acceleration and mass, and then it starts to become a virtuous cycle for everyone.

There are no guarantees in technology and even less in retail, of course. Given where Apple has taken Pay in just three months, however, and Tim Cook's confidence on the conference call, 2015 could very easily be the year of Apple Pay.

And that wouldn't just be good for Apple. It would be good for us all.

Rene Ritchie is one of the most respected Apple analysts in the business, reaching a combined audience of over 40 million readers a month. His YouTube channel, Vector, has over 90 thousand subscribers and 14 million views and his podcasts, including Debug, have been downloaded over 20 million times. He also regularly co-hosts MacBreak Weekly for the TWiT network and co-hosted CES Live! and Talk Mobile. Based in Montreal, Rene is a former director of product marketing, web developer, and graphic designer. He's authored several books and appeared on numerous television and radio segments to discuss Apple and the technology industry. When not working, he likes to cook, grapple, and spend time with his friends and family.