Why Apple 'computers' outselling Microsoft may not be fair, but is incredibly important

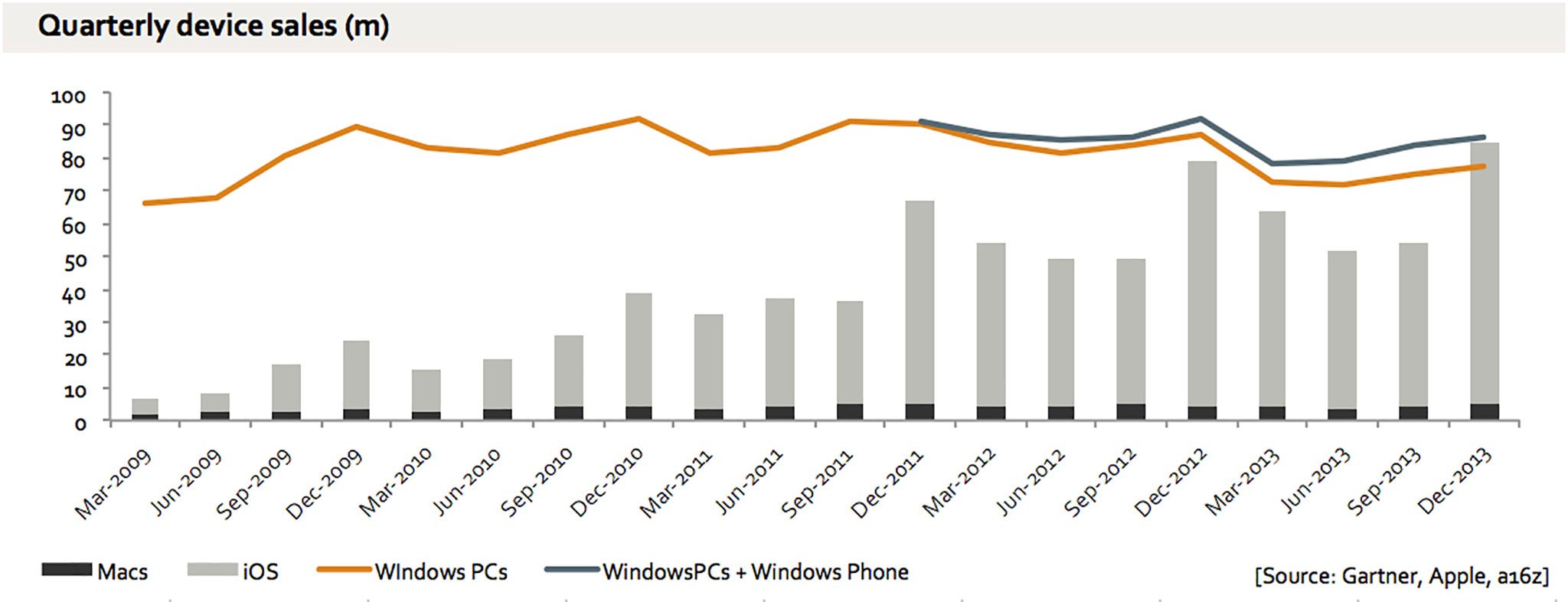

Earlier this week analyst Benedict Evans published a chart showing how “computers” running Apple software are starting to sell at greater volume than "computers" running Microsoft software. Of course he’s counting all Macs and iOS devices as computers, just as he’s counting all Microsoft Windows PCs and Windows Mobile phones as computers. But the numbers don’t lie. In the last quarter Apple's traditional + mobile business is responsible for shipping just as many units as Microsoft. And obviously Apple is growing much faster. The blog post accompanying the chart was a mere 3 sentences. The most important sentence was:

This is a pretty good illustration of the scale of mobile: Apple limits itself only to the high end of the mobile market but still sells more units than the whole PC industry.

The comments on Evans’ blog post do a great job of illustrating how poorly people can often understand very simple points. The argument that erupted is all about whether or not Evans’ comparison of Apple vs. Microsoft is fair. In reality this has nothing to do with fair. This has everything to do with showing just how bloody BIG the mobile space has become. Apple plays only at the high end of the market and they, alone, ship more devices than Microsoft powers PCs.

As an investor I take a very long term perspective on stocks, and I love seeing this kind of analysis. Remember the launch of the iPhone seven years ago? It had crap email. You couldn’t copy and paste. There were zero third party apps. It ran on a frikkin’ EDGE network, so without Wi-Fi the awesome browser was practically useless. In a short seven years the entire computing industry has been revolutionized, and I don’t think it’s stopping anytime soon.

The question is not “is the comparison fair?” It’s what happens in the next seven years?

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Former sell side analyst, out-of-box thinker, consultant, entrepreneur. Interests: Wife & kids, tech, NLP, fitness, travel, investing, 4HWW.