Apple Pay Later: Everything you need to know

Apple Pay Later is here to split up your Apple Pay purchases.

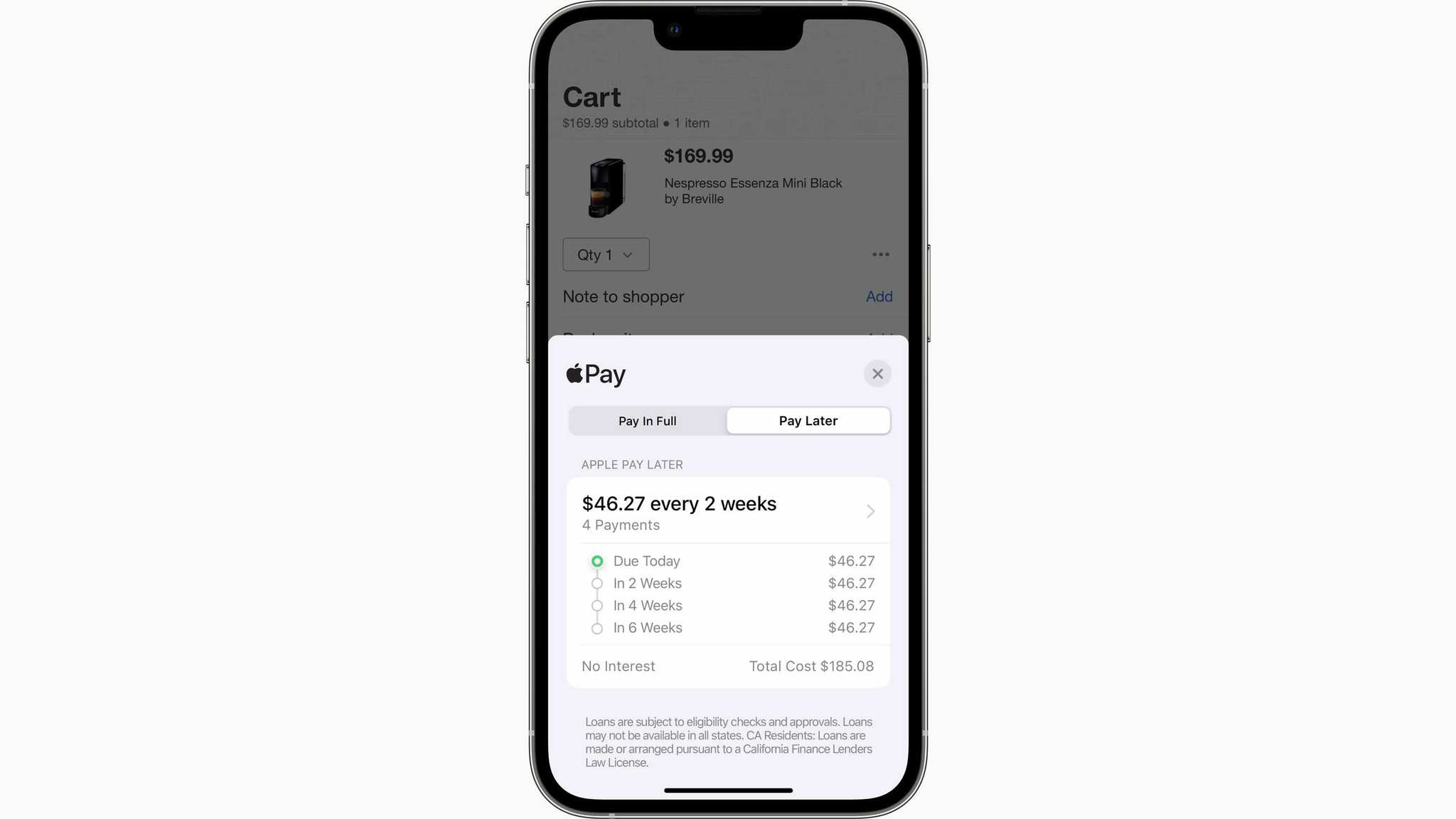

Apple Pay Later is rolling out to customers who want to make Apple Pay payments using four installments over the course of six weeks to break up the cost of their purchases.

The company announced the rollout of the new service on March 28 and is randomly selecting users to take part in an early access pre-release.

Before covering Apple, Joe worked for the company in Apple Retail. He also has more than a decade of experience in the technology, financial, and compliance industries, serving as a Personal Banker, Retail Manager, and Software Support Manager. His previous experience gave him years of insight into financial technologies and the proliferation of fintech. In addition to being a user of Apple Card, Apple Savings, Apple Cash, and Apple Pay Later, Joe has also tested out multiple other financial products ranging from checking to investment accounts.

What is Apple Pay Later?

Apple Pay Later is a "Buy Now, Pay Later" financing service that is offered directly from Apple to customers using the company's Apple Pay digital payments service. While Apple Pay is the technology that allows you to make a purchase online safely and securely, Apple Pay Later is a service that allows you to finance an Apple Pay purchase over a short period of time.

Apple Pay Later, as explained by the company, lets Apple Pay users split the cost of an Apple Pay purchase into four equal payments that will need to be made over the course of six weeks. The new option is similar to other "Buy Now, Pay Later" services that are offered by companies like PayPal, Affirm, and Klarna.

The company has confirmed that it is using the Mastercard network to offer the service, the same network that it uses for its Apple Card credit card.

How do I use Apple Pay Later?

In order to use Apple Pay Later, you will need to apply for and receive approval for the service.

Apple Pay Later is technically a lending service, so Apple will need to run a credit check and make a decision on whether or not to offer you the loan that will be used to finance a purchase. Apple is using its own subsidary, Apple Financing LLC, to handle the credit checks, decision-making, and lending for Apple Pay Later.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You can apply for Apple Pay Later while making an Apple Pay purchase or within the Wallet app. If approved, you'll see the option to use Apple Pay Later when making an Apple Pay purchase.

Apple Pay Later loans can range from between $50 and $1,000.

A report in February 2023 from Bloomberg says that "the new service will let Apple leverage its trove of data on customers, including their spending at company retail outlets, App Store transactions, and services like Apple Cash peer-to-peer payments. Apple Pay, a mobile payment service launched in 2014, and the Apple Card." That indicates that, in addition to your credit score and report, Apple may also use your relationship history with the company to determine your worthiness of a loan through the new payment service.

According to that report, "When customers sign up, they’re asked to give an amount they would like to borrow and then the system comes back with an approved total — similar to the Spending Power feature for American Express cards." The process, which will be integrated into the Wallet app, will require those who apply to provide a government ID card, social security number, and two-step verification on their Apple ID account. Approved loans will expire after 30 days.

How do I manage my Apple Pay Later payments?

Once you make a purchase using Apple Pay Later, you will be able to manage your payments in the Wallet app.

As Apple showed in a screenshot of the Apple Pay Later section of the Wallet app, you'll be able to see a number of helpful information including the total amount of payments due, how much is due in the next 30 days, and a breakdown of all of your upcoming payments.

Does Apple Pay Later charge any fees?

Apple says that Apple Pay Later will charge "zero interest and no fees of any kind." However, it is currently unclear what will happen if you manage to miss one of your payments.

Apple Pay Later will be fee-free minus any possible overdraft fees from banks.

It appears that while users of the service will be able to manually make a payment early, Apple Pay Later payments will be automatically deducted from your bank account on the date that each payment is due. While it is unclear what kind of penalty may happen if your bank account does not allow overdrafts, Apple has said that "a user's card-issuing bank may charge a fee if the user's debit card account contains insufficient funds."

Which countries can use Apple Pay Later?

Apple has confirmed that Apple Pay Later will only be available in the United States when the service launches this fall. While the company is surely planning to bring the service to additional countries, it is currently unclear which countries are next on the list or when the service could come their way.

The fine print on the Apple Pay Later purchase screen also mentions that loans may not be available in every state. It's currently unclear which states the service will be available when it launches.

If it is working in your state, the financing option should be available both online and in-app on the best iPhones with iOS 16, iPadOS 16, and macOS Ventura.

When will Apple Pay Later launch?

Apple Pay Later launched on March 28, however, it is only currently available to users who are randomly selected for early access. The company has not yet stated when it will roll out the feature fully.

Joe Wituschek is a Contributor at iMore. With over ten years in the technology industry, one of them being at Apple, Joe now covers the company for the website. In addition to covering breaking news, Joe also writes editorials and reviews for a range of products. He fell in love with Apple products when he got an iPod nano for Christmas almost twenty years ago. Despite being considered a "heavy" user, he has always preferred the consumer-focused products like the MacBook Air, iPad mini, and iPhone 13 mini. He will fight to the death to keep a mini iPhone in the lineup. In his free time, Joe enjoys video games, movies, photography, running, and basically everything outdoors.