iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

Apple Card is the biggest hyped credit card since Magnises. Apple recently launched its application process web page, which includes a video detailing how to apply.

Just because the Apple Card is Apple's next big thing, doesn't mean you should run out and get one. Remember, this could affect your credit score (and may put you deeper in debt than you've budgeted for). If, however, you've thought about it and have come to the responsible decision to apply for an Apple card, here's how.

Note: Apple Card sign-up appears to currently only be available in a preview capacity. You'll need an invitation from Apple to the Apple Card preview to apply.

- What you need to apply

- First step: Update your iPhone to iOS 12.4

- How to apply for an Apple Card on your iPhone

What you need to apply

- Be sure your Apple ID has updated information with your current phone number, address, and email address for a faster application.

- You must be 18 years or older, depending on what state you live in.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that is not a P.O. Box. If you're a U.S. citizen, you can also use a military address.

- You must be running iOS 12.4 or later on a supported iPhone (iPhone models with Face ID and iPhone models with Touch ID, except for iPhone 5s).

- Have two-factor authentication enabled with your Apple ID.

- Be signed in to iCloud with your Apple ID.

- If you have a freeze on your credit report, you need to temporarily lift the freeze to apply for Apple Card.

- You might need to verify your identity with a Driver License or State ID.

Currently, you'll need an invitation from Apple to apply for an Apple Card. You can sign up with Apple to be notified when it's more widely available.

First step: Update your iPhone to iOS 12.4

If you're hearing the buzz about Apple Card, but can't seem to find it anywhere on your iPhone (hint: it's inside the Wallet app), it might be that you still haven't updated your iPhone to iOS 12.4 or later. Once your iPhone is up to date, you'll see the new feature in the Wallet app. Here's how to update.

- Launch the Settings app on your iPhone.

- Tap General.

- Tap Software Update.

- Tap Download and Install.

- Enter your Passcode if prompted.

- Agree to the Terms and Conditions.

- Tap Agree to confirm.

How to apply for an Apple Card on your iPhone

Currently, you'll need an invitation from Apple to apply for an Apple Card. You can sign up with Apple to be notified when it's more widely available. If you have received an email invitation to the Apple Card Preview, the email will contain an Apply Now button that will take you into the Wallet app to the application.

Once the preview is over and Apple Card becomes widely available, you'll be able to apply directly within the Wallet app per the instructions below:

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

- Launch the Wallet app on your iPhone.

- Tap the Add button in the upper right corner of the Wallet app. It looks like a Plus symbol.

- Select Apple Card to apply for the Apple Card.

- Tap Continue to start the application process.

- Fill out the information if it doesn't automatically populate. You'll be asked for the following:

- First and last name, date of birth, and phone number

- Home address

- Last four digits of your social security number and country of citizenship

- Your annual income

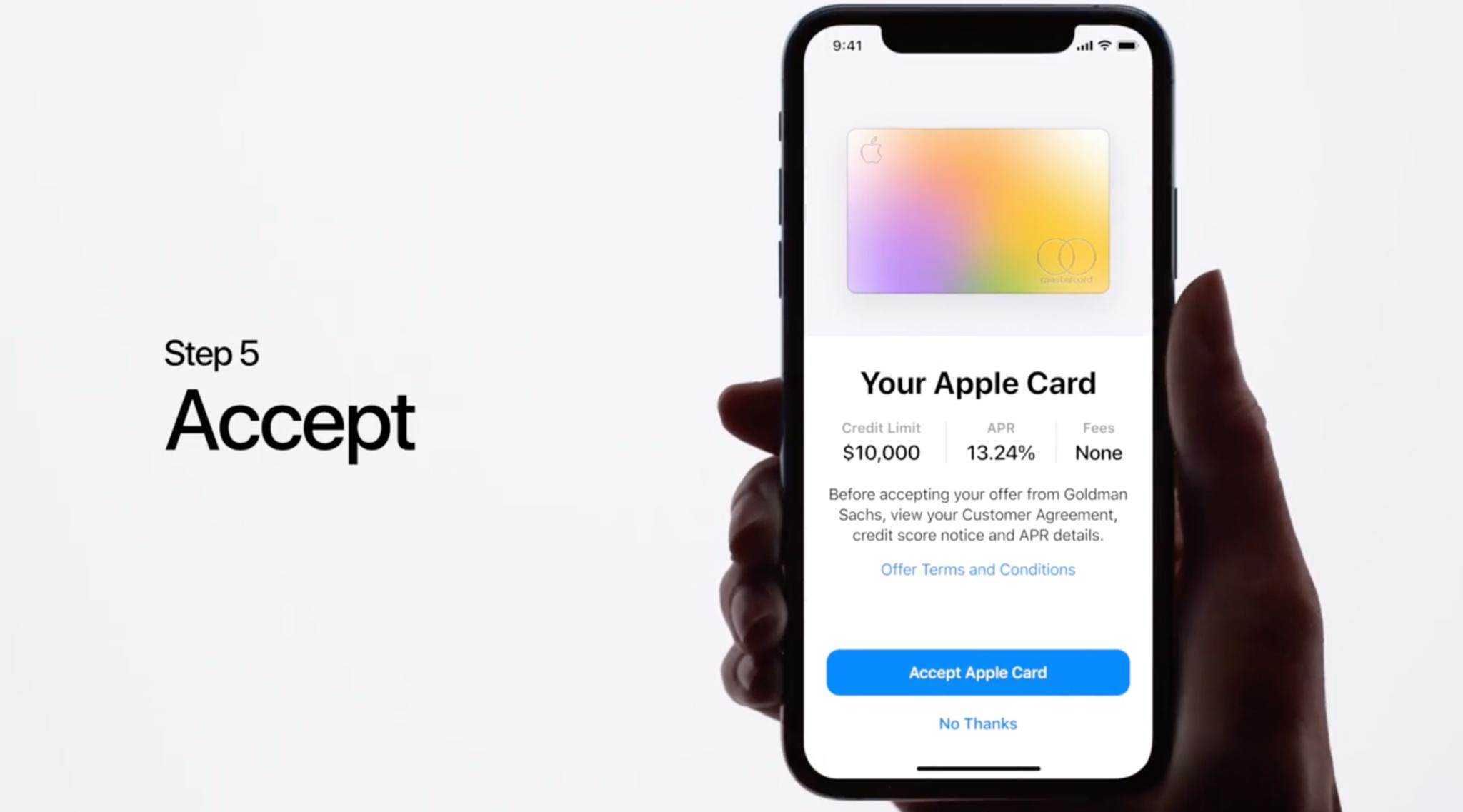

After you agree to the terms and conditions of the card, your application will be submitted and, if accepted, you'll be presented with your offer, which includes your credit limit, interest rate, and fees. You can tap Offer Terms and Conditions to see your agreement, credit score, and the details of your APR. Tap Accept Apple Card to accept the card.

If you are not approved immediately, you may be asked to submit additional information, like your full social security number, driver's license, state ID, financial assets, or your relationship with Apple. If prompted, providing this information is necessary in order to be approved for Apple Card.

Any questions?

Do you have any questions about how to apply for an Apple Card? Put them in the comments and I'll help you out.

Updated with additional details on the steps and what you need.

Lory is a renaissance woman, writing news, reviews, and how-to guides for iMore. She also fancies herself a bit of a rock star in her town and spends too much time reading comic books. If she's not typing away at her keyboard, you can probably find her at Disneyland or watching Star Wars (or both).