Why I've replaced my debit card with Apple Card for most purchases

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

When Apple first announced the Apple Card back in March, I thought long and hard about getting it. I didn't really think I needed another credit card, but it's Apple, and the physical card is beautiful. So I decided to go for it. I'm not in the market for a new car or house at the moment, so I don't mind the hard pull on my credit report right now.

As August rolls around and people were getting invites for getting the Apple Card early, I kept eagerly checking if I had one in my inbox. It took a few weeks, but I eventually got it, and it was about a week before the Apple Card became publicly available to everyone.

Since I accepted the offer and also received that beautiful titanium Apple Card, it has quickly become my everyday card for payments everywhere, replacing my Chase debit card. While I'll still be using my Chase Freedom and Chase Amazon Prime cards for their maximum cash back and rewards benefits (5 percent cash back on rotating categories and Amazon/Whole Foods purchases), my Apple Card is my go-to for everything else.

Even one percent is better than zero

Before the Apple Card, I would use credit cards sparingly. I never really liked having too big of a balance on my credit cards, so I opted to use my debit card most of the time. After all, I've always been following the mantra of "don't spend what you don't have," so what better way to see what I have and spend within that means than using my debit card?

But my Chase debit card doesn't give me any rewards for using it. So I was spending, but getting nothing back. Once I accepted my Apple Card and it was ready to use within seconds, I decided "what if I just use this card for everything?"

To me, it's not such a bad idea. I have always been fairly responsible with credit cards, and I was given a pretty generous credit line with the Apple Card compared to my other cards. And considering the fact that I was not getting any rewards back with my debit card, which I used the most, even the 1% Daily Cash back with the physical card is better than my debit card at 0%.

I've already moved pretty much all of the recurring payments that were on my debit card to my Apple Card. If I'm going to be paying for things like my Disneyland Annual Pass, might as well get some cash back for it, right?

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

And since I usually buy my Apple products directly from Apple, getting that 3% Daily Cash for my next iPhone (through iPhone Upgrade Program) and Apple Watch is a nice perk.

- How to activate your titanium Apple Card

- Apple Card offers 3% cash back through iPhone Upgrade Program payments

- Apple Card now available to everyone in the U.S., Uber added to 3%

Apple Pay all day, every day

Even with my debit card and other credit cards, I used it a lot with Apple Pay whenever I could. If I saw that a place took Apple Pay, I would whip out my phone to pay immediately. This is why the Apple Card is perfect for someone like me.

Again, getting 2% cash back is better than the zero percent I was getting back with my debit card, so this is why my Apple Card has replaced my debit. And even if a place doesn't take Apple Pay, using the physical card and getting only 1% is still better than zero.

Multiple payments are super easy

With my other credit cards, I pretty much make one payment each month, paying off the statement balance in full, at least a day or two before it's due. I even set up Auto-Pay on these cards so I don't forget to pay (it's happened before).

But the Apple Card works a bit differently for me. With my other cards, I usually just make the one payment because I'm not sure how many payments I can really make per month (is there a limit?) and it involves me logging into their website or app first.

With Apple Card, my balance and payments can all be done right within the Wallet app, no extra steps needed. It's seamlessly integrated, and Apple makes it so incredibly easy to make payments. I have been making, maybe, at least one payment per week, and sometimes even as soon as the payment is cleared.

I have been treating the Apple Card like a debit card in that I pay very frequently to bring that balance down as much as possible before the statement closes at the end of the month. I also use it as if I am paying with my debit card, so I don't spend what I don't have. So far, it seems to be working out pretty well.

I've also learned that it's always good to only utilize only 10 percent or less of your total credit. So my frequent payments help keep my utilization low by the time the statement closes.

Honestly, I'm sure that I could make multiple payments on my other credit cards, but it's so much easier to do it with Apple Card, that I just kind of treat it like a debit card. Plus, the payments post quickly, and my credit balance resets immediately.

- How to add your bank account to your Apple Card payment option

- How to schedule payments on your Apple Card

The Apple Card Wallet app interface is intuitive

One of my favorite reasons for using Apple Card is the seamless integration in Wallet. Whenever I use it, whether it's through Apple Pay or the physical card, I get a notification on my iPhone immediately once payment goes through.

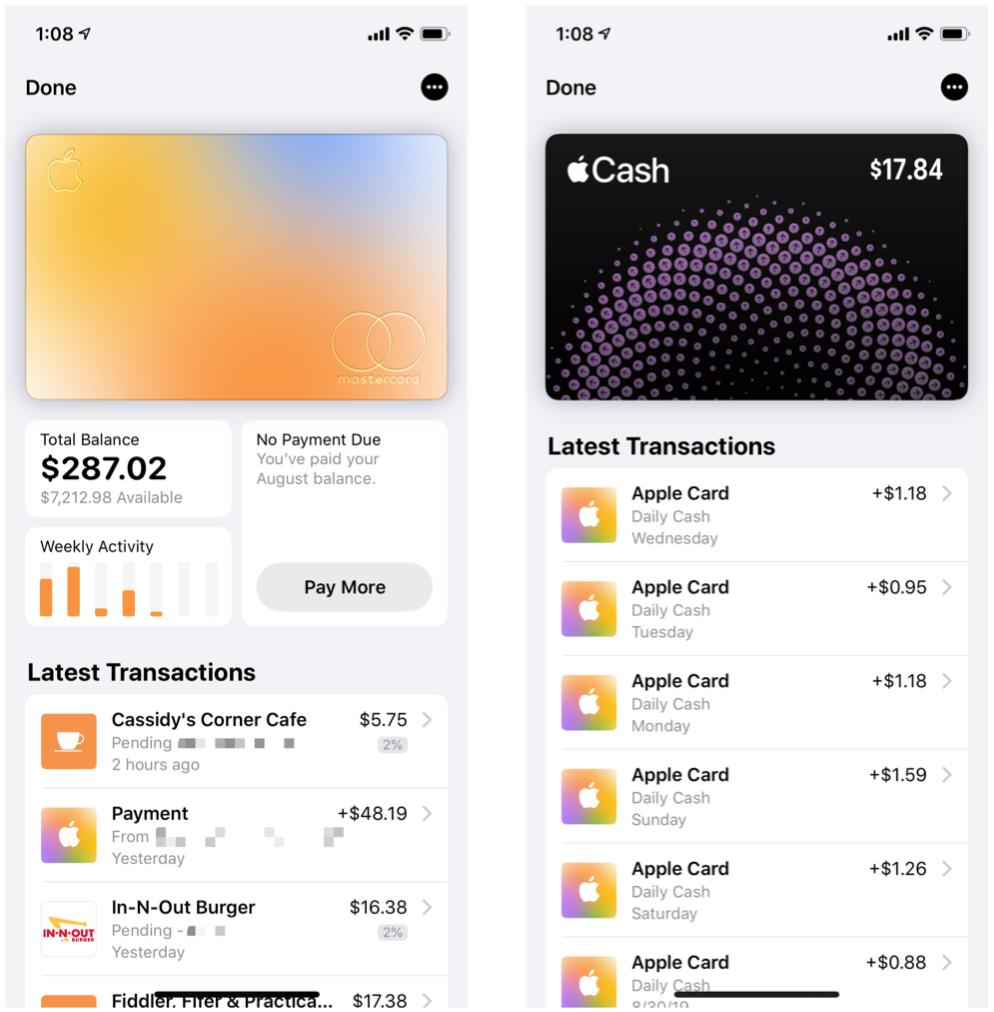

With just a few taps on my iPhone, I can quickly view how much my balance is and how much credit is remaining. Tapping my Total Balance lets me check how much I've paid so far, what my new spending total is since the last statement, how much Daily Cash I've accrued, and view my statements. And I don't have to log in to anything, it's fantastic.

The Weekly Activity section lets me see where my money is going. All of the spending categories are color-coded, so I love seeing the colors change on my digital Apple Card (though most of it is orange and yellow so far). I usually have to rely on other third-party finance apps to help me see where my money is going, as bank apps (like Chase) don't give me any insight on this, unfortunately.

Apple's way of showing you all of the latest transactions with an icon, Daily Cash earned, and even map of where that business was (when viewing full detail) is also another reason I love using the card. It's nice to see where you used the Apple Card at, and with the exact location information (where applicable), spotting fraudulent charges is easier than ever before (along with the instant notifications).

Going back to payments, I enjoy being able to pay off my Apple Card balance directly from the Wallet app. The payment amount circle is especially a great touch because it simplifies seeing how much you need to pay to avoid those pesky interest charges, so anyone can understand APR rates and interest.

Daily Cash is nice

Yes, we know that while Apple Card doesn't have the best rewards compared to other credit cards out there, the Daily Cash is not a bad perk at all.

You literally don't have to do anything to get it, as it gets deposited to your Apple Cash card once each payment is cleared. And the best part is that you get to use that Daily Cash right away if you want, or you can always save it up for something bigger.

- How to find your Apple Card Daily Cash

- How to redeem Daily Cash Rewards for Apple Card

- Opinion: Immediate access to cash-back rewards from Apple Card is a huge benefit

Sayonara, debit card

Ever since getting the Apple Card, my Chase debit card has remained untouched. I've switched over all payments that were pulling from my debit card over to my Apple Card, and have also replaced my Barclaycard Visa to my Apple Card for Apple and iTunes purchases. I still plan to use my Chase Freedom, Amazon Prime Visa, and PlayStation Rewards card when the rewards are better than Apple Card, but the Apple Card is for pretty much everything else.

Are you using your Apple Card as your primary payment card when it makes sense? Share your experiences in the comments!

Christine Romero-Chan was formerly a Senior Editor for iMore. She has been writing about technology, specifically Apple, for over a decade at a variety of websites. She is currently part of the Digital Trends team, and has been using Apple’s smartphone since the original iPhone back in 2007. While her main speciality is the iPhone, she also covers Apple Watch, iPad, and Mac when needed.

When she isn’t writing about Apple, Christine can often be found at Disneyland in Anaheim, California, as she is a passholder and obsessed with all things Disney, especially Star Wars. Christine also enjoys coffee, food, photography, mechanical keyboards, and spending as much time with her new daughter as possible.