Apple Pay Later just hit a roadblock in the UK thanks to new legislation

What you need to know

- New BNPL rules could affect Apple if it decides to bring Apple Pay Later to the UK.

- New government rules are designed to more tightly control the BNPL industry.

- Lenders will need to be approved by a UK financial watchdog, among other changes to the status quo.

Apple Pay Later has hit a roadblock in the United Kingdom after the government announced plans to more tightly control the Buy Now, Pay Later (BNPL) market.

Apple announced its new Apple Pay Later offering alongside iOS 16 earlier this month and while it will initially launch in the United States, it's to be expected that Apple intends to launch it internationally at some point. That looks to have been dealt a blow in the UK after the government announced that it will be reigning in companies that offer BNPL schemes. Currently, regulation is minimal.

The BBC reports that new plans set out by the government will mean that:

- Lenders will be required to carry out checks to ensure that loans are affordable for consumers,

- Advertisements must be fair, clear, and not misleading.

- Lenders will need to be approved by the Financial Conduct Authority (FCA).

- Borrowers will be able to take complaints about BNPL schemes to the Financial Ombudsman Service.

While this will only affect the likes of Klarna and Clearpay right now, such regulation would also impact Apple should it expand Apple Pay Later to the UK.

In the United States, Apple Pay Later is backed by Apple rather than a bank, meaning it would need to "be approved by the Financial Conduct Authority," something that Apple may not want to get involved in. The new rules won't come into place until next year at the earliest, but Apple will need to adhere to them eventually, even if it joins the UK market sooner rather than later.

Incumbent Klarna says that it welcomes the new rules, telling the BBC that it already carries out affordability checks. Apple will also do something similar via soft credit checks and by linking applications to Apple IDs, but it remains to be seen whether that will satiate the FCA if and when Apple Pay Later makes the trip across the pond.

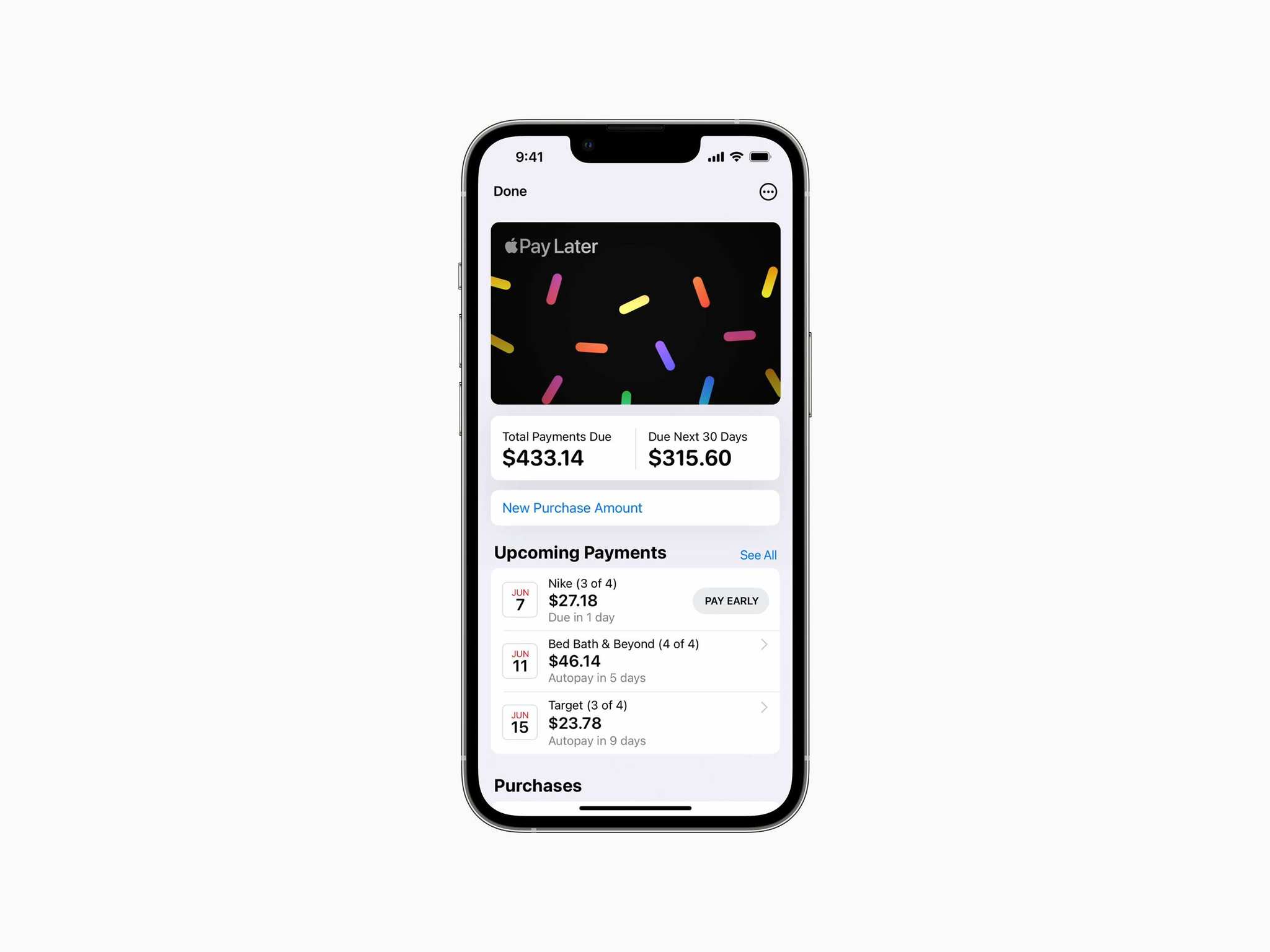

Apple Pay Later will allow customers to make a purchase using Apple Pay and then pay for it over a period of six weeks. Purchases will be less than $1,000, with payments handled via the Wallet app on iPhones.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Oliver Haslam has written about Apple and the wider technology business for more than a decade with bylines on How-To Geek, PC Mag, iDownloadBlog, and many more. He has also been published in print for Macworld, including cover stories. At iMore, Oliver is involved in daily news coverage and, not being short of opinions, has been known to 'explain' those thoughts in more detail, too.

Having grown up using PCs and spending far too much money on graphics card and flashy RAM, Oliver switched to the Mac with a G5 iMac and hasn't looked back. Since then he's seen the growth of the smartphone world, backed by iPhone, and new product categories come and go. Current expertise includes iOS, macOS, streaming services, and pretty much anything that has a battery or plugs into a wall. Oliver also covers mobile gaming for iMore, with Apple Arcade a particular focus. He's been gaming since the Atari 2600 days and still struggles to comprehend the fact he can play console quality titles on his pocket computer.