iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

Recently, Equifax announced it had been compromised and as many as 143 million U.S. residents may have had their personal information exposed, including home addresses, birth dates, credit account information, and Social Security numbers. One suggestion from the credit reporting agency, as well as many banks and credit card companies, is to freeze your credit report.

A credit freeze is a way for you to restrict access to your credit report to protect you from identity theft. If you've put a freeze on your credit report, it doesn't affect your credit score or keep you from being able to apply for loans. There are some caveats though.

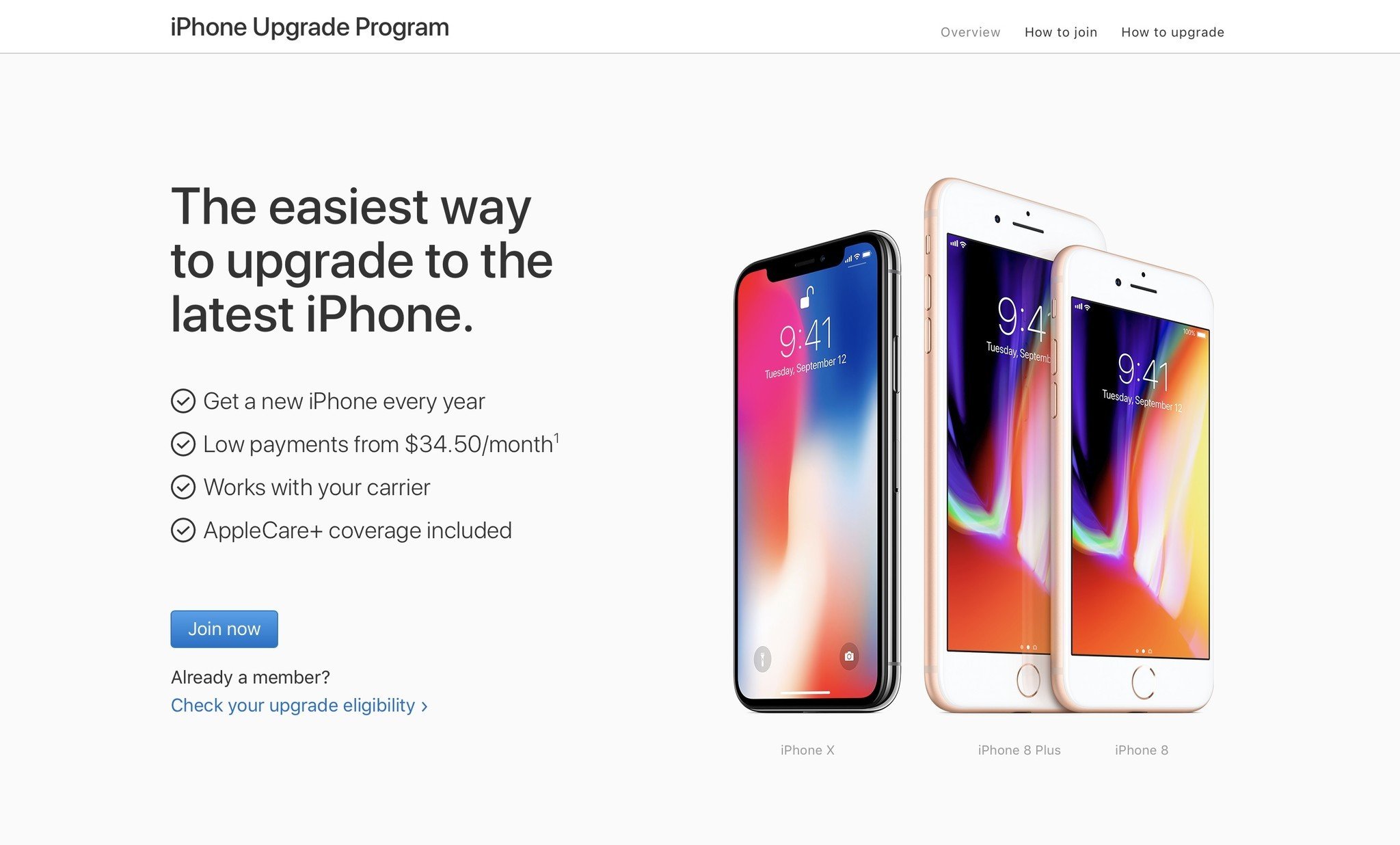

If you've put a credit freeze on your credit report, there are a few things you should know about applying for your iPhone Upgrade Program loan.

If you're already signed up with the iPhone Upgrade Program

If you are already signed up with the iPhone Upgrade Program, Apple will still be able to access your credit report for a credit check because you have an existing account with Citizen One Bank. The Federal Trade Commission states:

Your report can be released to your existing creditors or to debt collectors acting on their behalf.

You'll still need to provide Apple with a valid credit card, your Social Security number, your carrier's account login credentials, and two forms of ID if you are re-enrolling in-person at an Apple retail store.

The credit check process should go through without an issue. If there is a problem, call Citizens One at 1-888-201-6306 and make sure you have your 16-digit loan application number nearby.

Joining the iPhone Upgrade Program

If you are joining the iPhone Upgrade Program for the first time, Apple can still run a credit check, but you'll want to first temporarily lift the freeze on your credit report.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

I spoke with a customer service representative with Citizens One who said that Apple will run the credit check when you first enroll in the iPhone Upgrade Program. All four credit bureaus will be contacted, starting with Equifax first. Then, Experian, Innovis, and TransUnion.

The credit report agencies must lift the freeze within three business days of your request.

Fees typically range in price from $5 to $10 but are different in each region.

Here are the numbers for the U.S. credit report agencies:

- Equifax — 1-800-349-9960

- Experian — 1‑888‑397‑3742

- TransUnion — 1-888-909-8872

- Innovis — 1-800-540-2505

You'll need to provide these credit reporting agencies your name, address, date of birth, Social Security number and some other personal information.

More questions about the iPhone Upgrade Program?

If you're joining the iPhone Upgrade Program for the first time this year or re-enrolling for a brand new iPhone, read through our guide to everything you need to know so you'll be totally prepared when it comes time to preorder your iPhone.

iPhone Upgrade Program: The ultimate guide

Lory is a renaissance woman, writing news, reviews, and how-to guides for iMore. She also fancies herself a bit of a rock star in her town and spends too much time reading comic books. If she's not typing away at her keyboard, you can probably find her at Disneyland or watching Star Wars (or both).