Apple Pay Later launch sees PayPal fight back with extended payment options

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Apple's BNPL offering has already seen the competition make moves to combat it.

- PayPal has announced a new two-year payment plan.

- Interest will range from 0% to 29.9%.

Following the news that Apple is launching its own buy now, pay later (BNPL) system, one of the incumbents is fighting back. Today, PayPal announced that it is expanding its own BNPL offering to give customers more choice when choosing their repayment scheme.

PayPal already allows people to make a purchase and then spread the payments across a six-week period using its Pay in 4 service, but it's now expanding that to a new Pay Monthly offering that will give people up to two years to pay. Purchases between $199 and $10,000 will be eligible for the new Pay Monthly service, PayPal confirms.

Pay Monthly is a new way for customers to make large purchases between $199-$10,000 and lets them break the total cost into monthly payments over a 6–24-month period, with the first payment due one month after purchase. Once a customer selects Pay Monthly, they will complete an application at checkout and, if approved, will be presented with up to three different plans of varying lengths with risk-based APR ranging from 0%-29.99%. Customers can then compare and select the option that best suits their budget.

Management of the loan will be handled via the PayPal app, while Apple's service will be managed through the Wallet app installed on iPhones.

PayPal notes that interest will range from 0% to almost 30% based on the level of risk and, presumably, the amount of money being borrowed. Apple's new Apple Pay Later will be interest-free, but will also be limited to purchases of $1,000 and below.

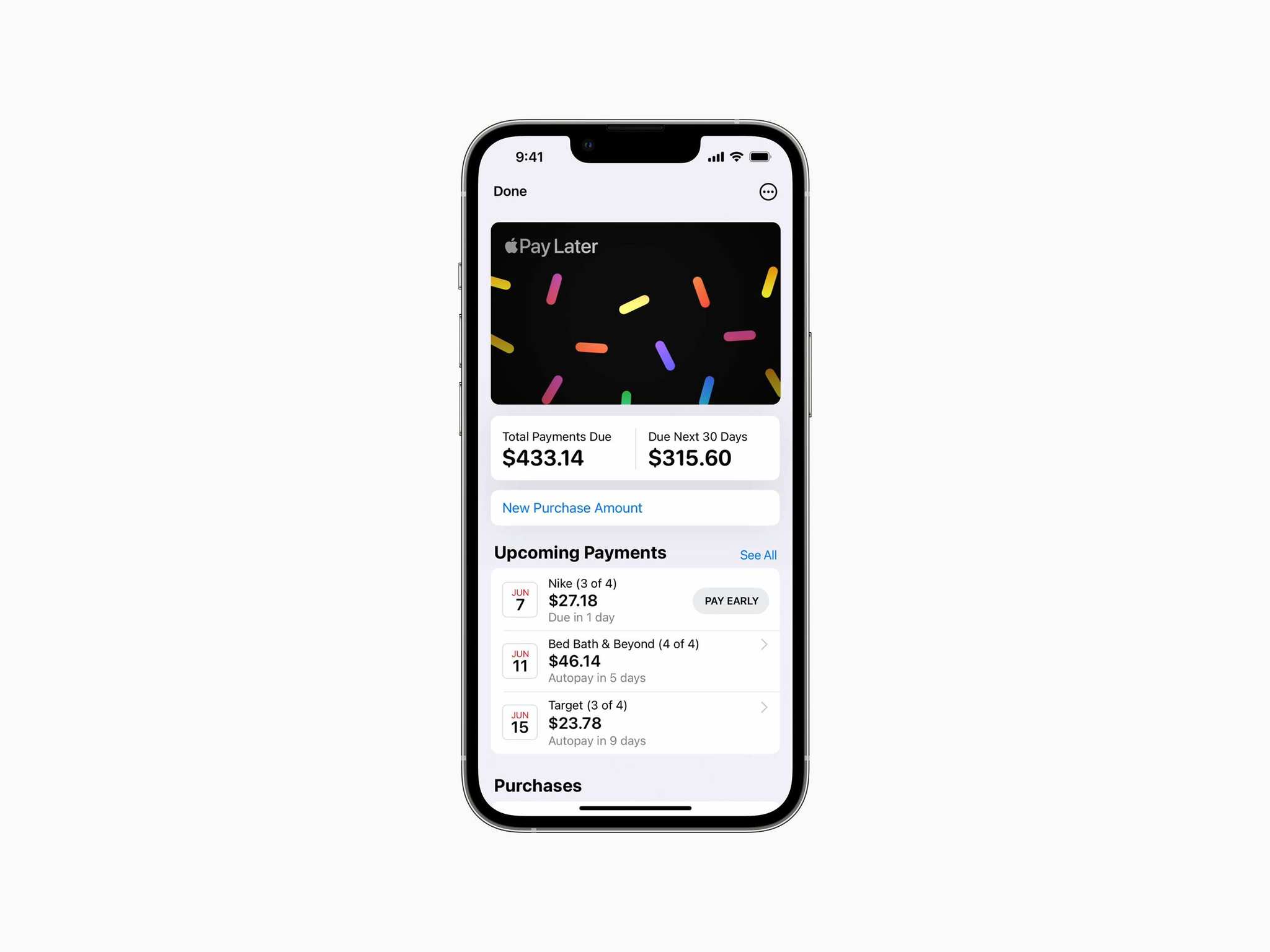

Apple Pay Later will launch as part of iOS 16 later this year and was announced as part of the WWDC22 opening keynote on June 6. People will be able to use Apple Pay to pay for goods and then spread the cost across six weeks with no formal credit checks being carried out — and Apple is the one on the hook for any defaults, too. In the case of PayPal, WedBank will be the outfit lending the money.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Oliver Haslam has written about Apple and the wider technology business for more than a decade with bylines on How-To Geek, PC Mag, iDownloadBlog, and many more. He has also been published in print for Macworld, including cover stories. At iMore, Oliver is involved in daily news coverage and, not being short of opinions, has been known to 'explain' those thoughts in more detail, too.

Having grown up using PCs and spending far too much money on graphics card and flashy RAM, Oliver switched to the Mac with a G5 iMac and hasn't looked back. Since then he's seen the growth of the smartphone world, backed by iPhone, and new product categories come and go. Current expertise includes iOS, macOS, streaming services, and pretty much anything that has a battery or plugs into a wall. Oliver also covers mobile gaming for iMore, with Apple Arcade a particular focus. He's been gaming since the Atari 2600 days and still struggles to comprehend the fact he can play console quality titles on his pocket computer.