Fallout 4 finally works like a charm on Mac

Gamers have reported Fallout 4 working on a Mac, thanks to the brand new next-gen update

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

By Stephen Warwick last updated

The iPhone 16 is expected to arrive in September 2024 and it could be one of the biggest upgrades in some time.

By Oliver Haslam last updated

The iPhone 16 Pro is expected to come with a few changes compared to the model you're already carrying.

By Oliver Haslam published

Someone found a way to get the EU's DMA features like third-party app stores and more, but the workaround probably isn't worth the hassle.

By John-Anthony Disotto last updated

The best MagSafe charging stand is the perfect way to take advantage of StandBy mode in iOS 17. Here are our favorites.

By Stephen Warwick last updated

The iPhone 16 is expected to arrive in September 2024 and it could be one of the biggest upgrades in some time.

By Oliver Haslam last updated

The iPhone 16 Pro is expected to come with a few changes compared to the model you're already carrying.

By Oliver Haslam published

Someone found a way to get the EU's DMA features like third-party app stores and more, but the workaround probably isn't worth the hassle.

By Oliver Haslam last updated

It's inevitable that the iPad Air lineup will get a refreshed model and here's what we've been hearing so far.

By Oliver Haslam published

This new iPad stand is adjustable, has a USB-C hub included, and looks great to boot.

By Oliver Haslam published

Rumors of a new iPad Air 6 with a mini-LED display were wrong, but we'll see a new 12.9-inch iPad instead, analyst says.

By Daryl Baxter published

Apple is reportedly planning to bring its Calculator app to iPadOS 18, ending 14 years of wishing from users.

By Oliver Haslam published

Apple isn't expected to update its Mac mini or Mac Pro lineups with M3 chips, leaving buyers to wait for M4 versions instead.

By Connor Jewiss published

According to a new report, the upcoming macOS 15 update is set to include a revamped and smarter Calculator app that looks like the one on iOS.

By Stephen Warwick last updated

With the advent of Apple silicon, gaming on Mac is better than ever. But what's the best gaming MacBook you can buy right now?

By Stephen Warwick published

2024 could herald the first wave of M4 Macs, what do we know about the next generation of Apple silicon?

By Karen S Freeman last updated

Apple makes some fantastic bands for the Apple Watch, that's for sure. But you can expand your band wardrobe with some incredible third-party options. Here are some of our favorites.

By Karen S Freeman last updated

Ultimate bands for the ultimate watch.

By James Bentley published

Apple Watch Ultra 2 is now available refurbished at the Apple store, which means you can get a restored Apple Watch with official parts for cheaper.

By Andrew Williams published

Fallout 4 may never have been ported to macOS, but there are multiple ways to play it on Mac.

By Daryl Baxter published

Quick Tips Thanks to this handy trick in Delta for iPhone, you can launch your retro games directly from the Home Screen.

By John-Anthony Disotto published

Quick Tips You can search using Spotlight directly from your iPhone's Lock Screen — I wish I'd known all this time.

By James Bentley last updated

Is AirDrop not working on your iPhone? Here are a few things you can try to get Apple's file transfer feature to work again.

By Andrew Williams published

Fallout 4 may never have been ported to macOS, but there are multiple ways to play it on Mac.

By John-Anthony Disotto last updated

You can play retro games with Delta Game Emulator for iPhone. Here's everything you need to know to add games, play games, and use the app everyone's talking about.

By James Bentley published

With Apple allowing game emulation on its app store, users have had a great week of video games, despite developers worrying about Apple’s guidelines.

By James Bentley published

PPSSPP, a PSP emulator for iPhone, is currently in the works but Apple’s unclearness around its own rules leaves the developer unsure of if it will launch.

By James Bentley published

The Lofree Dot Foundation is a gorgeous mechanical keyboard that takes its looks from makeup. Our review:

By Gerald Lynch published

The Satechi Thunderbolt 4 Slim Pro Hub is excellent — if all you need is more Thunderbolt ports for your Mac and practically nothing else.

By John-Anthony Disotto published

The BenQ beCreatus DP1310 is the perfect dock for Mac users who play games on console. With just one click you can jump between USB-C and HDMI 2.1.

By Alex Blake published

Stage View adds previews to apps and windows in the Stage Manager sidebar. Is it worth your cash?

By Tammy Rogers published

The Geekom A7 is a powerful, tiny, and very well-priced mini PC — but should you choose one over the Mac mini?

By Alex Blake published

The Logitech Signature Slim K950 is a more affordable version of the MX Keys S, with a similar typing feel but without a few nice-to-haves.

By Stephen Warwick published

President Biden has signed the TikTok ban into law, giving owner ByteDance 9 months to sell the company.

By Matt Evans published

How do Apple Fitness Plus’ exercise bike classes compare to the real thing? We look at the benefits and disadvantages.

By Becca Caddy published

App of the day The Tyme 3 iPhone and Mac app is for individuals and teams, and it works seamlessly when you're on the move.

By Becca Caddy published

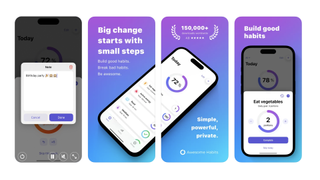

App of the day Awesome Habits isn't just another habit tracking app, it's perfect if you're overwhelmed by choice and want a straightforward option.