iOS 18 might add AI-powered Messages summary feature for your friends who text too much

One of Apple's first AI features for iOS 18 could make it easier to get through your messages.

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

By Oliver Haslam published

Tesla has so far refused to offer CarPlay in its vehicles and the news it's working on its own voice assistant seems unlikely to change that any time soon.

By Stephen Warwick published

The Core Our iPad event preview, Apple's earnings call, and more.

By Becca Caddy published

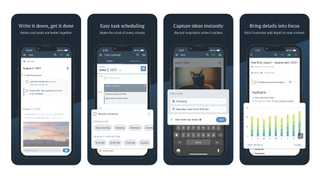

App of the day If you're looking for notes, task management tools and ultimate security, you've found all three with Amplenote.

By Daryl Baxter published

The developer of Folium, an upcoming Nintendo 3DS emulator for iPhone, tells iMore he’s unfazed by the recent takedowns by the company.

By John-Anthony Disotto published

Quick Tips This neat Siri trick is the best use case for the voice assistant despite launching on iPhone over a decade ago. Here's how to use it.

By Karen S Freeman, Tammy Rogers last updated

Charge up your iPhone and take advantage of MagSafe accessories with a MagSafe-compatible case on your iPhone 12.

By Daryl Baxter published

Exclusive Folium is the next major emulator about to be made available, and it works, but it needs improvements.

By Karen S Freeman, Tammy Rogers last updated

Drops and bumps happen, even if you're careful, so get your iPad Pro some protection with the best cases.

By Oliver Haslam published

Someone broke dozens of Apple Pencils because they wouldn't hold his weight in a viral TikTok video.

By John-Anthony Disotto last updated

iPadOS 17 has finally landed, a massive update with tweaks to homescreens, widgets ... and finally, alternate app stores

By Stephen Warwick published

A new report has revealed some of the exciting new display technology we can expect to see in the OLED iPad Pro.

By Stephen Warwick last updated

2024 could herald the first wave of M4 Macs and iPads, what do we know about the next generation of Apple silicon?

By Tammy Rogers published

Need to connect multiple devices to your MacBook Pro? Get yourself one of these docking stations.

By John-Anthony Disotto published

The Keychron Q1 HE adds magnetic hall effect switches to the tried and tested Q1 form factor. But is it good enough to replace the mechanical keyboard on your desk?

By Tammy Rogers published

While there are many options to consider if you're in the market for a new MacBook right now, we think the MacBook Pro M3 Pro is the best MacBook.

By Connor Jewiss published

A new rumour says the upcoming Apple Watch X will opt for a thinner motherboard, which will leave extra room inside for additional hardware.

By Karen S Freeman last updated

Apple makes some fantastic bands for the Apple Watch, that's for sure. But you can expand your band wardrobe with some incredible third-party options. Here are some of our favorites.

By Karen S Freeman last updated

Ultimate bands for the ultimate watch.

By John-Anthony Disotto published

Quick Tips This neat Siri trick is the best use case for the voice assistant despite launching on iPhone over a decade ago. Here's how to use it.

By John-Anthony Disotto published

Quick Tips Reachability is great but there's another iPhone trick that makes navigating your smartphone that much easier.

By John-Anthony Disotto published

Quick Tips Your iPhone has a neat drag-and-drop feature you've probably not been using. Here's how you can.

By Ian Osborne published

QUICK TIPS Problems with your Mac? Follow these tips to get your MacBook, iMac, Mini or Studio back in action.

By Daryl Baxter published

Quick Tips If you’re an early Apple Card owner, you may want to check the expiry date of your card.

By John-Anthony Disotto published

Quick Tips This iPhone wallpaper setting shuffles your photos so you can a new picture of your favorite people, animals, or things every time you pick up your device. Here's how to use it.

By James Bentley published

The new chip in the iPad Pro looks like it could offer a phenomenal boost in processing power, but I’m more excited about gaming on that excellent display.

By James Bentley published

Prices for Pokémon GO’s in-game currency have risen in Turkey to stop IP spoofers and Turkish players aren’t happy with the change.

By Tammy Rogers last updated

Streaming on a Mac is made easy with the right equipment. Get one of these capture cards and get streaming quickly.

By John-Anthony Disotto published

The Keychron Q1 HE adds magnetic hall effect switches to the tried and tested Q1 form factor. But is it good enough to replace the mechanical keyboard on your desk?

By Stephen Warwick published

The Twelve South ButterFly is the world's smallest 2-in-1 MagSafe charger, but is it any good?

By Gerald Lynch published

Too pricey to compete with its peers, and not quite as good as its remarkable LCD stablemates, the Dough Spectrum Black 27-inch OLED monitor is a good screen that’s still difficult to recommend.

By Stephen Warwick published

Secretlab's combo of monitor arm and laptop mount means Mac users can finally take its desks more seriously.

By Becca Caddy published

App of the day If you're looking for notes, task management tools and ultimate security, you've found all three with Amplenote.

By Connor Jewiss published

Almost two years after Apple first announced passkeys, Microsoft is rolling them out to all consumer accounts.

By Stephen Warwick published

Apple has today announced more changes to its Core Technology Fee in the EU, as well as plans to bring its iOS App Store changes to iPadOS.

By Becca Caddy published

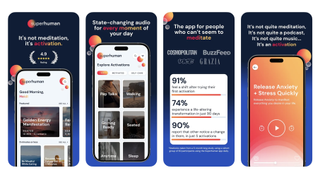

App of the day Superhuman is full of ‘activations’ that have the benefits of meditation without the meditating.