iPhone

• What's the best iPhone?

• Set up a new iPhone

• Best apps for new owners

• The best iPhone deals

Over 1 billion iPhones are in active use making it one of the world's most popular devices — with a fascinating history. The App Store features over a million apps, helping you unlock your iPhone using your face, charge without cables, have Siri turn on the lights in your home, and so much more. Apple's most advanced iPhone range is here: the iPhone 15, iPhone 15 Pro, and iPhone 15 Pro Max. And hints about the iPhone 16, iPhone 16 Plus, iPhone 16 Pro, iPhone 16 Pro Max, and iPhone 16 Ultra are already trickling in.

iPhone 15: The current lineup

Here's what you need to know about the iPhone 15, iPhone 15 Plus, iPhone 15 Pro, and iPhone 15 Pro Max, including specs and new features:

iPhone 15 / 15 Plus The everyman iPhone, without the bells and whistles.

Screen: 6.1- or 6.7-inch

RAM: 6GB

CPU: A16 Bionic

Rear Camera: 48MP

Connectivity: USB-C

iPhone 15 Pro Adds the faster A17 Pro chip and a new design, with a titanium frame.

Screen: 6.1-inch

RAM: 8GB

CPU: A17 Pro

Rear Camera: 48MP

Connectivity: USB-C

iPhone 15 Pro Max Adds a Telephoto lens tech for enhanced zoom capabilities.

Screen: 6.7-inch

RAM: 8GB

CPU: A17 Pro

Rear Camera: 48MP w/ Telephoto lens

Connectivity: USB-C

Do more with your iPhone

The iPhone isn't just beautiful and magnificently fun -- it's practical too. It's the best camera in the world, the window to your smart home, an assistant that can maintain your schedule as easily as your health, and more. And loads of stuff came to the iPhone with iOS 17. Here's the top features and how to use them.

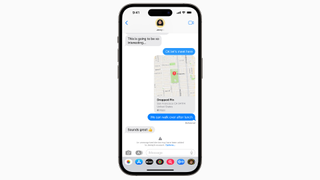

How to Download iOS 17 | Contact Posters | Standby | NameDrop | AirDrop

Explore iPhone

-

iPhone 11

-

iPhone 11 Pro

-

iPhone 11 Pro Max

-

iPhone 12

-

iPhone 12 Mini

-

iPhone 12 Pro

-

iPhone 12 Pro Max

-

iPhone 13

-

iPhone 13 Pro

-

iPhone 13 Pro Max

-

iPhone 14

-

iPhone 14 Pro

-

iPhone 14 Pro Max

-

iPhone 15

-

iPhone 16

-

iPhone 17

-

iPhone 3G

-

iPhone 4

-

iPhone 5

-

iPhone 6

-

iPhone 7

-

iPhone 8

-

iPhone Accessories

-

iPhone SE

-

iPhone X

Latest about iPhone

Best iPhone 14 Pro cases 2024

By Karen S Freeman last updated

You've selected a premium Apple device, don't let it get damaged. We've rounded up some of the best case options for you here.

Best iPhone 14 Pro Max cases in 2024

By Karen S Freeman last updated

You're pouring a pretty penny into your gorgeous iPhone 14 Pro Max. Be sure to get a case to keep it in tip top shape.

Epic drags Apple to court over App Store fees and more, judge orders a three-day evidentiary hearing as sanctions loom

By Oliver Haslam published

Apple and Epic Games are heading to court over new claims App Store rules violate an injunction that came into force in January 2024.

This iPhone trick has been around for years — why don't more people use Apple's built-in undo method?

By John-Anthony Disotto published

Quick Tips Did you know your iPhone has a secret undo feature that just requires a bit of arm strength? Here's how to use it.

Get an iPhone 15 for free at Verizon — and this time there's no trade in required

By Tammy Rogers published

Verizon has one of the best offers on an iPhone yet — and you don't even need to trade in your old phone to get it.

Best iPhone 15 screen protectors

By Karen S Freeman last updated

A screen protector will keep your iPhone from getting scratched, and maybe even ward off a costly repair in case of drops. Protect your iPhone 15 from the first day you get it with one of these.

Best iPhone 15 Pro screen protectors

By Karen S Freeman last updated

The iPhone 15 Pro sports Apple's best screen yet. Keep it looking amazing from the moment you take it out of the box.

Best iPhone 15 Plus screen protectors

By Karen S Freeman last updated

It's big, it's beautiful — protect it.

Become a master of your iPhone's calculator app with this hidden iPhone trick that not many people know even exists

By John-Anthony Disotto published

Quick Tips Did you know Calculator on iPhone has a backspace button? Here's how to use it.

Here are 10 great free games you can legally play on Delta Emulator for iPhone

By Daryl Baxter published

We’ve got 10 games that you can play on your iPhone with the Delta emulator without worrying about Nintendo’s lawyers knocking on your door.

Does your iPhone really get recycled when you give it back to Apple? This report says it might not

By Connor Jewiss published

It's been revealed that over 99,000 iPhones were not recycled as they were stolen by employees at Apple's recycling partner. Does your iPhone really get recycled?

Apple's on-device AI plans might have been confirmed as the tech giant acquires another AI startup

By Connor Jewiss published

Apple has acquired another AI startup with a focus on on-device processing, which might have confirmed the tech giant's on-device goal for AI.

All-screen iPhone SE 4 tipped for a 2025 launch, but those hoping for a low-budget powerhouse are set to be disappointed

By Oliver Haslam published

The long-awaited iPhone SE 4 could arrive next year but it still won't offer the entry-level price point Apple's lineup is crying out for.

Apple's iPhone 16 could finally get the capacitive buttons that the iPhone 15 missed out on with a supplier now lined up

By Oliver Haslam published

Apple is tipped to bring capacitive buttons to the iPhone 16 after a new report claimed one company has picked up an order for components.

Why would anyone choose Google Pay over Apple Pay?

By John-Anthony Disotto published

With reports that Apple will finally allow iPhone users in the EU to choose their digital wallet app of choice, I need to ask why?

This hidden iPhone feature puts your friends and family's locations directly into the Maps app using Find My

By John-Anthony Disotto published

Quick Tips Did you know you can see your friends and family's locations directly in the Maps app on iPhone? Here's how.

iPhones in the EU could get a major Apple Pay upgrade as soon as next month

By Stephen Warwick published

A new report says the EU is ready to accept Apple's proposed tap-to-pay changes, which will give rival wallets access to NFC on iPhone.

Apple is reportedly ending all production of controversial iPhone cases

By Tammy Rogers published

Apple's FineWoven cases haven't managed to drum up much support among users — and now it looks like they've been discontinued.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!